Closing Bell: Local markets ignore the conflict, follow the money to a fifth day of wins

Via Getty

- ASX 200 closes higher for a fifth straight day

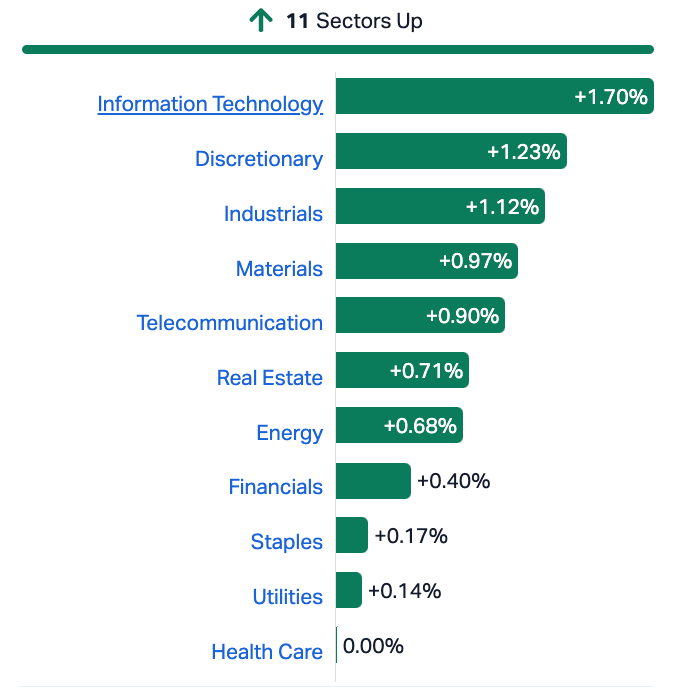

- All 11 Sectors make it home for supper

- Small caps led by Zuleika and Creasy

It’s fair to say the little battler of an Aussie sharemarket’s put in a real decent day’s work.

As various parts of the world lay in a heap of self-imposed ruin, the benchmark found at least +0.6% with change on Wednesday, riding an eerily warm uplift of sentiment to make it a fifth straight day of winning.

Wall Street helped a lot overnight, markets deciding we’ve all done war in the Middle East before. And should China’s Country Garden – formerly the largest homebuilder – eventually collapse in a heap of debt, it seems we’re universally assuming Beijing will buy its way out of the bother.

The property developer has warned investors it’s pretty likely to default on circa roughly $US187 billion in liabilities.

Anyhoo. It was a particularly strong showing on the Nasdaq Composite, which has in turn led to a happy day for local IT stocks. The ASX IT Sector gained 1.7%.

Sentiment is turning a corner on the toppy foreverness of US interest rates, too, and then there’s some fresh rumours of Beijing having to actually damn the torpedoes and whack out some fab economic stimulus – which always does the souls and the wallets on the ASX some good.

Both the ASX Emerging Co’s (XEC) index and the ASX Small Ords (XSO) climbed 0.8%.

It was thusly a decent day for Mining and Materials, although according to the pic below ALL 11 ASX sectors made gains. Healthcare, it seems gets a pass.

Wednesday’s ASX sectors:

Spending’s not ending: CBA

This is where and what CBA says we’re spending our money on lately, according to the latest Household Spending Insights report, which rather cheekily delves into the transactions of its circa 7 million customers.

Anonymised, apparently:

- Spending is down in five of 12 categories: Recreation, Utilities, Healthcare, Household goods and Household services

- Annual spending growth dropped to 1.8% from a high of 18.7% in August last

- Inflation and record population growth didn’t make much of a dent in our spending

- School hols and footy finals in September helped boost ‘hospitality’ splurging – bars, pubs, resto’s etc

CBA’s chief economist Stephen Halmarick says the report shows we pretty much kept spending our happy little fannies off, regardless of the 6% bump in inflation and the generally higher cost of everything.

Random Small Cap Wrap

We like a good Spacetalk (ASX:SPA) story here at Stockhead. This one’s dropped late in the day, but does represent a bit of a departure for the teens/kids smartwatch/child-espionage cap.

SPA’s launched a Spacetalk Family App. Quoting the cyber protection provider Malwarebytes, SPA says circa ‘80% of parents monitor their kids’ electronic behaviours and their location, and about 50% of these parents use more than one form of monitoring.’

