Closing Bell: Energy and tech stocks turn bullish as US backs down from tariff war

The bulls are on a run after the US and China slashed tariffs, driving Energy and Tech sectors up more than 3% each. Pic: Getty Images

- US and China have slashed tariffs by 115pc

- Energy and Tech sectors soar 3pc

- ASX sets new 50-day high, up 0.43pc

Anyone betting on a backdown from the US in the US-China trade war is sitting pretty today.

The US has cut its 145% tariff on all Chinese goods to 30%, while China pared back its 125% tariff to just 10%.

Although the numbers may appear to favour the US, it’s important to remember it was the US that started this fight, ostensibly over an “unfair” trade deficit and the flow of illicit drugs from China into the country.

Neither of those things have really been addressed in this ceasefire, which has met China’s core demands – a suspension of the high tariffs imposed by Trump’s administration and a formal negotiation channel with US Treasury Secretary Scott Bessent.

China has indeed promised to take aggressive action on fentanyl supply chains, but no concrete terms have been agreed upon in that regard.

Trump took an unusually reconciliatory tone. “We’re not looking to hurt China,” he said on Monday night.

“They were closing up factories. They were very happy to do something with us.”

As the dust settles, Trump’s tariffs appear to have achieved very little overall.

Instead, the US Fed is warning the threat of stagflation is looming higher than ever before, and both bond and securities markets took huge blows that they’re only just now recovering from.

“China’s tactic of fighting firmly and waiting patiently worked; it forced the US to change its mind,” Shanghai-based Fudan University director of the Centre for American Studies Professor Wu Xinbo said.

“If China had surrendered in the beginning, then Trump would say his tariff tactic works, and he would continue to play that trick.

“Now he has realised the limits of the tariff leverage.”

The trade war is certainly not over, but this ceasefire promises us at least three months to figure out the next step.

Energy and Info Tech do the heavy lifting

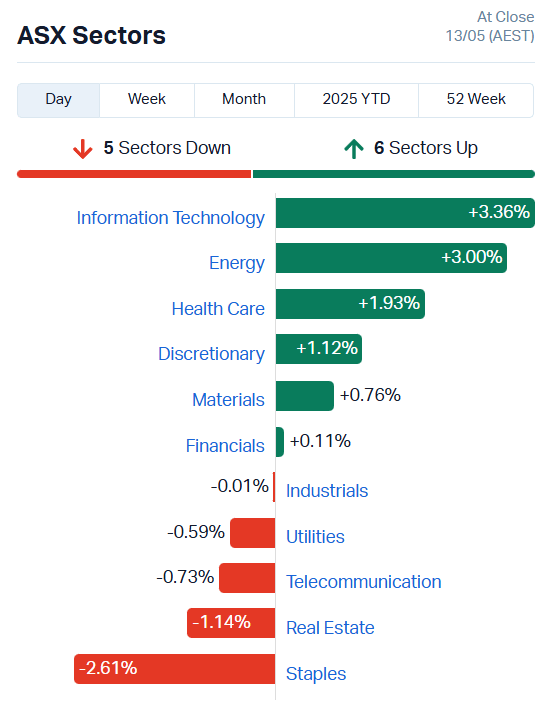

Rising oil prices and renewed optimism in international markets have given energy and tech stocks wings, with the respective sectors soaring about 3% each.

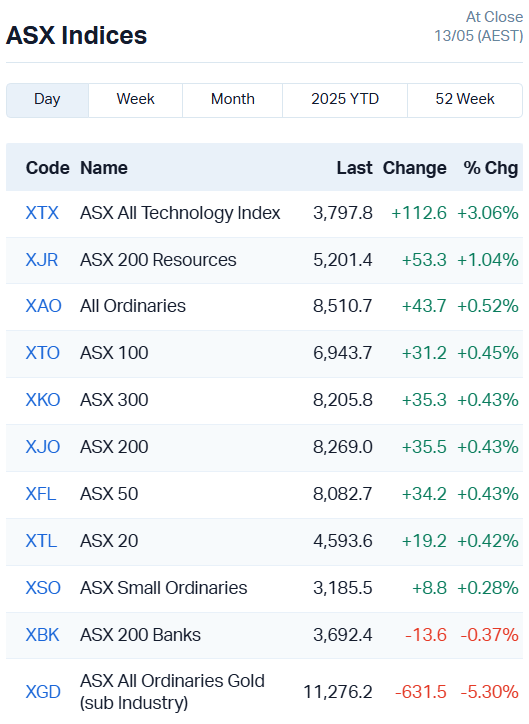

The ASX hasn’t been quite as enthusiastic as its US counterparts over the thaw in US-Chinese relations, gaining just 0.43% in trade today.

