Closing Bell: Market scales higher as gold, lithium and healthcare stocks gain

Traders were undeterred by a hot CPI reading for the month of October. Pic: Getty Images

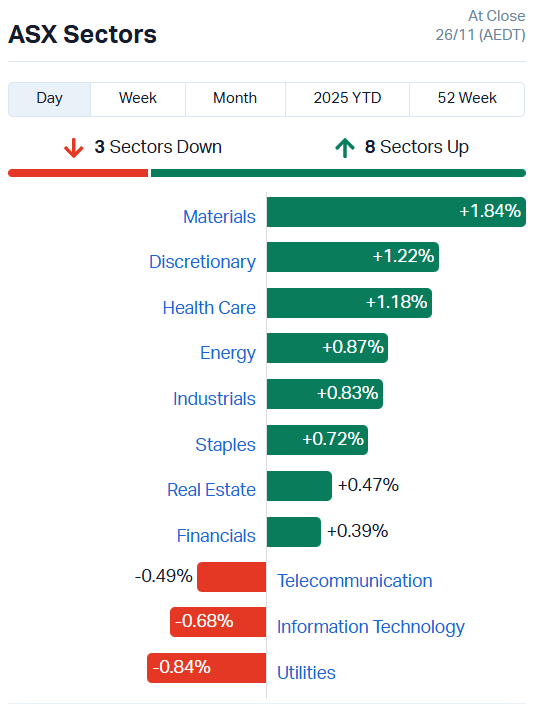

- ASX shrugs off hot CPI read, closes up 0.81%

- Gold, lithium, rare earths lead resources gains

- Broad upward momentum across eight sectors

Gold and lithium build momentum

Lion Selection Group (ASX:LSX) MD Hedley Widdup predicted Australia was at the start of a potential mining boom back in September.

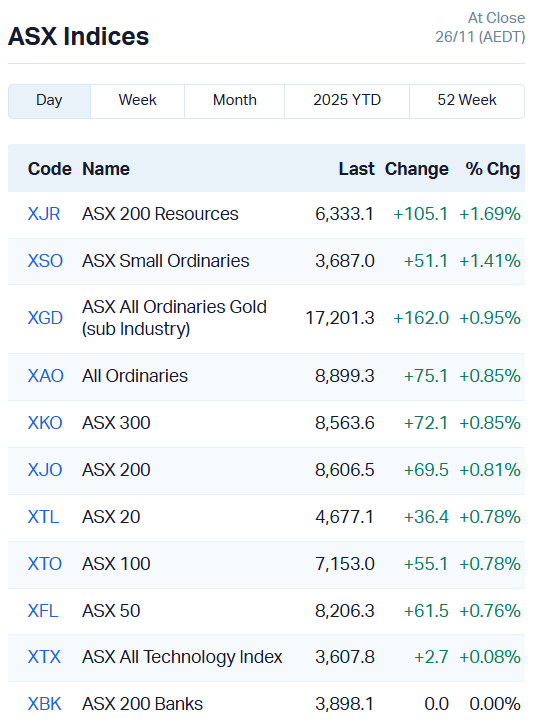

The Aussie mining sector is certainly looking robust today, with strong gains in lithium, rare earths and gold lifting the ASX 200 Resources index 1.69%.

Gold futures continued to gain ground, now hovering around US$4197 an ounce.

Ressie strength coupled with rising expectations of a December interest rate cut across the pond (more on that below) powered the ASX 200 higher, adding 0.81% by trade’s end.

It was a broad-based rally with eight of 11 sectors on the up and solid breadth as 144 of 200 stocks made gains.

Mesoblast (ASX:MSB) surged 14.29%. MSB is expecting to rake in US$30 million in sales of Ryoncil for the December Q, a healthy 37% increase on the September Q’s numbers.

The biotech also nabbed an upgrade from analyst firm Jefferies, flipping from Hold to Buy and raising its price target to $3.30 from $3. MSB closed out trade at $2.72 per share.

Abacus Storage King (ASX:ASK) shares shot up 10.18%. With no new announcements, there’s a good chance ASK is indirectly benefiting from a takeover offer for National Storage REIT (ASX:NSR), which owns a 5% interest in Abacus while also being a key competitor.

Of course, it wasn’t all gravy on the market.

Temple and Webster (ASX:TPW) plunged 32.34% on its FY26 update, despite lifting revenue 18% YoY.

Investors noted a distinct lack of sale acceleration coming up to the Black Friday and Cyber Monday period, perhaps a sign the stock’s strong growth trajectory is waning.

Analysts are expecting a 23% lift in revenue in the first half of FY26, and it appears TPW just isn’t living up to those expectations.

Powell rallies rate-cut support

US markets – as well as the ASX at home – have been on tenterhooks, trying to predict which way the Fed will jump at its December meeting on interest rate cuts.

