Closing Bell: Lessons aplenty as ASX dives on Day 2, while lithium upstart Wildcat Resources takes +2796pc out of 2023

Via Getty

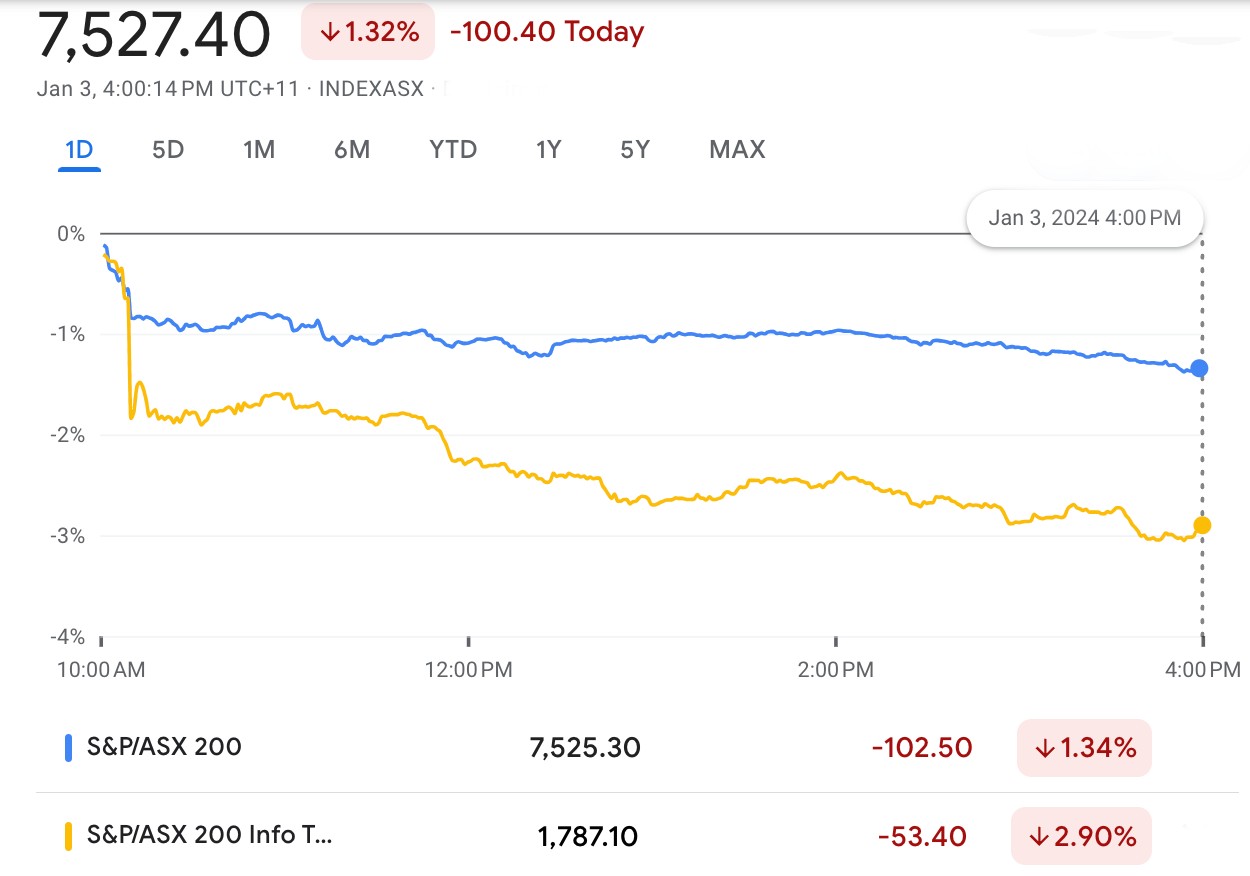

- ASX200 cops it on the chin, down -1.3% on a joyless Day 2 of 2024

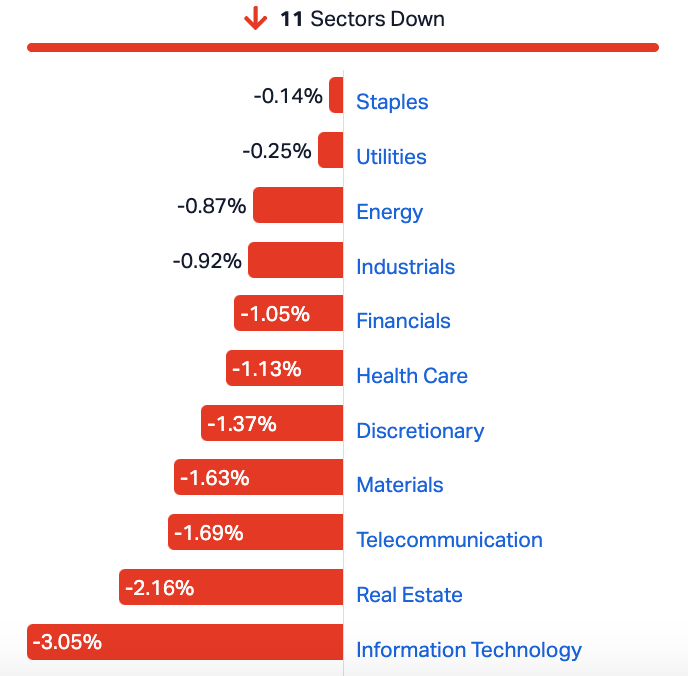

- Sectors losses led by appalling -3.0% for the InfoTech sector

- Small Cap Winners include Pan Asia Metals and Viridis Mining

The ASX has taken a big hit on Wednesday with Technology and Materials shares in the firing line, after the Nasdaq Composite index endured its 3rd worst Day 1 of any trading year since the dot-com collapse.

Investors locked in their profits and wound out of the betting based on falling inflation and the hopes of impending interest rate cuts from major central banks.

All 11 local sectors were in the red at the close.

At 4pm on Wednesday, 3 January, the ASX200 was more than 100 points or -1.32% lower at 7527:

The benchmark had it coming, they’ll say after a rollicking December which saw the ASX200 pile on more than +8%.

While it was bad news for most mining stocks on Wednesday, 2023 was far from being a fizzler for lithium small caps.

Analysis from Iress has WA lithium explorer Wildcat Resources (ASX:WC8) topping the 2023 ASX pops – up a magnificent , bestowing upon the minnow a market cap closing quickly on $1bn. The stock, now trading at circa 69 cents, began 2023 at just 2.5 cents.

Wildcat surged past $1 in November when golden eyed investor Chris Ellison’s Mineral Resources (ASX:MIN) snapped up a 19.8 per cent stake.

