Closing Bell: Broad-based whinging leads ASX back to the start of 2023, minus the hope and ignorance

Via Getty

- The ASX has ended -0.4% lower, just 2.5 points from 2023 parity

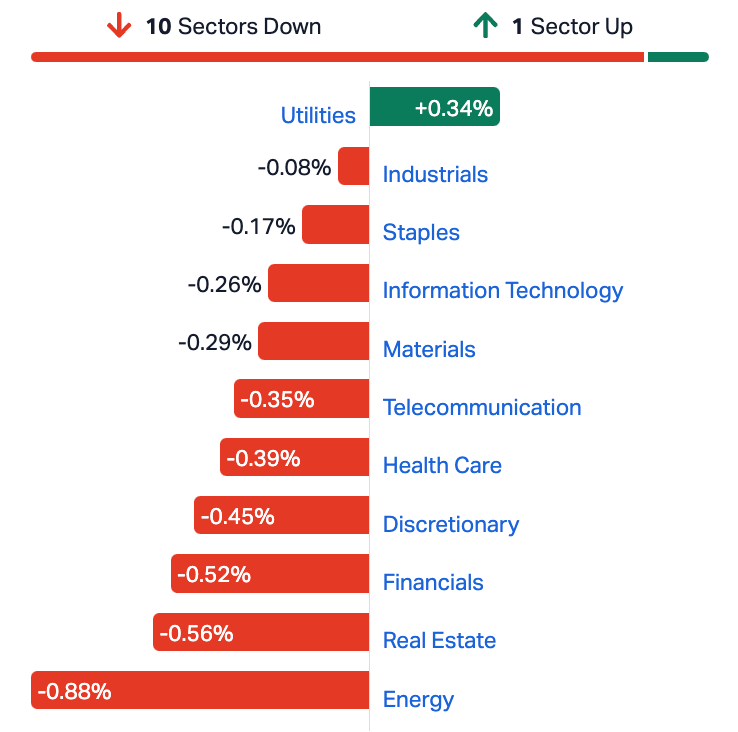

- Utilities only sector in green

- Small caps led by 4DX, Infinity and a few Lake Johnston lithium plays

The local market is back to digging its little hole from which it may take some time to get clear of.

At match-out on Monday November 13, the S&P/ASX 200 (XJO) index was down about 28 points, or -0.40% at 6,949.

Almost back to where we started on the benchmark XJO when 2023 first showed its hideous little face:

It was a tale of broad-based losses on Monday.

But, at least we’re not alone – as markets around the region took a backward step on Monday – despite the handsome tech-led gains on offer at the end of last week in New York.

To that end, the tech heavy Nasdaq Composite rose 2.4% per cent on Friday, its biggest one-day spree since June, while the S&P 500 closed up 1.6%

Aside from Japanese markets, which continue to enjoy the official protection of Warren Buffett’s spidey-sense, regional markets fell – Hong Kong’s Hang Seng index has lost about -0.34% in mid-arvo trade, which the mainland’s CSI 300 shed -0.65% after opening optimistically higher at 10am in Shanghai.

South Korea’s Kospi, now shorn of short traders has declined -0.5%.

Investors are possibly looking ahead to US inflation data this week, the CPI drops on Tuesday, where everyone is hoping prices do actually rise by the annual rate of 3.3% for October, which is deemed satisfactory, and down again from the 3.7% of September.

At home on Monday, the big bank earnings rotation has seen the ANZ take on the role of lead large-cap party popper after its $7.4bn profit was overshadowed by weaker forecasts for margins.

The other banks faltered to differing degrees – between 1% and 0.4% lower, although Macquarie has taken a bigger hit -2.5% after its involvement in Monday’s M&A failure of the day.

Energy, Property and the Financial Sector let everyone down by between 0.9% and 0.5% to start the week.

