Closing Bell: It’s a numbers game this week and coal, confidence and small caps are winning

Via Getty

- The ASX 200 gains 0.6%

- XEC ahead 0.9%

- Westpac: We all feel better now

The ASX Emerging Companies (XEC) Index is like a baby bull market with lots of tiny lovely baby bulls trotting about finding another near 1% after Monday’s strong gains.

The benchmark has made it back to the 7000 mark, gaining 0.6% by the close of business on Tuesday.

Wall Street indices locked in a fourth straight session of gains last night, rolling the dice that some easing economic and inflation data will allow the Fed to take a zero-Rates approach to the problem one day soon.

Around the grounds, regional markets were generally trading up on Tuesday, with the punters apparently punting ahead of tonight’s blockbuster US inflation report.

The South Korean Kospi index gained almost 3.2% on its return to trade after the mid-autumn break – led by Samsung gains to the tune of 5% . The Nikkei 225 and the Topix index in Tokyo were both about 0.3% ahead.

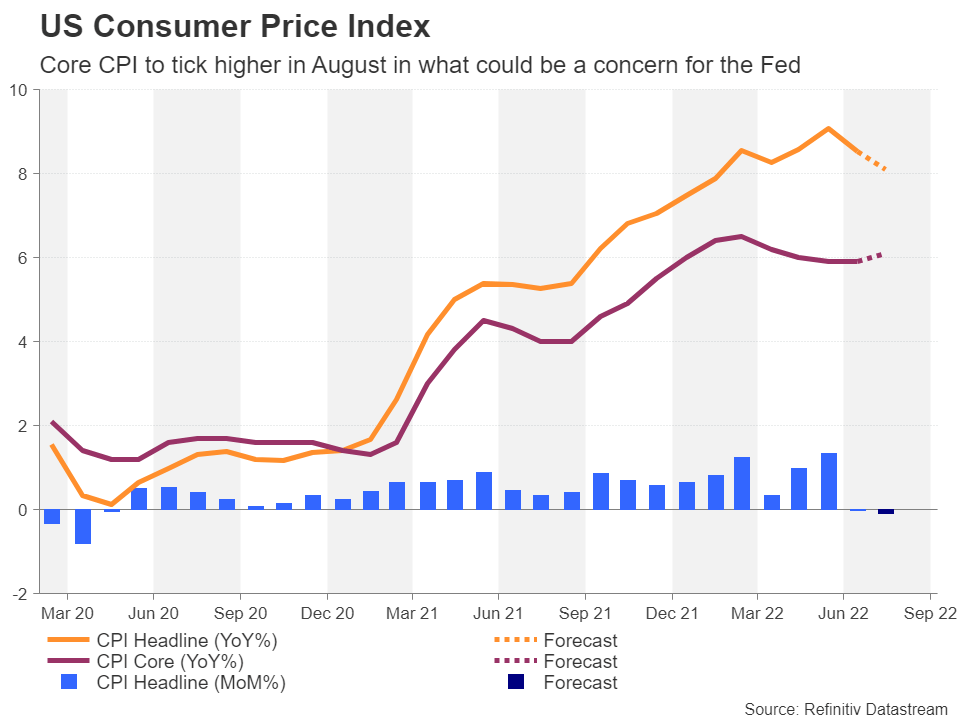

Tonight, (Tuesday 12:30 GMT) it really is all about the August US CPI inflation data. It’s the last full measure the Fed can taste before its September policy decision and while July’s report offered hope, Fed policymakers were more than happy to dash it last time out.

Pete McGuire at XM says another consideration for the Fed will be Thursday’s retail sales figures.

“The (Fed’s) series of rate hikes have yet to significantly dampen consumer spending. The US dollar has gotten off to a softer start to the week ahead of the data, amid speculation that September’s rate rise will be the last three-quarter point move.”

There was overshot relief when America’s CPI index stood flat in July, marking the slowest monthly change since May 2020 when the economy was just coming out of lockdown.

“On a year-on-year basis, CPI rose by 8.5%, slowing from June’s four-decade peak of 9.1%.”

“Much of the slowdown was attributed to the drop in gasoline prices that came on the back of the decline in crude oil prices during the summer.

