Closing Bell: Lithium Plus adds much more lithium, but can’t stop BHP from ruining benchmark’s day

Via Getty

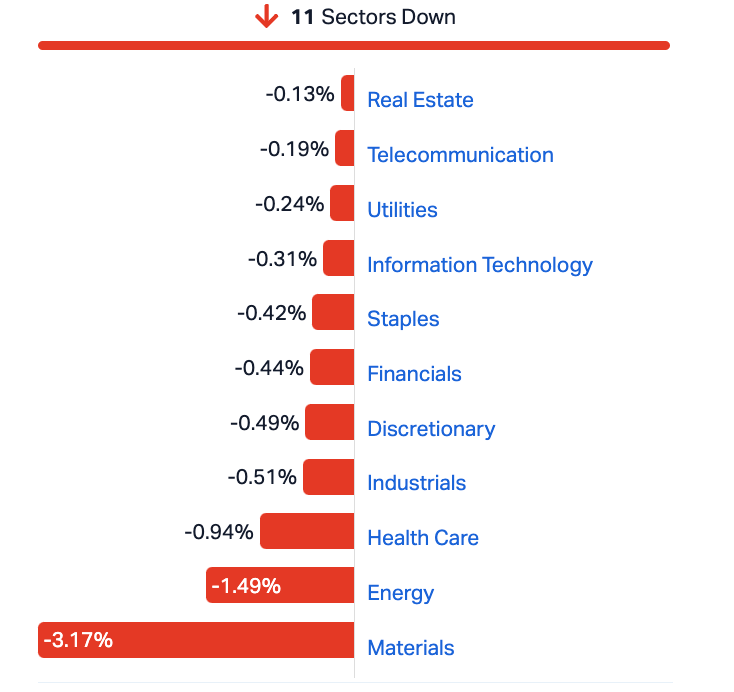

- ASX 200 closes significantly lower

- Mining Sector sheds -3.2% after BHP goes ex-div

- Small caps led by huge LPM find

I’m usually the first to kick the Australian sharemarket when its down, but the kind of losses the ASX200’s been handing out on Thursday – down 1.2% – are more of an ex-divvy story, than anything I should put my steel-tipped doc martins on for.

With all three major Wall Street indices coughing up their lollies (S&P 500 lost -0.7%, Dow Jones lost -0.6% and tech heavy Nasdaq gave up -1.1%, it was always going to be an uphill battle for Asian markets.

Outstandingly early in the AM, is Stockhead’s evergreen Eddy Sunarto who noted that the Nasdaq’s megacaps were much to blame with Apple down by -3.6%, on reports China’s banning iPhones for government operatives, on the reasonable assumption that it only takes one bad apple.

Back here, well, the benchmark in particular is on soft ground.

It never likes to do much that doesn’t ape New York markets, and while the US economy is spunkily resilient, the top 200 Aussie caps are far more exposed to the Chinese economy than most anyone.

With China customs data this arvo showing August delivered a 4th straight month of declines, Beijing’s timid response to the economic doldrums is starting to depress people.

The clincher has been a bottle-neck of stocks going ex-dividend, dragging us all lower to be fully frank, with their tax free booty.

Eddy will be all over this, but the largest heavyweight lugging its market cap about the ASX is BHP (ASX:BHP) and the stock price tumbled from the get go.

The world’s largest mining company gave up more than 4% when I checked in at 2pm. When the the Broken Hill Proprietary Company Limited aka “the Big Australian,” goes ex-divvy (which BTW, means its stock traded minus its latest $1.25 shareholder payout), everyone feels the toilet flush.

As a result, the Mining Sector (down 2.4 per cent) was most pantless on Thursday, that other great heaver of iron ore, Rio Tinto (ASX:RIO) also giving up 1.5%.

Thursday’s ASX sectors:

The ASX Emerging Co’s (XEC) index lost -0.9%. The ASX Small Ords (XSO) shed -1.2%.

RIPPED FROM THE HEADLINES

Australia’s monthly trade surplus undershoots expectations.

The July trade balance falls to $8.04bn versus $10bn expected and $10.27bn in June, as exports fall 2 per cent and imports rise 3 per cent on month.

The Australian dollar falls a few points to $US63.72c, but remains above a 10 month low of $US63.56c reached on Tuesday.