Of course, the Aussie market didn’t take as much damage from the tariffs as US markets either.

Trump began imposing tariffs early in February, but didn’t let them rip until April.

The S&P500 fell from 6111.4 points on February 1st to 4956.25 points by April 7, a whopping 18.9% drop.

In comparison, the ASX was sitting at 8532 points on January 31st (our nearest trading day) and bottomed out at 7343 points on April 7, a still eye-watering 13.9% fall, but not quite as dire.

Today, the ASX recovered to its February 27 level, while the S&P500 has returned to levels last seen on March 4.

While our recoveries aren’t quite as flashy as the US’s surging bull runs, the Aussie bourse is performing better than it first appears.

Much of that strength has come from our resilient energy sector. While oil and gas companies dominate our big caps, our healthy mix of uranium, helium, hydrogen and renewables kept our energy sector afloat as oil prices dropped off steeply.

Even with oil making a recovery, uranium and alternate energy companies are making gains within the sector today.

Blue Star Helium (ASX:BNL) has jumped 16.67%, Provaris Energy (ASX:PV1) 15%, and Lotus Resources (ASX:LOT) climbed 2.78%.

There was also plenty of movement in Info Tech. The ASX All Tech index shot up more than 3%, with the biggest movers being the usual suspects.

Xero (ASX:XRO) posted a 1.71% gain, WiseTech (ASX:WTC) 4.91%, Macquarie Technology (ASX:MAQ) 3.17% and Life360 Inc (ASX:360) surged 13.96% after netting a big subscriber increase in the previous quarter.

Now, let’s see who’s making the most of the bull run, and who’s missed the boat today.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| JAV | Javelin Minerals Ltd | 0.003 | 50% | 4329851 | $12,092,298 |

| RMI | Resource Mining Corp | 0.006 | 50% | 13124354 | $2,661,623 |

| SNX | Sierra Nevada Gold | 0.027 | 35% | 1884394 | $3,293,182 |

| GGE | Grand Gulf Energy | 0.004 | 33% | 38359065 | $8,401,161 |

| SRK | Strike Resources | 0.045 | 32% | 1103675 | $9,647,500 |

| HCF | Hghighconviction | 0.026 | 30% | 248146 | $388,130 |

| BCC | Beam Communications | 0.13 | 30% | 261267 | $8,642,192 |

| GSM | Golden State Mining | 0.009 | 29% | 45162 | $1,955,594 |

| RCL | Readcloud | 0.135 | 29% | 384725 | $16,022,932 |

| TASDA | Tasman Resources Ltd | 0.023 | 28% | 656486 | $2,898,899 |

| ADY | Admiralty Resources. | 0.005 | 25% | 401053 | $10,517,918 |

| AMS | Atomos | 0.005 | 25% | 730294 | $4,860,074 |

| RDS | Redstone Resources | 0.005 | 25% | 640211 | $3,701,514 |

| CDR | Codrus Minerals Ltd | 0.041 | 24% | 787771 | $5,457,788 |

| HPC | Thehydration | 0.011 | 22% | 292714 | $3,449,708 |

| PHO | Phosco Ltd | 0.08 | 21% | 825192 | $28,929,216 |

| ORP | Orpheus Uranium Ltd | 0.036 | 20% | 53468 | $8,458,114 |

| IFG | Infocusgroup Hldltd | 0.006 | 20% | 1031552 | $1,312,134 |

| WWG | Wisewaygroupltd | 0.165 | 18% | 92326 | $23,429,447 |

| 1AE | Auroraenergymetals | 0.062 | 17% | 306725 | $9,490,378 |

| JLL | Jindalee Lithium Ltd | 0.42 | 17% | 118938 | $27,583,676 |

| RNT | Rent.Com.Au Limited | 0.021 | 17% | 941895 | $15,352,930 |

| BKT | Black Rock Mining | 0.028 | 17% | 8139252 | $35,266,557 |

| BNL | Blue Star Helium Ltd | 0.007 | 17% | 2779621 | $16,169,312 |

| MGU | Magnum Mining & Exp | 0.007 | 17% | 1667776 | $6,729,905 |

Making news…

While gold prices are falling from all-time highs, the metal certainly hasn’t lost its shine. Sierra Nevada Gold (ASX:SNX) has claimed the New Pass Gold Mine in Nevada, US. The company will look to restart gold production at the historical mine, which produced at least 40,000 ounces of gold at an average grade of 17 g/t until 2012.

Resource Mining Corp (ASX:RMI) is also enjoying gold-borne success at the Mpanda copper-gold project in Tanzania, with soil and auger sample analysis underway. The company is chasing up some tasty rock chip samples, which graded up to 36.6 g/t gold and 11.89% copper.

