Closing Bell: iSelect jumps 75%; Asian markets choke ahead of most important US CPI data since forever

Via Getty

- Aussie markets lower

- Regional markets also sink ahead of US inflation data

- iSelect jumps 75% on takeover

Local markets were overdue some bloodletting and the Commonwealth Bank (ASX:CBA) drew the first cut in morning trade, boring investors with its weak Net Interest Margins (NIM) and a full year profit of $9.6 billion.

This will be Day 8 of the ASX 200 closing within 30 points on either side of the key 7000 level, according to Tony Sycamore at City Index.

After eeking rude gains on its way to finding a fresh two month high on Tuesday, the benchmark has fallen on materials weakness and broader losses across 10 out of 13 sectors. The ASX Emerging Companies (XEC) index is 0.8% lower at 4PM in Sydney.

Meanwhile, the cost of food has helped lift China’s headline CPI to 2.7% year-on-year in July, coming in under expectations while the core measure (ex. fuel and energy) softened a bit to 0.8%. YoY.

“China is not facing the same inflationary pressures that many other major economies are experiencing with the lockdowns earlier this year dampening demand. Accommodative monetary policy and the risk of further lockdowns will keep a lid on CNH.”

Asian markets have fallen across the board – South Korea’s Kospi and Japan’s Nikkei are around 0.7% down, The Shanghai Composite and Shenzhen Component are slightly better, but across the road in Hong Kong the Hang Seng is down over 2%.

But it’s probably not China’s inflation read that’s stressing Asian investors.

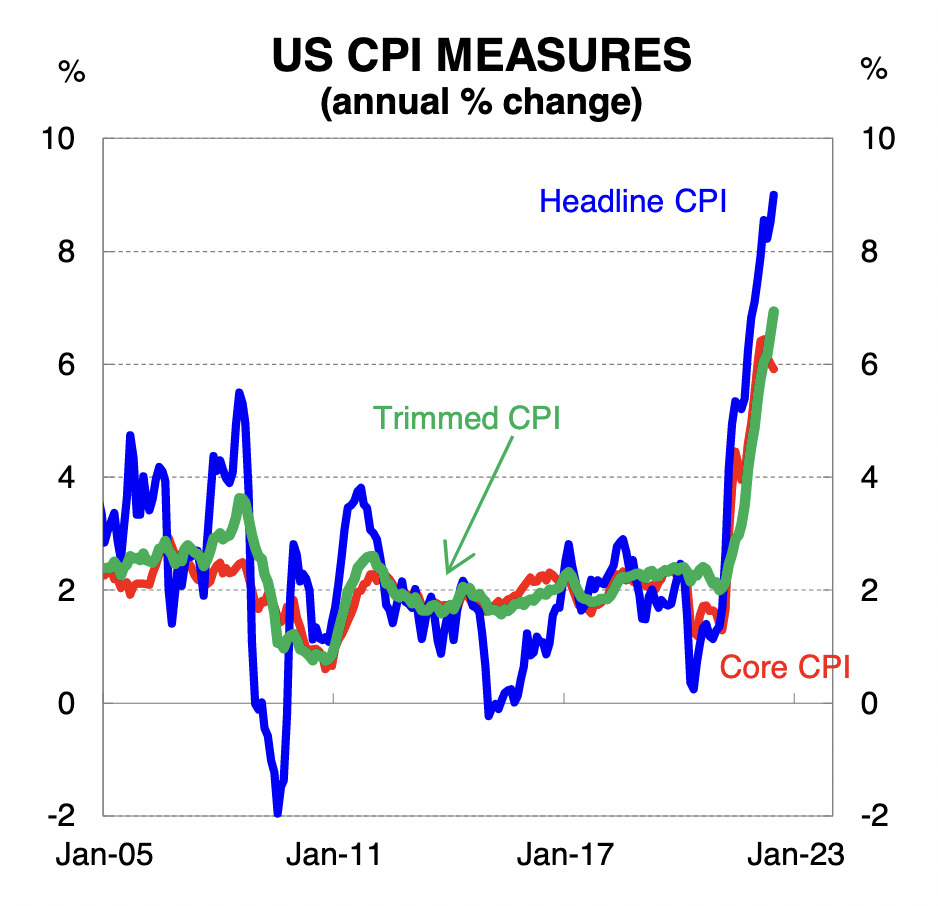

More likely it’s this one:

Adding to trader inflation-angst, Tony Sycamore says, is that while the market is expecting the sharp fall in US gasoline prices, the core inflation rate, which strips out the volatile price categories of food and energy is expected to rise from 5.9% to 6.1% YoY.

“While there are questions around which matters most to the market, core or headline inflation, there is little doubt that higher-than-expected prints will see equity markets sell-off as the interest rate market firms up the odds of a 75bp rate hike at the September FOMC meeting,” Sycamore says.

