Closing Bell: It’s Day Two of Small Cap suffering, XEC index now 10% lower in five days

Depressed small cat. Via Getty

- Emerging Companies (XEC) index tumbles 2.8%

- Benchmark ASX200 down 7% over five sessions

- Square Inc is leaking

Small caps have been hit hard for the second consecutive day – down 2.8% and some 11% over the last five sessions. The benchmark ASX200 is shedding weight in late afternoon trade, down over 1.5% and 7% for the last week of business.

Stateside, the S&P 500 waded on deeper into the mire overnight, closing down about 0.5% officially starting its 20th bear market of the past 140 years.

According to the Bank of America, the average peak to trough bear decline is 37.3%, and the average duration is 289 days.

So, if history is a guide, from today’s Official Bear Market #20 Day One will have run its course on Wednesday October 19th 2022 with the S&P 500 at 3000.

Investor expectations for where the Fed Put is. Interestingly, with a 75bps hike expected tonight, if the Fed goes 50bps, it will be bearish risk assets. If they go 100bps, it may actually be bullish as it shows a commitment to get ahead of the curve.

Further curvaceous movements happening over at China’s central bank today, but not as expected. The People’s Bank of China keeping the interest rate of one-year medium-term lending facility (MLF) loans unchanged at 2.85% for the five months now.

Some 220 billion yuan (US$30 bn) of 1-year MLF loans – like Reuben’s overfed and mollycoddled Groodles – matured and rolled over on Wednesday. The MLF’s are a pretty handy and oft-used tool with which the PBoC moderates liquidity levels in the important Chinese interbank market.

Nevertheless, by refusing to play ball, or take the bait to cut a key policy rate, Beijing is obvs choosing to keep the powder dry just as major western nations aggressively hike rates seemingly at the rise of a hat.

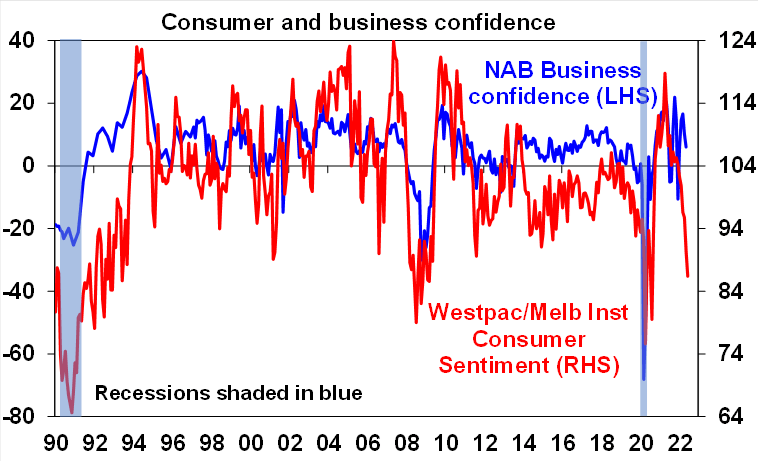

We have our own problems here at home, consumer confidence – according to the latest Westpac/Melbourne Institute thingy – fell by 4.5% in June, the seventh straight decline leaving us consumers at our least confident since way back when the pandemic was but a sneeze and a runny nose back in 2020 (see the chart below).

The weekly ANZ/Roy Morgan consumer confidence data has been similarly shite of late, while NAB’s business survey suggests confidence is slowing but business conditions also remain obtusely positive.

Lastly, it seems Crown Resorts (ASX:CWN) has traded its last security, bringing to an end a messy life as a publicly-listed …whatever-that-was, just a few minutes ago. The delisting comes after the Federal Court green-lit Crown’s absorption into the bosom of US raider Blackstone.

We’re not much for editorialising here at Stockhead, so I know i speak for all of humanity when I say let that be an end to it.

