Closing Bell: Energy stocks sink and goldies rally; white knight comes to save Star

A white knight came to save Star on Thursday. Picture via Getty Images

- ASX takes a hit as energy sector sinks

- Gold miners shine, Star entertainment gets a lifeline

- Spacetalk shifts gears with AI health tech partnership

The ASX had a rough Thursday, slipping by 0.57% with the energy sector, in particular, feeling the heat.

Energy stocks dragged as crude fell over 4% overnight, with US tariff uncertainty casting a huge shadow over energy demand.

And as if that wasn’t enough, OPEC+ said it wants to ramp up oil supply, which didn’t help the situation.

Oil stocks Santos (ASX:STO) and Ampol (ASX:ALD) slid almost 2% each, while Woodside Energy Group (ASX:WDS) dropped 5% after trading ex-dividend.

But there were also some bright spots, too. The gold sector saw a bit of a rally. With all the tariff fears floating around, investors turned to gold as a safe haven.

Gold miners such as South32 (ASX:S32) and Bellevue Gold (ASX:BGL) were well bid.

Meanwhile, just when it looked like Star Entertainment Group (ASX:SGR) was about to crash and burn, some Hong Kong investors swooped in to save the day.

Media reports including the AFR said that Chow Tai Fook Enterprises and Far East Consortium are about to provide Star with a short-term loan, enough to keep it afloat and avoid collapse for now.

As part of that deal, these investors are apparently going to take control of Star’s Brisbane casino.

Star has been struggling with a massive liquidity crunch caused by cost tight regulations that have driven high rollers away. The company has not officially announced this news to the ASX, and its shares are currently in suspension.

Elsewhere in the large caps space, packaging giant Amcor (ASX:AMC) dipped 1.3% after announcing plans to reorganise its business after its $13 billion merger with Berry, and it hinted at appointing a new CFO.

But the real shocker today came from Mesoblast (ASX:MSB). The biotech company, which had just joined the ASX 200, plummeted 7%. While the inclusion should’ve been positive news, investors seemed unimpressed, possibly because the stock had already been priced in for this move.

In December, Mesoblast’s cell therapy Ryconcil received FDA approval to treat steroid-refractory acute graft versus host disease (SR-aGvHD) in kids. This life-threatening condition, affecting those who undergo bone marrow transplants, had no previous treatment options.

And while the ASX was having a rough one, over in Hong Kong, Alibaba was doing the complete opposite.

Its stock price jumped 7% after it unveiled a new AI model called QwQ-32B, which apparently could perform just as well as DeepSeek, but with a fraction of the data.

