Closing Bell: It could get bearish tonight in New York as local small caps close slightly higher

Wall Street faces a difficult few sessions. Via Getty

- ASX 200 ends flat again

- Small caps gain a little bit

- ELO, DRO and EOS rise like legends

There are some mixed feelings around the neighbourhood heading into this latest gut churning measure of US inflation tonight.

US futures are slightly ahead on Thursday arvo in Sydney as US investors wrestle with pre inflation data tension and pre Q3 earnings anxieties.

Futures for all three major US indices are pointing to around 0.1% gain at the open in New York.

Economists, who I’m really liking more as people than as effective predictors of economic outcomes, are pegging US consumer prices to have risen 0.3% in September, month-on-month, and 8.1% from this time last year.

Wall Street started agonising over the inflation read early, the three majors ending lower overnight, led by the S&P 500 closing at its meekest level in almost 2 years.

At home, we’re either too hard, too resilient, too myopic or too distracted to bother too much.

The ASX 200 and small cap XEC indices are ahead on Thursday.

The benchmark, only in the most technical of senses – it’s up 0.029% at 4.05pm in Sydney town – while the XEC has about 0.15% to take home and share among the children.

Elsewhere in the Asia-Pac, The Shanghai Composite is eeking out an equally small gain (0.15%), while Japan’s Nikkei is short some 0.5% and the Hang Seng continues it’s ignominious slide, losing 1% by early arvo trade.

US earnings

So US earnings are back and last week John Butters VP and senior earnings analyst at Factset revealed just how much there is to fear.

Butters peeled out a few rather alarming factoids which do not bode well for US equities and by proximity, our own:

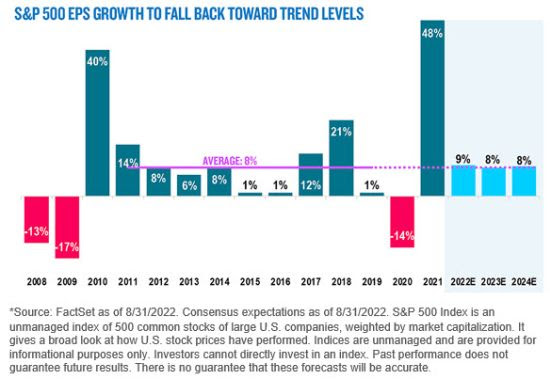

- Earnings Growth: For Q3 2022, the estimated earnings growth rate for the S&P 500 is 2.4%. If 2.4% is the actual growth rate for the quarter, it will mark the lowest earnings growth rate reported by the index since Q3 2020 (-5.7%).

- Earnings Revisions: On June 30, the estimated earnings growth rate for Q3 2022 was 9.9%. Ten sectors are expected to report lower earnings today (which was actually last week) compared to June 30, due to downward revisions to EPS estimates.

- Earnings Guidance: For Q3 2022, 65 S&P 500 companies have issued negative EPS guidance and 41 S&P 500 companies have issued positive EPS guidance.

