Closing Bell: Energy, Real Estate stocks claw back up as dip-buyers lift ASX

Aussie shares rebounded further today, with all sectors ending higher. Picture Getty

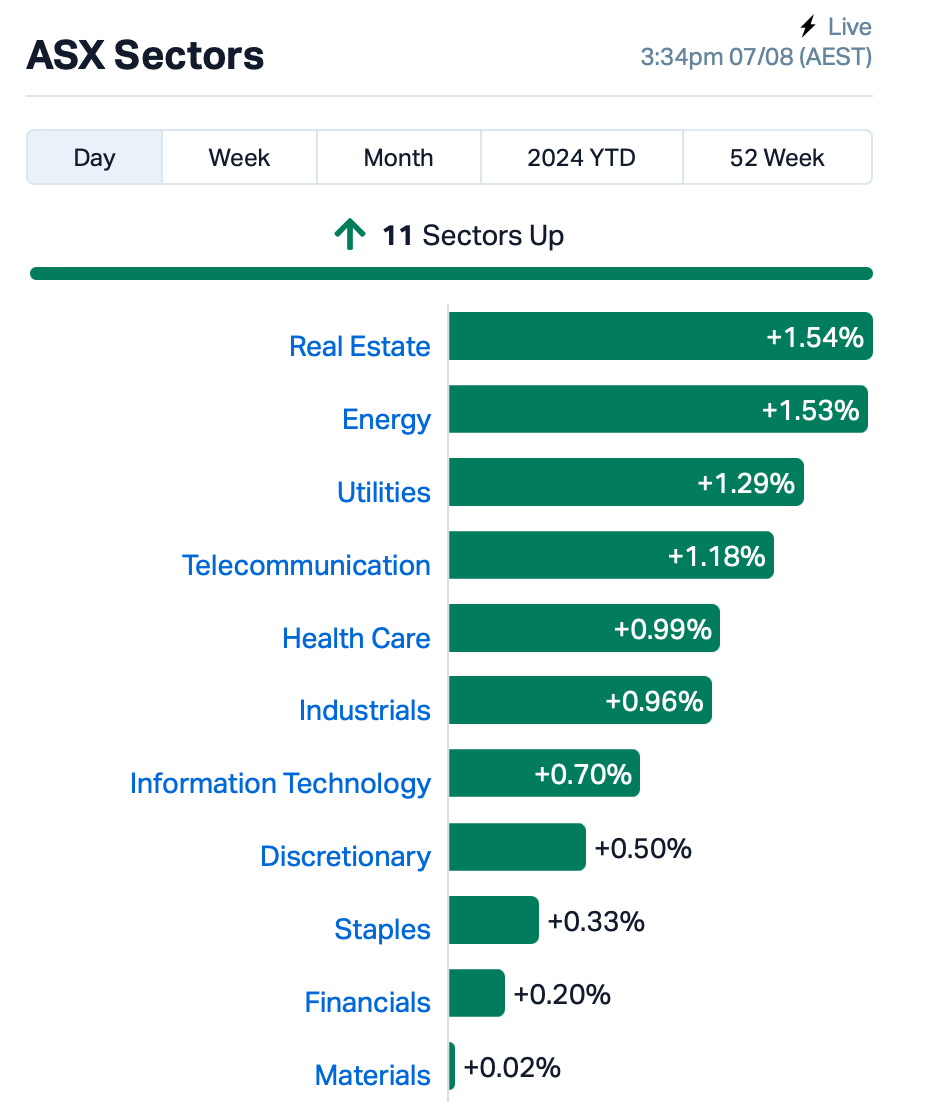

- Aussie shares rebounded further today, with all sectors ending higher

- Energy sector’s Woodside Energy and ERA saw good recoveries

- ABS report revealed that living costs rose faster in June quarter

Aussie shares swung back to gains after opening lower on Wednesday, thanks to improved sentiment across Asia following a global market slump in earlier sessions.

At the close of day, the ASX 200 index was 0.6% higher.

All 11 sectors ended in positive territory following a calmer night on Wall Street, and as local investors adjusted to the RBA’s decision on Tuesday to keep the cash rate at a 12-year high.

Mining stocks however had a volatile session but managed to recover early losses as iron ore prices ticked up in Singapore.

