Closing Bell: Inflation cools, miners rally hard, and Fortescue leaps after going electric

Fortescue shares soar 6pc on electric truck upgrade. Pic via Getty Images

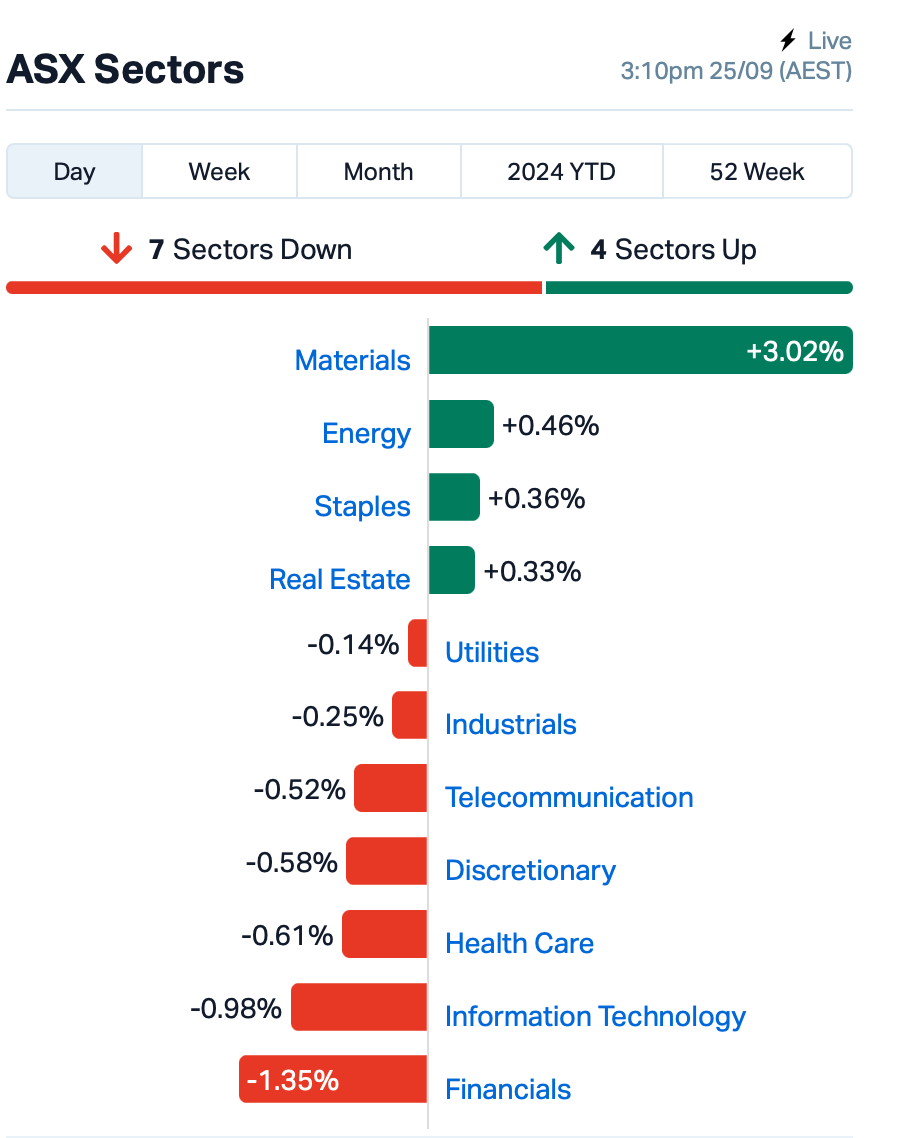

- ASX closes flat amid shift from banks to miners

- CPI slows to 2.7pc, first dip within RBA’s target

- Fortescue shares soar 6pc on electric truck upgrade

The ASX closed 0.19% lower on Wednesday as the shift from financial stocks to miners continued, fuelled by the People’s Bank of China’s recent stimulus announcement.

China said yesterday that it was rolling out a wide-ranging package that included lower reserve requirements for banks and over 800 billion yuan (around $160 billion) in liquidity support for the stock market.

The announcement pushed commodity prices to rise across the board overnight.

On the data front, the latest CPI report from the ABS revealed a slowdown to 2.7% in August, down from 3.5% in July, just as expected.