The other stellar performer for 2023 according to Iress (ASX:IRE) was lithium legend Azure Minerals (ASX:AZS) whose stock price exploded some +1600% after starting out at 22c and setting a record high of $4.37 in November.

Azure’s incredibly high-grade lithium intersected at its West Pilbara lithium project only went higher once Chile’s Sociedad Química y Minera de Chile lobbed a takeover bid which Azure finally green-lit in December.

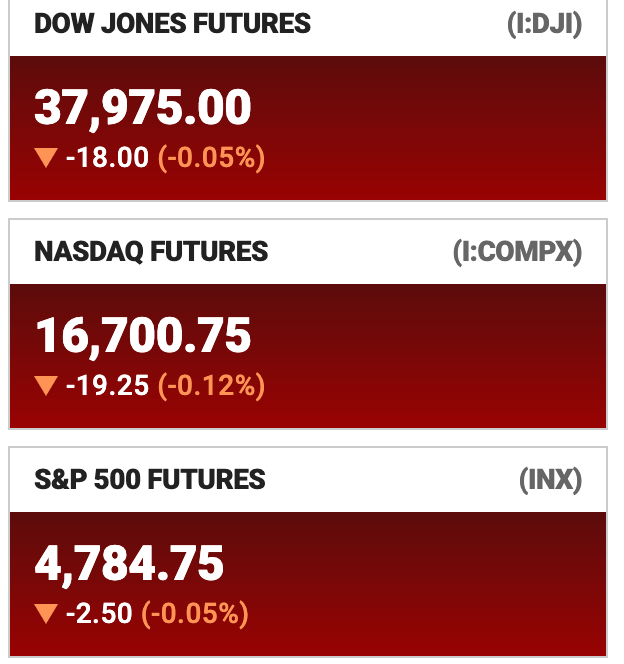

In New York, chastened investors pulled in their heads and their bigger bets on Biggest Tech and the scent of descending interest rates, after the nine straight weeks of significant gains which ended 2023.

The Nasdaq 100 had its worst session in over 2 months after analysts Barclays Bank downgraded Apple to underweight.

At home, losses in the IT Sector were led by Block Inc (ASX:SQ2) which crashed well over -6%, as well as stiff hits for both Xero (ASX:XRO) and WiseTech Global (ASX:WTC).

While Tech was surely terrible, not far behind was the mega Materials Sector which tracked weakening commodity prices overnight. The Sector fell by well over -1.5% with losses across the board.

Gold stocks and the major iron ore names tumbled and lithium companies were mixed.

The headline goldies – Northern Star Resources (ASX:NST) and Evolution Energy Minerals (ASX:EV1) – shed between 2-3% on Wednesday. Gold Road Resources (ASX:GOR) is putting in an absolute shocker after letting slip that annual production barely made it to the lower end of a broad guidance for 2023.

