Closing Bell: Iron ore giants help ASX to another record; RBA rate cut far-off as job market stays tight

RBA rate cut far off as job market stays tight. Pic: Getty Images

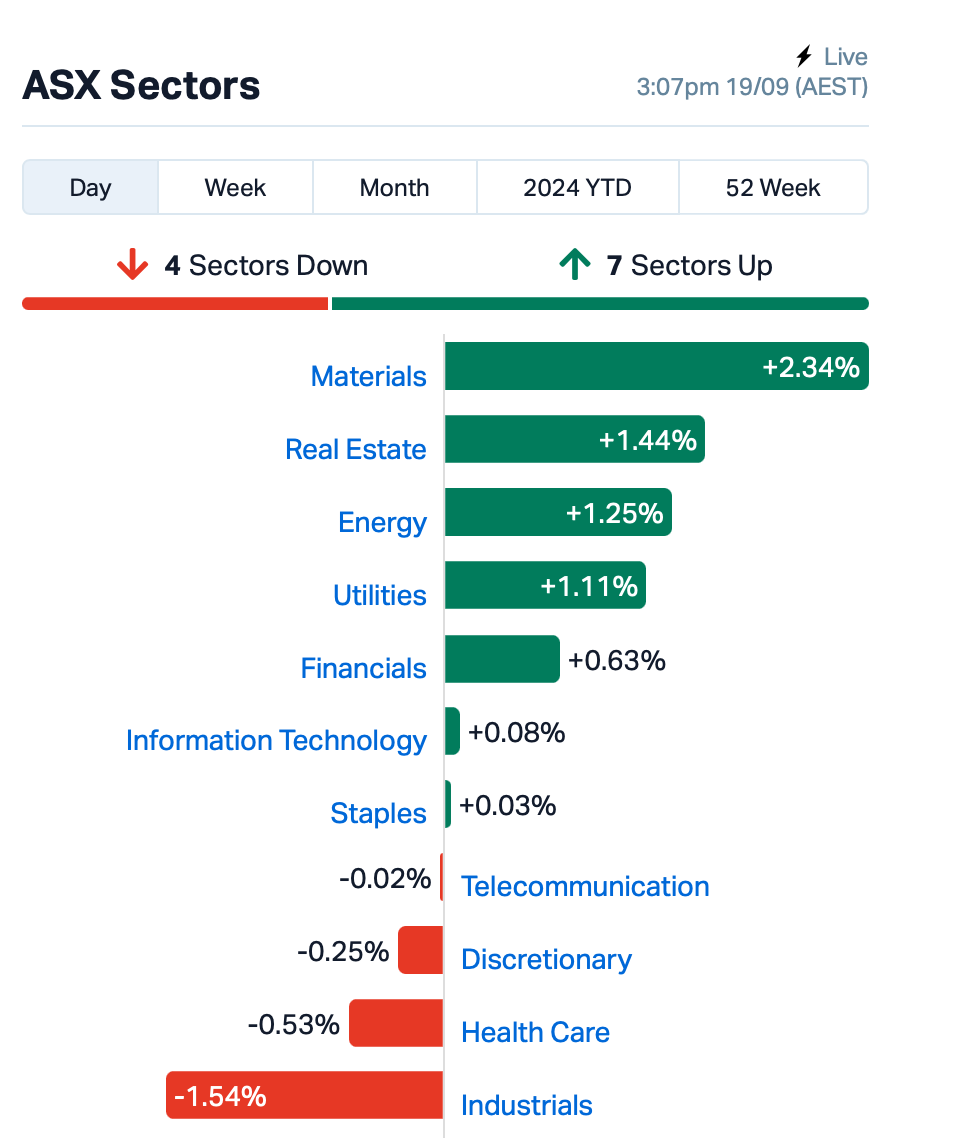

- ASX200 hits record high driven by US Fed interest rate cut

- Mining stocks surge as iron ore prices rebound

- ALS shares drop 10pc, Monadelphous rises on new contracts

The ASX200 hit yet another record high today, boosted by the first interest rate cut from the US Fed Reserve in over four years.

The benchmark index gained 0.6% on the back of a mining stocks rally as iron ore prices bounced back.

BHP (ASX:BHP), Fortescue (ASX:FMG) and Rio Tinto (ASX:RIO) gained 2-3%.

Overnight, however, US traders didn’t share the same enthusiasm, with major indexes dropping after Fed chairman Jerome Powell warned not to expect more aggressive cuts.

“I do not think that anyone should look at this and say, ‘Oh, this is the new pace,’” Powell said at the post-meeting conference.

Statements from the meeting also showed that only 10 out of 19 officials supported another 50 basis point cut in their upcoming meetings, which added to the uncertainty.

What’s worth noting however is that the US dollar strengthened while Treasury yields dropped right after the announcement.

This suggests that investors might believe the Fed’s bold decision to begin cutting at 50 bp means future rate reductions will likely be smaller.