This is the first dip within the RBA’s target band of 2-3%, and the lowest level we’ve seen since 2021.

“The falls in electricity and fuel had a significant impact on the annual CPI measure this month,” said ABS head of stats, Michelle Marquardt.

But even with energy prices dropping thanks to rebates, renters are still facing rising costs.

Also, while the inflation figure of 2.7% is now within the RBA’s target range of 2-3%, experts believe it won’t trigger a rate cut just yet.

The RBA itself has made that very clear in a statement released yesterday:

“Headline inflation is expected to fall further temporarily, as a result of federal and state cost of living relief. However, our current forecasts do not see inflation returning sustainably to target until 2026.”

To stocks, Materials are enjoying a day in the sun off the back of yesterday’s relatively surprising word out of China that Beijing finally appears to have landed on a course of stimulus action.

Also in the spotlight today was Solomon Lew’s Premier Investments (ASX:PMV), which crumbled by 10% after the retail giant revealed its full-year results this morning which didn’t quite hit the mark.

For the year ending July 31, PMV’s revenue slipped by 2.7% to $1.62 billion, and net profit dropped 4.9% to $257.9 million.

The company also announced it’s hitting pause on the Smiggle demerger and will instead focus on merging its Apparel Brands with Myer Holdings (ASX:MYR).

On a brighter note, Fortescue Metals (ASX:FMG) jumped 6% after the company announced a big plan to upgrade its haulage trucks to electric ones.

This $2.8 billion move means Fortescue will replace two thirds of its fleet in Western Australia with electric vehicles.

What else is happening today?

Asian stockmarkets were mostly on the rise today as a wave of optimism from China’s big stimulus package lifts the market for a second day straight.

The CSI 300 index in China jumped as much as 3%, edging closer to erasing its losses for the year.

Meanwhile, Hong Kong’s short sales ratio dipped, suggesting many investors have already covered their shorts.

On the commodities front, futures prices continue to rise, with iron ore and gold hitting record highs this afternoon.

There was some tension in the region today as China announced it test-launched an intercontinental ballistic missile (ICBM), complete with a “dummy warhead”, into the Pacific Ocean.

The launch happened at 8.44am Chinese time, according to China’s military, and the missile landed in an “expected” area, though they didn’t specify where.

ICBMs are designed to hit targets thousands of miles away, often carrying nuclear warheads.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AMD | Arrow Minerals | 0.002 | 100% | 4,926,059 | $12,689,365 |