ASX SECTORS

Local traders have deserted heavyweight energy names like Santos (ASX:STO) and coal miner Whitehaven (ASX:WHC)

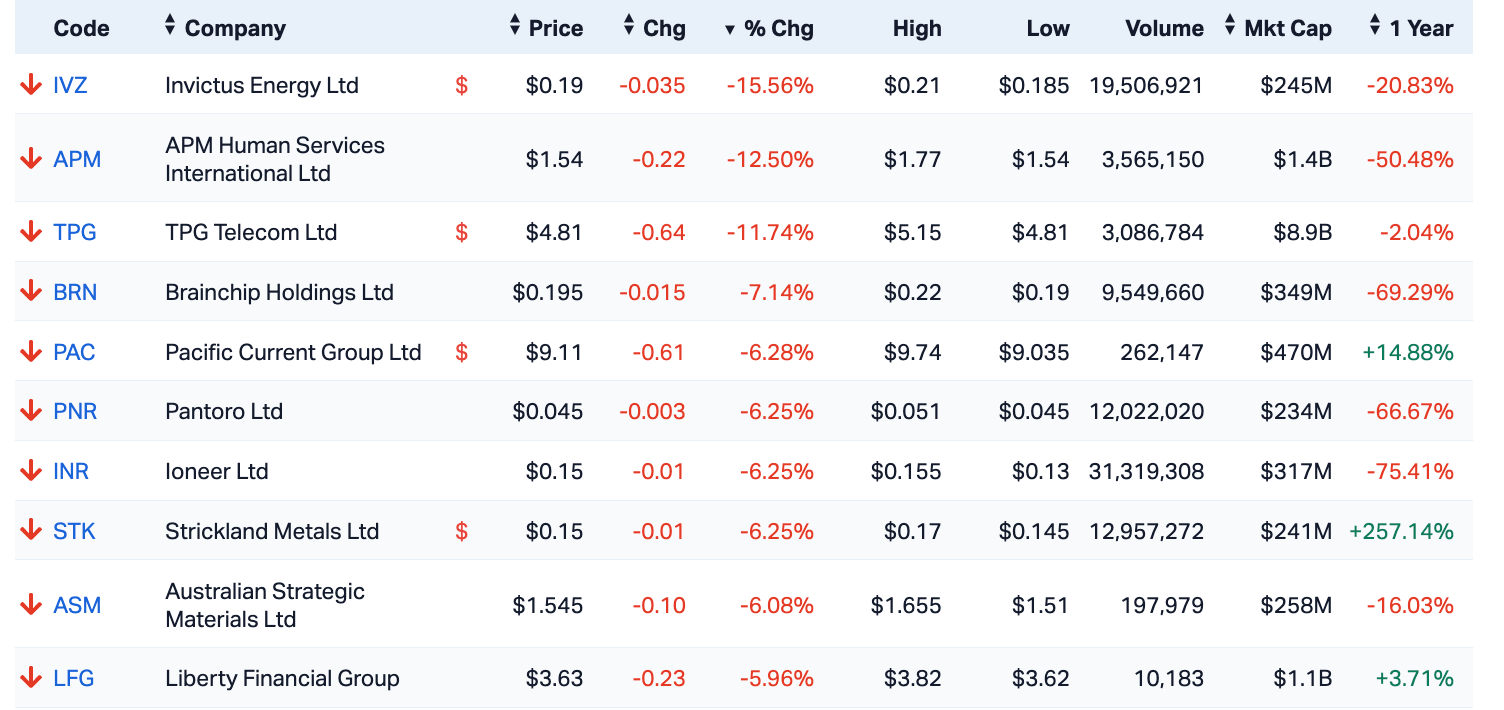

TPG Telecom (ASX:TPM) down about 10% is the soap opera of the hour and easily the biggest large-cap ratbag.

Monday’s All Ords (XAO) Guilty Parties

Strickland Metals (ASX:STK) is perhaps the odd one out of that list.

It’s hard to win new friends after soaking up some +250% of the little love that’s been out there, in 2023.

Even so, the stock has declined hard on some decent news; the goldie says the first four diamond holes into the Marwari discovery in WA have intersected the same – albeit thicker – gold-rich rocks as the discovery hole, which pulled up 31m at 5.6g/t from ~70m.

The company is on a tear ever since it sold its Millrose gold project to Northern Star Resources (ASX:NST) for a whopping $61m.

STK is now laser-focused on squeezing as much as it can out of its underexplored Horse Well gold project in the prolific Yandal greenstone belt.

