Closing Bell: Market gains despite heavy gold sell down as prices dip from peaks

The materials sector weighed heavily on the ASX today, but the market lifted anyway, demonstrating its overall resilience. Pic: Getty Images

- ASX overcomes tepid morning to rise 36 points or 0.41pc

- Strong gains in blue chips, banks, real estate

- Heavy sell down in resource stocks as gold retreats from all-time highs

Market stages blue chip recovery

The ASX wasn’t quite sure which way to jump on Monday morning, shedding about 40 points by 11 am AEDT.

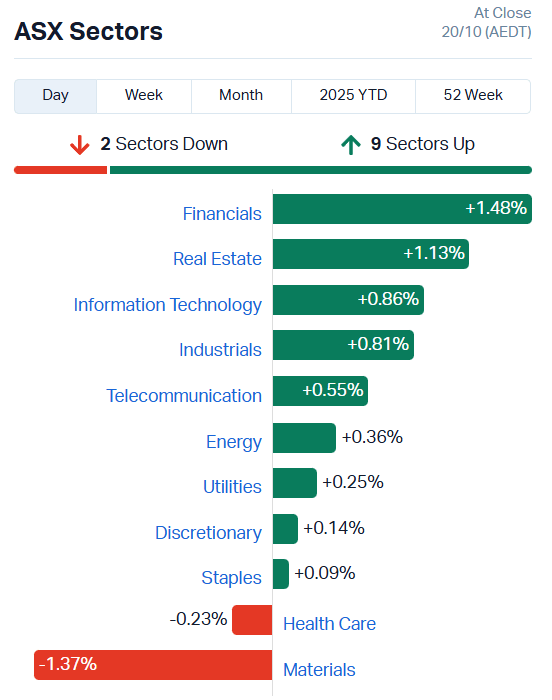

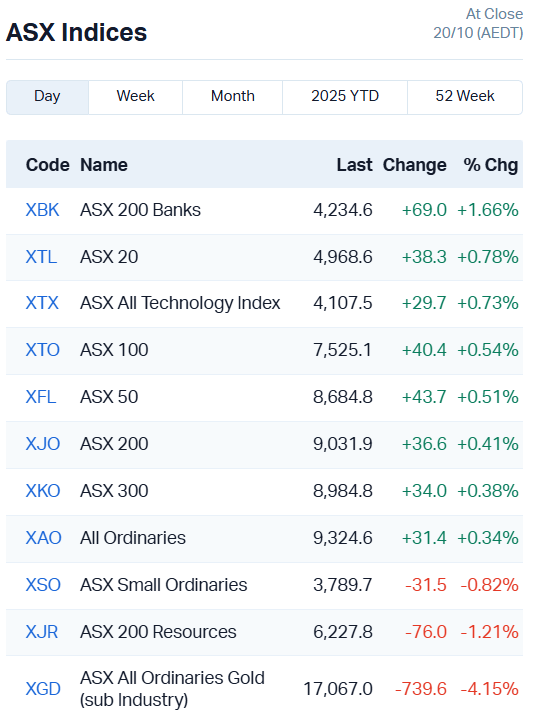

By the end of trade today it had found its footing, climbing 36.6 points or 0.41% with all but two sectors higher.

Trump backed away from new tariffs on China in his latest comments on the two countries’ negotiations, soothing Wall Street fears. US indices all added 0.5% on Friday.

While that provided space for gains on the wider market, a resulting dip in gold futures slammed the materials sector.

A modest 2.1% slide to US$4213 an ounce on Friday sent investors running for the hills. Unlike past dips, gold futures haven’t made up much of that ground yet, hovering around US$4270 an ounce.

Gold, copper, uranium and silver miners all copped it, driving the materials sector down 1.37% and the XGD All Ords gold index 4.15% lower.

The exception was rare earth stocks, which are still riding a US hype wave.

Arafura Rare Earths (ASX:ARU) surged 19.14%, Dateline Resources (ASX:DTR) 11.25% and Northern Minerals (ASX:NTU) 8.82%.

Lucky for the rest of the bourse, the gold dip came in response to improving sentiment.

Our major banks bumped up 1.66%, and the ASX 20 blue chips 0.78%.

Commonwealth (ASX:CBA) lifted 2.6%. Lynas Rare Earths (ASX:LYC) climbed 6.6%.

Zip Co (ASX:ZIP) added 4.3%, and Wesfarmers (ASX:WES) nudged up 0.97%.

The clock is ticking down on the next US Fed meeting – less than ten days away now – which markets are all but certain will result in another interest rate cut.

