Closing Bell: Despite arvo fightback ASX200 loses again, ending an awful week barely +0.25pc ahead for 2023

Via Getty

- Benchmark recovers morning collapse to close just -0.13% lower, down 1.8% for the week

- Industrial and Energy Sectors led a 7-hour fightback

- Small caps led by Symbio following new Superloop offer

After local markets crashed at the open on Friday morning, following Wall Street’s very forgettable worst single session since about March, the plucky ASX200 has spent the next 7 hours incrementally picking itself off the canvas.

It nearly made it too. The ASX200 (XJO) gained about 1.4% between 11am and 4pm on Friday, still ending slightly lower at -0.12%. That leaves the benchmark 1.8% lower for the week and just 0.25% higher, year-to-date.

The ASX Small Ords (XSO) and the ASX Emerging Companies (XEC) ended Friday down 0.1% and 0.05% on Friday, leaving them down 1.5% and 2.4% for the week, respectively.

And it was a bad week for equity markets in general, but why the “higher for longer” interest rate anxieties should end up crippling businesses down this way is a curious conundrum.

The Fed (and some other central banks) managed to push bond yields higher – local bond yields clocked 10-year highs, which also set the teeth of US stocks chattering, back toward the lows (and there were some) of August, now creating a steady downtrend from July.

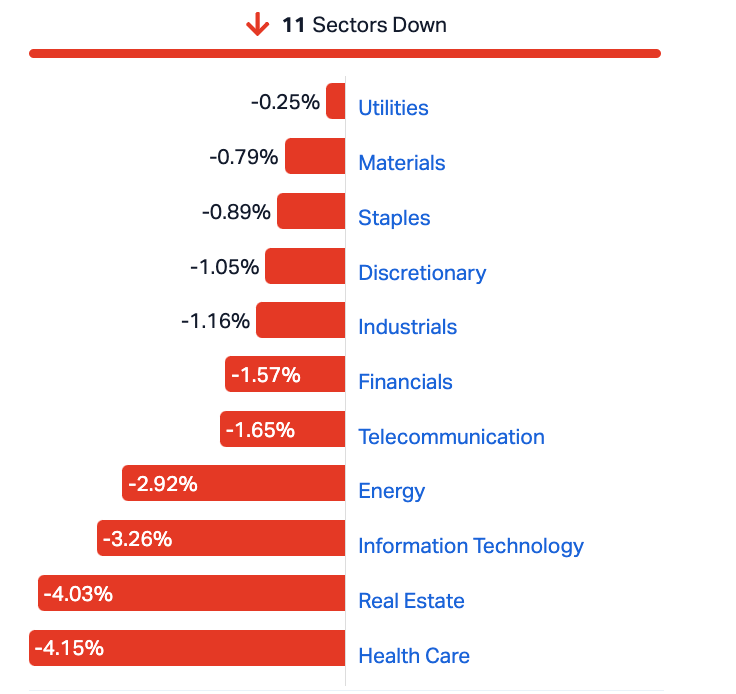

Be that as it may, local shares have not enjoyed this week one little bit. Local markets have fallen by well over 3.something% this week. The guilty sectors are, in order: IT, resources, energy, health and real estate.

Back to this morning’s doubtful action, however.