In September it discovered Marwari, which could potentially host a very significant gold deposit.

Among the first four diamond holes drilled at the Marwari prospect which have now all successfully intersected the targeted stratigraphy one of them returned 31m at 5.6g/t gold from ~70m to bottom of hole.

Ripped from the headlines

We’re watching oil

WTI crude futures fell below $77 per barrel on Monday amid slowing demand in the world’s biggest two economies, the US and China.

These guys love oil. The Energy people in the US suggested on Friday that US oil consumption could fall by some 300,000 barrels a day this year, while soft economic data in China raised fears of slowing energy demand. We’ve also got talk of Chinese refiners telling Saudi suppliers to ease back on the dose for December.

This is all after oil prices found 2% on Friday as Iraq voiced support for OPEC+ oil cuts. The group of major producers is scheduled to meet on November 26 to decide on production policy.

We’re watching inflation

Turns out inflation in Australia, and not just in our imaginations, is still too high.

The acting assistant governor of the Reserve Bank of Oz, Marion Kohler, has come out on an already miserable Monday to warn us all about high and persistent services prices and that the next stage in bringing inflation back to target was likely to be more drawn out than the first.

The bank, which last week hoisted the official cash rate back to a 12-year high of 4.35%, subsequently suggested that further screw tightening could be on, with inflation likely to hit the top of the central bank’s 2-3% target only by the end-2025.

Kohler said the jump in fuel prices was a useful red flag of likely upside surprises from supply shocks could affect headline inflation.

We’re still watching gold, too

Gold dropped below $1,950 an ounce on Friday, heading for its second straight weekly decline thanks to a stronger US dollar and those US Treasury yields amped again by hawkish signals the US Fed.

A larger-than-anticipated fall in the US consumer sentiment and higher inflationary expectations hasn’t helped and that led CBA’s Vivek Dhar to suggest falling demand for the safe‑haven could pressure gold futures to ~$US1900/oz, after retaining a 7‑8% premium since the Israel‑Hamas war began.

Gold futures rose as high as ~$US2006/oz on 30 October, but have now eased to ~$US1964/oz.

“Safe‑haven demand helps explain the initial surge in gold futures since the war began, but there are credible concerns that the precious metal may see its post‑war premium continue to fade.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ASR | Asra Minerals Ltd | 0.015 | 88% | 30,197,508 | $11,573,097 |

