Closing Bell: Local markets fall into pre-Santa sulk just as RBA says we’re done for now

Via Getty

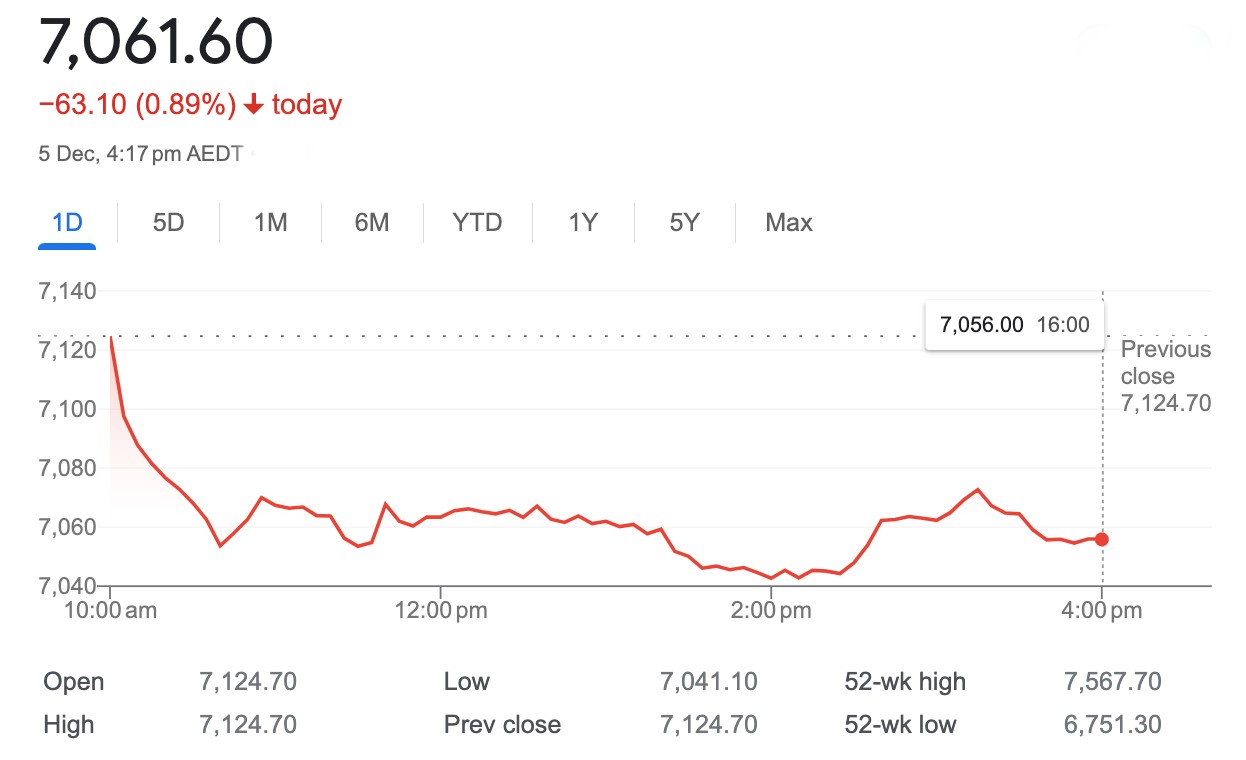

- The ASX benchmark ends sharply lower on Tuesday

- 9 of 11 sectors in the red

- Small caps led by Atlas Pearls

Australia’s share market was awful on Tuesday.

At match-out on Tuesday December 5, the S&P/ASX 200 (XJO) index was down 63 points, or -0.89%.

At 2.30pm, the Reserve Bank of Australia left the cash rate on hold at 4.35%, as was pretty much expected. And all was well within the land.

The RBA kept the OCR on hold, in line with expectations, but was less hawkish in its minutes than CBA expected.

-

Actual OCR: 4.35%

-

CBA expected: 4.35%

-

Bloomberg consensus: 4.35%

-

Christian’s preferred OCR: 0.00%

“Our central scenario sees the RBA commence an easing cycle in September 2024. We have 75 basis points of rate cuts in our profile in late 2024 and a further 75 basis points of easing in the first half 2025, which would take the cash rate to 2.85 per cent,” said CBA’s Gareth Aird after the announcement.

“Our central scenario sees the RBA commence an easing cycle in September 2024.”

Despite the new governor M. Bullock’s recent hawkish rhetoric, the RBA Board also left their forward guidance unchanged from last month:

“Whether further tightening of monetary policy is required to ensure that inflation returns to target in a reasonable timeframe will depend upon the data and the evolving assessment of risks.”

