Closing Bell: Liontown’s kitty is sitting pretty; Benchmark makes most of Monday ahead of RBA meet

LTR is purring. Via Getty

- ASX 200 find 0.5% to start the week, LTR looks ready to sell

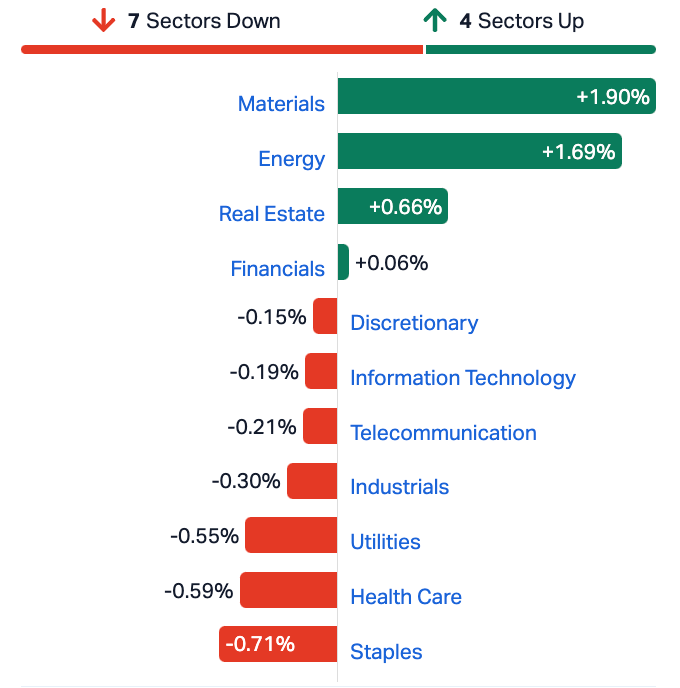

- Energy stocks and miners offset IT and Consumer Discretionary losses

- Small cap winners led by EMD and GLH

Local markets were led higher on Monday, supported by resource businesses as the Mining and Energy sectors reacted best to signs of positive economic life in the States and in China.

With US jobs growth moderating nicely on Friday (bad news is still good news there), the ASX 200 ended about 0.5% ahead, with IT, Consumer Discretionary and Utility names offsetting the Energy Sector following a 2.5% jump in Brent crude prices.

Lithium and iron ore companies were inspired after a visit from lithium legend Albemarle – always welcome here at Stockhead – and the US giant popped up again on Monday with a sharper kniife for a better stab at local lithium lad Liontown Resources (ASX:LTR).

The new offer is worth $6.6 billion for a $3 per share offer the Kathleen Valley mine owner and Our Josh says LTR’s Tim Goyder-led board looks ready to play.

This’d represent for the original punters who bought into LTR in 2019 at 2 cents a pop, a good ’nuff 14,900% gain.

After rejecting bids at $2.20, $2.35 and $2.50 in March for the company and its $895 million, 500,000tpa Kathleen Valley operation in WA’s Northern Goldfields, Goyder and CEO Tony Ottaviano look ready to settle.

“Should Albemarle make a binding proposal at $3.00 per share, subject to agreement of a mutually acceptable binding scheme implementation agreement, the intention of the Liontown Board is to unanimously recommend shareholders vote in favour of the proposal in the absence of a superior proposal and subject to an independent expert concluding (and continuing to conclude) that the proposed transaction is in the best interests of shareholders,” the company said this morning… before gasping for breath after the world’s longest sentence (which we just made longer).

“Liontown notes that there is no certainty that the Revised Indicative Proposal will progress to a binding offer for consideration by shareholders.”

The bid comes in at almost double the $1.53 price Liontown was trading at on March 27, before the initial Albemarle offers were revealed to the ASX.

Monday’s ASX sectors:

The ASX Small Ordinaries Index (XSO) ended 0.25% higher, and the ASX Emerging Companies Index (XEC) found 0.5%.

RIPPED FROM THE HEADLINES

In China, the Hang Seng has climbed to near one-month highs after shuttering for Typhoon Somebody on Friday. The winners circle consisted of state-backed consumer and financial bluechips including Longfor Group (12%), China Overseas Land (10%), sports apparel maker Li Ning (8.5%) and China Merchants Bank (8%).