Stronger-than-expected job additions for the month of September (released last week) slashed hopes of a cut at the next meeting to 30%, but the market pricing is looking a lot more optimistic today.

The US Federal Reserve is divided on whether to cut rates at its next meeting, with chair Jerome Powell falling on the rate-cutting side of the debate.

He’s likely to have the deciding vote.

On Monday, Fed Governor Christopher Waller said the US job market was weak enough to warrant another 0.25% rate cut.

“January could be a little trickier, because we’re going to get a flood of data that’s released,” Waller said on further cuts.

“If it is kind of consistent with what we’ve seen, then you can make the case for January.

“But if it suddenly shows a rebound in inflation or jobs or the economy’s taking off, then it might give concern.”

Markets are now pricing an 83% chance of a December cut.

The positive spin has helped stave off the effects of a hot CPI read for the Australian economy today.

October’s read came in at 3.8% YoY, above expectations of 3.6%.

It’s the first iteration of our new monthly inflation measure, and it’s all but rung the death knell for any more Aussie rate cuts in 2025.

Normally, that would’ve given banks and real estate something to think about, but most traders had already accepted we won’t be getting another cut this year.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| M2R | Miramar | 0.003 | 50% | 3348151 | $2,389,846 |

| AEU | Atomic Eagle | 0.3 | 36% | 2242063 | $83,832,059 |

| CCO | The Calmer Co Int | 0.004 | 33% | 370000 | $9,175,060 |

| RLC | Reedy Lagoon Corp. | 0.004 | 33% | 1679234 | $2,330,120 |

| SRJ | SRJ Technologies | 0.017 | 31% | 10429426 | $17,928,886 |

| RTG | RTG Mining Inc. | 0.034 | 26% | 790362 | $49,761,462 |

| SOP | Synertec Corporation | 0.025 | 25% | 8194449 | $10,386,688 |

| MOM | Moab Minerals Ltd | 0.0025 | 25% | 333333 | $4,015,034 |

| OEL | Otto Energy Limited | 0.005 | 25% | 6242838 | $19,180,039 |

| CP8 | Canphosphateltd | 0.056 | 24% | 43520 | $13,804,224 |

| LSR | Lodestar Minerals | 0.0245 | 23% | 31466031 | $20,278,381 |

| DTM | Dart Mining NL | 0.04 | 21% | 2410016 | $6,920,385 |

| MML | Mclaren Minerals | 0.035 | 21% | 2894038 | $5,763,309 |

| SEA | SEA Forest Limited | 2.4 | 20% | 424153 | $93,525,478 |

| HIQ | Hitiq Limited | 0.024 | 20% | 1008332 | $9,747,649 |

| M4M | Macro Metals Limited | 0.006 | 20% | 1101616 | $21,601,711 |

| MAY | Melbana Energy Ltd | 0.012 | 20% | 5880172 | $37,819,688 |

| PGM | Platina Resources | 0.031 | 19% | 606779 | $16,768,189 |

| FNR | Far Northern Res | 0.17 | 17% | 15022 | $5,838,545 |

| 1CG | One Click Group Ltd | 0.0105 | 17% | 4748643 | $11,765,575 |

| ATX | Amplia Therapeutics | 0.14 | 17% | 1291545 | $61,568,595 |

| GT1 | Greentechnology | 0.042 | 17% | 5029820 | $21,382,652 |

| AHN | Athena Resources | 0.007 | 17% | 1000000 | $13,595,742 |

| AX8 | Accelerate Resources | 0.007 | 17% | 590821 | $4,987,132 |

| RGL | Riversgold | 0.007 | 17% | 1893440 | $12,502,276 |

In the news…

Synertec (ASX:SOP) has nabbed a contract to supply its all-in-one microgrid Powerhouse system to a Coal Seam Gas wellsite owned by Shell QGC. The deal adds contracts already signed with industry powerhouses like Santos.

Management reckons there’s scope to install the Powerhouse system at Shell’s 2,800 other wellsites, although no further agreements have been signed at this stage.

Lodestar Minerals (ASX:LSR) has begun the hunt for magnet and heavy rare earths including yttrium, neodymium and praseodymium at its Virgin Mountain project in Arizona.

Yttrium pricing has surged from $6 per kilogram at the start of 2025 to a current trading range of $220-$320kg by November – an increase of between 3,567% and 5,233%.

Sea Forest (ASX:SEA) rang the bell on the ASX today, having raised $20.5 million in an IPO to list at $2 a share.

The stock provides seaweed-based feed for cattle farmers looking to reduce methane emissions by up to 80% while also providing productivity improvements.