Barclay’s Bank said the minutes were ‘less hawkish than November’s and also less hawkish than we expected.’

“The RBA’s November forecasts bake in enough space for data surprises. This, coupled with the bank’s data dependence, suggests low likelihood for further hikes.”

Barclay’s expect the next move to be a cut in Q4 24… ‘but acknowledge the near-term risk sits with another 25bp rate hike.’

The next Board decision is February 6, 2024. ‘Cos January’s a holiday for the RBA Board.

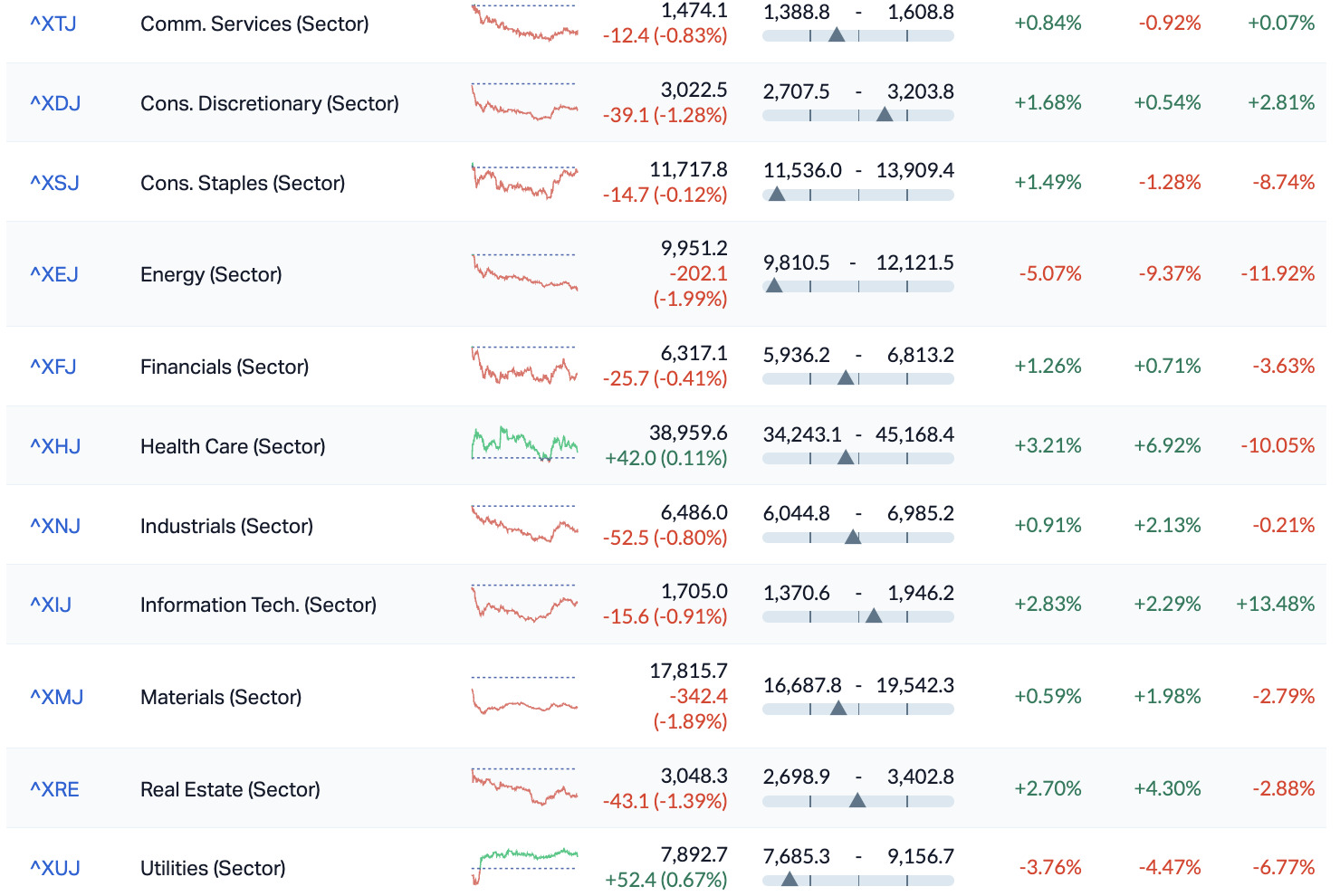

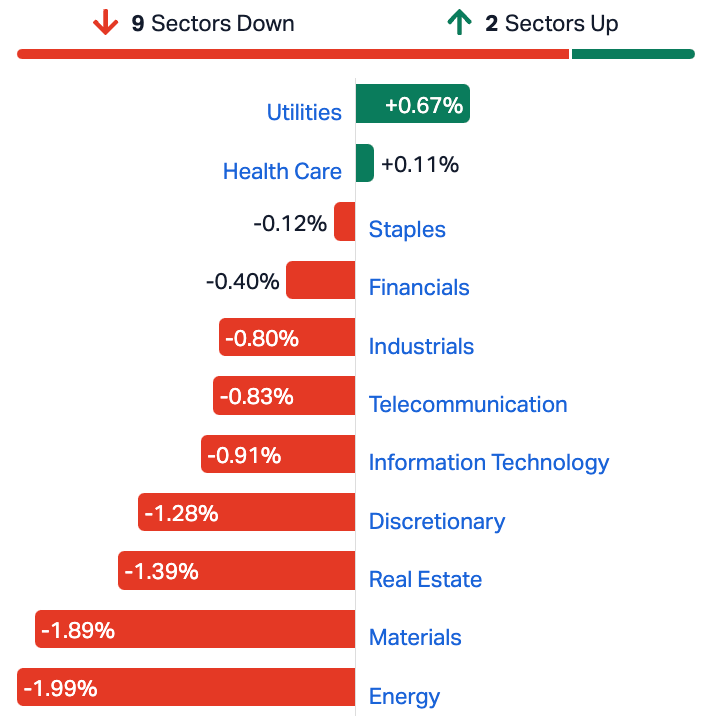

ASX SECTORS ON TUESDAY

The benchmark Aussie index fell sharply after paying a short visit to near three-month highs on Monday, losing its nerve ahead of the big RBA decision. Traders were at their wariest at around 2pm, when the index hit an intra-day low before the RBA dropped, and then climbed steadily on the relief.

But mostly maudlin local traders tracked the Monday losses in New York as Wall Street put an end to its recent winning ways.

At the sectoral level it was materials and energy stocks that copped the brunt of selling. That said, real estate and discretionary consumer stocks deserve special mention for backtracking well over -1%.

Oil’s had a shocker, too, and weaker overall commodity prices hit hard on the major miners – BHP (ASX:BHP) (-2.1%), Fortescue (ASX:FMG) (-2.4%), Rio Tinto (ASX:RIO) (-1.7%), Pilbara Minerals (-5%), Woodside Energy (-1.3%) and Santos (-0.9%).

Elsewhere it was the big banks, the technology and consumer-related stocks that also suffered.

Servicing China

Caixin’s China General Service PMI lifted to 51.5 last month, up from 50.4 in October and the fastest expansion since August, amid reports of firmer market conditions.

New orders grew the most in three months, indicating that domestic and overseas demand improved, with new export orders up slightly for a third straight month.