TODAY’S BIGGEST SMALL CAP WINNERS

(Stocks highlighted in yellow rose after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ARE | Argonaut Resources | 0.003 | 50% | 6,303,518 | $7,212,409.56 |

| JAV | Javelin Minerals Ltd | 0.0015 | 50% | 5,178,436 | $9,354,152.77 |

| PXX | Polarx Limited | 0.018 | 38% | 11,449,972 | $11,688,314.21 |

| BTN | Butn Limited | 0.165 | 32% | 98,590 | $9,606,080.00 |

| 8IH | 8I Holdings Ltd | 0.12 | 32% | 1,000 | $32,610,395.09 |

| VAR | Variscan Mines Ltd | 0.026 | 30% | 326,366 | $5,334,640.48 |

| LCT | Living Cell Tech. | 0.009 | 29% | 6,166,444 | $8,997,546.06 |

| RIM | Rimfire Pacific | 0.01 | 25% | 3,939,279 | $14,449,957.88 |

| SBR | Sabre Resources | 0.005 | 25% | 12,055,700 | $11,158,924.03 |

| AWV | Anova Metals Ltd | 0.011 | 22% | 250,002 | $13,482,847.80 |

| EDE | Eden Inv Ltd | 0.011 | 22% | 1,377,794 | $22,369,076.96 |

| CML | Chase Mining Limited | 0.017 | 21% | 117,065,011 | $6,553,858.65 |

| LPM | Lithium Plus | 0.355 | 20% | 2,160,360 | $13,162,369.00 |

| PAB | Patrys Limited | 0.024 | 20% | 2,185,499 | $41,139,995.14 |

| SHE | Stonehorse Energy Lt | 0.02 | 18% | 2,146,115 | $11,635,396.41 |

| TGH | Terragen | 0.17 | 17% | 275,911 | $27,992,139.08 |

| DEM | De.Mem Ltd | 0.175 | 17% | 6,666 | $33,434,203.65 |

| OEC | Orbital Corp Limited | 0.28 | 17% | 164,788 | $21,839,206.56 |

| CTV | Colortv Limited | 0.007 | 17% | 28,571 | $927,738.80 |

| MRQ | Mrg Metals Limited | 0.007 | 17% | 2,896,720 | $10,482,351.77 |

| NAE | New Age Exploration | 0.007 | 17% | 3,635,430 | $8,615,393.46 |

| TD1 | Tali Digital Limited | 0.007 | 17% | 1,791,452 | $7,348,750.00 |

| GAL | Galileo Mining Ltd | 1.595 | 16% | 9,115,569 | $245,861,357.50 |

| ISU | Iselect Ltd | 0.145 | 16% | 19,577 | $30,010,844.13 |

| DTR | Dateline Resources | 0.105 | 15% | 253,781 | $40,318,496.40 |

Reuben of Denmark says 10,000m of drilling is ready to unlock rock at Lithium Plus Minerals’ (ASX:LPM) flagship ‘Bynroe’ lithium project, which shares a border with Core Lithium’s (ASX:CXO) ‘Finniss’ mine development.

The focus will be the ‘Lei’ and ‘Cai’ prospects where there is “strong potential to delineate a maiden high-grade resource”, the company reports. The drilling program, set to kick off in early July, will take about four months to complete.

LPM listed in April following a $10m IPO, with the share price rocketing 292% on debut.

LPM, led by exec chair Dr Bin Guo, is going ahead with its aggressive exploration program, after earlier securing a cornerstone investment from Suzhou CATH Energy Tech – a subsidiary of CATL which is the world’s largest EV battery manufacturer and a potentially super-reliable Chinese offtake partner.

LPM is focused on exploring its 19 granted exploration licences and three exploration licences under application in the Bynoe and Arunta regions in the Northern Territory.

It peaked at $0.98 per share from its listing price of $0.25, before trailing down to 44c currently.

TODAY’S BIGGEST SMALL CAP LOSERS

(Stocks highlighted in yellow fell after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| GFN | Gefen Int | 0.095 | -27% | 518,447 | $7,941,812.58 |