It’s already providing feed to some 118,000 head of cattle, with new distribution partnerships coming online as well. SEA added $0.25 to its share price by day’s end, a solid first day of trade.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| VMSDC | Venari Minerals | 0.051 | -66% | 13 | $15,852,245 |

| BMO | Bastion Minerals | 0.001 | -33% | 1000000 | $3,849,675 |

| TPW | Temple & Webster Ltd | 13.77 | -33% | 3303177 | $2,458,417,096 |

| IVZ | Invictus Energy Ltd | 0.094 | -33% | 37797931 | $224,487,856 |

| VMM | Viridismining | 0.98 | -30% | 2501841 | $154,333,142 |

| IRX | Inhalerx Limited | 0.028 | -22% | 312850 | $7,846,133 |

| BLGDA | Bluglass Limited | 0.19 | -21% | 171041 | $31,375,388 |

| NHE | Nobleheliumlimited | 0.036 | -20% | 120397 | $26,978,625 |

| AYM | Australia United Min | 0.004 | -20% | 230226 | $9,212,887 |

| VEN | Vintage Energy | 0.004 | -20% | 78827 | $10,434,568 |

| PVW | PVW Res Ltd | 0.018 | -18% | 1296923 | $5,474,281 |

| JAL | Jameson Resources | 0.06 | -18% | 96724 | $51,883,533 |

| MVL | Marvel Gold Limited | 0.014 | -18% | 2271241 | $24,130,804 |

| RIE | Riedel Resources Ltd | 0.028 | -18% | 304124 | $4,850,309 |

| LNU | Linius Tech Limited | 0.0025 | -17% | 2732230 | $24,089,582 |

| RDN | Raiden Resources Ltd | 0.005 | -17% | 1468117 | $20,705,349 |

| GAS | State GAS Limited | 0.031 | -16% | 72331 | $14,535,482 |

| LRM | Lion Rock Minerals | 0.021 | -16% | 10112990 | $76,597,929 |

| KCC | Kincora Copper | 0.89 | -15% | 64822 | $22,564,869 |

| ALM | Alma Metals Ltd | 0.006 | -14% | 2175355 | $13,070,461 |

| CTN | Catalina Resources | 0.003 | -14% | 17646139 | $8,543,567 |

| PIL | Peppermint Inv Ltd | 0.003 | -14% | 3478726 | $8,781,573 |

| BAS | Bass Oil Ltd | 0.031 | -14% | 100056 | $11,497,928 |

| NC6 | Nanollose Limited | 0.039 | -13% | 386505 | $14,190,589 |

| HTM | High-Tech Metals Ltd | 0.27 | -13% | 63896 | $18,405,736 |

In Case You Missed It

Flynn Gold (ASX:FG1) has fielded high-grade gold up to 35g/t from Double Event prospect at its Golden Ridge project in Tasmania.

Recce Pharmaceuticals’ (ASX:RCE) R327 has demonstrated significant antibacterial activity against multidrug-resistant pathogen, Acinetobacter baumannii.

Race Oncology (ASX:RAC) has received human ethics approval for the HARNESS-1 Phase 1a/b lung cancer trial of RC220.

Loyal Metals (ASX:LLM) has begun geophysics as part of its plans to unlock the discovery potential of its historic Highway Reward copper-gold mine.

Mammoth Minerals’ (ASX:M79) magnetic survey has revealed a large intrusive complex and associated caldera north of the Buster trend at the Excelsior project in Nevada.

Blue Star Helium (ASX:BNL) is developing the Galactica project in tune with global helium demand as the company prepares for first production before the end of 2025.

iTech Minerals (ASX:ITM) is drilling for gold and antimony at its Reynolds Range project in the Northern Territory.

Auravelle Metals (ASX:AUV) has completed drilling which infills previous high-grade gold results at Sheoak and tests potential northern and southern extensions.

Bubalus Resources (ASX:BUS) has confirmed elevated gallium at the Amadeus project and inspected drill sites at the Nolan’s East project in a field visit.

With yttrium prices surging more than 3000%, Lodestar Resources (ASX:LSR) is hunting for the metal along with other heavy REEs at Virgin Mountain in Arizona.

Peregrine Gold (ASX:PGD) has uncovered a second major channel iron discovery dubbed the Carneys prospect, at the Newman project.

Riversgold (ASX:RGL) has expanded the gold-mineralised footprint of the Northern Zone within its Kalgoorlie project in WA.

Nimy Resources (ASX:NIM) to benefit from CSIRO expertise and $50,000 in funding from the Kick-Start Program for gallium research at Mons project in WA.

White Cliff Minerals (ASX:WCN) is encouraged by maiden diamond drilling at two prospects of its Rae copper project in Canada.

Trading halts

Viridis Mining and Minerals (ASX:VMM) – price query

Meteoric Resources (ASX:MEI) – responding to media speculation on licence process

Terra Critical Minerals (ASX:T92) – proposed acquisition and entitlement offer

Nagambie Resources (ASX:NAG) – cap raise

Galilee Energy (ASX:GLL) – cap raise and acquisition

Restaurant Brands New Zealand (ASX:RBD) – delisting following takeover

National Storage REIT (ASX:NSR) – potential control transaction

At Stockhead, we tell it like it is. While Lodestar Minerals is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.