And as mentioned, China’s exports tumbled for the fourth consecutive month in August amid weak external demand and ongoing global supply chain upheaval, posing more challenges to the world’s second-largest economy as it struggles to carve out a path to a post-pandemic rebound.

The awful Aussie dollar is another 0.2% less than it was, wallowing somewhere around 10 month lows at circa US63.70¢. The pacific peso’s copped a full gale force of China’s weak economic reads and its worsening real estate woes.

Finally, the PM Anthony Albanese says he’s been invited to visit Chinese President Xi Jinping in Beijing later this year. It’s been ages since we had a PM get a guernsey to China. Face to face meets are good.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ODE | Odessa Minerals Ltd | 0.011 | 47% | 73,598,531 | $7,103,339 |

| CXU | Cauldron Energy Ltd | 0.009 | 29% | 19,251,975 | $6,660,981 |

| VMM | Viridismining | 0.895 | 27% | 461,506 | $22,031,719 |

| LPM | Lithium Plus | 0.3525 | 26% | 11,498,176 | $18,476,696 |

| EX1 | Exopharm Limited | 0.01 | 25% | 757,944 | $3,515,385 |

| IPB | IPB Petroleum Ltd | 0.01 | 25% | 9,115,703 | $4,520,980 |

| QFE | Quickfee Limited | 0.063 | 24% | 49,979 | $13,960,749 |

| PNT | Panthermetalsltd | 0.08 | 23% | 244,039 | $3,974,750 |

| MRI | Myrewardsinternation | 0.011 | 22% | 1,029,748 | $3,839,704 |

| JCS | Jcurve Solutions | 0.04 | 21% | 200,287 | $10,835,333 |

| NAE | New Age Exploration | 0.006 | 20% | 9,445,657 | $7,179,495 |

| RML | Resolution Minerals | 0.006 | 20% | 202,500 | $6,286,459 |

| ELS | Elsight Ltd | 0.37 | 19% | 1,084,941 | $46,599,070 |

| MHI | Merchant House | 0.038 | 19% | 38,500 | $3,016,528 |

| CCA | Change Financial Ltd | 0.064 | 19% | 573,204 | $33,893,715 |

| AJQ | Armour Energy Ltd | 0.135 | 17% | 91,201 | $11,858,813 |

| CRB | Carbine Resources | 0.007 | 17% | 2,050,000 | $3,310,427 |

| LRL | Labyrinth Resources | 0.007 | 17% | 330,999 | $7,125,262 |

| DAL | Dalaroometalsltd | 0.05 | 16% | 250,274 | $2,230,625 |

| SUH | Southern Hem Min | 0.022 | 16% | 420,700 | $10,010,225 |

| RDN | Raiden Resources Ltd | 0.0405 | 16% | 114,799,475 | $80,127,594 |

| BCT | Bluechiip Limited | 0.03 | 15% | 2,852,116 | $18,555,432 |

| EMP | Emperor Energy Ltd | 0.015 | 15% | 19,070 | $3,495,212 |

| MGL | Magontec Limited | 0.46 | 15% | 55,740 | $31,324,217 |

| AL8 | Alderan Resource Ltd | 0.008 | 14% | 250,000 | $4,316,863 |

Lithium Plus Minerals (ASX:LPM) is out in front of the pack at lunchtime, climbing ~43% on news that the first completed diamond hole (BYLDD019) at the Lei Prospect has intersected 127m of strongly mineralised pegmatite from 609m (with a true width of ~60m), with assays pending.

LPM says the find represents “one of the largest mineralised intersections ever recorded from the Bynoe pegmatite field”, putting the Lei pegmatite in company with Core Lithium’s (ASX: CXO) previously reported world-class 119m intercept at the BP33 deposit.

Killi Resources (ASX:KLI) was up over 25% before lunch after collecting high-grade copper hits up to 7.2% Cu and gold 12.4g/t Au at surface from rock chip samples from the Baloo prospect within the company’s 100% owned Mt Rawdon West project, Queensland.

Killi says 12 of the 26 rock chip samples collected have returned assays greater than 1% Cu, including 7.2% Cu and 27.2g/t Ag, 4.2% Cu, 1.16g/t Au, 75.8g/t Ag, 1 % Pb and 0.3 % Zn, and 4.5% Cu, 0.09g/t Au and 83.7g/t Ag.

Elsight (ASX:ELS) is soaring on news the US Federal Aviation Administration (FAA) has granted the Halo enabled Airobotics Optimus-1EX system a (really important) Type Certificate, that will allow flight operations over people and infrastructure without the need for case-by-case waivers.

