Closing Bell: Energy weighs on ASX as Syrian regime toppled

Oil in focus as Syrian regime toppled. Picture via Getty Images

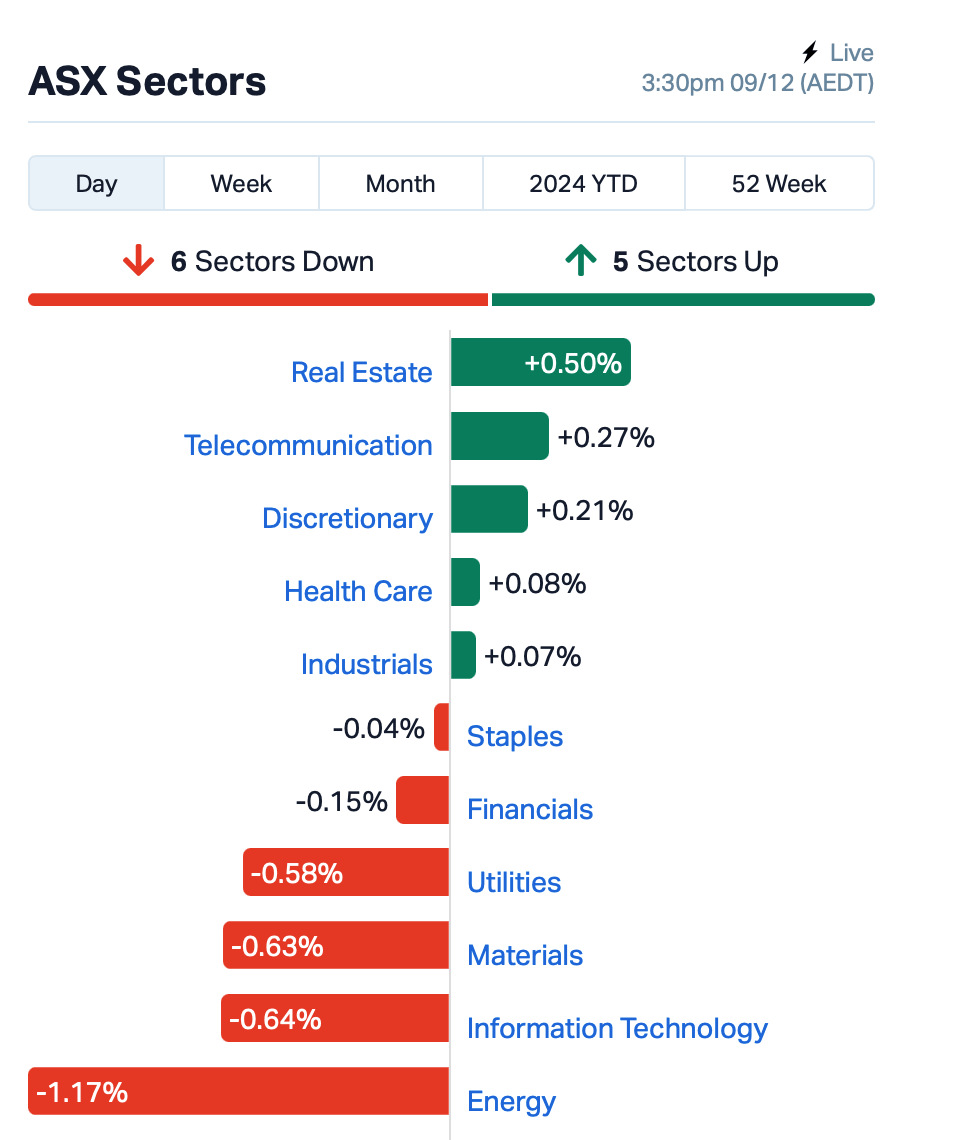

- ASX200 falls as energy and mining stocks sink

- Life360, ANZ and Platinum hit

- Aussie dollar dips, markets await RBA decision

The ASX200 index closed higher on Monday, but not by much (+0.025%), with energy and tech stocks contributing to making it a fairly ‘meh’ day for the local bourse overall.

Weaker commodity prices were dampening investor sentiment most of the day, pushing the Aussie dollar to a near one-year low, dipping below US64¢.

The Energy sector, however, was hit hardest after oil prices continued their two-week decline with Brent trading now at US$71.35/Bbl.

Oil traders were on high alert as they watched the geopolitical fallout from the collapse of the Syrian regime. Syrian President Bashar al-Assad has reportedly fled to Moscow after rebel forces swiftly overthrew his government.