The stock deflated like a busted beachball, down about 8% at lunch. See below for more on the gold price action, but conditions may have momentarily turned against gold assets, but with Iranian warships in the Red Sea, the world needs a safe haven more than ever.

The iron ore triumvirate gave back more than they made on Tuesday. BHP (ASX:BHP) and Rio Tinto (ASX:RIO) down between 1.5 – 2%.

Fortescue is having more than macro problems. It fell sharply in the same way it’s ore train did after confirming a derailment that which has hit port supply in Western Australia.

Compounding matters for the benchmark – the influential Big 4 were all in retreat around 1%.

ASX SECTORS at 3.45pm on WEDNESDAY

Around the neighbourhood, Japanese markets were fortunate to be shuttered for the holidays as regional equity markets faithfully tracked the losses on Wall Street.

In Honkers, the Hang Seng tech index is falling fast, down almost -2% and shadowing the horrible day on the Nasdaq 100. Shares in South Korea, Hong Kong and mainland China all fell early and were lagging badly at lunchtime in Beijing and beyond.

We’re watching gold

Which is levitating at around US$2,060 retreating from Tuesday’s intraday highs in New York to end that session -0.2% lower after a positive rebound for the greenback and US Treasury yields.

A selloff in risk assets and heightened geopolitical tensions in the Middle East has given gold fans encouragement and provided some intraday support to the spot Gold price, nudging ahead by almost +0.3% and ensuring the safe haven narrative is far from a done discussion.

However, for now it seems reality has bitten the yellow metal with markets now plotting the odds of a quarter-point rate cut from the US Fed at a mere 70%, down sharply from nearly 90% a few days ago.

Investors in the states will be looking ahead to the Fed minutes for signs of dovish thoughts on interest rates.

US Futures at 4pm on Wednesday in Sydney:

SMALL CAP LEADERS

Today’s best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| OEQ | Orion Equities | 0.15 | 121% | 104,868 | $1,064,148 |

| CHK | Cohiba Min Ltd | 0.003 | 50% | 2,855,927 | $5,060,460 |

| ME1 | Melodiol Glb Health | 0.0015 | 50% | 13,110,740 | $4,728,824 |

| CUF | Cufe Ltd | 0.019 | 36% | 8,539,277 | $16,045,573 |

| NWF | Newfield Resources | 0.135 | 35% | 121,000 | $90,322,242 |

| PAM | Pan Asia Metals | 0.205 | 32% | 684,573 | $26,011,601 |

| SRK | Strike Resources | 0.062 | 27% | 166,202 | $13,903,750 |

| KNM | Kneomedia Limited | 0.0025 | 25% | 500,003 | $3,066,543 |

| VMM | Viridismining | 1.62 | 21% | 1,147,603 | $59,957,115 |

| DY6 | Dy6Metalsltd | 0.12 | 20% | 25,714 | $3,856,249 |

| CRB | Carbine Resources | 0.006 | 20% | 1,000,000 | $2,758,689 |

| IVX | Invion Ltd | 0.006 | 20% | 629,240 | $32,108,161 |

| NKL | Nickelxltd | 0.044 | 19% | 107,299 | $3,249,161 |

| AKM | Aspire Mining Ltd | 0.13 | 18% | 452,462 | $55,840,068 |

| NRX | Noronex Limited | 0.013 | 18% | 139,443 | $4,161,319 |

| TAR | Taruga Minerals | 0.013 | 18% | 28,502 | $7,766,295 |

| LLI | Loyal Lithium Ltd | 0.43 | 18% | 1,327,667 | $30,399,871 |

| CLU | Cluey Ltd | 0.083 | 17% | 45,597 | $14,314,563 |

| PXX | Polarx Limited | 0.007 | 17% | 3,388,471 | $9,837,701 |

| DEV | Devex Resources Ltd | 0.325 | 16% | 4,506,380 | $123,533,388 |

| M2M | Mtmalcolmminesnl | 0.03 | 15% | 266,833 | $3,050,931 |

| VTX | Vertexmin | 0.155 | 15% | 82,500 | $8,425,125 |

| A1G | African Gold Ltd. | 0.031 | 15% | 46,350 | $4,571,403 |

| SRX | Sierra Rutile | 0.11 | 15% | 228,308 | $40,726,699 |

| LPD | Lepidico Ltd | 0.008 | 14% | 7,490,796 | $53,468,156 |

The Small Caps winners for the day include Pan Asia Metals (ASX:PAM) , which is continuing to surge on yesterday’s news that it has put pen to formal papers to acquire 100% interest in the massive Tama Atacama Chilean lithium brine asset, which comprises some 1,200km2 of “Tier 1” ground.

