Closing Bell: Hold onto your horses, Nathan is tinkling with coal again

Via Getty

- Small caps and benchmark down over 1%

- All sectors retreat on ill-winds blowing in from the states

- Tinkler is back

The ASX 200 has started a new week with its worst session since early July.

While that can be pinned on a shift in US sentiment, it’s little consolation when every sector on the ASX is trading below the salt – literally everyone – Banks, Tech, Consumer Discretionary, Consumer Indiscretionary, REITs, Industrials and Banks again because they’re just terrible in a crisis – you name it, they’ll underperform it.

The ray of hope is that Materials might reconstellate around Dalian iron ore futures which are up almost 2% thanks to a suddenly less sonambulistic People’s Bank of China (PBoC) which has had a sprightly crack at trimming the key one-year loan prime rate (1yr LPR) by another 5 basis points (to 3.65% from 3.7%), while the property-related 5-year rate was tinkered with by 15bps (to 4.3% from 4.45%).

They’re a reactive bunch though – new bank lending in China crashed in July on this zero-COVID nonsense, the joblessness, housinglessness and more lessness generally.

Chinese banks extended less than a quarter of June’s total lending – extending some 680bn yuan (US$101 billion) in new loans in July, the PBoC said/discovered on August 12.

The vast majority of loans – when borrowing via an actual bank in China – are based almost exclusively on the 1yr LPR, which is now loosely pegged to the PBoC’s medium-term lending facility rate. The five-year rate is more tied to the property market and influences mortgage pricing.

Gregor found this and it seems appropriate as a short comment on where that market is right now:

This new surprise PBoC move follows last week’s old surprise PBoC move – when the central bank took a stick to interest rates – trimming the 1yr LPR by 10 bps while concurrently lowering the seven-day reverse repo rate — which is the daddy rate for short-term lending to pique liquidity into shonky regional banks — from 2.1% to 2%.

The plan is pretty clear – and familiar – to boost its weak-ass economy by pouring some sweet sugar down the throats of provincial lenders in a bid to up weak-ass industrial production and retail sales.

With youth unemployment revealed to be at record highs last week, the world’s no 2. economy barely shifted during Q2.

With the Wall Street open but a few hours away, all three major US Futures are down circa 0.5%. S&P 500 futures are short 0.4%.

In the states last week, market losses were led by the tech firms and the small caps also fell away sharply on Friday, pulling the Russell 2000 2.2% lower to more of a rustle. But when some 80% of the benchmark S&P 500 reverse gains it suggests the jig is up for the latest inexplicable resurgence.

Anyhoo, what I do know, is we’re onto the final week of US earnings and the hawkish tone set last week by Fed speakers has US traders on tenterhooks ahead of Thursday’s Jackson Hole Symposium.

In Europe, it’s business as usual with people in various states of panic, disillusion and confusion as energy prices continue to go off like a Fromagerie without refrigeration and the general sentiment on the nose after Germany’s Friday PPI release literally the worst since 1949.

At home, it’s been a while since anyone kicked Nuix (ASX:NXL) while it was down. Enter the brokers at Morgan Stanley who’ve had a red hot crack on Monday, culling some 85% off the troubled software maker’s target price.

The brokers didn’t have much to say that was nice either. Just pointing out that the previous target price of $5.50 was “wrong”.

Nuix had been celebrating after posting a decent (for Nuix) circa $23m full year loss.

At circa 90 cents a pop Morgan Stanley says of Nuix:

“You can have the best software in the world, but if the corporate entity that owns that software becomes uninvestable (for example, due to legal action, staff turnover, etc.), then it likely confines a stock to underperform.”