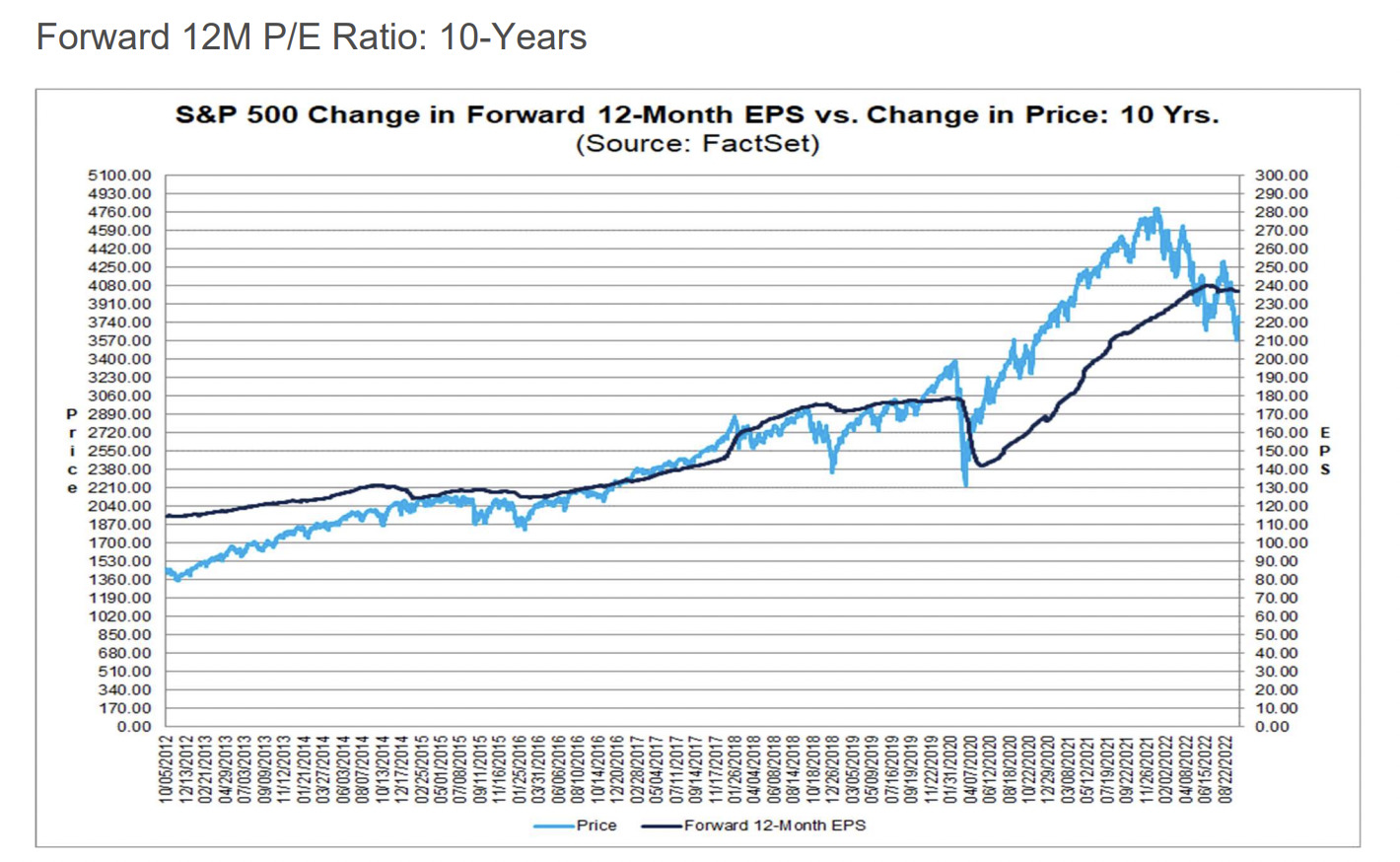

- Valuation: The forward 12-month P/E ratio for the S&P 500 is 15.8. This P/E ratio is below the 5-year average (18.5) and below the 10-year average (17.1).

While all eyes are glued to the inflation dial, it’s worth reserving some fear for the Q3 earnings season stateside, which begins this week with a full on banking expose – many of the majors lining up to spill a range of truth beans.

But as you can see from the work of VP Butters, this time there’s been a number of early warnings triggered – like scary central banks, scary, inflation, scarily slowing growth, super scary higher yields, and a heinously strong USD have made their presence felt.

Critical bellwether stocks, from FedEx to Apple and Tesla and Nike, have all made a big thing of getting out front of the incoming bad news, flagging warnings for quarterly earnings which will make difficult reading.

And they’re not alone because these kinds of red flags, as Mr Butters shows, well they just scream volatility – but this time, not inspired by marco, geopolitical or monetary movements, but by a potential tsunami of corporate misses and downgrades.

