Closing Bell: Local markets make it back to back gains as ASX warns Toys R Us not to play games

Via Getty

- ASX 200 ends 0.3% higher

- Small caps ahead 0.4%

- Dr Oliver says go climb the wall of worry, Dolorean does exactly that, up +30%

The ASX 200 and the Emerging Companies (XEC) index rose 0.3% and 0.4% respectively on Wednesday.

The insurer Medibank Private (ASX:MPL) is likely pleased to be in a trading halt, after revealing late Monday it was the likely target of some kind of data breach, following “unusual activity” last week. MPL told the exchange earlier today there’s nothing so far which indicates customer data has ben exposed to potential abuse.

Overnight in New York, the major Wall Street indices all closed around 1% higher, the Nasdaq fell into negative territory but clawed its way higher into the close as strong Q3 earnings surprised to the upside.

The big cheese on the tech-heavy yesterday was Netflix. The streaming company’s share price retraced some of the heavier 2022 losses, up over 13% on better-than-expected results, driven by a sterling boom in global subscribers, well over double previous forecasts.

In a weird little cafe off the Pacific Highway in St Leonard’s this morning, eToro’s Sydney-based, global-facing, well-dressed and under-rated market analyst Josh Gilbert told Stockhead of the need for a haircut and that content, it turns out, is still king.

“After a decline in subscribers for the first time in its history, Netflix beat estimates and added 2.41 million subscribers in Q3. Content has once again been king and the reason Netflix has seen such a strong performance this quarter, from Stranger Things to Cobra Kai.

I replied that Cobra Kai was silly.

Josh said:

“Your idea of quality television is not important. Cobra Kai has been in the top ten of most subscriber countries since last year.

“Netflix revenue jumped by 5.9% for the quarter to $7.93 billion, and earnings topped estimates at $3.10 a share. So, although Netflix isn’t growing at the same pace it was a few years ago, it’s back on a positive trajectory.”

Not kindly said Josh, but point taken.

“The next focus for investors will be the company’s new ad tier. Whilst the model may not have a significant impact until 2023, it seems that Netflix may have found the key to its next stage of growth. You pay. I have to go.”

And he did.

Elsewhere, it’s bank season on Wall Street and while some have slipped, others have struck Q3 gold.

One of those was bank of banks (or the bankers’ bank) Goldman Sachs, which rose a decent 3% after outdoing Q3 expectations on both profit and revenue. The investment machine also revealed a structural shake-up trimming its four main divisions into three and culling fat from the bottom line.

And quickly, one of the more interesting overnight outcomes – the US toymaker Hasbro – slipping over 2% after the producer of quality action figurines missed market expectations on revenue. Chief toymaker Chris Cocks pinning the disappointment on more price sensitive purchasing habits and rising costs around higher inventories.

The Habro miss contrasts rather compellingly with local player Toys’R’Us ANZ (ASX:TOY), which has been going off like a firework this week.

This morning’s 35% leap of faith caught the ire of the ASX highway patrol who’ve pulled TOY over with a speeding ticket.

In response Toys R Us said (in short) we didn’t do anything wrong, and maybe everyone got confused about an article in Forbes which talked up Toys R Us, but not us Toys R Us, rather the USA Toys R Us:

However, with Toys ‘R’ Us shares in pause this morning, there’s speculation, pending a further announcement, that some kind of positive takeover chatter is about to materialise.

Construction is falling apart

The Australian Bureau of Statistics reports that the total number of dwellings under construction around Australia fell 2.7% in the June quarter.

Building starts are down some 28.9% on last year.

Also. The Aussie dollar is a haggard wastrel.At lunchtime it was barely buying 63.2 cents. Even that felt generous. I ate a glass of water and breathed deeply outside for desert.

The other currency mismatch – the USD/JPY – continues to edge higher according to CMC markets.

“There’s support at the 147.70 area which was the 1998 peaks. Now trading at its highest levels since September 1990, we could well see a test of 150.00 in the coming days, and beyond towards 152.30.”