Grand Gulf Energy (ASX:GGE) has struck a deal with Sage Potash to team up on exploring the Red Helium project in Utah. The two signed a non-binding MoU to share the costs of a 3D seismic survey targeting helium and potash. The partnership is set to speed up development at the Red Helium site, where Grand Gulf’s Jesse-1A well has already shown promising helium reserves.

Beam Communications (ASX:BCC) is set to pocket an extra $4.1 million from its settlement with Roadpost, separate from the sale of its 50% stake in Zoleo Inc. The payout includes $3.9 million for early royalty payments and $238k for selling remaining ZOLEO devices. Beam has been in a joint venture with Roadpost for Zoleo Inc, a company known for its satellite communication devices.

ASX SMALL CAP LAGGARDS

Today’s worse performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| EDE | Eden Inv Ltd | 0.001 | -50% | 1017042 | $8,219,762 |

| CZN | Corazon Ltd | 0.002 | -33% | 992435 | $3,553,717 |

| EEL | Enrg Elements Ltd | 0.001 | -33% | 5982796 | $4,880,668 |

| TMX | Terrain Minerals | 0.002 | -33% | 509664 | $6,745,670 |

| VML | Vital Metals Limited | 0.002 | -33% | 1176136 | $17,685,201 |

| LKY | Locksleyresources | 0.032 | -22% | 8340430 | $6,013,333 |

| RBX | Resource B | 0.029 | -22% | 459309 | $4,261,826 |

| FBR | FBR Ltd | 0.0055 | -21% | 16715454 | $39,826,165 |

| XPN | Xpon Technologies | 0.012 | -20% | 3575143 | $6,213,798 |

| CAV | Carnavale Resources | 0.004 | -20% | 679728 | $20,451,092 |

| ERL | Empire Resources | 0.004 | -20% | 3797436 | $7,419,566 |

| SHP | South Harz Potash | 0.004 | -20% | 3507546 | $5,412,894 |

| TFL | Tasfoods Ltd | 0.004 | -20% | 1049999 | $2,185,478 |

| FBM | Future Battery | 0.018 | -18% | 150214 | $14,713,730 |

| WEC | White Energy Company | 0.028 | -18% | 17741 | $10,595,077 |

| PEB | Pacific Edge | 0.076 | -17% | 37016 | $74,696,270 |

| WYX | Western Yilgarn NL | 0.03 | -17% | 258587 | $4,952,199 |

| EAT | Entertainment | 0.005 | -17% | 156419 | $7,852,716 |

| MEM | Memphasys Ltd | 0.005 | -17% | 26182 | $11,901,589 |

| SHE | Stonehorse Energy Lt | 0.005 | -17% | 72500 | $4,106,610 |

| CMG | Criticalmineralgrp | 0.11 | -15% | 101726 | $9,364,861 |

| NWM | Norwest Minerals | 0.011 | -15% | 1279693 | $6,306,554 |

| MIO | Macarthur Minerals | 0.017 | -15% | 140414 | $3,993,310 |

| CCM | Cadoux Limited | 0.0385 | -14% | 1628794 | $16,691,292 |

| BMR | Ballymore Resources | 0.15 | -14% | 322890 | $30,927,852 |

IN CASE YOU MISSED IT

DY6 Metals (ASX:DY6) has netted just over $261,000 in a research and development tax rebate from the ATO. DY6 now has about $1.95m in the bank, which will drive exploration at its Machinga heavy rare earth and Tundulu rare earth and phosphate projects.

Impact Minerals (ASX:IPT) raised another $881,000 under a shortfall offer for a recent renounceable rights issue, and received a final payment of $350,000 from the sale of its subsidiary Blackridge Exploration Pty Ltd, which holds the Blackridge project in Queensland. Impact recently acquired a 50% stake in Alluminous, owner of HiPurA, with assets and intellectual property IPT considers a bolt-on opportunity for its Lake Hope high purity alumina project.

Legacy Minerals (ASX:LGM) has applied for an exploration licence over one of Australia’s largest nickel deposits. Check out StockTake for more.

Trading Halts

Elixinol Global (ASX:EXL) – cap raise

Lanthanein Resources (ASX:LNR) – drilling results at Lady Grey Project, WA

Marquee Resources (ASX:MQR) – cap raise

RareX (ASX:REE) – cap raise

Sunstone Metals (ASX:STM) – inadvertent non-lodgement of a cleansing notice

Trinex Minerals (ASX:TX3) – cap raise

At Stockhead, we tell it like it is. While DY6 Metals, Impact Minerals and Legacy Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.