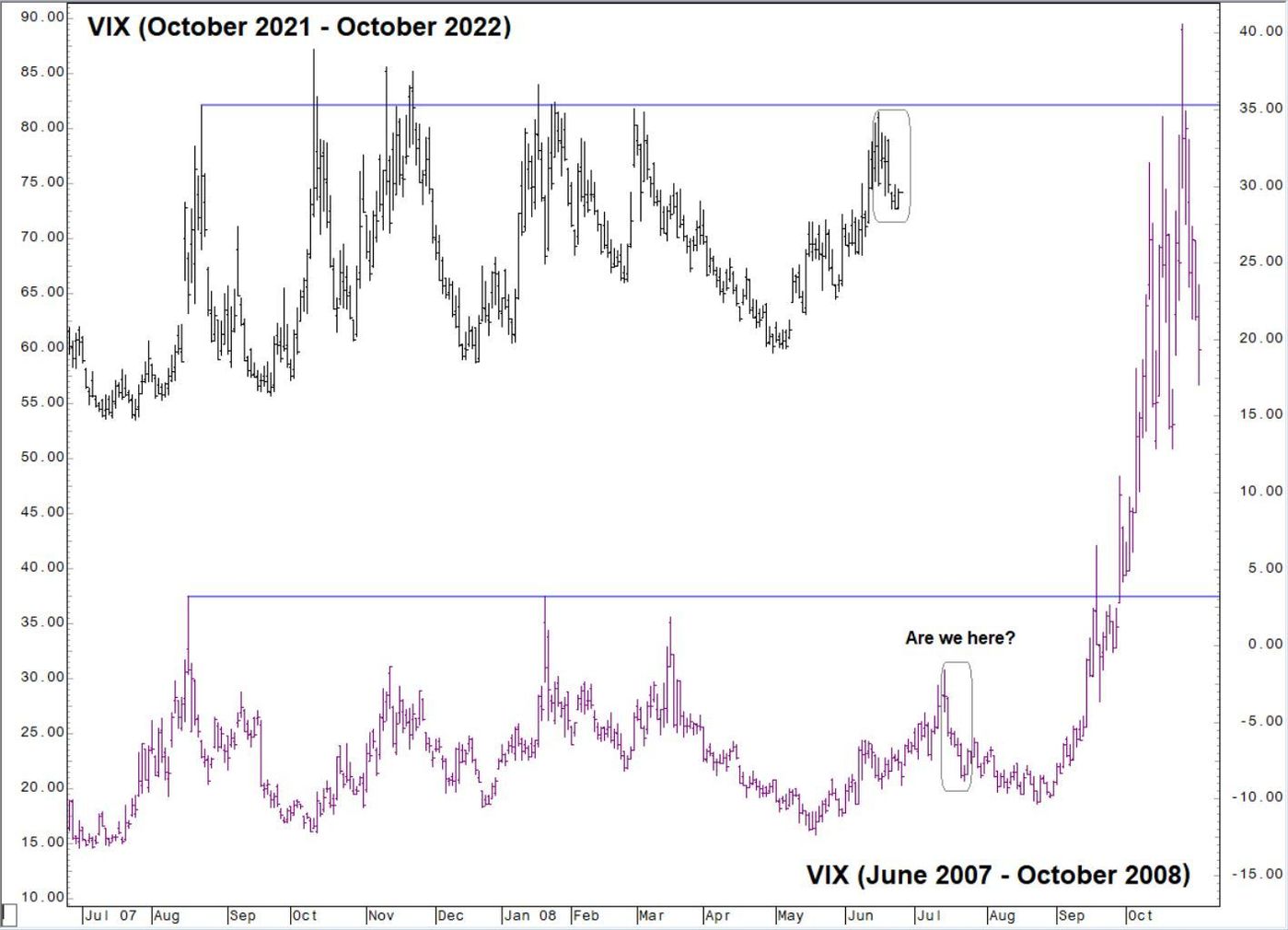

If you’ve not yet had the pleasure, VIX is the ticker symbol and preferred moniker for the Chicago Board Options Exchange’s CBOE Volatility Index. basically it’s a measure of the stock market’s expectation of volatility based on S&P 500 index options

The VIX, according to Fairlead Strategies is almost at the moment of eclipse, bringing a potential golden cross into play – that’s basically when the 50-day moving average eclipses the 200-day.

Like upside down bond yields, surging gold prices or annoyingly cryptic ghosts, golden crosses tend to appear just before some of the more terrific stock market dives, perhaps most memorably ahead of the GFC, back in September ’08.

UBS says crack on at home

At the same time, UBS has got its beady eye on a bunch of Aussie stocks which the powerhouse says look like they’ve been priced for a recession that may not come. Certainly UBS aren’t expecting a recession here in the lucky island.

So with some familiar names exposed to the doghouse sectors like consumer or property, there’s year to date share price losses stacking up about the place circa 30% in some cases.

Naturally – US tsunami’s aside, these present something of a buying opportunity for UBS which has always been partial to ‘high-quality businesses with solid medium-term prospects.’

Leaving the influential local cyclical sectors (which are no longer expensive, but sitting mid-cycle), UBS believe we need to at least get half way through the earnings downgrade cycle before share prices can detach – therefore the upgraded sectors are Tech and Media (to Overweight) and Consumer Discretionary (to Neutral).

The names UBS believe look attractive in this regard?

Seven West Media, Adairs, Bank of Queensland, JB Hi-Fi, Domain, Star Entertainment, Stockland, Premier Investments and Nine Entertainment.

Could probably use a few small caps in there, but then again UBS don’t tell me how to write cracking copy with a little bit of extra fizz, so… good choices.