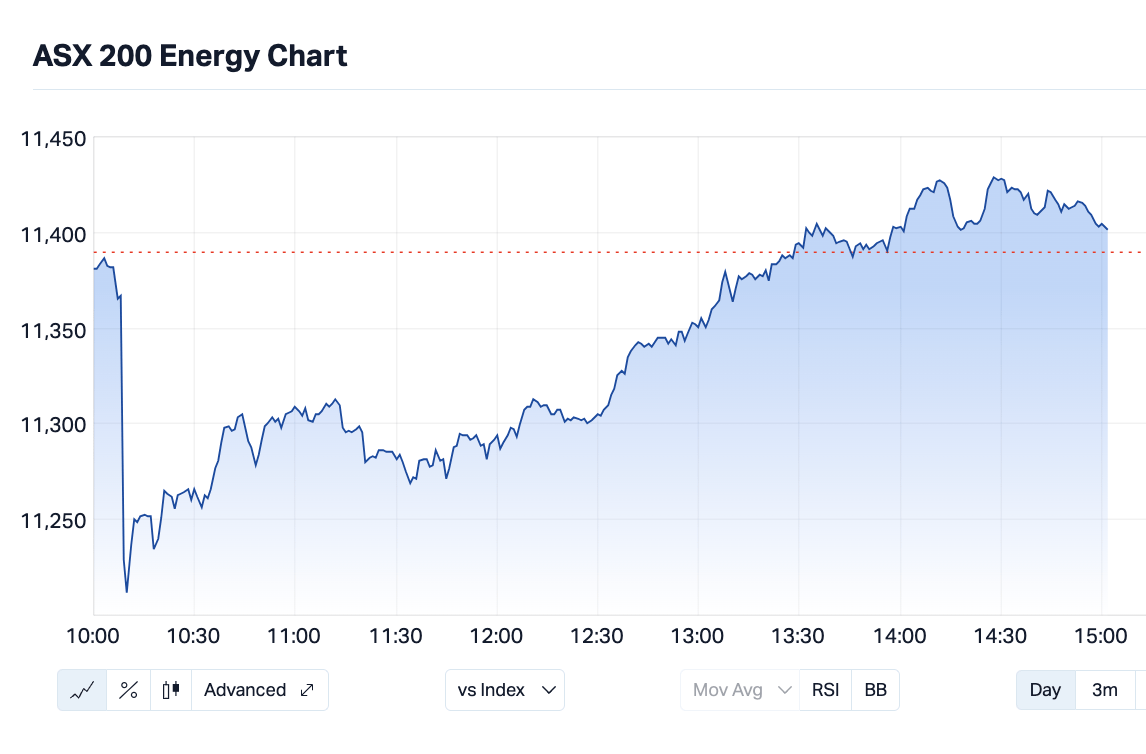

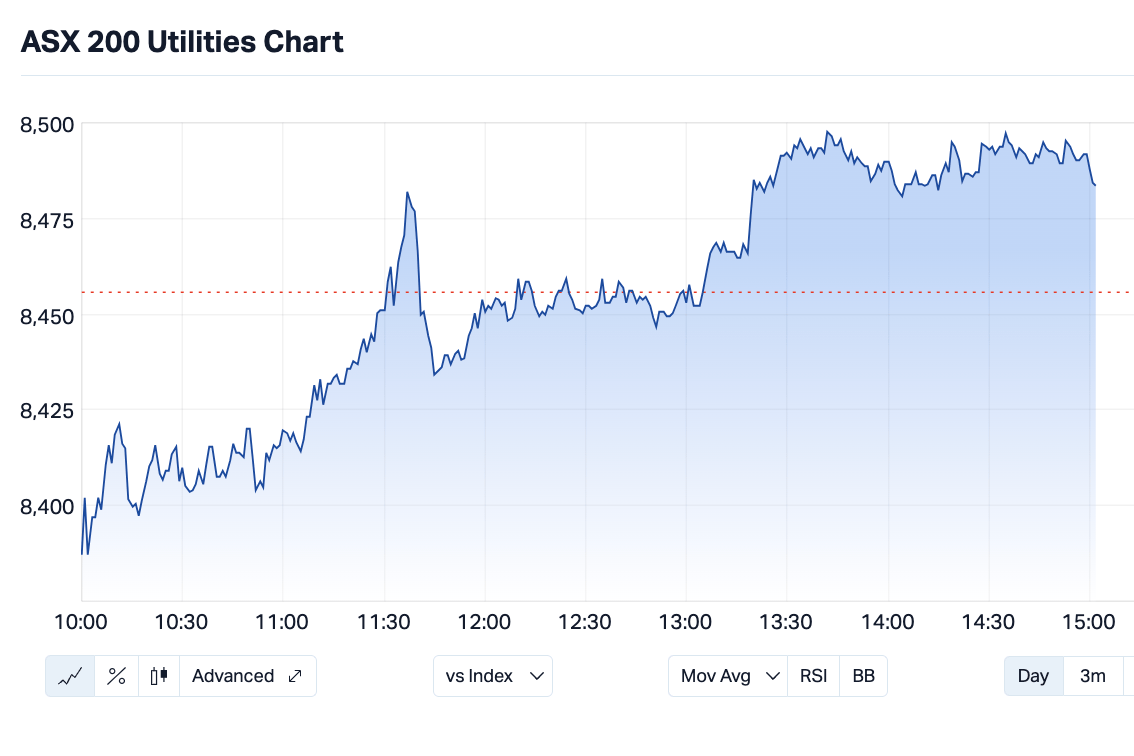

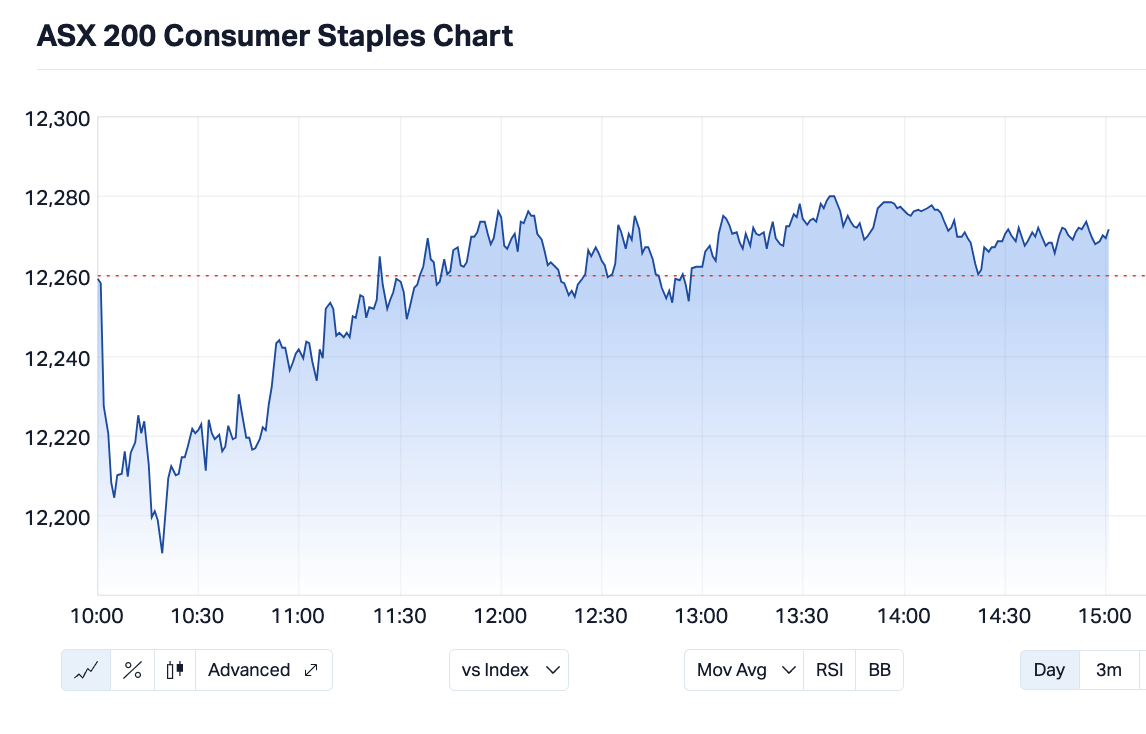

The Utilities, Consumer Staples and Energy Sectors have done most of the paddling, climbing into the green just after lunch, as I am about to illustrate with math!