| DOU | Douugh Limited | 0.005 | 67% | 29,968,882 | $3,246,207 |

| BP8 | Bph Global Ltd | 0.003 | 50% | 216,667 | $793,283 |

| IVX | Invion Ltd | 0.003 | 50% | 10,583,988 | $13,533,183 |

| WEL | Winchester Energy | 0.002 | 50% | 2,375,000 | $1,363,019 |

| CAN | Cann Group Ltd | 0.063 | 40% | 3,381,389 | $21,089,992 |

| RIL | Redivium Limited | 0.007 | 40% | 13,293,101 | $13,734,274 |

| DGR | DGR Global Ltd | 0.018 | 38% | 4,472,068 | $13,568,015 |

| 4DX | 4Dmedical Limited | 0.605 | 36% | 7,260,845 | $182,686,368 |

| ATH | Alterity Therap Ltd | 0.004 | 33% | 131,237 | $15,961,008 |

| NTM | Nt Minerals Limited | 0.004 | 33% | 3,501,057 | $3,052,209 |

| OVT | Ovanti Limited | 0.004 | 33% | 13,392,722 | $4,669,045 |

| RLG | Roolife Group Ltd | 0.004 | 33% | 200,978 | $3,507,439 |

| VEN | Vintage Energy | 0.009 | 29% | 1,142,158 | $11,686,719 |

| FBM | Future Battery | 0.023 | 28% | 983,831 | $11,976,407 |

| NYR | Nyrada Inc. | 0.073 | 26% | 1,822,992 | $10,568,104 |

| 88E | 88 Energy Ltd | 0.003 | 25% | 892,265 | $57,867,624 |

| CYQ | Cycliq Group Ltd | 0.005 | 25% | 1,956,082 | $1,782,067 |

| TEG | Triangle Energy Ltd | 0.005 | 25% | 12,604,156 | $8,320,536 |

| RTR | Rumble Res Limited | 0.047 | 24% | 4,743,967 | $28,744,631 |

| NC6 | Nanollose Limited | 0.021 | 24% | 30,000 | $2,924,108 |

| G50 | G50Corp Ltd | 0.160 | 23% | 436,160 | $15,718,300 |

| NSM | Northstaw | 0.015 | 22% | 63,157 | $1,714,178 |

ReNu Energy (ASX:RNE) doubled up (from $0.001 to $0.002) on news that it has entered into a binding Grant Deed with the Tasmanian Government for the award of up to $8 million of funding for its Tasmanian green hydrogen project, to be paid on delivery of green hydrogen to customers.

Western Gold Resources (ASX:WGR) was up after the company published a positive Scoping Study for its Gold Duke project in Western Australia, noting that the study has only assessed the economics based on mining 51% of the current published 2.9Mt at 2.07g/t for 234,000oz gold mineral resource of Gold Duke.

Lodestar Minerals (ASX:LSR) was up on news that test drilling at its Ned’s Creek site has been completed, and data from two drillholes at the Ned’s Creek project in Western Australia is due from the lab imminently. Lodestar recently completed placing of the Rights Issue shortfall, with exploration at Ned’s and inaugural Aircore drill testing on gold anomalies at Coolgardie West set to kick off shortly.

Ecofibre (ASX:EOF) was up on news that it has completed an agreement with Under Armour for the supply of NEOLAST yarns to Under Armour’s nominated knitting mills, including the purchase of associated manufacturing equipment. The initial term of the supply agreement is three years, with an expected annual revenue at full production of US$6.0 million.

Si6 Metals (ASX:SI6) announced plans to undertake a non-renounceable rights issue of one (1) fully paid ordinary share in the capital of the company for every two (2) shares held by eligible shareholders at an issue price of $0.001 per share (pre-consolidation) or $0.02, with funds raised to go towards exploration programs at the Lithium Valley (lithium), Pimento (rare earth elements) and Monument (gold) projects and for general working capital purposes.

Earlier, Great Boulder Resources (ASX:GBR) revealed that infill and extensional RC drilling at its Mulga Bill project has intersected more extremely high gold grades, extending the resource and adding thickness and grade to existing lodes. Highlights include 5m @ 43.13/t Au from 185m, including 2m @ 102.80/t Au from 186m, and 5m @ 40.61g/t Au from 256m, including 1m @ 194.50g/t Au from 258m.

In a strategic move to expand its niobium exploration tenure in Brazil, Power Minerals (ASX:PNN) has inked an option agreement to acquire the Tântalo project in Paraiba state.

It resides south of the company’s Nióbio project and adjacent to Summit Minerals (ASX:SUM) Equador niobium project, where it has seen recent success of its own. Power will make a non-refundable payment of $50,000 and carry out a 60-day due diligence period.

PNN says the acquisition would represent a major, material expansion of Power’s niobium, tantalum, REE and lithium-prospective ground position in Paraiba state, Brazil, and reinforces its position as a South American-focused explorer and developer.

$30 million capped Labyrinth Resources (ASX:LRL) is up again, with a whole bunch of executive movements bringing investors onside. Monday’s close of the deal to acquire the Vivien mine, famously worked over by Ramelius Resources, came alongside a host of management and board changes.

Alex Hewlett and Kelvin Flynn are now on the board. Their list of credits between them include Spectrum Metals, Silver Lake Resources, MinRes, Delta Lithium and Wildcat Resources, the latter where the two worked on the transformational Tabba Tabba lithium deal. Charles Hughes has flown in as CEO. A former Bellevue, Northern Star and Saracen man, the geo has led the drilling teams at Delta’s Mt Ida lithium and gold projects over the past three years.

It comes as the company reloads for a fresh assault on the gold potential at Comet Vale and Vivien, with a share consolidation upcoming and ~$2m entitlement offer in the works.

And, cancer cell therapy drug developer Chimeric Therapeutics (ASX:CHM) has struck an alliance with a US blood bank that will enable access to ‘fresher’ blood cells for its proposed immune therapies. Chimeric’s collaboration is with the Los Angeles-based Achieve Clinics, which cryopreserves product collected from apheresis: the process of dividing blood into its components of red and white blood cells, platelets and plasma.