The Mining (Materials below) sector wasn’t far behind today as iron ore futures dropped by more than 1% in Singapore.

In the large caps space, dual-listed Life360 (ASX:360) fell 8.5% on no announcement, but it’s believed that the Russell Group, which publishes the Russell Small Caps Index in the US, announced it had begun to recalculate certain index weightings.

Life360 had previously revealed in September that it would join the popular Russell 2000 and 3000 indexes.

Australia and New Zealand Banking Group (ASX:ANZ) tumbled 3% following the announcement of Nuno Matos as the bank’s new CEO. Matos, who previously served as the CEO of HSBC Wealth and Personal Banking, is stepping into the role after Shayne Elliott’s retirement.

And, Platinum Asset Management (ASX:PTM) had a sharp drop of 16% after Regal Partners (ASX:RPL), a rival firm, ended buyout talks without a new deal in sight.

All eyes will now turn to the RBA’s meeting on Tuesday, with most analysts predicting the cash rate will remain unchanged.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AMD | Arrow Minerals | 0.002 | 100% | 6,250,828 | $13,223,628 |

| NVQ | Noviqtech Limited | 0.140 | 51% | 13,117,906 | $20,872,673 |

| TGH | Terragen | 0.050 | 40% | 414,342 | $13,199,227 |

| IGN | Ignite Ltd | 0.560 | 38% | 1,137 | $6,609,012 |

| CYQ | Cycliq Group Ltd | 0.004 | 33% | 5,000 | $1,381,550 |

| GMN | Gold Mountain Ltd | 0.004 | 33% | 34,923,067 | $11,722,420 |

| YAR | Yari Minerals Ltd | 0.004 | 33% | 3,001 | $1,447,073 |

| IXU | Ixup Limited | 0.012 | 33% | 4,601,612 | $15,038,873 |

| RAD | Radiopharm | 0.041 | 32% | 56,689,986 | $67,361,783 |

| NFM | New Frontier | 0.014 | 27% | 4,002,779 | $15,991,089 |

| ARN | Aldoro Resources | 0.290 | 26% | 3,191,592 | $30,963,461 |

| ADD | Adavale Resource Ltd | 0.003 | 25% | 3,905,907 | $2,469,864 |

| CDT | Castle Minerals | 0.003 | 25% | 162,741 | $3,345,628 |

| NRZ | Neurizer Ltd | 0.003 | 25% | 1,402,248 | $5,635,721 |

| RRR | Revolverresources | 0.040 | 25% | 73,666 | $8,739,976 |

| VML | Vital Metals Limited | 0.003 | 25% | 9,067,036 | $11,790,134 |

| KGL | KGL Resources Ltd | 0.110 | 24% | 665,732 | $57,682,061 |

| ANX | Anax Metals Ltd | 0.011 | 22% | 1,815,464 | $7,842,914 |

| FGH | Foresta Group | 0.011 | 22% | 199,842 | $23,196,411 |

| OCT | Octava Minerals | 0.145 | 21% | 1,468,983 | $7,109,352 |

| ALM | Alma Metals Ltd | 0.006 | 20% | 271,942 | $7,832,611 |

Microbial tech company Terragen (ASX:TGH) jumped after the company successfully completed the institutional component of its equity raising, with a solid take-up rate of 74% from institutional shareholders.

The total funds raised amounted to approximately $4.76 million, with strong support from both new and existing investors. The proceeds will be used for scientific research, development, and global commercialisation efforts.

Arrow Minerals’ (ASX:AMD) share price doubled after the company reported exciting results from its Niagara bauxite project in Guinea. New high-grade bauxite assays extended the mineralisation to 5 km², confirming significant scale and quality in the deposit.

The project, located near a multi-user railway, has already caught the attention of potential bauxite customers, with strong demand driven by record high bauxite prices. The latest drilling results highlight impressive alumina grades, including several intercepts of over 50% Al2O3. With ongoing drilling and further results expected, Arrow has plans for a scoping study in 2025.

Triton Minerals (ASX:TON) has agreed to sell 70% of its Mozambique graphite assets to Shandong Yulong Gold for $17 million, to be paid in three stages by February 2025. Triton will retain a 30% stake in the assets.

The proceeds will fund Triton’s joint venture, exploration at its Aucu gold and copper project, and new acquisitions. The company said it’s also confident the partnership with Yulong will advance its graphite projects and help drive future growth.