But overall, the Fed’s decision has boosted confidence that the US economy will sidestep a recession, which should be positive for stocks in the days ahead.

A recent survey of Bloomberg professional users shows that a large majority, about 75%, believe the US will achieve a soft landing and avoid a technical recession by the end of next year.

To local markets, and the August jobs report showed a tight employment market, with the unemployment rate staying at 4.2%.

The ABS said the economy gained 47,500 jobs last month, significantly surpassing economists’ prediction of 25,000.

For the RBA, this latest job figures could indicate that an interest rate cut is less likely in the near future.

“I think it is unlikely that the RBA will implement interest rate cuts until 2025 to avoid any possible spike in inflation triggered by increased household spending,” said Anders Magnusson at BDO.

In the large caps space today, testing company ALS Limited (ASX:ALQ) slumped by 8.5% after a trading update that revealed challenges in its Minerals division. ALS reported a decline in sales volumes as well as margin pressures, particularly in Australia and Latin America.

Engineering firm Monadelphous Group (ASX:MND) rose 2% after announcing several new contracts worth about $230 million.

The company secured a construction contract for a urea plant in Western Australia and a multidisciplinary contract for BHP’s Prominent Hill Expansion Project. Also, it won a three-year maintenance contract with South32 (ASX:S32).

What else was happening today?

Across the region, Asian stocks mostly rose with Japan’s markets leading the way.

At the time of writing, Singapore stocks were also on track for their best close since 2007.

The Hong Kong Monetary Authority has cut its base rate for the first time since 2020, while New Zealand’s economy reported a contraction in the second quarter.

As for the Bank of England, they are expected to hold off on cuts for now when the rates decision is announced tonight.

Elsewhere, gold prices nudged higher after a volatile session, and oil prices held steady as investors weighed weak US demand against geopolitical tensions.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

Recent drilling at GreenTech Metals’ (ASX:GRE) Whundo Copper Project has revealed strong potential for resource expansion, with high-grade copper results reaching up to 4.6% Cu. A 1710m drilling program confirmed continuity of copper and zinc mineralisation at two sites, Austin and Ayshia, with significant intersections of 16 metres at 1.2% Cu and previous high-grade results of up to 5.4% Cu. GreenTech says it plans to advance its drilling efforts to target these high-grade areas and expand the current copper-zinc resource, which stands at 6.2 million tonnes.

Bindi Metals (ASX:BIM) has acquired two promising antimony projects in Serbia, located in the renowned Tethyan Magmatic Belt. The Mutnica Antimony-Copper Project has shown historical antimony grades of up to 4.5%, while the Lisa Antimony-Gold Project features high-grade antimony mines with grades between 5% and 20%, from which around 60,000 tonnes of ore were extracted between 1932 and 1951. These projects are well-positioned near major European markets and benefit from modern infrastructure, especially important given China’s recent export ban on antimony, which raises supply chain concerns for Europe. To support these initiatives, Bindi Metals has raised $2 million from investors for further exploration and development.

Javelin Minerals (ASX:JAV) is set to begin drilling at the Coogee Gold-Copper Project in Western Australia during the December quarter. The initial program will involve about 2,500 metres of drilling aimed at extending known mineralisation and exploring new targets around the Coogee Pit, which is located near the St Ives goldfield. Despite its promising resource of 126,685 ounces of gold, Coogee hasn’t seen a systematic drilling campaign since 2014. The company is finalising a drilling-for-equity agreement with a Kalgoorlie contractor and said it was excited about the potential for significant discoveries in the area.

There were no market details behind big rally in Miramar Resources (ASX:M2R) stocks, with the last bite from the WA explorer being the issue of a touch over 2 million shares to Topdrill in exchange for services provided by the Kalgoorlie driller.

Eyes are closely trained on assays due from its maiden campaign at Bangemall where M2R and its boss, former WMC and Doray mineral hunter Allan Kelly, are looking for Norilsk style magmatic nickel, copper and PGE targets. Located in the Capricorn Orogen, the project includes the Mount Vernon prospect where RC drilling is testing geological and geophysical targets and where the WA Government co-funded drilling through its exploration incentive scheme.

While nickel prices have put pressure on Aussie producers, magmatic discoveries like Norilsk or IGO’s Nova mine are typically at the lowest end of the cost curve, well below Indonesian laterites and Australia’s narrow-vein or disseminated nickel sulphides. Exploration work is also ongoing at the Chain Pool and Gidji projects, the latter a gold opportunity over the fence from Northern Star Resources’ Kalgoorlie ops.

Also on a run today, Copper Search (ASX:CUS) delivered the results from its first drill hole at the Douglas Creek IOCG copper prospect in South Australia last week.

Nothing super in there, with some non-copper explanations for a co-incident gravity magnetics anomaly. Assays for a second 820m deep hole were still pending as of September 13, though MD Duncan Chessell was quick to point out neither Rome nor Olympic Dam was built (or drilled) in a day.