“This mobile first family safety and tracking app, which significantly increases the Company’s addressable market, provides parents with a way to seamlessly progress older children from a Spacetalk smartwatch to their first mobile phone. The app delivers many of the features and benefits offered by Spacetalk’s best-selling smartwatches,” the company says.

Since the launch of SPA’s ‘kid’s wearables products,’ it’s accrued some >60k active companion app subscribers.

The new app gives Spacetalk a fresh hook to retain the wicked little trolls as they hit the teenage years, which’ll result in ‘improved customer retention,’ says Spacetalk CEO and MD Simon Crowther.

“The launch of the Spacetalk Family App represents a key milestone in the delivery of the strategic plan we communicated to the market back in mid calendar 2023. Thanks to this new product, we are now able to bridge the transition that kids have between a Spacetalk Watch and the receipt of their first smartphone. Parents can be assured that all the same great features and benefits of family safety and security incorporated in the Spacetalk Watch are carried across and accessed via our new dedicated mobile Spacetalk Family App.”

Outside improving customer retention, the strategy revolves around plugging in new space-talkers via a ‘significantly larger addressable market, which now also encompasses the late tweens and teen segments.’

Simon says the app also gives SPA access to a whole new group of potential customers.

“Parents who were previously not Spacetalk product users will be attracted by the app’s ability to add safety and security features to the first mobile phones they are giving their older tween/young teenager children.

“Spacetalk estimates that the app will triple its total addressable market to around 5.3 million persons (from 1.6 million previously). New Spacetalk subscribers together with improved customer retention generated by the Family App will promptly feed through into an increased recurring revenue base.”

The addressable market is considerable, Simon says.

Immuron (ASX:IMC) says it’s struck record quarterly Travelan sales as everyone heads out for a bit of OS holiday action. You’ll recognise Travelan from the chemist, when you get the runs during a long trip somewhere fun.

Immuron describes it thusly:

“Travelan® is an orally administered passive immunotherapy that prophylactically reduces the likelihood of contracting travelers’ diarrhea, a digestive tract disorder that is commonly caused by pathogenic bacteria and the toxins they produce. Travelan® is a highly purified tabletized preparation of hyper immune bovine antibodies and other factors, which when taken with meals bind to diarrhea-causing bacteria and prevent colonization and the pathology associated with travelers’ diarrhea.”

So now you know how it works, too.

Some bullies:

• Record quarterly Travelan sales of $1,550,240

• Total sales of A$1,565,767 in Q1, FY24

– $1,508,933 increase on Q1, FY23 sales

– 130% higher than pre-pandemic period Q1, FY20 sales

There was a bit of a short-term stock outage, but IMC says it’s since supplied product to wholesalers who in turn have re-upped the pharmacies.

IMC share price is up 9.33% to 0.082 cents.

Finally, the Board at Tombador Iron (ASX:TI1) has decided to suspend mining operations at the Tombador Project, due to a mix of safety, market conditions and strategic resource retention issues.

“The suspension of operations will enable the Company time to thoroughly assess the economic viability of the Project in the current market without the pressure of constrained production and the associated monthly fixed costs,” the company said on Wednesday.

RIPPED FROM THE HEADLINES

• Qantas chairman Richard Goyder has announced he will stand down from national carrier some time in the next 12 months. Qantas has had a bit of a rough run and Goyder’s head on a platter was starting to look like the shortest distance between two points. Up 3% on Wednesday and it appears to be correct.

• The Reserve Bank of Australia has thrown its two cents into the what to do about the China debate. Australia’s biggest trading partner is facing its worst economic slowdown since the reform and opening up initiated by Deng Xiao Ping in the late 80’s/early 90’s.