Chimeric is now recruiting gastrointestinal cancer patients in the US for a phase I/II trial of its CHM CDH-17, “the world’s first cadherin 17- directed CAR-T cell therapy.”

Read: Health Check: Cancer drug developer Chimeric heads to blood bank for better patient cells

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| 88E | 88 Energy Ltd | 0.002 | -33% | 37,323,189 | $86,801,436 |

| ALR | Altairminerals | 0.003 | -25% | 8,727,260 | $17,186,310 |

| BCT | Bluechiip Limited | 0.003 | -25% | 3,678,353 | $4,737,249 |

| RIL | Redivium Limited | 0.003 | -25% | 31,691 | $10,987,419 |

| SIS | Simble Solutions | 0.003 | -25% | 475,000 | $3,013,803 |

| SMM | Somerset Minerals | 0.003 | -25% | 1,000,666 | $4,123,995 |

| NPM | Newpeak Metals | 0.013 | -24% | 766,794 | $5,191,886 |

| AIV | Activex Limited | 0.004 | -20% | 1,990 | $1,077,513 |

| WML | Woomera Mining Ltd | 0.002 | -20% | 3,834 | $3,795,347 |

| OCN | Oceanalithiumlimited | 0.029 | -17% | 19,115 | $2,887,430 |

| AKN | Auking Mining Ltd | 0.005 | -17% | 4,694,370 | $2,013,421 |

| C7A | Clara Resources | 0.009 | -15% | 563,167 | $2,651,374 |

| HOR | Horseshoe Metals Ltd | 0.006 | -14% | 84,040 | $4,642,972 |

| MCT | Metalicity Limited | 0.030 | -14% | 2,117,101 | $17,450,458 |

| RFA | Rare Foods Australia | 0.012 | -14% | 124,706 | $3,807,765 |

| BIT | Biotron Limited | 0.019 | -14% | 471,133 | $19,850,803 |

| SMX | Strata Minerals | 0.026 | -13% | 1,030,211 | $5,634,455 |

| 8IH | 8I Holdings Ltd | 0.007 | -13% | 356,144 | $2,785,287 |

| AUZ | Australian Mines Ltd | 0.007 | -13% | 3,451,911 | $11,188,097 |

| BNL | Blue Star Helium Ltd | 0.004 | -13% | 110,425 | $9,724,426 |

| BUY | Bounty Oil & Gas NL | 0.004 | -13% | 202,391 | $5,994,004 |

| VRC | Volt Resources Ltd | 0.004 | -13% | 55,000 | $16,634,713 |

IN CASE YOU MISSED IT

Maronan Metals (ASX:MMA) has reported further wide intercepts of ore-grade silver with lead mineralisation through infill drilling within the starter zone at its namesake silver-lead and copper-gold deposit in Queensland.

Hits included 17.1m at 3.6% lead, 103g/t silver (202g/t silver equivalent), including 7.11 at 5.4% lead, 197g/t silver (343g/t silver equivalent) (MRN24003), with further assays pending. MMA’s namesake project is right next door to the giant Cannington silver-lead-zinc mine.

West Australian renewable energy project developer Frontier Energy (ASX:FHE) has kicked off environmental surveys at its Waroona project in the state’s southwest region.The company is now surveying and completing environmental studies over 565ha of the project area to determine the best spot for a Stage 2 expansion. Stage 1 of the project combines a 120 megawatts of direct current solar facility with an integrated 4.5 hour duration 80MW/360MWh lithium-ion phosphate battery.

Fresh off acquiring the ultra-high grade Taylors Arm project in northern NSW, Trigg Minerals (ASX:TMG) has commenced maiden exploration to prioritise targets. Antimony prices are at an all time high after China’s recent export ban, and Trigg’s project is considered to be highly prospective for economic antimony and gold mineralisation.

Queensland explorer Red Metal (ASX:RDM) is beating the drum on a $2m share placement plan to fund exploration activities across copper, gold, rare earths and base metals at three of its projects. Shareholders will have the chance to purchase shares at 10c – an 18% discount to the company’s 5-day VWAP – with funds supporting works at the Sybella, Gidyea and Lawn Hill projects.