Meanwhile, employment fell slightly amid relatively subdued demand conditions, while the rate of backlog accumulation slowed and was only marginal.

On the cost side, input price inflation hit its lowest since June 2022 as rises in costs of labor and raw materials were limited. As a result, prices charged rose the least in three months and were broadly in line with the series average.

Lastly, sentiment improved for the 1st time in five months amid hopes of rising demand at home and abroad. However, sentiment remained softer than seen on average since the survey began in late 2005.

The national deficit

Australia unexpectedly posted a current deficit of AUD 0.2 billion in Q3 of 2023, reversing from an upwardly revised AUD 7.8 billion surplus in Q2, missing market expectations of an AUD 3.1 billion surplus. It was the first deficit in the current account since Q3 of 2022, mainly due to falls in key export commodities prices.

The goods and services account surplus plunged to AUD 22.9 billion in Q3 from AUD 30.8 billion in Q2 due to moderating commodity prices, with prices of good exports falling 1.9%, mainly coal and agricultural commodities.

Simultaneously, the net secondary income deficit increased to AUD 0.7 billion from AUD 0.4 billion. Meanwhile, the net primary account gap narrowed slightly to AUD 22.3 billion from AUD 22.7 billion in Q2, dragged down by a decrease in dividend payments by ASX-listed mining companies.

And we’re surely still watching gold…

Gold is soaring.

The precious metal is ahead by… well it’s a lot…

Trading on terror?

It looks like Hamas is perfecting its received financial windfalls following the Oct. 7 attacks on Israel after making bets on Israeli securities in the weeks leading up to the massacre that killed at least 1,200 people, according to researchers.