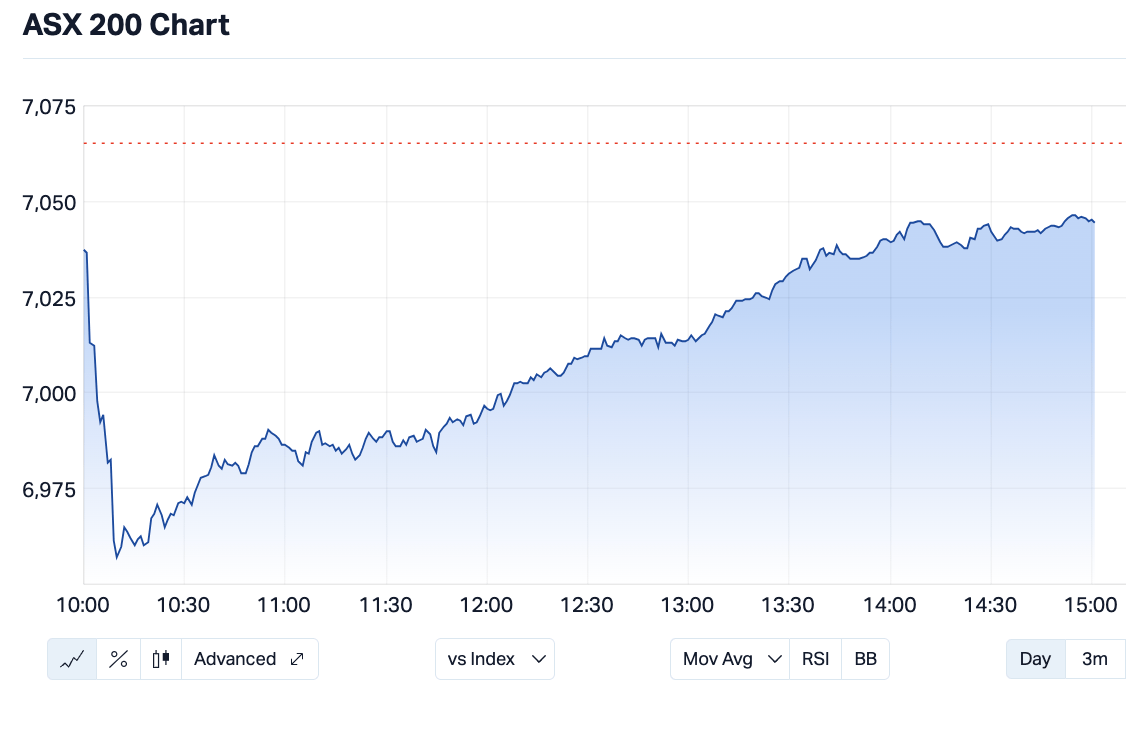

Here’s the ASX200 (XJO) on its brave little journey this Friday session:

In morning trade one can literally see the benchmark fall out of its seat in to the depths of a two-month low, caught up in the renewed Wall Street fears that US interest rates would indeed, as The Fed’s been warning, stay higher for longer.

By lunch however, the ASX200 had regained the half of those losses and was only down about 70 points – as good as 1% and still lifting.

That’s because of these three:

Both industrial and energy stocks firmed as the price of oil continued to inflate itself on fears that Russia’s ban on fuel exports could pressure global supply.

To be frank, it didn’t take much to tip Australian shares off of a 1.6% Friday morning abyss.

The Tech stocks have again been the most willing to give up their treasure, as the entire IT Sector dropped sharply after falls on the Nasdaq Composite, and has stayed down, as did the tech heavy index in the US, where rates obsessed American investors had a mini pity party because of the US Federal Reserve’s hawkish commentary after holding rates again this week.

Why Fed speakers would come out sounding all jolly – potentially unwinding all the cruel and hard work they’ve done over the last 13 months or so is beyond me, but apparently also beyond Wall Street.

Here’s our ASX Sectors for the week:

FROM THE HEADLINES

Bigger in Japan

Core consumer prices in Japan lifted 3.1% in August from a year earlier, remaining well above the Bank of Japan’s (BOJ) 2% inflation target for a 17th straight month, while Japan’s annual inflation rate edged down to 3.2% in August, the lowest reading in three months.

The news follows Finance Ministry data from Wednesday, which shows Japan posted a trade deficit of ¥930.48 billion (US$6.3 billion) in August after being thwacked by trade restrictions out of China which in turn led to the biggest drop in food exports to China in about 12 years.

The core consumer price index (CPI) – which cuts out the volatile energy and fresh food items – rose for the 24th straight month, as companies continued to pass higher production costs on to consumers.

And to complete the hat-trick for a big day in Japan, late this arvo in Tokyo, the BOJ has ended its 2-day meet to hold true to its ultra-low interest rates with a dose of further dovish guidance putting the kibosh on any ideas it was about to phase out its cheap money binge.