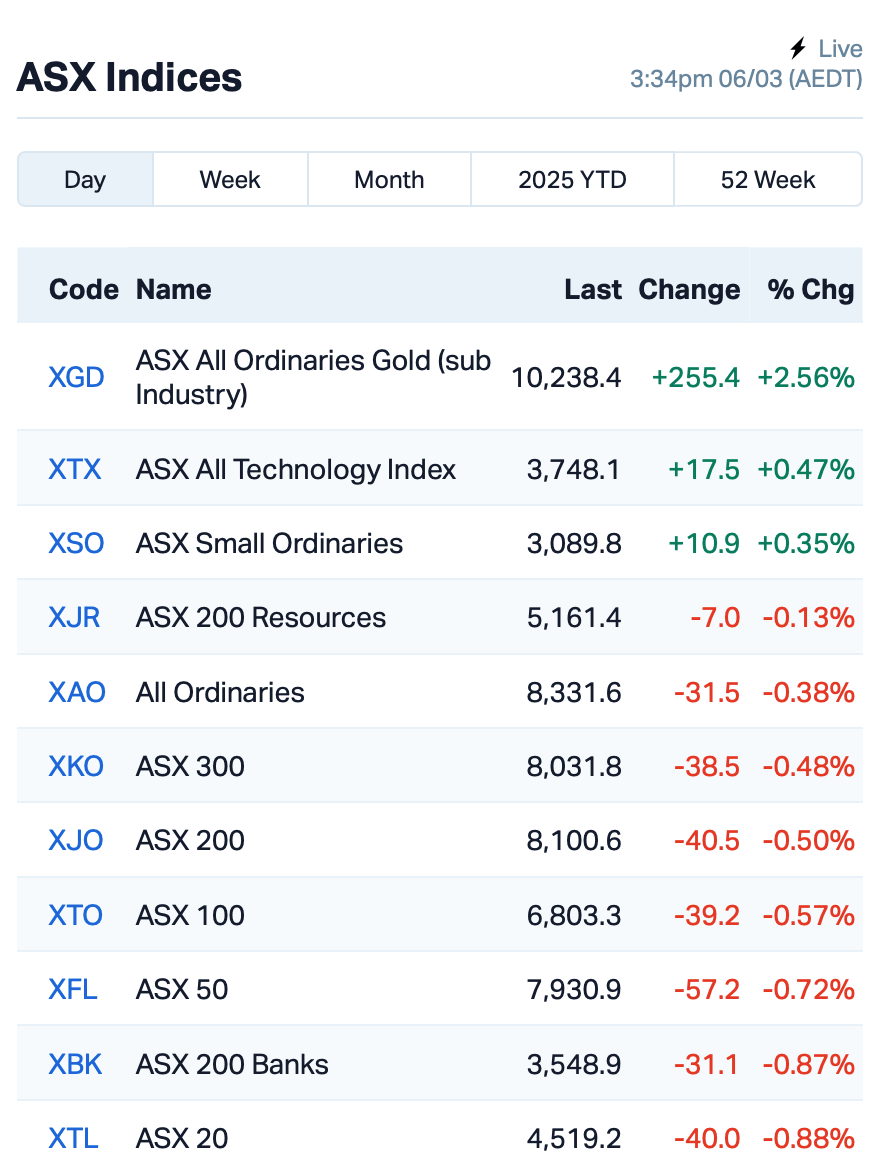

This is how the ASX stood leading up to today’s close:

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Code Description Last % Volume MktCap AMS Atomos 0.006 50% 98,399 $4,860,074 AXP AXP Energy Ltd 0.002 50% 3,426,180 $6,574,681 CR9 Corellares 0.003 50% 333,480 $935,487 VPR Voltgroupltd 0.002 50% 1,000,000 $10,716,208 CAG Caper Range 0.090 43% 6,500 $5,978,938 RTG RTG Mining Inc. 0.027 42% 35,302,492 $20,589,265 DDB Dynamic Group 0.280 40% 195,858 $28,632,356 M2R Miramar 0.004 33% 250,000 $1,369,040 MEL Metgasco Ltd 0.004 33% 37,999 $4,372,760 TG6 TG Metals 0.140 33% 572,581 $7,466,292 BLU Blue Energy Limited 0.009 29% 1,072,682 $12,956,815 AUG Augustus Minerals 0.041 24% 972,183 $3,933,317 GEN Genmin 0.037 23% 1,110,387 $26,588,583 HLX Helix Resources 0.003 20% 1,063,349 $8,410,484 LML Lincoln Minerals 0.006 20% 100,000 $10,281,298 RDN Raiden Resources Ltd 0.006 20% 961,885 $17,254,457 YAR Yari Minerals Ltd 0.006 20% 2,008,064 $2,411,789 SPA Spacetalk Ltd 0.290 18% 72,811 $15,625,208 FNR Far Northern Res 0.140 17% 3,270 $4,351,899 ENV Enova Mining Limited 0.007 17% 1,382,827 $7,383,862 NPM Newpeak Metals 0.014 17% 2,600 $3,864,861 RDS Redstone Resources 0.004 17% 5,070,000 $2,776,135 SMP Smartpay Holdings 0.600 17% 305,789 $124,600,884 DEL Delorean Corporation 0.145 16% 409,520 $27,534,769 TMS Tennant Minerals Ltd 0.015 15% 766,383 $12,426,575

RTG Mining (ASX:RTG) said Mt. Labo Development Corp has teamed up with global giant Glencore to finance Stage 1 of the high-grade Mabilo copper-gold project, securing up to US$30m in a three-part financing deal. The project will mine about 100,000 tonnes of copper-gold material.

RTG said it expects to receive about 50% of the total cash flow from Stage 1 of the project, based on current commodity prices. This includes the early repayment of around US$26m that Mt. Labo owes to RTG, a 2% royalty on the project’s gross revenue, and 40% of the net profits.

TG Metals (ASX:TG6) has snapped up 80% of the Van Uden gold project in WA for $2.5 million in cash and shares. The project has four mining leases and past production from two open pits, with plenty of room for growth by expanding the mineralisation down dip. TG Metals said it was eyeing near-term cash flow from stockpiles, and is close to processing plants for quick toll treatment. The deal will be funded from its cash reserves, with no shareholder approval needed.

Augustus Minerals (ASX:AUG) has extended high-grade gold mineralisation at its Music Well project near Leonora, WA. Recent rock chip samples from Clifton East and St Patrick’s Well showed impressive gold grades, including up to 50.3g/t. The gold trend now spans 700m at Clifton East and 300m at St Patrick’s Well, with further exploration underway. Augustus is planning more drilling and mapping to explore these targets.