In a report titled law professors Robert Jackson Jr. of New York University, and Joshua Mitts of Columbia University, detailed suspicious trading activity.

The report details how so-called short sellers made risky bets against stocks that paid off.

In one trade reported by the New York Post, an unidentified trader shorted 4.43 million shares in Israel’s largest bank, Leumi, between Sept 15 and Oct 5. The move resulted in a nearly US$900mn profit.

Just five days before the attacks, someone short-sold the Enterprise Investment Scheme (EIS), a security that gives investors exposure to Israeli exchange-traded funds through the MSCI Israel ETF, making around 227,000 short transactions against the exchange.

“It is extremely unlikely that the volume of short selling on Oct 2 occurred by random chance,” the pair wrote of the volume of short-selling.

Ahead of Monday trade in New York, US Futures linked to all 3 major US indices were lower:

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ATH | Alterity Therap Ltd | 0.0075 | 88% | 225,480,015 | $11,209,442 |

| ATP | Atlas Pearls Ltd | 0.135 | 53% | 12,511,750 | $37,652,715 |

| ADD | Adavale Resource Ltd | 0.011 | 38% | 10,038,334 | $5,842,954 |

| BP8 | Bph Global Ltd | 0.002 | 33% | 3,296,032 | $2,423,345 |

| FGL | Frugl Group Limited | 0.009 | 29% | 2,078,286 | $6,727,434 |

| EDE | Eden Inv Ltd | 0.0025 | 25% | 1,000,000 | $7,334,027 |

| KPO | Kalina Power Limited | 0.005 | 25% | 500,000 | $6,060,783 |

| HAW | Hawthorn Resources | 0.098 | 23% | 11,859 | $26,801,249 |

| GLV | Global Oil & Gas | 0.0195 | 22% | 69,607,822 | $7,472,005 |

| HTA | Hutchison | 0.04 | 21% | 38,371 | $447,892,783 |

| EEG | Empire Energy Ltd | 0.205 | 21% | 2,462,709 | $131,430,595 |

| ESR | Estrella Res Ltd | 0.006 | 20% | 375,000 | $8,795,359 |

| RWD | Reward Minerals Ltd | 0.095 | 19% | 768,978 | $18,228,251 |

| CST | Castile Resources | 0.077 | 17% | 105,600 | $15,965,560 |

| AQX | Alice Queen Ltd | 0.007 | 17% | 360,228 | $872,952 |

| BFC | Beston Global Ltd | 0.007 | 17% | 1,774,059 | $11,982,281 |

| KNM | Kneomedia Limited | 0.0035 | 17% | 650,469 | $4,599,814 |

| MOM | Moab Minerals Ltd | 0.007 | 17% | 70,000 | $4,271,781 |

| POL | Polymetals Resources | 0.32 | 16% | 31,838 | $41,846,261 |

| NSB | Neuroscientific | 0.055 | 15% | 88,952 | $6,941,034 |

| NET | Netlinkz Limited | 0.008 | 14% | 700,799 | $25,322,699 |

| NTM | Nt Minerals Limited | 0.008 | 14% | 614 | $6,019,320 |

| SER | Strategic Energy | 0.016 | 14% | 175,075 | $6,801,412 |

| SWP | Swoop Holdings Ltd | 0.25 | 14% | 132,736 | $45,805,966 |

| LSR | Lodestar Minerals | 0.0045 | 13% | 24,891 | $8,093,589 |

You probably didn’t see this one coming.

Tuesday’s all you can buy stock is Atlas Pearls (ASX:ATP), which notes that at its recently completed auction in Kobe, Japan, the company sold 130,000 loose pearls for total revenue of $14.81 million.

ATP’s total revenue from loose pearl sales for the five months ended 30 November 2023 is now just below the comparable revenue for all of FY2023 as shown below:

Atlas Pearls’ CEO Michael Ricci:

“The sales outcome underlined the continuing strength in the global market for south sea pearls with strong demand for the company’s offering from both Chinese and Japanese buyers.”

Reward Minerals (ASX:RWD) has entered into a binding share sale agreement with the receivers at Kalium Lakes, to acquire the $400m Beyondie sulphate of potash (SOP) project for $20 million.

That’s a WA project, about 160 km SE of Newman and SOP is a compound commonly used in agriculture – in fertilisers.

We recently reported this acquisition was on the table as a potential outcome, after the company entered into an exclusivity deed with Kalium and its receivers.

