Closing Bell: Local markets lift on Tuesday despite hawkish glimpse into Michele Bullock’s RBA board

This man is not a dentist, so we refuse to show you his teeth on the internet. Pic via Getty Images.

- Benchmark ASX 200 index closes 0.4% higher after Wall Street did “okay”

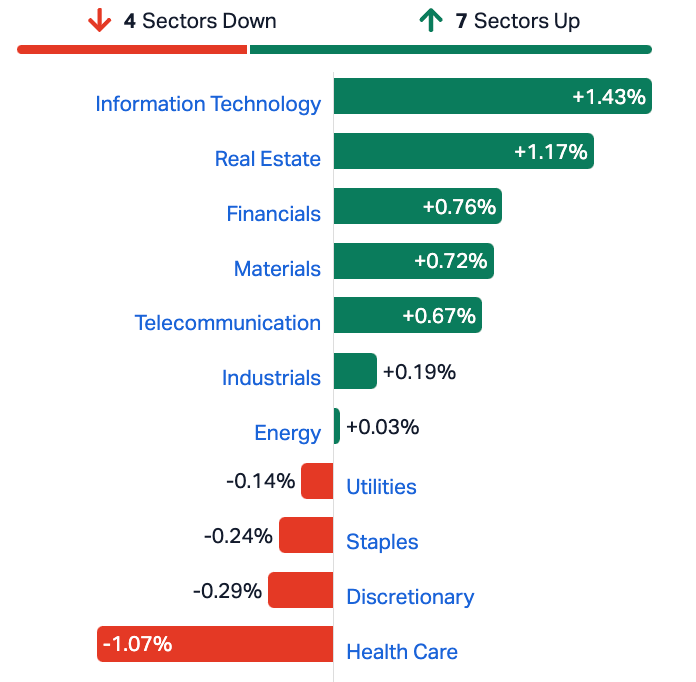

- ASX Sectors led by InfoTech rallying after yesterday’s not-so-great day

- Small caps led by PIM, AHF and a smattering of nice little miner news.

The ASX200 has closed higher, despite some hawkish moments from the Reserve bank’s statement on monetary policy (SOMP), taking its leads from a positive session on Wall Street as optimism around corporate earnings offset rising US Treasury yields.

IT stocks led the gains after a strong showing overnight on the Nasdaq Composite. The tech names are up well over 1.5%, following the the tech-heavy’s near 2% gain.

Things at home reversed fairly quickly once the RBA made it clear that we’re still living on the edge, and while the board held rates on hold again this month, it was a lot closer than punters thought.

The devil in the RBA’s October board minutes confirmed for CBA’s economic team that the upcoming November meeting is “live.”

CBA’s Gareth Aird writes that the RBA’s historic tightening cycle “is not necessarily over.”

Led by M. Bullock, the board warned some further monetary tightening may be needed to bring back inflation to the target range of 2 to 3% in late 2025.

The committee reiterated as per usual any rate adjustment will be dependant on how the economy and various indicators hold up.

Following the statement, retail names and both consumer discretionary and staples stocks dropped, and remain the worst performing of the 11 sectors, dragged by Coles and Woolworths, which are both down 0.8 per cent.

Overnight, both oil and gold prices backed off a little on hopes Israel’s response to the Hamas attacks will be more measured than previously expected as US President Joe Biden said he expected to visit Jerusalem.

ASX Sectors on Tuesday

Small cap wrap

GUD Holdings (ASX:GUD) says it’s just entered into an agreement to acquire RVX and its subsidiary Vision X Europe AB from the company’s Swedish owners.

The RVX leadership team is to remain in place and the acquired business is to become part of the BWI group.

RVX will complement BWI’s business with established sales and distribution facilities in Sweden with reach across Scandinavia and other Northern European countries (including Germany and Poland).

Its customers include Original Equipment Manufacturers like Volvo and Scania and their respective networks of truck and car dealerships.

While RVX predominantly sells light bars, the product suite extends to truck and bus camera and digital mirror systems, and accessories aimed at pickups and all-terrain vehicles. In addition, RVX’s customer base includes original equipment and aftermarket sellers.

CEO George Davies:

“Rindab has the market expertise to drive the distribution of Vision X lighting and other products through its network of original equipment and aftermarket customers and to enter new European markets, giving BWI a footprint into one of the stronger and larger lighting management markets globally.”

The deal is expected to complete on 1 November 2023 with a completion payment of SEK83.6 million (c.A$12m), subject to customary cash and working capital adjustments. Including subsequent earn out payments up to a maximum of SEK15 million.

Mighty Kingdom (ASX:MKL) says it’s received ‘several unsolicited enquiries’ about buying the game developer.