Elsight and its project partner Airobotics have been working on getting the Optimus-1EX drone certified for four years, the company says, leaving Elsight CEO Yoav Amitai delighted at the result.

“We warmly congratulate Airobotics for this achievement,” Amitai said. “This is a major step forward for the drone industry in general. Completing the long-complicated process to achieve the first non-air carrier drone Type Certification by the FAA shows that the regulators are coming to the position that drones are a part of the future.”

Digital tracking firm Bluechiip (ASX:BCT) rose quickly after providing a strong strategic update, saying it would hit FY24 with a heao of momentum and plucky with optimism given the positivity around FY23.

FY22 strategies are now resulting in rising sales and, importantly, repeat orders. Quarterly repeat revenue has risen 25-fold from March 2022 to today.

In addition BCT says its Bluechiip tracking solution is now installed in a Big Pharma laboratory in Europe, and further Big Pharma groups in the US are expected to sign with Bluechiip by the end of calendar 2023.

Bluechiip says it has targeted a very sizeable market and has a significant level of engagement with the world’s 20 leading Big Pharma companies.

“No other company has been able to achieve these milestones, coupling temperature with identification at the sample level in the $1B+ global market in which we operate,” the company noted.

Bluechiip’s Advanced Sample Management Solution provides sample temperature with ID in cryogenic environments in stem cells, blood, eggs, sperm and other yummy bio-specimens.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| SRR | Saramaresourcesltd | 0.034 | -43% | 259,108 | $3,375,192 |

| T92 | Terrauraniumlimited | 0.099 | -34% | 1,836,211 | $7,740,774 |

| CPT | Cipherpoint Limited | 0.005 | -29% | 729,388 | $8,114,692 |

| CLE | Cyclone Metals | 0.0015 | -25% | 3,634,500 | $20,529,010 |

| CI1 | Credit Intelligence | 0.145 | -19% | 82,304 | $15,029,849 |

| CL8 | Carly Holdings Ltd | 0.017 | -19% | 600,342 | $5,635,778 |

| RNX | Renegade Exploration | 0.009 | -18% | 200,000 | $10,484,362 |

| CHW | Chilwaminerals | 0.15 | -17% | 27,700 | $8,257,500 |

| NOU | Noumi Limited | 0.15 | -17% | 221,659 | $49,879,677 |

| AVM | Advance Metals Ltd | 0.005 | -17% | 929,039 | $3,531,352 |

| HLX | Helix Resources | 0.005 | -17% | 560,136 | $13,938,875 |

| LNU | Linius Tech Limited | 0.0025 | -17% | 16,228 | $12,689,372 |

| PRX | Prodigy Gold NL | 0.005 | -17% | 93,137 | $10,506,647 |

| LYK | Lykosmetalslimited | 0.066 | -16% | 49,992 | $4,929,600 |

| AHI | Advanced Health | 0.205 | -16% | 524,831 | $53,337,472 |

| ZNC | Zenith Minerals Ltd | 0.105 | -16% | 105,169 | $44,047,610 |

| CTQ | Careteq Limited | 0.021 | -16% | 1,526,717 | $5,553,072 |

| NMR | Native Mineral Res | 0.04 | -15% | 1,549,331 | $8,224,778 |

| PGO | Pacgold | 0.205 | -15% | 145,176 | $16,080,136 |

| G50 | Gold50Limited | 0.15 | -14% | 14,735 | $18,725,125 |

| 1MC | Morella Corporation | 0.006 | -14% | 1,907,171 | $42,970,590 |

| CNJ | Conico Ltd | 0.006 | -14% | 484,953 | $10,990,665 |

| EEL | Enrg Elements Ltd | 0.006 | -14% | 3,869,846 | $7,069,755 |

| IEC | Intra Energy Corp | 0.006 | -14% | 2,404,282 | $11,345,471 |

| KGL | KGL Resources Ltd | 0.12 | -14% | 1,772 | $79,420,861 |

TRADING HALTS

BPH Energy (ASX:BPH) – Pending a material announcement to be made by the Company for the purpose of considering, planning and executing a capital raising

Revasum (ASX:RVS) – Pending the outcome of discussions in relation to funding

Audinate (ASX:AD8) – Pending a proposed capital raise

Eroad (ASX:ERD) – Pending a proposed capital raise

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.