The BoJ once more pledged to maintain ultra-loose monetary policy “as long as necessary to maintain the (2% inflation) target in a stable manner”.

Sorry, not sorry

Some top corporate grovelling on the part of new Qantas CEO Vanessa Hudson has come with a bonus exploration of possible changes she’d consider at the national carrier to make it less of a brain sore on the public imagination.

Hudson says she’d be looking at actually bringing call centres back onshore and also reminded customers to point the finger at the previous team behind ex-CEO Alan Joyce for any bad stuff, and to let her reign over the skies be a calm one where she’s judged by how the airline goes from here.

“I am saying sorry today but it’s not about what I say but what I do and how we behave,” Ms Hudson said in a pre-rec apology posted on the company website.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MTH | Mithril Resources | 0.002 | 100% | 36,395,166 | $3,368,804 |

| ERG | Eneco Refresh Ltd | 0.025 | 79% | 264,032 | $3,813,017 |

| INP | Incentiapay Ltd | 0.009 | 50% | 44,000 | $7,590,382 |

| EXL | Elixinol Wellness | 0.008 | 33% | 2,059,640 | $3,758,896 |

| NET | Netlinkz Limited | 0.008 | 33% | 4,192,680 | $21,183,170 |

| GTG | Genetic Technologies | 0.0025 | 25% | 661,684 | $23,083,316 |

| KNO | Knosys Limited | 0.04 | 25% | 50,614 | $6,916,438 |

| OLL | Openlearning | 0.02 | 25% | 109,648 | $4,285,905 |

| CBL | Control Bionics | 0.08 | 23% | 21,447 | $6,656,580 |

| BTN | Butn Limited | 0.14 | 22% | 29,599 | $21,047,139 |

| RML | Resolution Minerals | 0.006 | 20% | 2,294,891 | $6,286,459 |

| TSL | Titanium Sands Ltd | 0.006 | 20% | 3,808,401 | $8,859,024 |

| WCN | White Cliff Min Ltd | 0.012 | 20% | 16,171,821 | $12,570,186 |

| PVT | Pivotal Metals Ltd | 0.02 | 18% | 250,000 | $9,258,205 |

| SYM | Symbio Holdings Ltd | 2.63 | 17% | 823,830 | $193,522,883 |

| DVR | Diverger Limited | 1.045 | 17% | 304,411 | $33,718,322 |

| AOA | Ausmon Resorces | 0.0035 | 17% | 370,012 | $2,907,868 |

| CHK | Cohiba Min Ltd | 0.0035 | 17% | 7,152 | $6,639,733 |

| E33 | East 33 Limited. | 0.028 | 17% | 413,583 | $12,458,129 |

| SHP | South Harz Potash | 0.036 | 16% | 190,578 | $22,118,697 |

| SOV | Sovereign Cloud Hldg | 0.11 | 16% | 9,984 | $32,243,064 |

| DTC | Damstra Holdings | 0.115 | 15% | 83,712 | $25,788,209 |

| SEG | Sports Ent Grp Ltd | 0.23 | 15% | 46,522 | $52,222,406 |

| TMR | Tempus Resources Ltd | 0.031 | 15% | 3,121,914 | $8,419,633 |

| ETR | Entyr Limited | 0.008 | 14% | 1,887,576 | $13,837,977 |

As our own leading indicator Gregor wrote today, the small cap leaders swung to-and-fro on very low-volumes and with some star no-news performers lurching all over the place.

Examples:

Mithril Resources (ASX:MTH) doubled its share price to a whopping 0.002c, up 100% on nothing I could see.

Eneco Refresh (ASX:ERG) found 78% with no news to guide it and White Cliff Minerals (ASX:WCN) is up 20% on reasonable volume, despite no market-moving news for more than a week.

The hero of the dish on Friday was a surprise packet. The tech group Symbio Holdings (ASX:SYM) which says it is mulling a final takeover offer from Superloop (ASX:SLC) which dropped this morning, giving the share price a worthy circa 20% boost in early trade to around $2.69. Based on Superloop’s closing price of 69.5 cents per share on 21 September, this implies an offer price of $2.91 per share.