And… Spacetalk (ASX:SPA) has teamed up with Neuroscience Research Australia (NeuRA) to license the Watch Walk AI. Spacetalk said the AI, created by a team of experts from the University of New South Wales and NeuRA, uses wearable device data to predict serious health risks such as dementia, strokes and heart attacks. The plan is to integrate Watch Walk AI into a new suite of Software-as-a-Service and Subscription App products aimed at consumers, insurers and care providers.

With these new tools, Spacetalk said it aims to turn its business around and shift from a kids’ wearables company to a high-growth, data-driven subscription software model.

This deal, the company said, could open up some massive growth opportunities, especially in the rapidly expanding senior care and wearable AI markets. If all goes well, Spacetalk plans to roll out this software in the 2026 financial year.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ADD | Adavale Resource Ltd | 0.002 | -33% | 56,426 | $6,819,838 |

| JAY | Jayride Group | 0.002 | -33% | 22,056,389 | $715,737 |

| OB1 | Orbminco Limited | 0.002 | -25% | 150,522 | $4,333,180 |

| VML | Vital Metals Limited | 0.002 | -25% | 706,108 | $11,790,134 |

| ASQ | Australian Silica | 0.022 | -21% | 73,593 | $7,892,091 |

| EVR | Ev Resources Ltd | 0.004 | -20% | 12,182,262 | $9,662,517 |

| NAE | New Age Exploration | 0.004 | -20% | 1,773,827 | $10,781,995 |

| TAS | Tasman Resources Ltd | 0.004 | -20% | 1,050,338 | $4,026,248 |

| TMX | Terrain Minerals | 0.004 | -20% | 997,010 | $10,017,783 |

| PFT | Pure Foods Tas Ltd | 0.029 | -17% | 696,879 | $4,739,897 |

| ACU | Acumentis Group Ltd | 0.079 | -17% | 650,301 | $21,038,229 |

| ARI | Arika Resources | 0.030 | -17% | 6,835,472 | $22,806,311 |

| BKT | Black Rock Mining | 0.025 | -17% | 1,009,064 | $37,561,458 |

| CTN | Catalina Resources | 0.003 | -17% | 49,086 | $3,948,786 |

| OSL | Oncosil Medical | 0.005 | -17% | 221,819 | $27,639,481 |

| IFG | Infocusgroup Hldltd | 0.016 | -16% | 9,351,887 | $3,539,159 |

| APC | APC Minerals | 0.013 | -16% | 1,820,718 | $1,804,466 |

| FG1 | Flynngold | 0.023 | -15% | 261,852 | $7,055,545 |

| ALY | Alchemy Resource Ltd | 0.006 | -14% | 155,011 | $8,246,534 |

| AVE | Avecho Biotech Ltd | 0.006 | -14% | 19,367,896 | $22,185,079 |

| MKL | Mighty Kingdom Ltd | 0.006 | -14% | 415,182 | $1,512,444 |

| RSH | Respiri Limited | 0.040 | -13% | 1,577,466 | $69,111,749 |

| EMT | Emetals Limited | 0.004 | -13% | 209,999 | $3,400,000 |

| GBZ | GBM Rsources Ltd | 0.007 | -13% | 32,555 | $9,368,560 |

IN CASE YOU MISSED IT

Mount Hope Mining (ASX:MHM) is kicking off a ground gravity survey at its namesake project in New South Wales’ prolific Cobar region. The company sees this as a key step in its exploration plans, especially since similar surveys have helped uncover major discoveries in the area.

TG Metals (ASX:TG6) has acquired 80% of the Van Uden gold project in WA, near its Lake Johnston lithium project, securing a near-term cash flow opportunity through toll treating existing stockpiles. The company also plans to update the project’s 2013 resource estimate and explore its upside potential.

OzAurum Resources (ASX:OZM) has begun a 20-hole, 1500m RC drilling program at the New Cross Fault gold discovery, part of its Mulgabbie North project in WA. The program aims to follow up on high-grade gold hits from recent aircore drilling, with assay results expected in the coming weeks.

New Age Exploration (ASX:NAE) has secured $1.6 million through a well-supported share placement to fast-track drilling at its Wagyu gold project in WA’s Central Pilbara. The funds will support a 3000m RC drilling program, testing gold targets at depth and along strike, with further aircore drilling planned for Q2.

At Stockhead, we tell it like it is. While Mount Hope Mining, TG Metals, OzAurum Resources and New Age Exploration are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.