Before the slightly good news, one more gentle slap, with love:

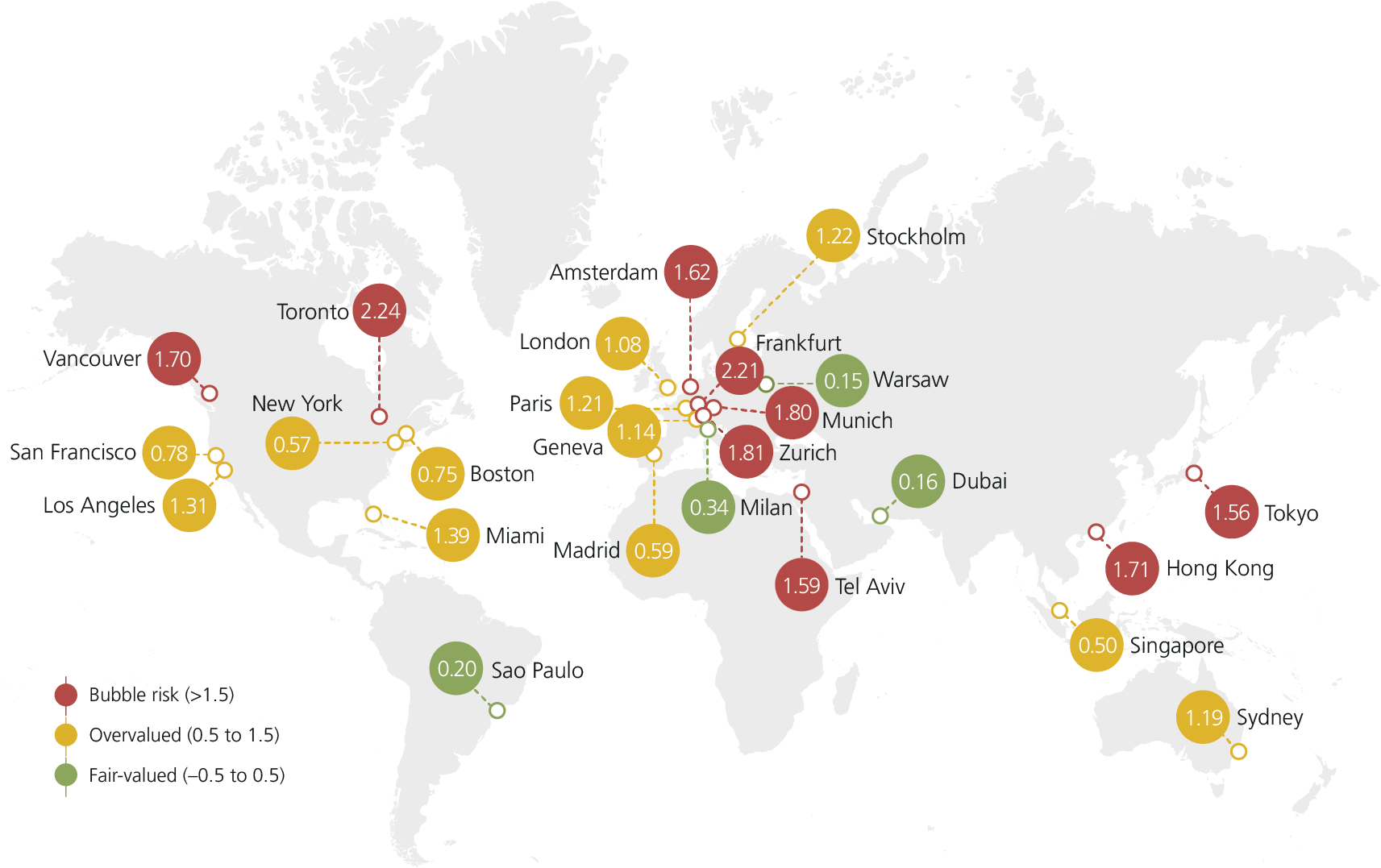

The once a year UBS Global Real Estate Bubble Index – a measurement of impending pain if ever there was – has been released and once again Sydney features significantly.

Although far from the worst in the property bubble stakes – that disgrace goes to the fools buying into Toronto* – UBS says Sydney property prices are “highly overvalued” despite recent price falls.

*Have you been to Toronto??

