Closing Bell: Can’t bat, can’t bowl ASX falls on a deteriorating global wicket

The ASX is down for the day. It's just not a cricket. Via Getty

- ASX200 a victim of reflation fears, drops 0.4pc

- 5 sectors in the red, 3 led by Utilities are green and there’s three I’m calling as flat

- Small cap winners led by Alicanto Minerals

The ASX benchmark has had worse days, but just like someone forgot to remind the touring West Indian cricket team: the only ball that matters is the one you’re facing.

At 4pm on Tuesday, the S&P/ASX200 was down 30 points or 0.41% to 7,384.5:

US stocks ended broadly lower overnight, hit by (reflation?) fears, rising bond yields and some as sharp corporate losses by blue chips like Boeing which weighed down the Dow.

The Dow Jones fell 231 points to 37361, the S&P 500 lost 0.4% to 4765 and the Nasdaq dropped 0.2% to 14944.

In commodity markets, Brent crude oil fell 0.6% to US$77.72 a barrel while gold was down 1.4% to US$2,027.79.

By lunch in Sydney four out of the 11 ASX benchmark sectors were doing business in the green. After Tuesday’s shocker, traders filled the vacuum left by Utilities stocks with the sector the best on ground.

In the red and not without company was Energy (down 1.35 per cent).

Evolution Mining (ASX:EVN) had a crummy day. Down about 18%, EVN was caught in a pincer movement of falling commodity prices and a stinker of a December quarter, dominated by a downgrade for production guidance following problems at the company’s Red Lake mine in Canada.

On the flipside Woomera Mining (ASX:WML) has earned the ASX price query badge of honour before reporting it’s completed a 26-hole/2813m RC drill program at its Ravensthorpe projects located in SE Western Australia.

“Samples have been submitted with all results expected in the first quarter 2024,” the company said this arvo.

The Ravensthorpe projects comprise the Mt Short JV where the company can earn up to 70% equity and the wholly owned Mt Cattlin exploration licence immediately to the south. The two tenements cover a combined area of 103km2 (36 blocks) and are located within the same greenstone belt as Allkem’s Mt Cattlin lithium mine, a short distance to the south.

Who knows what secrets lurk in those samples (and the hearts of men)?

ASX SECTORS at 4pm on TUESDAY

Around the ‘hood, stocks in Hong Kong have taken a spectacular nose dive to fresh and exciting lows. That’s rather at odds with the altogether gushing description of what’s going on in China as reported overnight by Premier Li Qiang in Davos.

What’s moved traders to desert an already waterlogged ship?

Was it Qiang’s praise for annual China’s GDP beat of 5.2% vs an expected 5%?

Or the actual quarterly GDP miss?

Was it instead Qiang’s bald faced nonsense about the Chinese economy and the health of a sick person? That bit suggested stimulus for the economy was a mug’s game. No one would’ve enjoyed hearing that.

Maybe it was his unexpected break with protocol in revealing official GDP data from Switzerland?

Is it the release of Chinese jobless numbers for the first time since they got so bad that they stopped releasing them back in June?

Or that the reality on the ground suggests about 1 in 5 young Chinese can’t find a gig, although today China says its annual unemployment rate was just 5.2%, roundly better than the government’s advertised target of circa 5.5%?

Pick one. Because at lunchtime in Hong Kong the Hang Seng had already lost over 400 points or 2.8%, extending losses for a second day and burrowing toward 18 month lows.

All sectors were lower, while in Shanghai and Shenzhen markets were down around 1%.

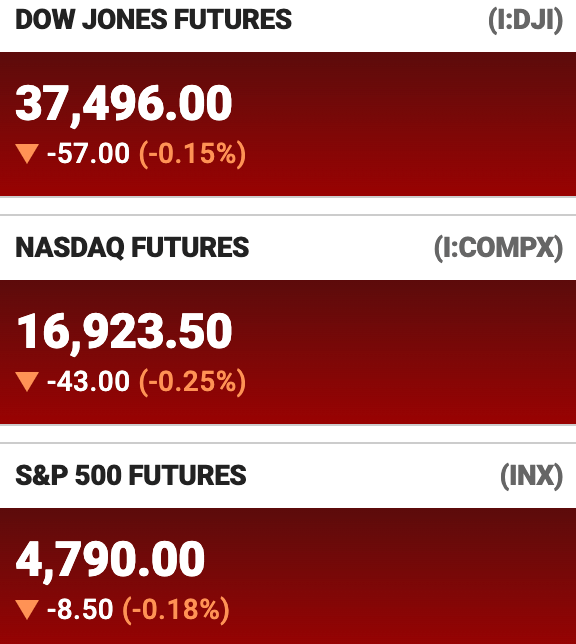

US markets struggled again overnight, all three majors in the red.