In addition, with Symbio sitting on 15 cents per share worth of franking credits, the offer will lift to $3.06 per share if these are released via a special dividend from the ASX tech share prior to implementation.

Following a period of exclusive due diligence, which expired on 12 September, Symbio says it’s received a revised Best and Final non-binding indicative proposal from Superloop, wherein Symbio shareholders would receive a consideration of $1.425 in cash and 2.14 Superloop shares for each Symbio share.

Symbio shareholders would also have the ability to receive a greater portion of the consideration in scrip or shares by way of a mix and match facility, subject to scale back to achieve an overall consideration mix of up to 60% cash or up to 60% scrip, depending on the elections made by shareholders, SYM says.

The Board meanwhile says standby, and asked shareholders not to do anything till they get back.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CHR | Charger Metals | 0.135 | -29% | 2,415,406 | $11,801,730 |

| ADS | Adslot Ltd. | 0.003 | -25% | 4,155 | $12,897,982 |

| CCE | Carnegie Cln Energy | 0.0015 | -25% | 7,357,509 | $31,285,147 |

| PKD | Parkd Ltd | 0.021 | -25% | 196,203 | $2,850,913 |

| AN1 | Anagenics Limited | 0.014 | -22% | 693,880 | $6,581,159 |

| IPB | IPB Petroleum Ltd | 0.01 | -17% | 2,112,604 | $6,781,469 |

| OAR | OAR Resources Ltd | 0.005 | -17% | 6,445,548 | $15,678,814 |

| VN8 | Vonex Limited. | 0.016 | -16% | 703,545 | $6,874,744 |

| SRZ | Stellar Resources | 0.011 | -15% | 583,912 | $13,077,535 |

| PLG | Pearlgullironlimited | 0.028 | -15% | 2,539,102 | $5,161,736 |

| MKG | Mako Gold | 0.017 | -15% | 2,363,734 | $11,520,164 |

| BBX | BBX Minerals Ltd | 0.029 | -15% | 634,371 | $17,602,976 |

| 1AI | Algorae Pharma | 0.012 | -14% | 1,733,444 | $22,900,363 |

| 88E | 88 Energy Ltd | 0.006 | -14% | 4,289,674 | $154,830,585 |

| GCM | Green Critical Min | 0.006 | -14% | 1,001,745 | $7,956,095 |

| YPB | YPB Group Ltd | 0.003 | -14% | 1,000,000 | $2,602,115 |

| ID8 | Identitii Limited | 0.013 | -13% | 3,052,584 | $5,199,217 |

| NGS | NGS Ltd | 0.013 | -13% | 2,962,349 | $3,768,411 |

| APL | Associate Global | 0.2 | -13% | 34,130 | $11,136,804 |

| KTA | Krakatoa Resources | 0.02 | -13% | 1,078,625 | $9,806,661 |

| JNO | Juno | 0.096 | -13% | 243,114 | $14,922,380 |

| DES | Desoto Resources | 0.14 | -13% | 152,010 | $9,588,240 |

| RRR | Revolverresources | 0.105 | -13% | 74,083 | $13,961,892 |

| SSH | Sshgroupltd | 0.14 | -13% | 4,000 | $10,543,976 |

| PHO | Phosco Ltd | 0.049 | -13% | 174,957 | $15,367,148 |

TRADING HALTS

Aurum Resources (ASX:AUE) – For the purposes of considering, planning and executing a capital raising

Jayride (ASX:JAY) – Pending news of a capital raising

MetalsTech (ASX:MTC) – In relation to the 100% acquisition of a significant package of exploration licenses prospective for hard rock lithium, located just 3km from the Ridge Zone, Main Zone (Jamar) and Far East Zone that form the Adina Lithium (Spodumene) Project being developed by Winsome Resources and along the same greenstone belt hosting the recent spodumene discovery on the Galinee Lithium Project (Rio Tinto / Midland Exploration) and the Trieste Lithium Project (Loyal Lithium), in the James Bay region of Quebec, Canada

Orbital Corporation (ASX:OEC) – Pending news of a capital raising

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.