Krakatoa Resources (ASX:KTA) has secured an exclusive option to acquire up to 80% of the Zopkhito project in Georgia, a major antimony and gold deposit. The project covers 1,779 hectares and has a foreign estimate of 225,000 tonnes of antimony and 7.1 million tonnes of gold at significant grades.

KTA said only a fraction of the known mineral veins have been explored, leaving substantial upside potential. The company has raised $1.28 million to fund its next steps, with director participation pending shareholder approval.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AXP | AXP Energy Ltd | 0.001 | -33% | 1,009,736 | $8,737,021 |

| ERA | Energy Resources | 0.002 | -33% | 869,914 | $1,216,188,722 |

| MOM | Moab Minerals Ltd | 0.002 | -33% | 197,340 | $4,700,998 |

| MTL | Mantle Minerals Ltd | 0.001 | -33% | 300,000 | $9,296,169 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 377,524 | $57,867,624 |

| SFG | Seafarms Group Ltd | 0.002 | -25% | 186 | $9,673,198 |

| T3D | 333D Limited | 0.010 | -23% | 799,865 | $2,290,385 |

| IRX | Inhalerx Limited | 0.031 | -23% | 68,355 | $8,447,267 |

| FL1 | First Lithium Ltd | 0.091 | -21% | 94,018 | $9,160,164 |

| ILA | Island Pharma | 0.135 | -21% | 345,742 | $30,728,914 |

| AAU | Antilles Gold Ltd | 0.004 | -20% | 247,591 | $9,289,380 |

| AHN | Athena Resources | 0.004 | -20% | 2,733,755 | $6,677,338 |

| AYT | Austin Metals Ltd | 0.004 | -20% | 42,369 | $6,620,957 |

| BMO | Bastion Minerals | 0.004 | -20% | 401,573 | $4,223,623 |

| FIN | FIN Resources Ltd | 0.004 | -20% | 267,500 | $3,246,344 |

| MMR | Mec Resources | 0.004 | -20% | 11,169,219 | $9,159,035 |

| EUR | European Lithium Ltd | 0.050 | -19% | 4,419,906 | $86,683,604 |

| AZI | Altamin Limited | 0.022 | -19% | 618,973 | $15,511,578 |

| SI6 | SI6 Metals Limited | 0.018 | -18% | 19,643 | $3,222,242 |

| VAR | Variscan Mines Ltd | 0.009 | -18% | 4,632,012 | $8,121,673 |

| EFE | Eastern Resources | 0.035 | -17% | 766,359 | $5,295,778 |

| MNC | Merino and Co | 0.210 | -16% | 26,543 | $13,269,143 |

| BTR | Brightstar Resources | 0.025 | -16% | 47,194,460 | $206,849,027 |

IN CASE YOU MISSED IT

Recce Pharmaceuticals (ASX:RCE) has received approval from Indonesia’s National Agency of Drug and Food Control to commence a phase III registrational clinical trial evaluating RECCE 327 as a topical gel for treating diabetic foot infections. The trial, set to begin as early as this quarter, has been granted expedited regulatory review status in Indonesia, enabling faster progression.

Pursuit Minerals (ASX:PUR), has reported a “transformational” 339% increase in the resource at its Rio Grande Sur project in Argentina. The updated resource now totals 1.1 million tonnes, grading above 500mg/L, bringing the junior closer to commercial production in one of the world’s top emerging lithium regions. The expanded resource has also opened the door for potential offtake agreements, with discussions already in progress.

Coming off a strong 2024, Brightstar Resources (ASX:BTR) is showing no signs of slowing down, securing a $30 million capital raise to advance its position among Australia’s junior gold miners. The raise, carried out at 2.3 cents per share, coincides with the execution of an ore purchase agreement with a regional processing plant in the Laverton district.

In Africa, Many Peaks Minerals (ASX:MPK) has launched into a 5,000m aircore drilling program targeting gold prospects at its Odienné project. It follows the completion of auger drilling at Ferké, both advancing on previous successes, including 39.7m at 3.54g/t gold, with further exploration planned in the new year.

Recharge Metals (ASX:REC) has finalised the acquisition of the advanced Carter uranium project and a $2.5 million placement to drive exploration, with drilling set to start next year.

Located in the prolific Powder River Basin in the USA, the project sits within 250kms of six permitted ISR uranium production sites and lies in a region with a history of uranium exploration. First announced in late October, the acquisition is a timely move, aligning with the renewed focus on nuclear power in the US.

At Stockhead, we tell it like it is. While Recce Pharmaceuticals, Pursuit Minerals, Brightstar Resources, Many Peaks Minerals and Recharge Metals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.