| RBR | RBR Group Ltd | 0.003 | -25% | 750,000 | $5,150,481.38 |

| MRL | Mayur Resources Ltd | 0.075 | -25% | 557,900 | $24,034,294.50 |

| RMX | Red Mount Min Ltd | 0.005 | -23% | 5,141,844 | $10,675,365.08 |

| CL8 | Carly Holdings Ltd | 0.027 | -23% | 98,860 | $4,071,269.23 |

| PLG | Pearlgullironlimited | 0.045 | -22% | 2,519,037 | $3,184,333.86 |

| MCM | Mc Mining Ltd | 0.11 | -21% | 275,411 | $27,671,681.80 |

| NFL | Norfolkmetalslimited | 0.14 | -20% | 166,426 | $4,948,474.30 |

| AO1 | Assetowl Limited | 0.002 | -20% | 198,731 | $3,930,324.40 |

| CFO | Cfoam Limited | 0.004 | -20% | 7,088,080 | $3,669,203.17 |

| GML | Gateway Mining | 0.008 | -20% | 4,385,144 | $22,601,063.67 |

| MBK | Metal Bank Ltd | 0.004 | -20% | 3,250,000 | $13,039,090.80 |

| MGG | Mogul Games Grp Ltd | 0.002 | -20% | 3,898,138 | $8,154,149.89 |

| PNX | PNX Metals Limited | 0.004 | -20% | 4,188,786 | $22,220,289.04 |

| SGC | Sacgasco Ltd | 0.016 | -20% | 2,743,842 | $12,102,941.70 |

| XST | Xstate Resources | 0.002 | -20% | 2,498,643 | $8,037,954.13 |

| NSX | NSX Limited | 0.033 | -20% | 35,000 | $11,587,136.24 |

| EM2 | Eagle Mountain | 0.295 | -19% | 1,237,109 | $97,649,595.74 |

| PYR | Payright Limited | 0.11 | -19% | 123,607 | $10,558,919.30 |

| KWR | Kingwest Resources | 0.094 | -18% | 1,018,744 | $27,941,897.88 |

| OAU | Ora Gold Limited | 0.009 | -18% | 342,578 | $10,806,901.26 |

| GSN | Great Southern | 0.038 | -17% | 545,752 | $24,488,885.96 |

| W2V | Way2Vatltd | 0.038 | -17% | 1,481,697 | $6,355,329.59 |

| EPN | Epsilon Healthcare | 0.024 | -17% | 871,794 | $6,970,266.23 |

| DUN | Dundasminerals | 0.1 | -17% | 75,421 | $4,610,981.40 |

No real small cap, but working its way eagerly to that cherished status, I thought it was worth flagging the flagging Block Inc (ASX:SQ2) share price which is down 7% for the day, 51% for the year to date.

It’s just a miserable time to be the owner of the biggest BNPL deal around, and it certainly doesn’t help that the wobbly payments giant’s dual identity over on the NASDAQ has struggled not to look like a rusty bucket amid a gleaming flotilla of starships which are also floating in the ether in exactly the same way that bricks don’t.

Also opening a fresh chapter of pain is Booktopia (ASX: BKG) which is down circa 15% today after shedding some has dropped a comparable 17% over the previous five sessions.

It’s been a spectacular post-Q3 results fade out and one that’s looking hard to come back from minus founder and CEO Tony Nash’s imminent departure.

ANNOUNCEMENTS YOU MAY’VE MISSED

It’s been busy-busy around town today, so there’s probably some stuff you missed… like the exciting news that Northern Star Resources (ASX: NST) has completed the sale of its Paulsens Gold Operation and Western Tanami Gold Project, in WA. Northern Star sold the whole lot off to Black Cat Syndicate Limited (ASX: BC8; Black Cat) for a total cash, scrip and contingent cash payment consideration of $44.5 million, laying to rest (hopefully once and for all) any belief in that thing about black cats being bad luck.

Elsewhere, Southern Palladium (ASX:SPD) is feeling pretty chipper after a high-definition, helicopter-borne TMF gradient and gamma-ray spectrometry survey turned up evidence to support its earlier Inferred Mineral Resource of 18.8Moz (3PGE + Gold), situated within the UG2 and Merensky Reefs at the Bengwenyama platinum group metals (PGMs) project. It’s a total mouthful, but good news often is.

And finally, a bit of happy news for you lithium fans out there: Venus Metals Corporation (ASX:VMC) has started poking great big holes in the ground at its Henderson Project, about 50km northwest of Menzies in the Eastern Goldfields of Western Australia. Experts have told Stockhead that “big holes like that aren’t unusual in the region, so there’s no cause for alarm”, as Venus goes looking for that sweet, sweet pegmatite we’ve all been hearing so much about lately.

TRADING HALTS

Dacian Gold (ASX: DCN) – regarding an update on operations and Jupiter drilling results

FBR Ltd (ASX:FBR) – regarding a capital raising

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.