This share sale agreement now represents the next step in an acquisition that’s looking pretty likely.

The company reports that the share sale will be on a “debt-free basis, free of encumbrances for total consideration of A$20 million, comprising a A$250,000 exclusivity payment previously made, upfront cash consideration of $14.75 million and deferred cash consideration of $5 million by 30 June 2025.”

Reward’s executive director, Dr Michael Ruane:

“Assuming that the proposed DOCA [deed of company arrangement] with creditors, shareholder approval and capital raising are completed, the Reward team are keen to move quickly on evaluation of the plant and flowsheet modifications and costs for potentially recommissioning the Beyondie project.”

TODAY’S ASX SMALL CAP LAGGARDS

Here are the day’s worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| T3D | 333D Limited | 0.007 | -77% | 33,336 | $3,189,317 |

| ICU | Investor Centre Ltd | 0.034 | -37% | 166,705 | $16,372,694 |

| ICN | Icon Energy Limited | 0.005 | -29% | 842,757 | $5,376,096 |

| IND | Industrialminerals | 0.81 | -26% | 1,863,169 | $74,403,400 |

| MTL | Mantle Minerals Ltd | 0.003 | -25% | 914,350 | $24,589,783 |

| SHO | Sportshero Ltd | 0.015 | -25% | 136,112 | $11,500,022 |

| SP3 | Specturltd | 0.015 | -25% | 789,200 | $4,590,698 |

| TSL | Titanium Sands Ltd | 0.01 | -23% | 4,666,967 | $23,033,461 |

| AYT | Austin Metals Ltd | 0.007 | -22% | 1,327,845 | $9,142,872 |

| H2G | Greenhy2 Limited | 0.007 | -22% | 1,363,636 | $3,768,802 |

| SLB | Stelarmetalslimited | 0.28 | -20% | 850,645 | $18,167,774 |

| 88E | 88 Energy Ltd | 0.004 | -20% | 61,371,800 | $110,593,275 |

| ALM | Alma Metals Ltd | 0.008 | -20% | 1,992,353 | $11,140,008 |

| ASP | Aspermont Limited | 0.008 | -20% | 1,180,999 | $24,387,637 |

| AUK | Aumake Limited | 0.004 | -20% | 4,204,391 | $9,295,367 |

| CT1 | Constellation Tech | 0.002 | -20% | 16,356 | $3,678,001 |

| CTO | Citigold Corp Ltd | 0.004 | -20% | 2,252,513 | $14,368,295 |

| WEL | Winchester Energy | 0.002 | -20% | 183,000 | $2,551,055 |

| WIN | Widgienickellimited | 0.079 | -19% | 2,319,638 | $29,198,615 |

| PEC | Perpetual Res Ltd | 0.013 | -19% | 1,948,628 | $10,080,471 |

| MSB | Mesoblast Limited | 0.3175 | -17% | 13,779,940 | $329,752,954 |

| MM1 | Midasmineralsltd | 0.12 | -17% | 313,964 | $12,578,351 |

| AGR | Aguia Res Ltd | 0.01 | -17% | 2,239,122 | $5,620,044 |

| DOU | Douugh Limited | 0.005 | -17% | 240,858 | $6,406,254 |

| GTG | Genetic Technologies | 0.0025 | -17% | 2,834,204 | $34,624,974 |

TRADING HALTS

Evolution Mining (ASX:EVN) – Capital raising comprising an institutional placement and a share purchase plan.

Indiana Resources (ASX:IDA) – pending an announcement to the market in relation to the Australian Centre for Commercial Arbitration (ACICA) proceedings between Indiana’s subsidiary Nachingwea U.K. Limited and Loricatus Resource Investments.

Invictus Energy (ASX:IVZ) – Invictus is prepping an update on the intermediate wireline logging and fluid sampling results from Mukuyu-2 Side Track well.

MRG Metals (ASX:MRQ) – Pending the release of an announcement to the market in relation to a Western Australia Lithium project acquisition and a capital raising.

Elixir Energy (ASX:EXR) – Pending the release of an announcement by the Company concerning initial drilling results from its Daydream-2 appraisal well.

Cohiba Minerals (ASX:CHK) – Pending an announcement by the Company to the market in relation to a material capital raising.

Future Metals (ASX:FME) – Pending the release of an announcement regarding the Scoping Study on the Panton PGM-Ni-Cr Project.

Emu (ASX:EMU) – Pending the release of an announcement advising results from its maiden reconnaissance field survey at its Georgetown Project in Queensland.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.