CBA expects tonight’s extraordinarily anticipated US headline CPI inflation to soften from 40-year highs in July as the cost of gasoline has fallen from previous highs.

“But as various Fed officials signalled, the FOMC is not nearly done with tightening monetary policy,” Kristina Clifton says. “High inflation expectations and strong wages growth suggest underlying inflation may remain stubbornly high for longer.”

“The FOMC will need to make sure inflation moves back towards target sustainably before contemplating pausing its tightening cycle.”

However, Kristina added that a strong inflation outcome tonight, will ‘likely reinforce the FOMC is still some way away from that point yet.’

A great many deals are riding on it all.

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks for today [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume |

|---|---|---|---|---|

| ISU | Iselect Ltd | 0.275 | 72% | 13,697,011 |

| GLV | Global Oil & Gas | 0.003 | 50% | 10,088,975 |

| MEK | Meeka Metals Limited | 0.067 | 34% | 93,445,993 |

| KFE | Kogi Iron Ltd | 0.004 | 33% | 17,746,002 |

| POW | Protean Energy Ltd | 0.008 | 33% | 12,079,079 |

| EQN | Equinoxresources | 0.16 | 28% | 205,000 |

| ECG | Ecargo Hldg | 0.015 | 25% | 26,000 |

| AFW | Applyflow Limited | 0.0025 | 25% | 6,255,000 |

| VPR | Volt Power Group | 0.0025 | 25% | 1,955,946 |

| PH2 | Pure Hydrogen Corp | 0.43 | 25% | 1,627,916 |

| ARV | Artemis Resources | 0.052 | 24% | 4,515,362 |

| MIO | Macarthur Minerals | 0.21 | 24% | 603,652 |

| DCG | Decmil Group Limited | 0.22 | 22% | 672,821 |

| KZR | Kalamazoo Resources | 0.275 | 22% | 176,171 |

| TRU | Truscreen | 0.05 | 22% | 179,022 |

| LNR | Lanthanein Resources | 0.029 | 21% | 29,497,883 |

| DMG | Dragon Mountain Gold | 0.018 | 20% | 75,000 |

| TSL | Titanium Sands Ltd | 0.018 | 20% | 204,724 |

| LPM | Lithium Plus | 0.6 | 20% | 1,278,524 |

| CPT | Cipherpoint Limited | 0.006 | 20% | 924,334 |

| LDX | Lumos Diagnostics | 0.066 | 20% | 4,819,991 |

| SUM | Summitminerals | 0.185 | 19% | 1,111,937 |

| BEZ | Besragoldinc | 0.038 | 19% | 40,000 |

| CPN | Caspin Resources | 0.635 | 19% | 334,290 |

| AHQ | Allegiance Coal Ltd | 0.165 | 18% | 2,824,101 |

Consumer and insurance services firm iSelect’s (ASX:ISU) set the day on fire by entering into a Scheme Implementation Agreement (SIA) with Innovation Holdings Australia (IHA).

On the back of the news, iSelect’s share price sky-rocketed – well over 75%.

IHA is ISU’s biggest shareholder and after sitting on a 26% stake, decided it was time to go the full house, snapping up 100% of the company instead.

Nothing meek about this streak — up 30% today is Meeka Metals (ASX:MEK) which has wandered into an exceptionally high-grade gold situation after combing through a recent drill program at St Anne’s prospect within its Murchison gold project in WA.

MEK says assays from 38 holes drilled in the area and said the new results showed broad zones of high-grade gold at the northern end of St Anne’s.

Shallow aircore drilling has turned up highlights such as 32m @ 16.07g/t Au from 48m including 16m @ 28.59g/t Au, and 20m @ 20.74g/t Au from 48m including 16m @ 24.86g/t Au.

The junior iron ore digger Equinox (ASX:EQN) is up on the smell of an oily rock today.

For a little background, EQN listed last year with its Pilbara-based Hamersley Iron Ore project, 60km northeast of Tom Price in the Pilbara ripe enough to have run through stakeholder engagement with the Wintawari Guruma Aboriginal Corporation (WGAC) in the recent quarter.

The company has also requested that updated archaeological and ethnographic surveys be undertaken over the entire project.

Once completed, and subject to the survey outcomes, the planned drill program will be reviewed and implemented.

ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks for today [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume |

|---|---|---|---|---|

| T3D | 333D Limited | 0.0015 | -25% | 1,583,761 |

| ARE | Argonaut Resources | 0.002 | -20% | 5,826,347 |

| CFO | Cfoam Limited | 0.004 | -20% | 15,306,486 |

| PCL | Pancontinental Energ | 0.004 | -20% | 26,724,428 |

| AOU | Auroch Minerals Ltd | 0.068 | -17% | 2,400,853 |

| CCE | Carnegie Cln Energy | 0.0025 | -17% | 581,667 |

| TD1 | Tali Digital Limited | 0.005 | -17% | 370,000 |

| 3DA | Amaero International | 0.185 | -16% | 326,035 |

| AVW | Avira Resources Ltd | 0.003 | -14% | 399,998 |

| ENT | Enterprise Metals | 0.012 | -14% | 724,838 |

| GO2 | Thego2People | 0.012 | -14% | 765,622 |

| BLZ | Blaze Minerals Ltd | 0.025 | -14% | 680,092 |

| KOR | Korab Resources | 0.025 | -14% | 682,104 |

| CNJ | Conico Ltd | 0.034 | -13% | 32,649,334 |

| BGD | Bartongoldholdings | 0.175 | -13% | 103,953 |

| PVE | Po Valley Energy Ltd | 0.07 | -13% | 1,591,257 |

| APS | Allup Silica Ltd | 0.092 | -12% | 9,455 |

| AQC | Auspaccoal Ltd | 0.092 | -12% | 2,333 |

| CZL | Cons Zinc Ltd | 0.022 | -12% | 1,474,631 |

| 3MF | 3D Metalforge | 0.015 | -12% | 175,000 |

| VOL | Victory Offices Ltd | 0.03 | -12% | 37,020 |

| SBM | St Barbara Limited | 1.07 | -12% | 9,256,936 |

| CL8 | Carly Holdings Ltd | 0.031 | -11% | 38,985 |

| AER | Aeeris Ltd | 0.12 | -11% | 23,490 |

| ADV | Ardiden Ltd | 0.008 | -11% | 7,239,682 |

WHAT YOU MAY’VE MISSED

Artemis Resources (ASX:ARV) had the ASX tug on the handbrake quick-smart this morning, with trade paused well before lunch after its price climbed more than 16% since the bell rang this morning.

We’re still waiting on an official response from Artemis, which called for a trading halt of its own to give it time to put a response together – but there’s little wonder why the ASX tapped the company on the shoulder.

Artemis issued a string of securities cessation notices on 01 August, and since then its price has climbed from $0.025 to $0.049 – an nearly-90% jump to its highest price since 05 May. We’ll let you know what Artemis says as soon as they’re done announcing a reply.

Meanwhile, Platina (ASX:PGM) has made a play for a minerals acquisition, signing a conditional binding term sheet with unlisted Sangold Resources to acquire 100% of the advanced, high-grade, near-surface Brimstone Gold Project, 40km north-east of Kalgoorlie.

The original announcement said the acquisition also includes full ownership of the nearby Beete, and Binti Binti gold projects, and a subsequent update from PGM sets out a few more parameters of the deal – and there’s a bit to unpack.

The deal is is subject to an exclusivity and due diligence period, funded by a $50,000 option payment that expires on 31 October 2022, and consideration for the acquisition includes $2.5 million of Platina shares issued at a 5% discount to the 10-day (VWAP) price on announcement of the transaction and $150,000 cash.

On top of that, of the shares issued for the transaction, $2.4 million will be subject to a 12-month escrow period and $0.1 million for a 3-month period, and a further $1 million shares will be issued if a JORC compliant Inferred Mineral Resource above 100,000 ounces at 1.5g/t is achieved on any project within the acquisition tenements.

Not good news for Health imaging company Mach7 (ASX:M7T) which has announced that dismissal of the patent infringement lawsuit brought by Al Visualize, a corporation in Texas, has been appealed.

The United States District Court for the District of Delaware dismissed Al Visualize’s claims of wilful infringement in July on the grounds that the patents were not eligible for patenting.

Mach 7 received noticed on August 9 from the United States District Court for the District of Delaware that Al Visualize has appealed the dismissal to the United States Court of Appeals for the Federal Circuit.

Medical device company EBR Systems (ASX:EBR), has announced a scientific paper describing the use of its wireless cardiac pacing system WISE for heart failure has been published in the leading peer-reviewed journal Heart Rhythm.

The paper describes the use of leadless septal left ventricle pacing with WISE. Heart Rhythm is the official journal of the Heart Rhythm Society, the Cardiac Electrophysiology Society and the Paediatric & Congenital Electrophysiology society.

TRADING HALTS

88 Energy (ASX:88E) – Capital raising, but with a cool, late-80s electro beat.

Austral Resources Australia (ASX:AR1) – Share placement (we reckon a nice sunny spot over by the window would be perfect).

Platina Resources (ASX:PGM) – Platina’s raising capital to cover a new mineral project buy.

Gratifii (ASX:GTI) – Materiial acquiisiitiion and capiital raiise.

Calidus Resources (ASX:CAI) – We’ll see your plans, and raise you 9 capitals.

Atturra (ASX:ATA) – News incoming about its Scheme of Arrangement with MOQ.

MOQ (ASX:MOQ) – News incoming about its Scheme of Arrangement with ATA.

Artemis Resources (ASX:ARV) – Drafting a letter after today’s ASX speeding ticket.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.