“In response to this interest, the board of Mighty Kingdom has decided to undertake a strategic review process of the company with the view of maximising shareholder value,’’ the company says.

“As part of this review process, MKL is considering all options with respect to its business including, but not limited to, a whole or partial divestment, joint venture arrangement or a strategic investment into the company to further growth and development.

“The Company has not made a decision at this stage with respect to terms and deal structure that it is prepared to consider and therefore makes no assurances that a transaction will eventuate.

“Mighty Kingdom cautions shareholders not to make any investment decisions about the Company’s shares on the assumption that a transaction will proceed and further market updates will be provided following any material developments arising as a result of the review process.”

Mighty Kingdom also said it had conducted a share placement to raise $1m, with director and sophisticated investors taking up the shares at 1c a pop.

Ripped from the headlines

The Shanghai Composite fell 0.1%, while the tech-laden Shenzhen Component lost 0.2% by mid-arvo on Tuesday, sliding for the third straight session amid a lack of market-moving cues.

Punters are looking ahead to China’s Q3 gross domestic product figures on Wednesday, with economists expecting a 4.4% year-on-year expansion, down from a 6.3% growth in the previous quarter.

In Japan, the Nikkei 225 Index rallied 1.8% while the broader Topix Index jumped 1.3%, breaking a 2-day decline.

Investors also look ahead to Japan’s September inflation report due later in the week, which will come ahead of the central bank’s monetary policy meeting on Oct. 30 and 31.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| PIM | Pinnacleminerals | 0.15 | 67% | 13,343,130 | $2,301,750 |

| AYM | Australia United Min | 0.003 | 50% | 241,000 | $3,685,155 |

| BAT | Battery Minerals Ltd | 0.037 | 48% | 608,134 | $2,990,112 |

| RIM | Rimfire Pacific | 0.0085 | 42% | 14,661,559 | $12,631,468 |

| KEY | KEY Petroleum | 0.002 | 33% | 30,889,542 | $2,951,892 |

| NME | Nex Metals Explorat | 0.02 | 33% | 138,889 | $5,287,988 |

| PPK | PPK Group Limited | 1.08 | 32% | 216,354 | $73,217,220 |

| CYQ | Cycliq Group Ltd | 0.005 | 25% | 323,881 | $1,430,067 |

| ERL | Empire Resources | 0.005 | 25% | 1,008,600 | $4,451,740 |

| HFY | Hubify Ltd | 0.02 | 25% | 823,572 | $7,938,181 |

| TMX | Terrain Minerals | 0.005 | 25% | 250,000 | $5,030,575 |

| AHF | Aust Dairy Limited | 0.021 | 24% | 698,710 | $11,149,736 |

| VMS | Venture Minerals | 0.011 | 22% | 1,294,165 | $17,550,117 |

| ZEU | Zeus Resources Ltd | 0.011 | 22% | 602,158 | $4,133,529 |

| DCN | Dacian Gold Ltd | 0.27 | 20% | 10,542,197 | $273,780,211 |

| ADV | Ardiden Ltd | 0.006 | 20% | 23,202,354 | $13,441,677 |

| ECT | Env Clean Tech Ltd. | 0.006 | 20% | 519,916 | $14,237,776 |

| MHC | Manhattan Corp Ltd | 0.006 | 20% | 2,504,285 | $14,684,899 |

| SI6 | SI6 Metals Limited | 0.006 | 20% | 1,050,000 | $9,969,297 |

| FLN | Freelancer Ltd | 0.25 | 19% | 50,679 | $94,692,125 |

| BMR | Ballymore Resources | 0.13 | 18% | 314,732 | $16,081,699 |

| RLG | Roolife Group Ltd | 0.013 | 18% | 1,409,300 | $7,948,139 |

| SRI | Sipa Resources Ltd | 0.026 | 18% | 620,082 | $5,019,479 |

| JPR | Jupiter Energy | 0.021 | 17% | 16,000 | $22,865,945 |

| M2M | Mtmalcolmminesnl | 0.035 | 17% | 100,661 | $3,070,305 |

Pinnacle Minerals (ASX:PIM) led the way in small caps today, up 66.7% on news it is set to acquire a 75% interest in the Adina East Lithium Project in the James Bay lithium district.

The project covers 72.7km2 of land in the red-hot lithium region, just down the road from Winsome Resources’ (ASX:WR1) Adina Lithium Project, and next door to Winsome’s Tilly Lithium Project and Loyal Lithium’s (ASX:LLI) Trieste Lithium Project.

Pinnacle has acquired the interest from Electrification and Decarbonization AIE, which will also stump up US$500,000 in offtake pre-payment in consideration for offtake rights to 25% of any minerals extracted from Adina East Project.