Real estate stocks are trading broadly higher on that momentum, with Real estate investment trusts (REITs) doing particularly well.

Standouts among real estate-exposed stocks included Australian Financial Group (ASX:AFG), up 7.95%, and Liberty Financial Group (ASX:LFG) which added 5.45%.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AUR | Auris Minerals Ltd | 0.019 | 90% | 17468923 | $5,481,199 |

| AR3 | Austrare | 0.31 | 41% | 5760159 | $47,694,722 |

| RML | Resolution Minerals | 0.12 | 40% | 1.05E+08 | $154,643,642 |

| 1AD | Adalta Limited | 0.004 | 33% | 80966194 | $4,610,616 |

| BEZ | Besragoldinc | 0.084 | 33% | 3049532 | $26,176,751 |

| RAN | Range International | 0.004 | 33% | 1003926 | $3,237,871 |

| VFX | Visionflex Group Ltd | 0.0025 | 25% | 1360000 | $6,758,296 |

| HAS | Hastings Tech Met | 0.88 | 23% | 2599560 | $149,493,483 |

| SER | Strategic Energy | 0.011 | 22% | 37532510 | $9,890,400 |

| AOK | Australian Oil. | 0.003 | 20% | 7591500 | $2,653,207 |

| C7A | Clara Resources | 0.006 | 20% | 1130816 | $3,716,475 |

| ARU | Arafura Rare Earths | 0.48 | 19% | 54327570 | $1,189,535,711 |

| AI1 | Adisyn Ltd | 0.075 | 17% | 10928581 | $46,440,038 |

| IDT | IDT Australia Ltd | 0.069 | 17% | 587688 | $25,354,930 |

| BPM | BPM Minerals | 0.14 | 17% | 1753082 | $10,476,039 |

| LDX | Lumos Diagnostics | 0.21 | 17% | 6761925 | $141,454,335 |

| CR9 | Corellares | 0.007 | 17% | 415792 | $6,045,419 |

| ERL | Empire Resources | 0.007 | 17% | 410500 | $8,903,479 |

| NAE | New Age Exploration | 0.0035 | 17% | 11722961 | $8,117,734 |

| PGY | Pilot Energy Ltd | 0.007 | 17% | 5110330 | $12,951,960 |

| TEG | Triangle Energy Ltd | 0.0035 | 17% | 276015 | $6,603,702 |

| LKY | Locksleyresources | 0.57 | 16% | 8907920 | $135,484,491 |

| SHM | Shriro Holdings Ltd | 0.8 | 16% | 15961187 | $53,749,035 |

| SRJ | SRJ Technologies | 0.022 | 16% | 7762384 | $26,203,756 |

| PVT | Pivotal Metals Ltd | 0.015 | 15% | 10505599 | $11,793,936 |

In the news…

Resolution Minerals (ASX:RML) has added another $2 million to its war chest via a placement with Tribeca Investment Partners at 8 cents per share.

The fresh capital will support downstream critical mineral processing initiatives, a drilling campaign at the Horse Heaven project, and future drilling and surface sampling programs.

AdAlta (ASX:1AD) is also banging the capital raise drum, collecting $1.1 million through an at-market placement to at 0.3c a share. 1AD has raised a total of $1.6m in October between the placement and an earlier entitlement offer.

1AD will funnel the cash into its “East to West” cellular immunotherapy strategy, aiming to bring the enormous potential of CAR-T cell therapies to solid cancer patients globally.

Besra Gold (ASX:BEZ) and Strategic Energy Resources (ASX:SER) were both slapped with ASX price queries and a speeding ticket today.

BEZ is cooking up an update revolving around a resource estimate update for one of its projects, while SER says “nothing to see here.”

Strategic is gearing up for a drilling program at the Canobie project in the near future, but has nothing to say on the matter at present.

Graphene and semiconductor specialist Adisyn (ASX:AI1) will be presenting its progress on its patented low-temperature graphene technology at the Semiconductor Australia Conference.