TODAY’S SMALL CAP WINNERS

(Stocks highlighted in yellow rose after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AQC | Auspaccoal Ltd | 0.255 | 89% | 369,439 | $6,815,449 |

| RAS | Ragusa Minerals Ltd | 0.29 | 53% | 19,092,482 | $24,193,606 |

| NRX | Noronex Limited | 0.06 | 50% | 6,614,484 | $6,818,391 |

| TD1 | Tali Digital Limited | 0.007 | 40% | 16,102,968 | $6,163,153 |

| ASN | Anson Resources Ltd | 0.2 | 38% | 30,980,626 | $149,047,289 |

| CBE | Cobre | 0.61 | 36% | 56,179,758 | $90,944,521 |

| MCT | Metalicity Limited | 0.004 | 33% | 17,061,824 | $10,376,118 |

| CCE | Carnegie Cln Energy | 0.0025 | 25% | 314,809 | $30,205,147 |

| XST | Xstate Resources | 0.0025 | 25% | 1,453,981 | $6,430,363 |

| AMM | Armada Metals | 0.12 | 20% | 2,058,228 | $5,000,000 |

| PRM | Prominence Energy | 0.003 | 20% | 567,465 | $6,061,522 |

| MEM | Memphasys Ltd | 0.037 | 19% | 1,784,677 | $24,557,528 |

| JPR | Jupiter Energy | 0.032 | 19% | 3,178 | $4,141,198 |

| CNJ | Conico Ltd | 0.065 | 18% | 88,259,079 | $79,877,789 |

| MCM | Mc Mining Ltd | 0.305 | 17% | 58,615 | $51,390,266 |

| MGA | Metals Grove Mining | 0.14 | 17% | 92,592 | $4,320,060 |

| GCR | Golden Cross | 0.014 | 17% | 210,022 | $13,167,073 |

| GLV | Global Oil & Gas | 0.0035 | 17% | 723,245 | $5,620,064 |

| SYN | Synergia Energy Ltd | 0.0035 | 17% | 10,542,384 | $25,253,372 |

| TSC | Twenty Seven Co. Ltd | 0.0035 | 17% | 73,285 | $7,982,442 |

| FRM | Farm Pride Foods | 0.18 | 16% | 3,000 | $8,552,927 |

| BXN | Bioxyne Ltd | 0.015 | 15% | 250,000 | $8,321,890 |

| CBL | Control Bionics | 0.23 | 15% | 413 | $10,066,181 |

| CTO | Citigold Corp Ltd | 0.008 | 14% | 2,951,000 | $19,835,614 |

| M8S | M8 Sustainable | 0.008 | 14% | 230,000 | $2,936,360 |

A Nathan Tinkler backed consortium wants to buy struggle town coalie Australian Pacific Coal (ASX:AQC) and its Dartbrook project, prompting both the AQC share price and Dep Ed Reuben Adams to lap themselves by lunchtime.

Adams, in that ominously quiet tone found only at peak fury, asked me if the one time BRW Young Rich Lister and mining magnate “know’s something we don’t.”

I said, you’re scaring me Reuben. And that certainly, it’s a generous offer, proposing to subscribe for 19.97% of AQC shares at $0.30 per share for a total of $3.78m.

Tinkler et al would then refinance the company’s debt and buy the rest of the stock for up to $0.30 per share” to allow existing shareholders to take the opportunity to liquidate their investment, should they wish to do so, once the Refinancing has been completed”.

In 2017 Tinkler got ASIC’d from being a director until February 2021 because of his involvement in the collapse of 11 companies across mining, horse racing and sports.

This morning AQC confirmed it has received the non-binding alt-proposal for the sale of the Dartbrook Project to Trepang Services from Nakevo.

Nakevo proposition in dot points:

-

To provide immediate funding to AQC by way of an equity subscription for 19.97% of the shares in AQC at $0.30 per share for a total of $3.78 million (less fees and expenses) (Placement);

-

To arrange to refinance the debt (including outstanding interest) of AQC owed to Mr John Robinson Snr, Mr Nicholas Paspaley and Trepang Services (Refinancing); and

-

To make a takeover bid for AQC for up to $0.30 per share, to allow existing shareholders to take the opportunity to liquidate their investment, should they wish to do so, once the Refinancing has been completed (Takeover Offer).

AQC has been advised by Nakevo, that the shareholders of Nakevo are: Oceltip Coal 2 Pty Ltd (that’s an entity controlled by Mr Tinkler) and fundie Evolution Capital. Exciting!

Meanwhile, EML Payments (ASX:EML) is back in the news, the happy news anyway, jumping over 12% in morning trade after political, regulatory, economic and personal issues all took a backseat to some decent numbers out of its key market of Ireland. Revenue was a beat on expectations, although guidance was less than hoped for.