“However, prices either fell or grew at a weaker-than-expected rate in other categories too, in an encouraging sign that inflation may finally be peaking on a broader level,” McGuire adds.

But. Not so fast, says the Fed. We need to see several months of price pressure easing before we’re gonna be easing up on any of our rate hikes.

Get confident, stupid

At home, I certainly don’t feel any more self-assured myself, but Westpac insists Aussie consumer confidence is on the improve for the first time in 2022 and in almost a full year.

And yet Omicron is still abroad, rising cost of living is still high, as is inflation, stocks have bombed a few times and the Reserve Bank is waging a war on the cost of money… nevertheless the Westpac-Melbourne Institute sentiment index jumped 4% (at 84 points) vis a vis the first two weeks of this month.

Fittingly, it is still 20% lower than this time a year earlier.

Westpac chief economist Bill Evans:

“Consumers may be a little less fearful, but confidence remains very weak… Index reads in the 80-85 range mean pessimists still greatly outnumber optimists.”

I’d only add that the first sentence makes no sense and the second is true of the universe in general.

Whitehaven Coal (ASX:WHC) it has to be said is cashing in on some of these extraordinary coal prices.

As of Monday, WHC has recovered some 86.1 million shares, or about 8.3% (of a targeted 10% over 12 months). Management has paid an average price of $5.13 per share or $441.5 million.

Coal is at record highs and market watchers see prices going even higher as the global energy crisis takes new size and shape.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MGG | Mogul Games Grp Ltd | 0.002 | 100% | 8,996,504 | $3,263,441 |

| RFR | Rafaella Resources | 0.041 | 37% | 17,574,627 | $8,424,715 |

| CRR | Critical Resources | 0.068 | 36% | 158,648,369 | $74,400,762 |

| PCL | Pancontinental Energ | 0.004 | 33% | 5,165,399 | $22,662,668 |

| PRM | Prominence Energy | 0.002 | 33% | 36,730,713 | $3,636,913 |

| WFL | Wellfully Limited | 0.035 | 25% | 641,261 | $7,803,522 |

| FRM | Farm Pride Foods | 0.15 | 25% | 9,019 | $6,621,621 |

| TD1 | Tali Digital Limited | 0.005 | 25% | 2,139,062 | $4,930,522 |

| NES | Nelson Resources. | 0.018 | 24% | 3,546,455 | $4,267,309 |

| DAL | Dalaroometalsltd | 0.13 | 24% | 256,000 | $3,136,875 |

| ATC | Altech Chem Ltd | 0.076 | 23% | 4,585,612 | $88,459,484 |

| AXI | Axiom Properties | 0.055 | 22% | 11,818 | $19,472,115 |

| RIE | Riedel Resources Ltd | 0.006 | 20% | 699,999 | $5,358,535 |

| CCA | Change Financial Ltd | 0.066 | 20% | 2,513,838 | $28,234,876 |

| ARD | Argent Minerals | 0.019 | 19% | 2,264,592 | $14,164,133 |

| AZY | Antipa Minerals Ltd | 0.032 | 19% | 16,682,421 | $84,772,123 |

| KZR | Kalamazoo Resources | 0.26 | 18% | 326,926 | $32,404,762 |

| APS | Allup Silica Ltd | 0.092 | 18% | 250,552 | $2,890,064 |

| KOR | Korab Resources | 0.041 | 17% | 4,991,373 | $12,846,750 |

| FRE | Firebrickpharma | 0.31 | 17% | 125,574 | $28,214,992 |

| MXO | Motio Ltd | 0.042 | 17% | 200,416 | $9,204,889 |

| NAE | New Age Exploration | 0.007 | 17% | 4,450,000 | $8,615,393 |

| ROG | Red Sky Energy. | 0.007 | 17% | 2,206,393 | $31,813,363 |

| AZL | Arizona Lithium Ltd | 0.1 | 15% | 41,972,785 | $209,663,524 |

| AFL | Af Legal Group Ltd | 0.27 | 15% | 693,562 | $17,986,058 |

Critical Resources (ASX:CRR), is about 30% higher because of: “thick, high-grade intercepts, with sections of exceptionally high-grade lithium oxide” at Mavis Lake.