The S&P 500 and the Nasdaq lost 0.4% and 0.2%, respectively, and the Dow Jones slipped 231 points.

Federal Reserve Governor Waller overnight, suggesting the Fed may not cut interest rates as aggressively as initially expected.

US confidence in a soft landing for the US economy is back to about where it was in October – paranoia of a recession.

Wall Street earnings are still in the financials phase – latest banks to deliver:

Goldman Sachs reported better-than-expected profits and revenue.

Morgan Stanley beat on revenue guidance.

Both reported worst profits in four years as the slowdown slows down the M&A action.

On the corporate side of life, Apple stock fell 1.2% after offering iPhone discounts in China and after removing a blood-oxygen sensor from some of its watch to appease a patent issue… maybe get out of health is what the analysts are saying.

Elsewhere, Boeing shares lost 8% thanks to a Wells Fargo downgrade, but it’s Boeing’s apparently unfixable 737 Max 9 which is the carrier’s bugbear – it keeps breaking.

Right now US Futures are thus:

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MRD | Mount Ridley Mines | 0.002 | 100% | 8,487,888 | $7,784,883 |

| FTC | Fintech Chain Ltd | 0.009 | 50% | 7,769 | $3,904,618 |

| JAV | Javelin Minerals Ltd | 0.0015 | 50% | 9,676,290 | $1,633,729 |

| KEY | KEY Petroleum | 0.0015 | 50% | 3,563,007 | $2,262,928 |

| MCT | Metalicity Limited | 0.003 | 50% | 364,999 | $8,970,108 |

| PIM | Pinnacle Minerals | 0.17 | 42% | 2,150,661 | $4,159,574 |

| SPQ | Superior Resources | 0.015 | 25% | 3,976,081 | $24,014,645 |

| ESR | Estrella Res Ltd | 0.005 | 25% | 1,751,658 | $7,037,487 |

| NRX | Noronex Limited | 0.011 | 22% | 1,564,069 | $3,404,716 |

| ASN | Anson Resources Ltd | 0.12 | 21% | 4,346,714 | $127,288,178 |

| BFC | Beston Global Ltd | 0.012 | 20% | 814,725 | $19,970,469 |

| HOR | Horseshoe Metals Ltd | 0.006 | 20% | 216,670 | $3,232,393 |

| IEC | Intra Energy Corp | 0.003 | 20% | 9,179,921 | $4,151,954 |

| RIL | Redivium Limited | 0.006 | 20% | 2,295,429 | $13,654,274 |

| TML | Timah Resources Ltd | 0.031 | 19% | 5,715 | $2,307,754 |

| FIN | FIN Resources Ltd | 0.019 | 19% | 1,369,161 | $10,388,299 |

| MAN | Mandrake Res Ltd | 0.045 | 18% | 4,705,858 | $23,398,877 |

| KOB | Koba Resources | 0.099 | 18% | 370,234 | $8,855,000 |

| NIM | Nimy Resources | 0.1 | 18% | 390,739 | $11,850,440 |

| DVL | Dorsavi Ltd | 0.014 | 17% | 26,475 | $7,159,939 |

| LIS | Lisenergy Ltd | 0.1575 | 17% | 408,640 | $86,427,031 |

| MOM | Moab Minerals Ltd | 0.007 | 17% | 2,011,300 | $4,271,781 |

| PRX | Prodigy Gold NL | 0.007 | 17% | 12,561 | $10,506,647 |

| TMK | TMK Energy Limited | 0.007 | 17% | 12,813,133 | $36,735,476 |

| R3D | R3D Resources Ltd | 0.044 | 16% | 111,033 | $5,790,120 |

WINNERS

Alicanto Minerals (ASX:AQI) dominated the ladder early on Wednesday, spiking a Benaud-esque 22.22%, most likely off the back of yesterday’s announcement that the company’s Big Swede – the Skyttgruvan-Naverberg project, which lies alongside the fearsome 1,000-year-old Falun mine – is getting bigger every time the company starts poking around.

Mandrake Resources (ASX:MAN) took off at a gallop this morning, running helter skelter for 45 minutes until the ASX tugged on the handbrake and brought the party to a close – leaving Mandrake dangling at +18.4% for the morning, on a sharp increase in volume.