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CCE | Carnegie Cln Energy | 0.002 | 33% | 7,139,538 | $22,653,861 |

| T3D | 333D Limited | 0.002 | 33% | 2,500,000 | $4,581,445 |

| AUR | Auris Minerals Ltd | 0.022 | 29% | 152,616 | $8,102,641 |

| ELO | Elmo Software | 3.09 | 28% | 668,478 | $240,062,476 |

| EYE | Nova EYE Medical Ltd | 0.28 | 27% | 225,026 | $32,090,179 |

| HMI | Hiremii | 0.05 | 25% | 280,125 | $4,234,686 |

| CPT | Cipherpoint Limited | 0.005 | 25% | 5,611,583 | $3,316,653 |

| MGG | Mogul Games Grp Ltd | 0.0025 | 25% | 856 | $6,526,882 |

| NTL | New Talisman Gold | 0.0025 | 25% | 32,239 | $6,254,451 |

| SYN | Synergia Energy Ltd | 0.0025 | 25% | 357,266 | $16,835,581 |

| CNB | Carnaby Resource Ltd | 0.895 | 20% | 4,035,158 | $107,697,866 |

| FTC | Fintech Chain Ltd | 0.03 | 20% | 29,340 | $16,269,240 |

| GLV | Global Oil & Gas | 0.003 | 20% | 16,584 | $4,683,387 |

| RML | Resolution Minerals | 0.012 | 20% | 4,156,932 | $9,567,462 |

| AN1 | Anagenics Limited | 0.039 | 18% | 27,364 | $7,293,703 |

| MOZ | Mosaic Brands Ltd | 0.28 | 17% | 231,658 | $25,815,103 |

| AJQ | Armour Energy Ltd | 0.007 | 17% | 14,511,241 | $13,550,705 |

| GTG | Genetic Technologies | 0.0035 | 17% | 1,063,762 | $27,701,895 |

| RAN | Range International | 0.007 | 17% | 570,003 | $5,635,742 |

| TKL | Traka Resources | 0.007 | 17% | 253,571 | $4,132,647 |

| RGL | Riversgold | 0.05 | 16% | 17,542,952 | $33,380,945 |

| OSX | Osteopore Limited | 0.255 | 16% | 17,296 | $25,799,012 |

| IRD | Iron Road Ltd | 0.15 | 15% | 68,090 | $103,981,970 |

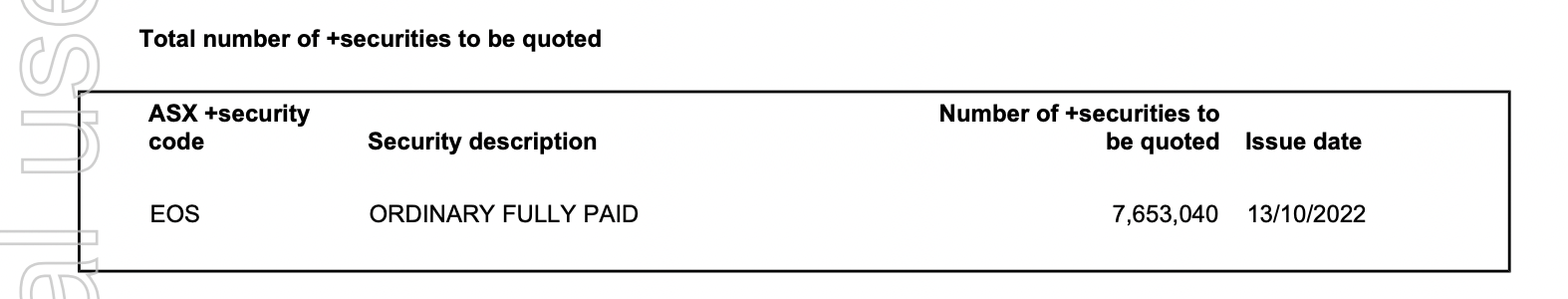

As Gregor reports, we’re literally in defensive mode on the ASX, Thursday, with Electro Optic Systems (ASX: EOS) up some 20% after market daddy Washington H Soul Pattinson & Co (ASX: SOL) grabbed a decent sized chunk of the weapons systems maker in return for sweet, sweet spending money.

This morning, EOS revealed it’s struck a new financing arrangements with its major shareholder, coming out of an undoubtedly big meeting with new debt facilities made up of 3-year $35 million new term loan and an 18-month $15 million working capital facility.

In return, Soul Patts will be locking in 4.68% of EOS’ entire issued capital, taking SOL’s total EOS holding to a whisker under 10%.