The numbers speak louder than words:

-

24.1m @ 1.62% Li2O, from 53m;

-

8.15m @ 1.70% Li2O from 89m

- including 1.0m @ 4.32% Li2O from 91m;

-

8.70m @ 2.18% Li2O from 112.75m; and

-

23.9m @ 1.55% Li2O from 112.75m

-

including 11.15m @ 2.28% Li2O from 112.75m

-

including 7.05m @ 2.77% Li2O from 129.35m

-

Including 3.80m @ 3.09% Li2O from 131m

-

Dalaroo Minerals (ASX:DAL) has added 19% and several more lead-zinc sulphide intersections during its first drill program at Browns in Gascoyne.

Numbers vs words again:

-

16m @ 0.72% Pb, 0.35% Zn and 2g/t silver (Ag) from 32m including 8m @ 1.1% Pb and 2.50 g/t Ag from 36m; and

-

28m @ 0.41 % Pb, 0.20% Zn from surface including 8m @ 0.75% Pb, 0.20% Zn and 1.25g/t Ag from 16m.

Also giving good numbers, Pantoro Limited (ASX:PNR) has the results from the initial phase one drilling program completed by Mineral Resources (ASX:MIN) at the Buldania Lithium Project – the focus of the joint venture between MinRes, Pantoro and Tulla Resources (ASX: TUL) or the Norseman Lithium JV, as its known.

The drilling has confirmed the presence of lithium bearing pegmatites with significant results returned including:

• 9 m @ 1.26% Li₂O and 151ppm Ta₂O₅ from 30 m.

• 8 m @ 1.10% Li₂O and 118 ppm Ta₂O₅ from 53 m.

• 6 m @ 1.02% Li₂O and 103 ppm Ta₂O₅ from 64 m.

• 6 m @ 1.03% Li₂O and 146 ppm Ta₂O₅ from 39 m.

• 2 m @ 1.79% Li₂O and 202 ppm Ta₂O₅ from 42 m.

• 3 m @ 1.47% Li₂O and 125 ppm Ta₂O₅ from 134 m.

• 3 m @ 1.24% Li₂O and 248 ppm Ta₂O₅ from 64 m.

• 3 m @ 1.23% Li₂O and 143 ppm Ta₂O₅ from 62 m.

MinRes has advised that its forward work program will consist of additional drilling, an auger soil sampling program over the full length.

Meanwhile, Alma Metals’ (ASX:ALM) is up about 15% after it raised $1.75m through a share placement and is wasting no time putting the funds to work with preparations now underway for drilling at its Briggs copper deposit in Queensland.

MD Frazer Tabeart is heading to the project area in Queensland tomorrow to commence preparations for the resource extension drill program which is expected to start in early October.

The six-hole core drilling program totalling 3,000m will test the validity of the Briggs, Mannersley and Fig Tree Hill project Exploration Target, which totals between 455Mt and 850Mt at grades of between 0.2% and 0.35% copper.

The Briggs copper deposit, already has an Inferred Resource of 143Mt grading 0.29% copper.

Drilling will be funded by placement of 174,528,539 shares priced at 1c each to institutional, sophisticated and professional investors.

This includes the issue of one free attaching option exercisable at 4c and expiring in two years for every two shares subscribed. Alma’s directors have also demonstrated their own support for the company by subscribing for $160,000 worth of shares under the placement.

ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ANL | Amani Gold Ltd | 0.001 | -33% | 509,570 | $35,540,162 |