“We have always known that Copper Search’s mission to find the next large-scale copper deposit was a high-risk, high-reward endeavour,” he said at the time.

“Over the past two years, we’ve seen indications of IOCG-style mineral systems in multiple drill holes, but pinpointing the core mineralised zone in these systems is often very challenging.

“Olympic Dam, for example, wasn’t ‘discovered’ until the 10th drill hole (RD10).

“While the latest results are not what we wanted, we’re looking forward to seeing the results of the second drill hole, 24PK14-B, at the Douglas Creek IOCG Prospect and Professor Schaefer’s review of the Peake Project.”

Douglas Creek is close to an interpreted “near miss” drill hole that found a maximum 0.45% Cu and 5.35g/t Au in 2023 drilling.

Cann Group (ASX:CAN) says it expects to return to underlying earnings profitability this year, having posted a $13.2 million loss in the 2023-24 stanza. The company also expects to be cash-flow positive in 2025-26. In a presentation to the Pitt Street Research life sciences conference in Sydney today, the company has outlined a plan to increase capacity at its flagship Mildura facility to the maximum 10,000 tonnes per annum, by 2026-27.

And, recycling firm Sims (ASX:SIM) announced that its Metal businesses are expected to perform well in the first quarter of FY25, projecting an estimated EBIT of around $55 million. North America Metal is anticipated to contribute $29 million, showing a strong recovery from previous losses. SA Recycling is also doing well, with Sims’ share expected to yield $24 million in EBIT. Meanwhile, Australia and New Zealand Metal faces market challenges but still aims for a solid $13 million in EBIT, marking a good start to the year.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

IN CASE YOU MISSED IT

Earths Energy (ASX:EE1) has started an internal scoping study into the viability of constructing geothermally-powered data centres at its Queensland tenure that will also determine the feasibility of direct geothermal cooling.

Drilling at GreenTech Metals’ (ASX:GRE) Whundo project in WA has returned grades of up to 4.6% copper, highlighting the potential to grow the current resource of 6.2Mt at 1.12% copper and 1.04% zinc.

GTI Energy’s (ASX:GTR) drilling has confirmed the presence of deeper mineralisation with elevated uranium grades in the upper Fort Union Formation within its Lo Herma ISR project in Wyoming. Results such as 1m at 1850ppm eU3O8 and 2m at 740ppm eU3O8 could deliver

significant upside potential.

Javelin Minerals (ASX:JAV) is preparing to launch exploration drilling to expand and upgrade known mineralisation and test prospective magnetic anomalies at its Coogee gold-copper project in WA.

Star Minerals (ASX:SMS) has entered into a binding agreement to acquire a 51% interest in the Cobra uranium project in Namibia from Madison Metals. Cobra is close to the long-running Rossing uranium mine and already hosts a resource of 15.6Mt at 260ppm U3O8.

Trigg Minerals (ASX:TMG) is in a halt ahead of an announcement relating to a new acquisition just as it starts drilling over a high-potential prospect at its Drummond epithermal gold and antimony project in northern Queensland.

Victory Metals (ASX:VTM) says portable x-ray fluorescence (P-XRF) has recorded heavy rare earth yttrium in clay regolith 2.6km south of the existing resource estimate at its North Stanmore project.

While not a substitute for lab analysis, the company says the results are a useful HREE vector that shows the potential extension of rare earth mineralisation defined in the resource.

“Drilling has now commenced 9km north of the current MRE,” CEO and executive director Brendan Clarks said.

“Shallow saprolitic clay horizons similar to those observed in previous drilling campaigns have been identified, supporting the prospect of further rare earth element (REE) mineralisation.”

To date, over 2,239m have been successfully completed in the current aircore drill program.

Firetail Resources (ASX:FTL) has appointed a new managing director in Glenn Poole, with Brett Grsovenor to transition to non-executive chairman.

Poole’s promotion is expected to facilitate exploration and development of Firetail’s portfolio of copper-focused assets, with his combination of advanced technical and corporate experience specifically expected to expedite the exploration and development of the York Harbour copper-zinc-silver project in Newfoundland.

“It is clear to us from the early works completed, that the York Harbour project will be transformational for Firetail and these changes ensure that we have the right team to develop the asset,” Grosvenor said.

In Newfoundland, the team is assembled and the company is eagerly awaiting the commencement of drilling and geophysics activities in the coming weeks.

“Work is ongoing reassessing the historic core, so we can further understand and demonstrate the unrealised potential of this project,” Poole said.

In Peru, the focus is on modification of the approved work area to encompass the highly prospective Ichucollo target in preparation for drilling, planned for mid 2025.

At Stockhead, we tell it like it is. While Victory Metals, Firetail Resources, Earths Energy, GTI Energy, Javelin Minerals, Star Minerals and Trigg Minerals are Stockhead advertisers, they did not sponsor this article.

Today’s Closing Bell is brought to you by Webull Securities. Webull Securities (Australia) Pty. Ltd. is a CHESS-sponsored broker and a registered trading participant on the ASX.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.