The one-day conference includes keynote presentations from internationally recognised engineer, scientist and entrepreneur Dr Simon Poole AO and Australia’s former Chief Scientist Dr Cathy Foley, as well as five expert roundtable sessions.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| JLL | Jindalee Lithium Ltd | 0.56 | -39% | 1678695 | $75,733,997 |

| BMO | Bastion Minerals | 0.001 | -33% | 173470 | $3,333,892 |

| SRH | Saferoads Holdings | 0.09 | -33% | 445892 | $5,900,230 |

| TMK | TMK Energy Limited | 0.002 | -33% | 3434411 | $35,692,149 |

| BMG | BMG Resources Ltd | 0.016 | -30% | 22024531 | $21,238,135 |

| BNL | Blue Star Helium Ltd | 0.005 | -29% | 40340057 | $25,220,197 |

| EUR | European Lithium Ltd | 0.3375 | -27% | 43771661 | $701,010,819 |

| FHS | Freehill Mining Ltd. | 0.003 | -25% | 1162560 | $13,830,414 |

| LIB | Liberty Metals | 0.003 | -25% | 66590760 | $23,931,732 |

| RAD | Radiopharm | 0.028 | -24% | 21462251 | $87,503,132 |

| AVW | Avira Resources Ltd | 0.014 | -22% | 11765848 | $4,140,000 |

| CUL | Cullen Resources | 0.007 | -22% | 435038 | $6,240,617 |

| RDN | Raiden Resources Ltd | 0.007 | -22% | 12448067 | $31,058,023 |

| AGD | Austral Gold | 0.092 | -20% | 3186615 | $70,415,806 |

| ARV | Artemis Resources | 0.008 | -20% | 20124442 | $37,709,222 |

| MEL | Metgasco Ltd | 0.002 | -20% | 523951 | $4,592,717 |

| OLH | Oldfields Holdings | 0.016 | -20% | 1152525 | $4,261,183 |

| ROG | Red Sky Energy. | 0.004 | -20% | 595779 | $27,111,136 |

| VKA | Viking Mines Ltd | 0.008 | -20% | 24165346 | $13,597,545 |

| DYL | Deep Yellow Limited | 1.885 | -19% | 13734330 | $2,257,647,770 |

| IRD | Iron Road Ltd | 0.041 | -18% | 55128 | $41,609,639 |

| IXC | Invex Ther | 0.115 | -18% | 72522 | $10,521,539 |

| AUA | Audeara | 0.028 | -18% | 55635 | $6,117,769 |

| SQX | SQX Resources Ltd | 0.165 | -18% | 1474921 | $6,250,000 |

| BAP | Bapcor Limited | 2.64 | -17% | 8876214 | $1,075,937,625 |

In Case You Missed It

Pivotal Metals’ (ASX:PVT) FLTEM surveying finds untested conductive plate that could extend Alotta deposit mineralisation at depth.

Continued gold hits from infill drilling will allow Ballard Mining (ASX:BM1) to convert a big chunk of the Baldock resource to the higher confidence indicated category.

TG Metals (ASX:TG6) has struck a run of high-grade gold in its first round of drilling inside the old Tasman open pit at the Van Uden project in WA, and the grades are anything but modest.

True North Copper (ASX:TNC) has appointed experienced mining leader Andrew Mooney as managing director to head up its next stage of growth.

Power Minerals (ASX:PNN) has responded to growing US investor interest in its Californian rare earth project acquisition by seeking an OTCQB listing.

Future Battery Minerals’ (ASX:FBM) one-metre splits have sharpened the gold grade picture at Miriam, boosting confidence in the WA project.

GoldArc Resources’ (ASX:GA8) review of the Cosmopolitan mine’s historical data has highlighted remnant areas of high-grade gold.

Astral Resources (ASX:AAR) has entered an LOI with Mineral Mining Services for potential early gold production at the Think Big deposit.

Locksley Resources (ASX:LKY) has made the first domestically sourced and refined antimony metal in decades from its Mojave Desert Mine in the US.

ClearVue Technologies (ASX:CPV) is pushing to accelerate commercialisation of its solar glass products globally.

Last Orders

Arika Resources (ASX:ARI) has offloaded the Admiral Bay zinc project for $1.15 million in cash, providing additional funding for exploration at the Yundamindra and Kookynie gold projects in WA.

Trading halts

Alice Queen Limited (ASX:AQX) – cap raise

Bryah Resources Limited (ASX:BYH) – cap raise

BlinkLab Limited (ASX:BB1) – pending company announcement

Broken Hill Mines Limited (ASX:BHM) – cap raise

Credit Clear Limited (ASX:CCR) – cap raise

Energy Transition Minerals Ltd (ASX:ETM) – acquisition update

Gorilla Gold Mines Ltd (ASX:GG8) – cap raise

Nordic Resources Ltd (ASX:NNL) – cap raise

Westar Resources Ltd (ASX:WSR) – cap raise

At Stockhead, we tell it like it is. While Arika Resources and Resolution Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.