The Doctor says: Come climb the wall of worry with me

AMP Capital’s flat out legend, Dr Shane Oliver says, when shares and all assets fall in price, they’re cheaper and offer higher long-term return prospects.

“As a result of the fall in share and bond prices (and the resultant decline in PEs and rise in dividends yields and bond yields) our estimated medium term return projections for a diversified growth mix of assets has improved from around 4.9%pa to around 6.7% annually.”

So, Doc Oliver reckons the key is to climb that wall of worry and look for the opportunities on the other side.

“It’s impossible to time the bottom but one way to do it is to “average in” over time…. While share market pullbacks can be painful, it’s the way the share market has always been, so they are nothing new.”

“As can be seen in the chart (above) shares climb a wall of worry over many years but with numerous events dragging them down periodically, but with the long-term rising trend ultimately resuming,” Dr Oliver said.

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AFW | Applyflow Limited | 0.002 | 100% | 1,042,488 | $2,957,608 |

| ANL | Amani Gold Ltd | 0.0015 | 50% | 348,500 | $23,693,441 |

| AZS | Azure Minerals | 0.3 | 40% | 3,275,415 | $66,808,180 |

| DEL | Delorean Corporation | 0.088 | 35% | 1,555,575 | $14,021,859 |

| TOY | Toys R Us | 0.062 | 35% | 4,442,167 | $39,645,614 |

| WBE | Whitebark Energy | 0.002 | 33% | 3,150,000 | $9,697,329 |

| FAU | First Au Ltd | 0.005 | 25% | 2,218,082 | $3,725,644 |

| TGM | Theta Gold Mines Ltd | 0.08 | 25% | 382,080 | $37,555,965 |

| 1CG | One Click Group Ltd | 0.016 | 23% | 4,522,255 | $7,707,154 |

| SW1 | Swift Networks Group | 0.016 | 23% | 737,144 | $7,679,705 |

| LPD | Lepidico Ltd | 0.022 | 22% | 25,042,131 | $118,479,442 |

| MYG | Mayfield Group Ltd | 0.3 | 20% | 15,000 | $22,646,474 |

| VTI | Vision Tech Inc | 0.27 | 20% | 15,700 | $5,535,336 |

| ADR | Adherium Ltd | 0.006 | 20% | 70,000 | $12,809,249 |

| DDT | DataDot Technology | 0.006 | 20% | 83,333 | $6,219,347 |

| GED | Golden Deeps | 0.014 | 17% | 19,019,317 | $13,862,721 |

| IG6 | International Graphite | 0.33 | 16% | 147,826 | $25,076,611 |

| AKN | Auking Mining Ltd | 0.11 | 16% | 7,558,394 | $9,469,088 |

| VRS | Veris Ltd | 0.09 | 15% | 510,111 | $40,852,458 |

| DLT | Delta Drone Intl Ltd | 0.015 | 15% | 723,543 | $3,898,522 |

| AUN | Aurumin | 0.092 | 15% | 181,332 | $10,024,571 |

| 1AE | Aurora Energy Metals | 0.195 | 15% | 42,459 | $20,299,844 |

| BLG | Bluglass Limited | 0.039 | 15% | 1,978,243 | $43,476,062 |

| CFO | Cfoam Limited | 0.004 | 14% | 25,000 | $2,568,442 |

One Click (ASX:1CG) is cruising on Wednesday after revealing the trial of its first step into the mortgage brokering market, (a fourth vertical called‘Loan Pack’), has had a successful kick off, with some 235 customers buying the product during the first quarter test run.

1CG says as part of the wider development pathway for One Click Mortgages, the first phase uptake shows demand is good for a digital mortgage brokering product in the Company’s user base.

Registered 1CG users exceeded 60,000 at the end of September, a 43% increase since the end of the 2022 financial year.

And up over 30%, bioenergy firm Delorean Corp (ASX:DEL) says it’s struck a multi-project deal to support its development kitty through an extra $200m of sweet, sweet cash, to be run by Palisade Impact and arranged by Planum Partners.