Now the RBA has sent out a warning missive that any painful ripples rolling across the debt-laden, shoddy property riddled economy will be felt around the world, but considering our sectoral exposure – most definitely here in Aussie.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ZAG | Zuleika Gold Ltd | 0.017 | 55% | 2,412,675 | $5,753,557 |

| CLE | Cyclone Metals | 0.0015 | 50% | 43,285,761 | $10,264,505 |

| MTL | Mantle Minerals Ltd | 0.003 | 50% | 2,150,785 | $12,294,892 |

| KP2 | Kore Potash PLC | 0.011 | 38% | 142,723 | $5,342,427 |

| AXP | AXP Energy Ltd | 0.002 | 33% | 14,907 | $8,737,021 |

| DDT | DataDot Technology | 0.004 | 33% | 10,610,861 | $3,632,858 |

| 5EA | 5Eadvanced | 0.475 | 28% | 1,015,906 | $112,695,962 |

| DXB | Dimerix Ltd | 0.205 | 28% | 8,250,981 | $64,662,772 |

| LNU | Linius Tech Limited | 0.0025 | 25% | 1,661,261 | $8,459,581 |

| DTR | Dateline Resources | 0.011 | 22% | 933,548 | $7,968,986 |

| BEZ | Besragoldinc | 0.165 | 22% | 6,740,591 | $56,443,622 |

| GTN | GTN Limited | 0.41 | 21% | 2,762 | $69,048,140 |

| PIL | Peppermint Inv Ltd | 0.012 | 20% | 4,242,093 | $20,378,568 |

| PNX | PNX Metals Limited | 0.003 | 20% | 5,003,386 | $13,451,562 |

| PLG | Pearlgullironlimited | 0.031 | 19% | 519,967 | $5,318,087 |

| AMA | AMA Group Limited | 0.044 | 19% | 31,976,927 | $65,575,067 |

| EVR | Ev Resources Ltd | 0.013 | 18% | 1,044,993 | $10,295,825 |

| AHF | Aust Dairy Limited | 0.02 | 18% | 282,146 | $11,149,736 |

| BDG | Black Dragon Gold | 0.034 | 17% | 16,764 | $5,819,432 |

| PHL | Propell Holdings Ltd | 0.014 | 17% | 41,667 | $1,444,266 |

| PUA | Peak Minerals Ltd | 0.0035 | 17% | 120,000 | $3,124,130 |

| HPR | High Peak Royalties | 0.0615 | 16% | 40,000 | $11,027,165 |

| SRI | Sipa Resources Ltd | 0.022 | 16% | 437,882 | $4,335,005 |

| GBR | Greatbould Resources | 0.061 | 15% | 2,254,251 | $26,781,407 |

| AIS | Aeris Resources Ltd | 0.23 | 15% | 4,440,919 | $138,189,119 |

Kalgoorlie-focused Zuleika Gold (ASX:ZAG) with x 4 gold projects in the post is killing Wednesday courtesy of a late Tuesday Mark Creasy flavoured revelation.

Overnight ZAG revealed a subscription cash deal with one of the legendary West Aussie prospector / investor’s various toys – Yandal Investments – for the raising of $3mn.

The subscription price is at a 28% premium. Handy.

The private placement cashola heads straight into the company’s ongoing exploration and development programs ‘across multiple targets’ at its four Kalgoorlie projects – Zuleika, Credo, Menzies and Goongarrie.

Our… Rob… Badman… noted this morning that it’s actually not ZAG’s first Creasy Rodeo…

Resources Top 5: Tiny goldie gets $3m thumbs-up from Mark Creasy, shares explodehttps://t.co/LalOlNk2ee #ASX $ZAG @AutecoMinerals @MTHResources @rarex_asx @KaiserReef pic.twitter.com/OI3vPco2Uc

— Stockhead (@StockheadAU) January 18, 2022

Creasy’s been busy of late, sinking far larger chunks of his enormous fortune into a significant iron-focused play in WA, as the inimitable Josh Chiat reported very early this morning:

“The famous Perth prospector owns more than 50% of CZR Resources (ASX:CZR), owner of the Robe Mesa deposit adjacent to Rio Tinto’s (ASX:RIO) Robe Valley mines, which include the Robe River JV from where over 1.7 BILLION TONNES have been shipped over the past 51 years.”

5E Advanced Materials (ASX:5EA) is up sharply on some American regulatory tango – the Environmental Protection Agency (EPA) green-lighting step-rate testing which has a little of the Frak about it and helps accurately measure the ‘fracture pressure of geological formations.’