| DDD | 3D Resources Limited | 0.0015 | -25% | 3,173,942 | $8,863,744 |

| GGX | Gas2Grid Limited | 0.0015 | -25% | 1,850,000 | $8,116,204 |

| DM1 | Desert Metals | 0.305 | -25% | 662,133 | $19,436,686 |

| EPX | Ept Global Limited | 0.048 | -21% | 2,375,969 | $11,094,790 |

| LNK | Link Admin Hldg | 3.58 | -20% | 14,072,712 | $2,298,183,915 |

| IND | Industrialminerals | 0.405 | -18% | 488,103 | $14,553,000 |

| ILA | Island Pharma | 0.135 | -18% | 8,333 | $7,135,644 |

| ICN | Icon Energy Limited | 0.019 | -17% | 772,541 | $17,663,328 |

| MAG | Magmatic Resrce Ltd | 0.145 | -17% | 6,226,155 | $44,535,190 |

| AJQ | Armour Energy Ltd | 0.005 | -17% | 19,592,019 | $13,550,705 |

| CLE | Cyclone Metals | 0.0025 | -17% | 2,474,098 | $18,350,211 |

| CBY | Canterbury Resources | 0.036 | -16% | 20,416 | $5,297,537 |

| EMT | Emetals Limited | 0.016 | -16% | 6,731,804 | $16,150,000 |

| EQS | Equitystorygroupltd | 0.061 | -15% | 60,000 | $2,118,599 |

| NNG | Nexion Group | 0.073 | -15% | 15,000 | $6,954,907 |

| HAL | Halo Technologies | 0.3 | -14% | 77,500 | $45,326,970 |

| MOB | Mobilicom Ltd | 0.012 | -14% | 2,866,343 | $18,637,915 |

| RNX | Renegade Exploration | 0.006 | -14% | 200,000 | $6,227,386 |

| ODE | Odessa Minerals Ltd | 0.025 | -14% | 35,542,901 | $15,577,382 |

| AQC | Auspaccoal Ltd | 0.45 | -13% | 139,653 | $26,252,101 |

| DMG | Dragon Mountain Gold | 0.013 | -13% | 500,257 | $5,905,075 |

| JAY | Jayride Group | 0.165 | -13% | 140,000 | $33,513,009 |

| CUL | Cullen Resources | 0.014 | -13% | 1,040,181 | $6,509,742 |

What you missed because you’re like you and we’re like us

or

And now for a bit of extra excitement on the sidelines

Star Entertainment Group (ASX:SGR) somehow jumped some 4% after the state casino regulator says Star had been issued with a “show cause notice” after a formal review into the company’s operations found all sorts of devious goings on.

The company has 14 days to respond to the review before disciplinary action is taken from the “Bell Report” findings which basically said the Star, like the Crown before it, was actually unsuitable to operate a casino licence in the great state of NSW.

Summit Minerals (ASX:SUM) continues to snap up ground around its Stallion rare earths project though its latest acquisition includes a tasty prize – an existing 3.3Mlb Inferred uranium resource.

The JORC 2012 resource within the new ELA 28/3241 licence application – and extending into the adjacent granted title E 28/2999 – was first defined by Manhattan Corporation back in 2017 and was based on the former owner’s 2010 and 2016 aircore and sonic drilling.

While Western Australia currently does not allow uranium mining, the same drilling which defined the uranium mineralisation also intersected REE enrichment in the granitic bedrock underlying the paleo-channels which form the exploration focus at the Stallion project.

Summit MD Jonathan King said the company has been assessing the additional historical drill holes for further rare-earth opportunities while validating the developing targeting model at Stallion.

“In doing so, we confirmed the location of the historical uranium Mineral Resource, which extends southwards from the new application and onto the adjacent granted title,” he added.

Heavy Minerals (ASX:HVY) has announced that Maurice Matich has resigned from the board to pursue other business opportunities, after being with the company since before it listed in 2021.

Never one to miss an opportunity, the company says Matich was “a key driver in the Company delivering its maiden JORC Mineral Resource estimate at the Port Gregory Project of 135Mt @ 4.0% THM containing 4.9Mt garnet and in the delivery of the Port Gregory Scoping Study which has shown the project to have a 16 year mine life and an NPV8 of $253M.”

TRADING HALTS

Atlas Arteria (ASX:ALX) – ALX is plotting a capital raise by way of an accelerated entitlement offer, which sounds like a drag race into the side of a pile of cash.

Dotz Nano (ASX:DTZ) – Proposed placement with a US-based institutional fund, which sounds like a work experience gig, but it’s not.

TechGen Metals (ASX:TG1) – Capital raise.

Lithium Energy (ASX:LEL) – Capital raise.

Whitebark Energy (ASX:WBE) – Capital raise.

Aspen Group (ASX:APZ) – Equity raise by way of an institutional placement, which is a very polite way of saying you’re putting your mother in a home and spending the inheritance.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.