Pilbara Minerals (ASX:PLS) led the big end of town, up over 5%, followed by fellow lithium miner Mineral Resources (ASX:MIN), which lifted 3%.

Stocks sensitive to interest rates pared losses, with the Real Estate sector turning positive after heavyweight Goodman Group (ASX:GMG) climbed almost 1%.

The major banks also rebounded, and the Energy sector, which was the worst performer yesterday, made a lot of ground back.

Woodside (ASX:WDS)’s shares recovered 2% after dropping 5% yesterday. This drop followed Woodside’s announcement that it will buy OCI Global’s clean ammonia project in Texas for $2.35 billion.

Energy Resources of Australia (ASX:ERA) jumped 7% after revealing that it was suing the Australian Government over a decision not to renew the Jabiluka mineral lease, which expires on Sunday.

ERA has also requested a court order to stop the decision from taking effect. Rio Tinto (ASX:RIO) owns 86.33% of ERA, and RIO’s shares were up slightly today.

Meanwhile, the ABS released a report containing select cost of living indices for the June quarter earlier today.

The report reveals that for the first time since December 2010, living costs for all Australian households have risen faster than inflation.

In the quarter, living costs went up by 1.2% to 1.4%, while the Consumer Price Index (CPI) rose by only 1%. Major drivers of these increased costs included insurance, housing, food, and drink.

Pensioners and those on government support also faced cost increases above the general inflation rate.

What happened elsewhere?

Stock markets in Asia also had a relatively good day.

The Nikkei 225 gained another 2% after Bank of Japan’s deputy governor said the BoJ won’t raise interest rates if markets continue to be unstable.

This news eased investors’ worries after the recent spike in the Yen’s value.

Chinese shares also edged up slightly after four days of losses, as mixed trade data was released.

Looking ahead to Wall Street’s session tonight, companies listed to report earnings include: Novo Nordisk, Shopify, Walt Disney and Warner Bros.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| TSL | Titanium Sands Ltd | 0.005 | 67% | 31,970 | $6,635,242 |

| ME1 | Melodiol Glb Health | 0.002 | 50% | 1,062,187 | $789,420 |

| HVY | Heavymineralslimited | 0.145 | 49% | 668,623 | $6,107,701 |

| PIL | Peppermint Inv Ltd | 0.011 | 38% | 26,783,015 | $16,970,867 |

| LNR | Lanthanein Resources | 0.004 | 33% | 1,031,887 | $7,330,908 |

| OVT | Ovanti Limited | 0.004 | 33% | 2,707,341 | $4,567,816 |

| RIE | Riedel Resources Ltd | 0.002 | 33% | 100,000 | $3,335,753 |

| HTM | High-Tech Metals Ltd | 0.160 | 33% | 36,274 | $2,970,179 |

| RRR | Revolverresources | 0.064 | 31% | 240,888 | $12,721,589 |

| ICL | Iceni Gold | 0.055 | 28% | 217,927 | $11,728,725 |

| GRL | Godolphin Resources | 0.014 | 27% | 74,289 | $2,352,803 |

| CND | Condor Energy Ltd | 0.029 | 26% | 261,226 | $13,294,008 |

| ODE | Odessa Minerals Ltd | 0.003 | 25% | 343,803 | $2,086,565 |

| RLG | Roolife Group Ltd | 0.005 | 25% | 979,222 | $3,176,585 |

| CYP | Cynata Therapeutics | 0.235 | 21% | 202,888 | $35,207,498 |

| IVX | Invion Ltd | 0.003 | 20% | 4,426,612 | $16,511,331 |

| BMT | Beamtree Holdings | 0.280 | 19% | 1,892,786 | $67,924,094 |

| NHE | Nobleheliumlimited | 0.058 | 18% | 326,022 | $23,261,781 |

| WRK | Wrkr Ltd | 0.033 | 18% | 99,334 | $35,604,493 |

| PGM | Platina Resources | 0.027 | 17% | 285,497 | $14,333,148 |

| KM1 | Kalimetalslimited | 0.175 | 17% | 384,305 | $11,524,144 |

| AAU | Antilles Gold Ltd | 0.004 | 17% | 314,895 | $4,384,283 |

| BXN | Bioxyne Ltd | 0.007 | 17% | 4,000,162 | $12,279,872 |

LBT Innovation (ASX:LBT) was one of the best performers today. LBT says AstraZeneca purchased 5 APAS Independence instruments with the total contract valued between USD 2.2 million and 2.7 million, depending on the level of maintenance and support services chosen. In addition to the equipment, AstraZeneca will receive annual maintenance and support for the next seven years. There is also potential for additional orders from AstraZeneca in the future. APAS Independence is an advanced microbiology automation system designed to streamline the process of analysing culture plates used in laboratories.