The naughty real estate developer, Country Garden Holdings (+14.9%), according to Reuters, won approval from creditors over the weekend to extend its massively maturing yuan bond and not therefore implode into a million worthless pieces. Interestingly, the vote was far from unanimous.

Its shares jumped by 15%, but they have about 60% more to get back to a week earlier.

Mainland China stocks have also risen, with momentum on the positive side after Beijing’s newest measures late last week added weight to capital markets and investor confidence, with the halving of the stamp duty on stock trades a p[articular hit.

There’s a long weekend tonight on Wall Street and US Futures are little changed ahead of key readings on US services later in the week.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| KEY | KEY Petroleum | 0.002 | 100% | 1,000,540 | $1,967,928 |

| AVW | Avira Resources Ltd | 0.0015 | 50% | 200,001 | $2,133,790 |

| CLE | Cyclone Metals | 0.0015 | 50% | 2,645,800 | $10,264,505 |

| EEL | Enrg Elements Ltd | 0.006 | 50% | 4,686,990 | $4,039,860 |

| BXN | Bioxyne Ltd | 0.016 | 45% | 293,359 | $20,918,099 |

| FAU | First Au Ltd | 0.004 | 33% | 196,000 | $4,355,980 |

| TYM | Tymlez Group | 0.004 | 33% | 27,479 | $3,714,586 |

| ASR | Asra Minerals Ltd | 0.009 | 29% | 6,041,851 | $10,082,710 |

| FRB | Firebird Metals | 0.185 | 28% | 660,601 | $10,595,875 |

| ZGL | Zicom Group Limited | 0.06 | 25% | 214,238 | $10,298,880 |

| BCB | Bowen Coal Limited | 0.125 | 25% | 5,182,977 | $213,598,588 |

| BTE | Botalaenergyltd | 0.125 | 25% | 290,008 | $5,331,667 |

| EMD | Emyria Limited | 0.1 | 25% | 11,142,082 | $24,667,945 |

| EMU | EMU NL | 0.0025 | 25% | 10,561,227 | $2,900,043 |

| MXC | Mgc Pharmaceuticals | 0.0025 | 25% | 707,068 | $8,509,936 |

| PEX | Peel Mining Limited | 0.13 | 24% | 1,360,866 | $60,980,626 |

| DUB | Dubber Corp Ltd | 0.16 | 23% | 1,920,052 | $46,475,907 |

| VKA | Viking Mines Ltd | 0.011 | 22% | 1,411,294 | $9,227,326 |

| CYQ | Cycliq Group Ltd | 0.006 | 20% | 200,000 | $1,787,583 |

| NES | Nelson Resources. | 0.006 | 20% | 762,970 | $3,067,972 |

| OLI | Oliver'S Real Food | 0.024 | 20% | 263,456 | $8,814,638 |

| ARV | Artemis Resources | 0.045 | 18% | 31,529,243 | $59,656,898 |

| JAY | Jayride Group | 0.13 | 18% | 25,025 | $22,400,158 |

| MGU | Magnum Mining & Exp | 0.039 | 18% | 3,056,299 | $23,816,226 |

| HT8 | Harris Technology Gl | 0.013 | 18% | 83,185 | $3,290,490 |

The clinical stage biotech Emyria (ASX:EMD), has secured firm commitments from new and sophisticated investors to raise $2 million (before costs) through an oversubscribed placement.

Emyria says it will also kick off a non-renounceable pro rata entitlement offer to raise approximately $3.1 million (before costs) at the same terms.

The plan is to cash-up and fast-track development of EMD’s MDMA-assisted therapy for PTSD, the usual “revenue growth and data collection” stuff, as well as “payer engagement”.

Global Health (ASX:GLH) jumped in early trade off the back of positive FY23 news, including Customer Revenue growth of 20% to $7.81 million, and Annual Recurring Revenue up 11% to $5.73 million.

Elsewhere the digger Viking Mines (ASX:VKA) is up on news of a solid vanadium find at its Fold Nose deposit, where the company says it’s hit significant vanadium pentoxide (V2O5) intercepts, such as 42m at 0.74% V2O5 (>0.5%) from 79m, including 17m at 0.80% V2O5 (>0.8%) from 83m and 8m at 0.99% V2O5 (>0.8%) from 108m.