5EA is up more than 25% on news the step-rate testing is underway and should quickly ID the porosity of the boron-loving small cap’s ore body and form a base-line parameter at Fort Cady Borate project in California, which hosts a multi-generational borate resource where boric acid, borate specialty materials, gypsum, and potassium sulphate will be produced.

The company plans to conduct a process to inject water into its wellfield, initiating the testing process and, says 5EA, this represents a meaningful step towards conducting full boric acid and lithium carbonate extraction operations.

“The commencement of Step-Rate Testing marks a significant milestone in our development sequence and an encouraging step towards operational production and mineral extraction, bringing 5E closer to becoming the first new boric acid producer in decades,” CEO Susan Brennan says.

Besra Gold (ASX:BEZ) is up well over 20% after getting paid US$10mn from Quantum Metal Recovery, as per conditions set by a US$300 million Gold Purchase Agreement back in May.

THIS IS THE ONE: $300m gold sale deal to supercharge Besra’s ~3Moz Bau project development

Quantum is Besra’s largest CDI (CHESS Depositary Interest) holder and under the terms of the GPA, Besra has agreed to sell to Quantum a quantity of refined gold from the Bau project (or any other gold project owned by the company or its subsidiaries) until: 3,000,000 ounces has been received by Quantum, or aggregate deposits hit US$300,000,000 equivalent.

Executive Chair, Dato’ Lim Khong Soon:

“Coming on the second anniversary of Besra’s listing, the transfer of the first US$10mn underscores the progress Besra has made… and sets the Company up well for its move back into commercial production.”

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| KZA | Kazia Therapeutics | 0.0985 | -38% | 2,530,310 | $37,815,900 |

| MXC | Mgc Pharmaceuticals | 0.0015 | -25% | 392,666 | $8,855,936 |

| BCT | Bluechiip Limited | 0.026 | -24% | 514,655 | $24,264,796 |

| CR1 | Constellation Res | 0.12 | -20% | 7,676 | $7,485,814 |

| AMD | Arrow Minerals | 0.002 | -20% | 1,000,000 | $7,559,413 |

| HOR | Horseshoe Metals Ltd | 0.008 | -20% | 651,052 | $6,434,787 |

| MCT | Metalicity Limited | 0.002 | -20% | 1,200,000 | $9,340,215 |

| NES | Nelson Resources. | 0.004 | -20% | 1,614,545 | $3,067,972 |

| RBR | RBR Group Ltd | 0.002 | -20% | 1 | $4,046,012 |

| SRJ | SRJ Technologies | 0.082 | -18% | 20,000 | $15,118,171 |

| ADV | Ardiden Ltd | 0.005 | -17% | 38,480 | $16,130,012 |

| ECT | Env Clean Tech Ltd. | 0.005 | -17% | 200,625 | $17,085,331 |

| VN8 | Vonex Limited. | 0.02 | -17% | 1,548,859 | $8,683,887 |

| BRN | Brainchip Ltd | 0.17 | -15% | 14,744,393 | $358,011,629 |

| RHY | Rhythm Biosciences | 0.26 | -15% | 1,105,142 | $67,448,490 |

| PCK | Painchek Ltd | 0.047 | -15% | 8,207,491 | $77,347,749 |

| CCZ | Castillo Copper Ltd | 0.006 | -14% | 713,653 | $9,096,537 |

| TSL | Titanium Sands Ltd | 0.006 | -14% | 243,952 | $12,402,633 |

| VAL | Valor Resources Ltd | 0.003 | -14% | 100,000 | $13,556,672 |

| RAD | Radiopharm | 0.125 | -14% | 1,828,950 | $34,700,390 |

| JPR | Jupiter Energy | 0.019 | -14% | 39,633 | $27,947,266 |

| JGH | Jade Gas Holdings | 0.032 | -14% | 280,000 | $58,342,864 |

| IMI | Infinitymining | 0.13 | -13% | 41,536 | $11,647,708 |

| W2V | Way2Vatltd | 0.013 | -13% | 196,297 | $9,518,826 |

| IAM | Income Asset | 0.1 | -13% | 41,594 | $32,202,394 |

TRADING HALTS

Javelin Minerals (ASX:JAV) – Pending an announcement providing an update on the proposed takeover bid by the company.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.