PAM had been eyeing off full control of Tama Atacama for good reason – the project is one of the largest lithium brine projects in South America, representing roughly 13% of the highly prized Pampa del Tamarugal Basin in Chile’s Atacama Desert.

It also boasts super high-grade lithium in surface assays up to 2,200ppm Li, averaging 700ppm Li extending over 160km north to south – so, naturally, everyone’s a bit excited about the new deal.

Meanwhile, Viridis Mining and Minerals (ASX:VMM) wasmaking waves on news that a third set of assays from Viridis Mining and Minerals’ Colossus REE project in Brazil, have returned an average grade of 3,002ppm TREO across 113 drill holes.

Colossus is starting to stack up as a world-class REE project, and those assays make perfect sense when you consider that it lies within Brazil’s pro-mining state of Minas Gerais and directly adjacent to Meteoric Resources’ (ASX:MEI) Caldeira project.

MEI’s Caldeira has a monster existing resource of 409Mt @ 2,626 parts per million (ppm) total rare earth oxides (TREO) – the highest grade for any Ionic Adsorption Clay (IAC) project known.

Aside from those two, the winner’s list early in the day was dominated by a number of little companies moving sharply despite the absence of fresh news, including Genetic Technologies (ASX:GTG), NickelX (ASX:NKL) and Taruga Minerals (ASX:TAR).

Later in the day, it was a safe bet that something’s afoot at Cufe this week, after a news-less 35% surge throughout the session ended with the company calling a pause in trading a bit over an hour before the market closed.

Orion Equities Limited (ASX:OEQ) also lifted late in the day, after announcing that its subsidiary CXM Pty Ltd stands to pocket about $5 million in a royalty payment from Miracle Iron Holdings, after Miracle moved to acquire the Paulsens East Iron Ore Project located in the Pilbara, Western Australia from Strike Resources (ASX:SRK).

Strike was, naturally, also up nicely, banking a better-than 26% boost for the session.

SMALL CAP LAGGARDS

Today’s worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| KBC | Keybridge Capital | 0.042 | -38% | 166,999 | $14,098,973 |

| CLE | Cyclone Metals | 0.001 | -33% | 736,838 | $15,706,757 |

| M4M | Macro Metals Limited | 0.002 | -33% | 3,040,364 | $7,401,233 |

| AUH | Austchina Holdings | 0.003 | -25% | 25,000 | $8,311,535 |

| DCX | Discovex Res Ltd | 0.0015 | -25% | 201,938 | $6,605,136 |

| ZEU | Zeus Resources Ltd | 0.0075 | -25% | 16,686,302 | $4,592,810 |

| JAY | Jayride Group | 0.03 | -23% | 3,380 | $9,141,956 |

| MTM | MTM Critical Metals | 0.071 | -23% | 15,777,485 | $9,148,212 |

| TSL | Titanium Sands Ltd | 0.011 | -21% | 470,248 | $27,912,223 |

| CGO | CPT Global Limited | 0.12 | -20% | 83,466 | $6,284,605 |

| 88E | 88 Energy Ltd | 0.004 | -20% | 8,175,183 | $123,204,013 |

| EDE | Eden Inv Ltd | 0.002 | -20% | 3,001 | $9,167,534 |

| RVS | Revasum | 0.125 | -17% | 32,350 | $19,218,755 |

| AL8 | Alderan Resource Ltd | 0.005 | -17% | 2,066,267 | $6,641,168 |

| RIL | Redivium Limited | 0.005 | -17% | 12,130,634 | $16,385,129 |

| SFG | Seafarms Group Ltd | 0.005 | -17% | 970,582 | $29,019,595 |

| LYN | Lycaonresources | 0.16 | -16% | 185,833 | $8,370,688 |

| WNX | Wellnex Life Ltd | 0.022 | -15% | 6,495,124 | $28,157,366 |

| NET | Netlinkz Limited | 0.0085 | -15% | 6,432,357 | $37,438,141 |

| ATH | Alterity Therap Ltd | 0.006 | -14% | 3,639,255 | $19,616,523 |

| BCK | Brockman Mining Ltd | 0.024 | -14% | 177,288 | $259,846,500 |

| CCO | The Calmer Co Int | 0.006 | -14% | 1,002,814 | $6,002,466 |

| UVA | Uvrelimited | 0.12 | -14% | 866,328 | $4,633,752 |

| VML | Vital Metals Limited | 0.006 | -14% | 2,114,496 | $41,265,469 |

| DEL | Delorean Corporation | 0.026 | -13% | 173,944 | $6,471,627 |

Trading Halts

Nope. Ask anyone.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.