Shiny new EOS boss CEO Andreas Schwer, (he took over in August) says the move comes as EOS continues to field inquiries “in relation to potential strategic growth partnerships and/or capital transactions”.

The new funding arrangements, meanwhile, will “ensure EOS is optimally positioned to develop its strategic growth potential,” Schwer said.

All of these are for you Washington H, love from EOS:

Also shooting both (drones this time) and the lights out is Droneshield (ASX: DRO).

Oleg’s solution to drone swarms flooding the combat arena is an early stage drone detection and drone destructor business.

If you don’t like drones, but do like cool looking guns, DRO is perhaps for you.

Critical infrastructure is important to secure, in an increasingly uncertain world. Human nature is to be reactive, and there is a perception that there is an “all knowing/all seeing” Govt agency, who will make sure things are ok.…https://t.co/jK6I5zOjtt https://t.co/rHDTADPSth

— Oleg Vornik (@OlegVornik) October 7, 2022

DRO’s quarter update was a good one. In fact the three months to September 30 represent Oleg’s 2nd best cash receipt quarter ever – $5.6 million customer and grant cash receipts, easily double the previous qtr.

Plus, there’s $50 million pipeline for remainder of 2022 (with a further $180 million pipeline for 2023 onwards), with growing focus towards the US and Australian Government customers.

Highlights include a few larger size contracts, including $2 million for DroneSentry systems out of the EU.

And this one:

It’s a pic of what a $1.8 million order for Oleg’s DroneGun MKIII handheld counterdrone system from the US Department of Defense (their sp) might look like in the field.

Delivery of the DroneGun MKIII’s to the DoD will be completed this month, with full payment in the post.

DRO also secured its first paid US civilian airport deployment – which could pave the way for additional airport sales.

Also of substantial interest – Elmo Software (ASX:ELO) is up 25% and in a holding pattern halt) after confirming it’s received all kinds of fascinating propositions approaches about acquiring an ELO with the lot, including one from Accel-KKR.

The software maker says discussions are ongoing with the goal of securing maximum shareholder value.

“No agreement has been reached in relation to any transaction, and there is no certainty that any proposal received will result in a binding offer or that any such offer would be recommended to shareholders,” the company told the ASX.

ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| DUN | Dundas Minerals | 0.53 | -38% | 5,234,315 | $33,040,625 |

| VIP | VIP Gloves | 0.006 | -33% | 921,078 | $7,081,033 |

| ARE | Argonaut Resources | 0.001 | -33% | 2,094,192 | $8,142,807 |

| MEB | Medibio Limited | 0.001 | -33% | 1,156,360 | $4,980,891 |

| VOL | Victory Offices Ltd | 0.026 | -28% | 3,737,001 | $5,682,529 |

| 1CG | One Click Group Ltd | 0.012 | -25% | 2,149,147 | $9,485,728 |

| SHH | Shree Minerals Ltd | 0.009 | -25% | 19,747,462 | $14,861,843 |

| HT8 | Harris Technology Gl | 0.015 | -21% | 4,719,039 | $5,667,614 |

| VTI | Vision Tech Inc | 0.2 | -20% | 68,086 | $6,150,374 |

| AHQ | Allegiance Coal Ltd | 0.054 | -19% | 8,330,227 | $28,127,949 |

| ARV | Artemis Resources | 0.042 | -19% | 3,631,466 | $72,353,755 |

| ATV | Active Port Group | 0.061 | -19% | 449,511 | $11,732,203 |

| SIX | Sprintex Ltd | 0.028 | -18% | 347,089 | $8,648,047 |

| ROG | Red Sky Energy | 0.005 | -17% | 1,431,390 | $31,813,363 |

| SI6 | SI6 Metals Limited | 0.005 | -17% | 500,000 | $8,929,134 |

| W2V | Way2Vatltd | 0.026 | -16% | 365,262 | $5,513,170 |

| REM | Remsense Technologies | 0.16 | -16% | 149,850 | $6,250,824 |

| SMN | Structural Monitor | 0.375 | -15% | 380,773 | $59,039,035 |

| ROC | Rocketboots | 0.094 | -15% | 128,029 | $3,492,500 |

| JTL | Jayex Technology Ltd | 0.006 | -14% | 56,717 | $1,744,600 |

| KTG | K-Tig Limited | 0.12 | -14% | 38,535 | $25,355,577 |

| MBX | My Foodie Box | 0.06 | -14% | 70,074 | $2,345,000 |

Not so much a loser considering the madness of the last few days, but it does appear that the Dundas (ASX:DUN) run is done, down about 24%.

That story’s a cracker, Josh has it here.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.