The share price continues to find support after coming off a near 7-year low.

TODAY’S SMALL CAP LAGGARDS

(Stocks highlighted in yellow fell after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| GMLDA | Gateway Mining | 0.066 | -34% | 121,590 | $2,260,106 |

| ALT | Analytica Limited | 0.001 | -33% | 2,570,879 | $6,920,702 |

| ANL | Amani Gold Ltd | 0.001 | -33% | 2,777,907 | $35,540,162 |

| MEB | Medibio Limited | 0.001 | -33% | 237,000 | $4,134,735 |

| SIH | Sihayo Gold Limited | 0.002 | -33% | 7,696,761 | $18,306,384 |

| DDD | 3D Resources Limited | 0.0015 | -25% | 1,306,966 | $8,863,744 |

| AYT | Austin Metals Ltd | 0.007 | -22% | 3,744,394 | $9,142,872 |

| LAW | Lawfinance Ltd | 0.205 | -21% | 128,650 | $16,557,039 |

| AUA | Audeara | 0.1 | -20% | 141,278 | $9,274,915 |

| ARE | Argonaut Resources | 0.002 | -20% | 1,440,000 | $9,015,512 |

| KFE | Kogi Iron Ltd | 0.004 | -20% | 229,918 | $8,087,889 |

| MGG | Mogul Games Grp Ltd | 0.002 | -20% | 833,333 | $8,158,603 |

| BPH | BPH Energy Ltd | 0.0145 | -19% | 8,805,926 | $11,969,069 |

| GRE | Greentechmetals | 0.25 | -19% | 1,043,588 | $9,696,800 |

| WCG | Webcentral Ltd | 0.21 | -19% | 3,349,713 | $86,084,126 |

| ABC | Adbri Limited | 2.21 | -17% | 7,121,666 | $1,735,989,296 |

| MTM | Mt Monger Resources | 0.16 | -16% | 904,015 | $7,126,906 |

| IS3 | I Synergy Group Ltd | 0.044 | -15% | 27,669 | $13,959,994 |

| OAU | Ora Gold Limited | 0.011 | -15% | 504,057 | $12,795,007 |

| DUN | Dundasminerals | 0.14 | -15% | 3,844 | $6,391,367 |

| LEG | Legend Mining | 0.04 | -15% | 13,116,117 | $129,491,379 |

| AHN | Athena Resources | 0.012 | -14% | 8,224,378 | $11,381,546 |

| AUK | Aumake Limited | 0.006 | -14% | 1,654,005 | $5,400,128 |

| CAV | Carnavale Resources | 0.006 | -14% | 1,453,925 | $19,029,862 |

| MTB | Mount Burgess Mining | 0.006 | -14% | 196,166 | $6,014,198 |

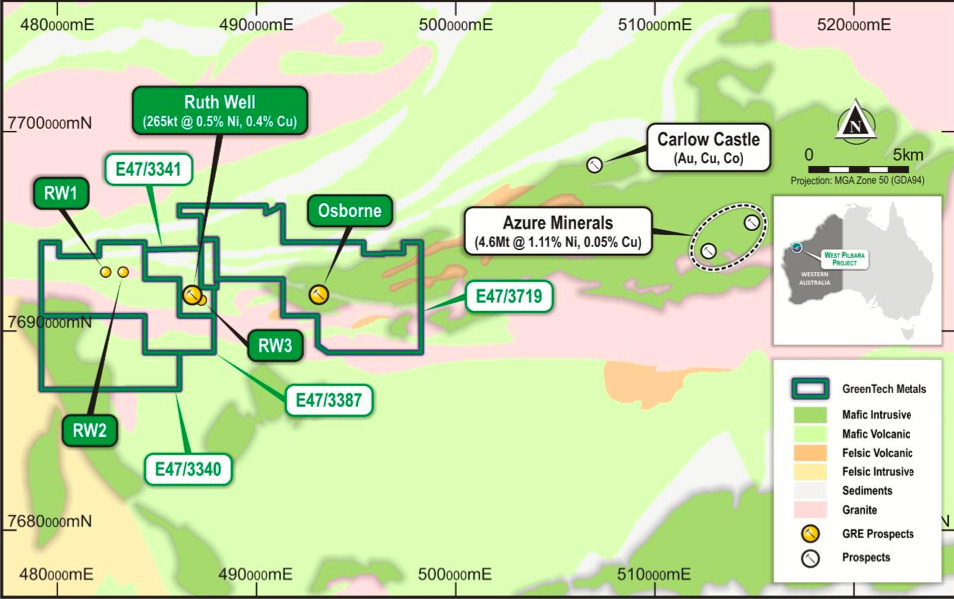

No good deed goes unpublished here at Stockhead, and thusly, down about 20%, GreenTech Metals (ASX:GRE) has done for its maiden drill at Osborne nickel JV with Artemis Resources (ASX:ARV) giving the explorer a chance to focus on both the Ruth Well deposit and it’s Pilbara-based Whundo prospect.

GRE executive director Thomas Reddicliffe said sulphides were visually observed in RC chips over a 7m interval from 173m depth, the diamond drill core giving greater detail of the host rocks and the nature of the sulphide mineralisation.

Unfortunately, while the nickel and copper potential of the sulphides in the first drill hole was initially confirmed by handheld pXRF analyser, no party bag nickel or copper results have so far come out of the lab analyses.

GRE is now diving into the Whundo prospect and the Ruth Well nickel–copper deposit which has a JORC 2012 Indicated Resource of 265,000t at 0.4% copper and 0.5% nickel.