DEL’s MD Joe Oliver:

“This development funding partnership with Palisade Impact is a major milestone for Delorean’s business. DEL listed on the ASX in April 2021 with the specific purpose of focusing on development and capitalisation of its own bioenergy infrastructure pipeline, to diversify the business beyond its already growing construction project portfolio and WA energy retail revenues”

Elsewhere, Azure Minerals (ASX:AZS) has gained over 25%. New assays returning ‘significantly higher grades’ of lithium topping up at 3.32% Li2O, well above initial sampling which returned up to 1.62% Li2O.

The Mark Creasy-backed explorer picked up the lithium scores in rock chips at Andover, according to Reuben.

“Andover is over at he Pilbara project best known for its namesake 75,000t (and growing) nickel-copper-cobalt discovery,” Reuben writes today in another fiery trademark edition of Resources Top 5: with Stockhead’s No. 2.

Meanwhile AZS is counting its coins and prepping for a drilling program, according to managing director Tony Rovira.

“The latest batch of assays returned high grades of lithium up to 3.32% Li2O, which is the highest lithium grade reported to date,” Rovira adds.

And finally Hawsons Iron (ASX:HIO) has rebounded circa 23%, but as Gregor maths out, is but a drop of salty tears in the ocean of HIO woe that has left the Iron digger down 67.1% for the week.

ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| JAV | Javelin Minerals Ltd | 0.001 | -33% | 251,000 | $14,181,229.16 |

| BFC | Beston Global Ltd | 0.045 | -27% | 8,608,455 | $53,833,438.62 |

| MP1 | Megaport Limited | 6.61 | -22% | 7,251,723 | $1,342,821,826.35 |

| LLO | Lion One Metals Ltd | 0.76 | -20% | 47,002 | $10,508,658.70 |

| GES | Genesis Resources | 0.008 | -20% | 50,000 | $7,828,412.94 |

| PXX | Polarx Limited | 0.008 | -20% | 3,242,110 | $8,991,010.93 |

| SIH | Sihayo Gold Limited | 0.002 | -20% | 19,411,977 | $15,255,320.23 |

| SRK | Strike Resources | 0.115 | -18% | 5,932,878 | $37,800,000.00 |

| PVL | Powerhouse Ven Ltd | 0.05 | -17% | 504,429 | $7,244,590.56 |

| AXP | AXP Energy Ltd | 0.005 | -17% | 208,050 | $34,873,084.04 |

| DMG | Dragon Mountain Gold | 0.01 | -17% | 500,091 | $4,724,059.98 |

| GLV | Global Oil & Gas | 0.0025 | -17% | 370,709 | $5,620,064.12 |

| SI6 | SI6 Metals Limited | 0.005 | -17% | 1,410,330 | $8,929,134.47 |

| CBL | Control Bionics | 0.155 | -16% | 20,000 | $9,311,217.61 |

| PFE | Pantera Minerals | 0.105 | -16% | 60,935 | $6,437,640.00 |

| CVV | Caravel Minerals Ltd | 0.195 | -15% | 954,982 | $96,412,405.79 |

| ARO | Astro Resources NL | 0.003 | -14% | 2,975,000 | $17,126,434.34 |

| CMD | Cassius Mining Ltd | 0.03 | -14% | 204,623 | $14,130,931.61 |

| CRB | Carbine Resources | 0.013 | -13% | 5,400 | $4,729,133.03 |

| CYQ | Cycliq Group Ltd | 0.007 | -13% | 1,631,050 | $2,780,133.26 |

| M8S | M8 Sustainable | 0.007 | -13% | 225,000 | $3,927,267.85 |

Beston Global Food Company (ASX: BFC) has launched a capital raise for some $28.2 million through an unconditional placement to sophisticated and professional investors (“Placement”) and a pro-rata non-renounceable Entitlement Offer to shareholders saying there’s “firm binding commitments” for just $27.3 million of the targeted amount.

The new shares – at an Offer Price of $0.025 per share – represents a 59.7% discount to the Company’s closing share price on ASX of $0.062 on 14 October 2022.

BFC says the money will go straight into resetting a balance sheet hit from all sides.

“…and accelerate earnings growth for the Company post the debilitating effects of the COVID 19 period,” the company told the exchange.

“Beston will pay down debt to enhance profitability, expand capacity to grow sales execute projects that will optimise operations and continue to grow gross margins.”

No one likes paying bills. Shares have crashed, accordingly.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.