Arrow Minerals (ASX:AMD) gained on Wednesday after releasing an exploration target estimate for its Niagara Bauxite Project, which the company says has come in at approximately 170 – 340Mt at a grade range of approximately 40-46% Al2O3, and 1-4% SiO2, which the company has reminded investors is a “conceptual” figure, not an official mineral resource estimate.

Centaurus was gaining nicely after delivering a presentation at the Diggers and Dealers conference in Kalgoorlie, which no doubt focussed heavily on its recent news of a major increase in its Mineral Resource Estimate for the Jaguar Nickel Project in Brazil, which puts the project on a whopping 138.2Mt @ 0.87% Ni for 1.20 million tonnes of contained nickel, which Centaurus says “cements its place as a Tier-1 project”.

Manhattan Corp (ASX:MHC) was up early after revealing that the entitlement offer announced by the company on Tuesday, 30 July 2024 is now open. The company is looking to raise up to $1.5 million, through a 1 for 2 non-renounceable pro-rata entitlement offer of 1,468,490,084 new Shares on a pre-Consolidation basis, at an issue price of $0.001 per New Share.

HighCom (ASX:HCL) was back in the winner’s circle on Wednesday, after providing fresh guidance for its FY24 results, revealing that revenue has come in at the lower end ($46 million) of the estimate given to the market in May. The company says that a delay in finalising a recent contract has pushed that revenue out to FY25, and that the company has seen an improvement in cash holdings from $1.6 million to $6.2 million, with new orders of ballistic products for US domestic and international customers valued at $13.7 million to be delivered soon.

First lithium carbonate from Arizona Lithium (ASX:AZL)’s pilot plant at its Prairie project in Canada has been produced using direct lithium extraction (DLE) tech and the first commercial production well at Pad #1 has been drilled. The milestones are sending the lithium-brine developer well on its way to becoming a fully-fledged producer, especially because Pad #1 has recveived a conditional $21.6m investment incentive by the Saskatchewan government. Full production is set to begin at the 6.3Mt LCE Prairie next year, pumping out battery-grade lithium carbonate. For now, the pilot plant material is being put up in the shop window for potential project partners to test.

Iceni Gold (ASX:ICL) was up on no news. The stock has been relatively quiet since a massive 300% gain on the back of its Christmas Gift gold discovery at 14 Mile Well in May. The junior exposed multiple “spectacular” gold-bearing quartz veins across a 20km-long strike length and produced a 9.5oz gold doré bar from a sample trench that had ridiculous grades in rock chips of up to 18,207g/t. Interestingly, the prospect is about 750m south of the historical Castlemaine mine, which produced 5.6Moz. A six-hole diamond drill program was completed in July to evaluate the gold-laden structure, with assays still pending.

Helix Resources (ASX:HLX) was also up on no news. But something’s a-rumblin’ around gold minnow HLX, which, last heard, has found prospective “Tritton-style copper-gold” at the Collerina copper trend, part of its Eastern Group Tenements near Nyngan in NSW.It’s got a whopping chunk of land that covers 1570km2 directly south and along strike of Aeris Resources’ (ASX:AIS) Tritton processing facility and several operating copper-gold mines. Some 600 augur sample assays confirmed both copper and gold mineralisation and the explorer said it was continuing infill and extension augur sampling, AC drilling and detailed assessment of the anomaly to delineate future targets.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| TEG | Triangle Energy Ltd | 0.007 | -50% | 108,686,163 | $29,121,876 |