Artemis Resources (ASX:ARV) is ahead again, after recent laboratory XRD analysis – by JV partner Greentech Metals (ASX:GRE) – of a known lithium bearing sample collected within the Osborne JV tenement in the Pilbara has returned 3.6% Li20 from a sample that was 44% spodumene and 43% quartz.

Greentech’s found 8%.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| LLL | Leolithiumlimited | 0.57 | -50% | 72,208,110 | $1,125,447,873 |

| CT1 | Constellation Tech | 0.002 | -33% | 20,000 | $4,413,601 |

| MTH | Mithril Resources | 0.001 | -33% | 225,190 | $5,053,207 |

| TD1 | Tali Digital Limited | 0.001 | -33% | 1,178,529 | $4,942,733 |

| VPR | Volt Power Group | 0.001 | -33% | 800,010 | $16,074,312 |

| AXP | AXP Energy Ltd | 0.0015 | -25% | 961,295 | $11,649,361 |

| DDT | DataDot Technology | 0.003 | -25% | 35,987,516 | $4,843,811 |

| DM1 | Desert Metals | 0.077 | -21% | 1,742,970 | $7,109,026 |

| APC | Aust Potash Ltd | 0.004 | -20% | 1,767,695 | $5,193,447 |

| CTO | Citigold Corp Ltd | 0.004 | -20% | 500,000 | $14,368,295 |

| NTM | Nt Minerals Limited | 0.008 | -20% | 773,543 | $8,006,989 |

| OPN | Oppenneg | 0.008 | -20% | 739,072 | $11,166,796 |

| AW1 | Americanwestmetals | 0.245 | -18% | 25,074,381 | $108,159,634 |

| PVW | PVW Res Ltd | 0.066 | -18% | 17,325 | $7,877,088 |

| SOM | SomnoMed Limited | 0.6 | -17% | 41,948 | $60,148,477 |

| JCS | Jcurve Solutions | 0.03 | -17% | 314,741 | $11,820,364 |

| CHK | Cohiba Min Ltd | 0.0025 | -17% | 7,830,000 | $6,639,733 |

| H2G | Greenhy2 Limited | 0.01 | -17% | 1,616,696 | $5,025,070 |

| LML | Lincoln Minerals | 0.005 | -17% | 850,227 | $8,524,271 |

| LNU | Linius Tech Limited | 0.0025 | -17% | 16,361 | $12,689,372 |

| ROG | Red Sky Energy. | 0.005 | -17% | 1,734,408 | $31,813,363 |

| LKY | Locksleyresources | 0.042 | -16% | 418,456 | $7,333,333 |

| KRM | Kingsrose Mining Ltd | 0.059 | -16% | 2,555,296 | $52,676,856 |

| MFD | Mayfield Childcr Ltd | 0.735 | -16% | 555,720 | $56,822,053 |

| CDX | Cardiex Limited | 0.14 | -15% | 181,047 | $23,707,781 |

TRADING HALTS

Cauldron Energy (ASX:CXU) – Pending a response by the Company to volume query received from ASX from 4 September 2023 and pending an operational update.

Orexplore Technologies (ASX:OXT) – Pending a proposed capital raising.

Carnegie Clean Energy (ASX:CCE) – Pending an announcement regarding the Phase 3 results of the EuropeWave Program.

Mobilicom (ASX:MOB) – Pending an announcement by the Company to the market regarding the proposed trading solely on Nasdaq and proposed delisting of the Company’s securities from the ASX.

Torque Metals (ASX:TOR) – Pending an announcement with regards to a proposed acquisition and associated capital raising.

Javelin Minerals (ASX:JAV) – Pending an announcement regarding a proposed takeover bid by the Company and a capital raising.

Antilles Gold (ASX:AAU) – Pending the release of an announcement in relation to a capital raising that will involve a placement to sophisticated investors, and a simultaneous Share Purchase Plan (“SPP”) for existing shareholders, the terms of which will be settled during the trading halt.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.