The vertically-integrated dairy group Australian Dairy Nutritionals (ASX:AHF) says it’s listed the Brucknell South farm near Nullawarre, in Victoria for sale.

The organic A2 milk produced by the farm is surplus to the raw milk requirements of the Group’s Depot Road infant formula manufacturing facility and will not impact production of the Ocean Road Dairies organic A2 infant formula range at the site.

The Group’s remaining farm, Yaringa, produces sufficient organic A2 protein milk for the Depot Road facility at full capacity.

The sale will release necessary cash reserves for the Group as it pursues its revised FY24 strategy including growing sales of the Ocean Road Dairies range domestically and internationally and investigating opportunities to increase utilisation at the Depot Road facility.

Battery Minerals (ASX:BAT), jumped early on the news it’s entered into a binding agreement to acquire the advanced Spur Gold project, in the heart of the highly prospective Lachlan Fold Belt.

BAT says Spur’s got multiple epithermal gold targets including near term, high impact drill targets, down-dip from open historic drill intercepts previously reported by Golden Cross Resources (ASX:GCR)

The Spur Project is located 14km west from Newcrest Mining’s (ASX:NCM) Cadia Valley Operations, which boast a 32.1Moz Au, 7.2Mt Cu, Measured and Indicated Mineral Resource in central western New South Wales.

Battery Minerals managing director, Peter Duerden says the deal represents ‘a transformative opportunity for the company, providing high-quality, nearterm drill targets, down-dip from open wide historic gold intercepts in the East Lachlan.’

And PPK Group (ASX:PPK) collected over 40% this morning, after its subsidiary, BNNT Technology, announced it would significantly reduce the price of its Australian-made boron nitride nanotubes (BNNT) following a series of production improvements.

Eddy Sunarto’s been super-busy and has this longer update for us all to absorb.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| WIA | WIA Gold Limited | 0.029 | -28% | 4,827,836 | $36,827,398 |

| CTN | Catalina Resources | 0.003 | -25% | 254,195 | $4,953,948 |

| FHS | Freehill Mining Ltd. | 0.003 | -25% | 26,000 | $11,379,204 |

| MXC | Mgc Pharmaceuticals | 0.0015 | -25% | 2,455,492 | $8,855,936 |

| JAN | Janison Edu Group | 0.29 | -25% | 8,011,483 | $97,178,247 |

| DDT | DataDot Technology | 0.004 | -20% | 227,462 | $6,054,764 |

| GTG | Genetic Technologies | 0.002 | -20% | 100,000 | $28,854,145 |

| LNU | Linius Tech Limited | 0.002 | -20% | 158,500 | $10,574,477 |

| MTL | Mantle Minerals Ltd | 0.002 | -20% | 150,000 | $15,368,615 |

| THR | Thor Energy PLC | 0.022 | -19% | 1,534,133 | $4,761,086 |

| ILA | Island Pharma | 0.066 | -18% | 169,185 | $6,501,477 |

| 88E | 88 Energy Ltd | 0.005 | -17% | 10,026,647 | $132,711,930 |

| FAU | First Au Ltd | 0.0025 | -17% | 800,000 | $4,355,980 |

| SIS | Simble Solutions | 0.005 | -17% | 2,238,000 | $3,617,704 |

| SKN | Skin Elements Ltd | 0.005 | -17% | 3,347,280 | $3,416,917 |

| FBM | Future Battery | 0.092 | -16% | 5,468,387 | $56,089,658 |

| ZMI | Zinc of Ireland NL | 0.017 | -15% | 828,878 | $4,262,886 |

| HFR | Highfield Res Ltd | 0.285 | -15% | 1,503,009 | $131,381,551 |

| EXT | Excite Technology | 0.006 | -14% | 13,816 | $8,464,692 |

| LRL | Labyrinth Resources | 0.006 | -14% | 387,349 | $8,312,806 |

| NGS | NGS Ltd | 0.012 | -14% | 5,409,355 | $3,517,184 |

| AW1 | Americanwestmetals | 0.1075 | -14% | 6,066,816 | $46,277,845 |

| AL8 | Alderan Resource Ltd | 0.013 | -13% | 6,481,289 | $9,250,420 |

| DCL | Domacom Limited | 0.013 | -13% | 19,187 | $6,532,527 |

| EMC | Everest Metals Corp | 0.115 | -13% | 31,091 | $17,660,012 |

TRADING HALTS

Icon Energy (ASX:ICN) – Pending an announcement by Icon regarding the court hearing in relation to renewal of ATP855

Metalicity (ASX:MCT) – Pending the announcement regarding a Capital Raising

EQ Resources (ASX:EQR) – Pending the release of information by the Company to the market relating to a material interest acquisition

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.