Artemis reported the results in 2018 including 13 metres at 2.14% nickel, 1.19% copper, 0.07% cobalt, 0.6 g/t gold, 0.6 g/t palladium from 55m (EWRC003).

The Whundo copper-zinc project in the Pilbara recently reported a highlight of 32m @ 2.43% copper as well as gold grades of up to 3.34g/t.

A detailed 25m x 25m ground gravity survey was completed over the deposit, revealing an associated gravity response presenting as a gravity ridge and the data will now be assessed to plan a drill program to test these new Ruth Well nickel targets.

WHAT YOU MAY’VE MISSED

Well, we like a near thing at Stocky too – so here’s to some cheers for the upward trajectory of Nearmap shares, with the globe-tracing aerial imagery firm climbing well over 5% on Monday. Nearmap has found itself the welcome target of power private equity firm, Thoma Bravo – and Nearmap has said ‘yes, you fool, yes!’ to Bravo’s ambitious $1.06bn takeover offer.

The Webcentral Board have agreed to sell the company’s block stake in Cirrus Networks Holdings (ASX: CNW) in an on-market trade today.

The sale of Webcentral’s (ASX:WCG) holding of 172 million shares (18.5% of CNW) will provide a cash inflow of $5.5m.

The cash will go and fund potential acquisitions, on-market share buybacks and to reduce debt, Managing Director Joe Demase said.

Webcentral is apparently reviewing a number of acquisition targets and ‘will pursue these more synergistic high EBITDA-accretive investments.’

“At this stage we have decided to not pursue the acquisition of CNW, we agitated for change, more accountability and improved performance and we can see that slowly taking place. The Enterprise hardware space is challenging with tight margins, that coupled with hardware constraints makes the turnaround road a bit tougher for CNW.’” Demase added.

TRADING HALTS

Pure Resources Limited (ASX: PR1) – trading halt in connection with the Company’s Loyalty Option Issue.

The Market Herald (ASX:TMH) – trading halt in relation to the execution of an agreement regarding a material acquisition (word is it’s Carsguide and Gumtree.)

Arcadia Minerals Limited (ASX: AM7) – trading halt – ahead of an announcement relating to the updated Bitterwasser Lithium Mineral Resource.

HeraMED Limited (ASX:HMD) – trading halt ahead of proposed capital raise.

Heartshead Resources (ASX:HHR) – trading halt ahead of capital raise.

Doctor Care Anywhere Group (ASX:DOC) – trading halt ahead of announcement to the market.

Magmatic Resources (ASX:MAG) – trading halt ahead of material announcement to the market.

Live Verdure Ltd (ASX: LV1) – trading halt, pending an announcement to the market regarding a material acquisition, capital raising and new CEO appointment.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.