| OVT | Ovanti Limited | 0.003 | -25% | 233,607 | $4,960,422 |

| TIG | Tigers Realm Coal | 0.003 | -25% | 203,467 | $52,266,809 |

| SGQ | St George Min Ltd | 0.031 | -24% | 27,534,356 | $40,530,158 |

| EVR | Ev Resources Ltd | 0.004 | -20% | 30,000 | $6,981,357 |

| SKN | Skin Elements Ltd | 0.004 | -20% | 300,052 | $2,947,430 |

| RWL | Rubicon Water | 0.260 | -19% | 565,057 | $55,228,511 |

| CAZ | Cazaly Resources | 0.018 | -18% | 4,309,180 | $10,148,666 |

| BNL | Blue Star Helium Ltd | 0.005 | -17% | 547,687 | $11,669,312 |

| ECT | Env Clean Tech Ltd. | 0.003 | -17% | 17,135 | $9,515,431 |

| EEL | Enrg Elements Ltd | 0.003 | -17% | 1,015,000 | $3,029,895 |

| DAF | Discovery Alaska Ltd | 0.011 | -15% | 61,202 | $3,045,051 |

| MKR | Manuka Resources. | 0.028 | -15% | 1,643,734 | $25,732,333 |

| CHM | Chimeric Therapeutic | 0.017 | -15% | 408,666 | $17,735,400 |

| IXU | Ixup Limited | 0.023 | -15% | 650,019 | $41,789,320 |

| ALY | Alchemy Resource Ltd | 0.006 | -14% | 1,351,001 | $8,246,534 |

| BMO | Bastion Minerals | 0.006 | -14% | 198,176 | $3,045,587 |

| EPM | Eclipse Metals | 0.006 | -14% | 180,000 | $15,755,989 |

| FIN | FIN Resources Ltd | 0.006 | -14% | 269,485 | $4,544,881 |

| PAB | Patrys Limited | 0.006 | -14% | 1,998,888 | $14,402,131 |

| SRN | Surefire Rescs NL | 0.006 | -14% | 317,000 | $13,904,155 |

| NYR | Nyrada Inc. | 0.037 | -14% | 1,206,254 | $7,834,974 |

| PLN | Pioneer Lithium | 0.155 | -14% | 8,247 | $5,148,000 |

| PTR | Petratherm Ltd | 0.019 | -14% | 732,508 | $4,979,037 |

IN CASE YOU MISSED IT

Altech Batteries (ASX:ATC) is raising up to $8.5m through a partially underwritten entitlement offer and a further $405,000 through a placement of shares priced at 4c each.The placement of 10.125 million shares will be made to sophisticated and professional investors while the entitlement offer of one share for every eight shares held will be partially underwritten to the tune of $5m by major shareholder MAA Group Berhard. Participants in both the placement and entitlement offer will also receive one free attaching offer exercisable at 6c and expiring on 31 December 2025 for every two shares subscribed for. Proceeds will be used to progress the company’s Cerenergy solid state sodium chloride battery and Silumina Anodes projects.

Brazilian Critical Minerals (ASX:BCM) has proven that it can produce a valuable mixed rare earth carbonate (MREC) with very low impurities using material from its Ema REE project in Brazil. This was achieved using low-capex industry standard leaching methods.

The company’s successful column testing also offers potential for low-capex heap leaching at the Ema project with fewer steps and lower risks.

Magnetic Resources (ASX:MAU) has updated economics for its Lady Julie gold project in WA which demonstrated that it is both technically and financially robust. Standouts include payback of 12 months, AISC of A$1,386/oz and NPV $925m.

Mt Malcolm Mines (ASX:M2M) has reported excellent gold recovery results of 94.6% and gold content in tailings ranging between 1-3.5g/t gold at its Golden Crown prospect in WA. A bulk sampling program is now underway.

Maronan Metals (ASX:MMA) has hit a bonanza 1520g/t silver intercept at the Maronan project in QLD, during an infill campaign targeting the upper part of the Starter Zone.

Arizona Lithium (ASX:AZL) has produced battery-grade lithium carbonate from the direct lithium extraction eluent of the ILiad pilot that operated at the Prairie project from November 2023 – February 2024.

TRADING HALTS

Neuren Pharmaceuticals (ASX:NEU) – pending an analysis of data and an announcement in relation to the top line results of its Phase 2 clinical trial of NNZ-2591 in Angelman syndrome.

Finder Energy Holdings (ASX:FDR) – pending announcements in relation to a material acquisition and a rights entitlement offer to shareholders.

ActivePort Group (ASX:ATV) – pending an announcement regarding a proposed capital raising.

At Stockhead, we tell it like it is. While Altech Batteries, Brazilian Critical Minerals, Magnetic Resources, Mt Malcolm Mines and Maronan Metals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.