Felix Gold (ASX:FXG) is also raising nearly $5 million through a placement to accelerate the bid for near-term antimony production at the Scrafford mine in Alaska. The company said the placement was well-supported, priced at 7.5c to existing shareholders and new sophisticated and institutional investors.

Belararox (ASX:BRX) is gearing up to launch drilling in just weeks at its TMT project in Argentina, with siteworks underway.

After recently acquiring another highly prospective copper project in the Kalahari Copper Belt, the company now holds two potentially significant copper projects in promising locations – Argentina and Botswana, where mining Giant BHP has shown plenty of interest as of late.

And in an effort to grow its Ontario lithium resource, Green Technology Metals (ASX:GT1) has kicked off a 14,000m diamond drilling campaign. GT1 wants to expand the 14.6Mt at 1.21% Li2O resource and find potential repeats, while also adding years to the mine life and improving the economics of its second project.

Gold explorer Riversgold (ASX:RGL) has plenty to smile about after receiving all assay results from aircore drilling it undertook at its Northern Zone Intrusive Hosted gold project 25km southeast of Kalgoorlie’s prolific Super Pit in Western Australia.

This is the third aircore drilling program RGL has completed this year at the project, with standout results announced to the market today including 58.09g/t gold within an intercept of 5m at 12.27g/t – the new highest-grade interval to date at the project.

Peregrine Gold (ASX:PGD) has identified a new high-grade gold zone 250m to the west of the Tin Can prospect, within its Newman Gold Project in WA. The initial discovery hole at ‘Tin Can West’ returned 4m at 9.0g/t gold – providing further confidence to the prospectivity of the Tin Can gold trend.

Copper explorer Firetail Resources (ASX:FTL) has completed the first milestone of its option agreement to earn up to 80% in the York Harbour project in Newfoundland, Canada. The project is prospective for copper, zinc and silver across seven mineral licences on nearly 5,000ha of land in the mining-friendly jurisdiction. The first milestone now completed means FTL owns a 49% interest in the project with another three milestones on the cards.

As part of the transaction with company York Harbour Metals (YHM), the vendor has joined FTL as a “significant and highly supportive shareholder” while FTL has granted a 2% net smelter returns royalty to YHM at the project.

FTL managing director and CEO Glenn Poole said the Aussie company was already rolling up its sleeves at the Canadian project.

“The recent work by the team has identified early opportunities to increase our knowledge of the project with further sampling and relogging of recent YHM, this has helped to set the foundation for the upcoming drilling program we have planned to further highlight the potential the project has to offer,” Poole said.

Point-of-care diagnostic technologies developer Lumos Diagnostics (ASX:LDX) has been awarded placement of its novel test FebriDx on the MediGroup National contract, making it available to all their members in the United States. MediGroup is the single largest non-acute purchasing organisation in the US.

What is FebriDx? It’s a rapid point-of-care respiratory test that can deliver results in up to 10 minutes from just a fingerstick blood sample.

FebriDx is certainly not too good to be true, as the system was cleared by the US Food and Drug Administration in July of last year to be marketed in the States as an aid in diagnosing bacterial acute respiratory infection and differentiation from non-bacterial etiology. Healthcare professionals in the industry have also been cleared to use FebriDxl on patients in need of urgent care.

“As a leading group-purchasing organisation, MediGroup has more than 30,000 members, including a mix of moderately complex labs and CLIA waived locations,” Lumos CEO and managing director Doug Ward said.

Finder Energy (ASX:FDR) has raised an additional $2 million through a shortfall placement, bringing the total amount raised in the entitlement offer to $6 million. The company placed just over 41.5 million shares at 4.8 cents each, with interest from new institutional investors. Directors joined in the raise, applying for more than 2 million shares valued at about $105,000

At Stockhead, we tell it like it is. While Finder Energy, Firetail Resources, Lumos Diagnostics, Maronan Metals, Frontier Energy, Trigg Minerals, Red Metal, Felix Gold, Belararox, Green Technology Metals, Riversgold, and Peregrine Gold are Stockhead advertisers, they did not sponsor this article.

Today’s Closing Bell is brought to you by Webull Securities. Webull Securities (Australia) Pty. Ltd. is a CHESS-sponsored broker and a registered trading participant on the ASX.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.