We’re talking roughly 7.5x the four-week average, and without a skerrick of news to the ASX as to why. There will no doubt be an explanation of sorts on the way, but at the time of writing, it remains a mystery for Scoob and the gang to unravel.

Mandrake’s trading pause was upgraded to a trading halt shortly before midday – still no explanation forthcoming. We’ll keep you posted.

Basin Energy (ASX:BSN) has timed the start of its 2024 exploration program very nicely indeed, capitalising nicely on yellowcakes high-vis on the market at the moment with news that field work has now commenced for Basin’s winter program across the entirety of the company’s Athabasca uranium projects.

That encompasses high-resolution ground Stepwise Moving Loop Time-Domain Electromagnetic survey work underway at the North Millennium and Marshall projects, while final preparations are being made for phase 2 drilling at the Geikie project.

Likewise, Pinnacle Minerals (ASX:PIM) has a timely announcement out this morning, providing an update on its uranium-REE Wirrulla Project in South Australia.

Pinnacle is reporting that recent satellite and radar imagery analysis at Wirrulla has highlighted uranium (U3O8) mineralisation potential and defined a number of priority target areas.

Additionally, exploration has found uranium mineralisation in place, with intercepts including 3,550ppm U3O8 over 1m from 66m in hole IR1377, and 1,400ppm U3O8 over 1m from 69m in hole IR1378.

Later in the day, Biome Australia (ASX:BIO) kicked into second gear for another stab at some gains on yesterday’s announcement that it’s pushing into the United Kingdom and the Republic of Ireland with its first allocation of Activated Probiotics hitting pharmacies and other retailers in those regions.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AD1 | AD1 Holdings Limited | 0.005 | -29% | 2,002,141 | $6,290,539 |

| AMM | Armada Metals | 0.023 | -26% | 100,000 | $6,448,000 |

| FAU | First Au Ltd | 0.003 | -25% | 3,300,000 | $6,647,973 |

| ASV | Assetvisonco | 0.008 | -20% | 120,000 | $7,258,366 |

| HTA | Hutchison | 0.033 | -20% | 69,481 | $556,472,852 |

| FRS | Forrestania Resources | 0.03 | -17% | 2,151,509 | $5,824,287 |

| WCN | White Cliff Minerals | 0.015 | -17% | 35,768,081 | $22,983,468 |

| AMD | Arrow Minerals | 0.005 | -17% | 21,989,151 | $20,842,591 |

| CT1 | Constellation Tech | 0.0025 | -17% | 513,066 | $4,424,201 |

| RDS | Redstone Resources | 0.005 | -17% | 1,996,969 | $5,528,271 |

| EVN | Evolution Mining Ltd | 3.145 | -16% | 42,933,809 | $7,408,149,488 |

| WML | Woomera Mining Ltd | 0.018 | -14% | 10,292,064 | $25,580,919 |

| ECT | Env Clean Tech Ltd. | 0.006 | -14% | 1,211,156 | $20,050,173 |

| OPN | Oppenneg | 0.006 | -14% | 742,537 | $7,904,257 |

| RMX | Red Mount Min Ltd | 0.003 | -14% | 646,250 | $9,357,516 |

| TX3 | Trinex Minerals Ltd | 0.006 | -14% | 311,000 | $10,409,173 |

| CMX | Chemx Materials | 0.073 | -14% | 40,000 | $4,524,767 |

| N1H | N1 Holdings Ltd | 0.155 | -14% | 12,836 | $15,850,003 |

| DNA | Donaco International | 0.032 | -14% | 2,296,716 | $45,709,407 |

| CXU | Cauldron Energy Ltd | 0.045 | -13% | 12,699,561 | $58,907,632 |

| BPM | BPM Minerals | 0.065 | -13% | 73,208 | $5,034,166 |

| VBS | Vectus Biosystems | 0.26 | -13% | 10,415 | $15,962,808 |

| NIS | Nickelsearch | 0.047 | -13% | 4,861,352 | $11,531,292 |

| AUK | Aumake Limited | 0.0035 | -13% | 2,778,756 | $7,657,627 |

TRADING HALTS

WA1 Resources (ASX:WA1) – pending the release of an announcement to the market in relation to a proposed capital raising.

Mandrake Resources (ASX:MAN) – This one looks like a speeding ticket, but it’s not 100% clear at this stage of the day.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.