| 4DX | 4Dmedical Limited | 0.765 | 66% | 6,303,446 | $159,374,677 |

| RON | Roninresourcesltd | 0.175 | 40% | 382,940 | $4,274,762 |

| INF | Infinity Lithium | 0.115 | 35% | 6,541,283 | $39,320,328 |

| MAU | Magnetic Resources | 0.66 | 35% | 2,000 | $10,005,242 |

| FNX | Finexia Financialgrp | 0.295 | 26% | 21,363 | $11,374,635 |

| FAU | First Au Ltd | 0.0025 | 25% | 250,000 | $2,903,987 |

| GTG | Genetic Technologies | 0.0025 | 25% | 127,944 | $23,083,316 |

| BMG | BMG Resources Ltd | 0.011 | 22% | 580,374 | $5,704,174 |

| RGL | Riversgold | 0.011 | 22% | 4,500,141 | $8,561,353 |

| PTX | Prescient Ltd | 0.07 | 21% | 6,314,132 | $46,708,548 |

| TG6 | Tgmetalslimited | 1.07 | 20% | 4,023,450 | $35,868,371 |

| EVR | Ev Resources Ltd | 0.012 | 20% | 567,309 | $9,447,798 |

| BC8 | Black Cat Syndicate | 0.26 | 18% | 1,567,496 | $66,828,375 |

| CSX | Cleanspace Holdings | 0.295 | 18% | 28,513 | $19,281,401 |

| CDR | Codrus Minerals Ltd | 0.066 | 18% | 298,101 | $4,886,000 |

| ITM | Itech Minerals Ltd | 0.165 | 18% | 314,952 | $17,105,699 |

| ACW | Actinogen Medical | 0.021 | 17% | 1,827,889 | $40,573,082 |

| AZL | Arizona Lithium Ltd | 0.042 | 17% | 79,152,772 | $119,476,297 |

| BFC | Beston Global Ltd | 0.007 | 17% | 186,475 | $11,982,281 |

| ENV | Enova Mining Limited | 0.007 | 17% | 1,750,000 | $3,845,576 |

| SI6 | SI6 Metals Limited | 0.007 | 17% | 19,806,773 | $11,963,157 |

| SKN | Skin Elements Ltd | 0.007 | 17% | 1,824,128 | $3,536,917 |

| ELD | Elders Limited | 7.17 | 16% | 2,559,072 | $967,025,227 |

| MCE | Matrix C & E Ltd | 0.29 | 16% | 787,856 | $54,887,641 |

Infinity Lithium (ASX:INF) has secured significant Spanish government funding for its headline act, the San José lithium project joint venture entity Tecnología Extremeña del Litio for advancement of said project – which, you can probably gather, is in Spain.

It’s an award of €18.8 million (A$31 million) grant funding from the government’s Ministry of Industry, Trade and Tourism, and INF’s MD and CEO Ryan Parkin is describing it as a “significant milestone” for Infinity Lithium and the San José lithium project, of which it owns 75%.

Spain’s now awarded a total of €528.7 million to 26 major projects, including €200 million to the Extremadura giga-factory.

The San José project is in the Extremadura region of Spain and boasts the EU’s second-largest JORC-compliant hard rock lithium resource.

A recent scoping study by INF assessed potential for a “significant increase” in production of battery-grade lithium hydroxide monohydrate from the company’s proposed integrated lithium chemical conversion facility.

“The company welcomes the government’s commitment to recognising the critical importance of lithium and its endorsement of the project. These first funding commitments for the processing of critical raw materials in Spain places the company at the forefront of future funding pathways at both the national and European level,” Parkin added.

On the way up again is the junior explorer Ronin Resources (ASX:RON) rising strongly on Monday, living off the lithium fumes of last week.

Beyond its flagship Colombian projects, including Vetas, a large, high-grade thermal coal operation, it’s also joined the recent frothy hunt for white gold in Canada. Lithium, that is.

It’s been focusing on the Hornby Lake lithium project in Ontario, where, about a week ago on Nov 6, it confirmed the sighting of numerous pegmatites, which it’s in the process of assessing for LCT-based mineralisation.

Those assay results are expected some time in December.

And it’s the Aussie imaging tech specialist 4D Medical (ASX:4DX) says that from January 1 next year, the notoriously difficult American healthcare world will start helping notoriously troubled American patients.

4DX surged on the news its scanning device has been included into the US Centers for Medicare & Medicaid Services (CMS) – which is the US federal agency providing health coverage through Medicare and the rest of those weird US health things.

So from 1 January 2024, XV LVAS scans conducted in a US hospital outpatient facility for Medicare patients can be billed to CMS.

Some 65.7 million Americans are enrolled in the program.

Here’s a very excited 4DXl MD, CEO, founder and soon-to-be Aussie medtech legend Andreas Fouras:

I am very excited by this progress in the commercialisation of our technology, and the positive impact this reimbursement decision will have upon doctors and their patients. Achieving a Medicare reimbursement of US$299 per scan is a major milestone in our progress to secure reimbursement across the entire U.S. healthcare system and meaningfully removes a barrier to broader adoption across the large network of facilities providing healthcare to the 65 million Americans enrolled in Medicare. This ruling will lead to accelerated uptake of XV LVAS, which in turn will support our pursuit of a Category I CPT code.

Also out of the medtech space, an update from Cleanspace (ASX:CSX) has the stock higher on Monday:

- October sales have continued growth trend up some +50% v PCP.

- Currently running ahead of expectations for sales growth in FY24.

- Costs and cash are also running in line with our expectations.

- At this run rate we can expect to be close to exiting FY24 at cash break even

- Europe the star performer at +111% growth, with strong growth in France, UK and Germany where sales have doubled v PCP.

- Growth in Asia Pacific is +25%. Australia is +31%. North America +7%

The newly set CEO Graham McLean says the tide is turning for the Sydney-based designer and manufacturer of respiratory protection equipment for industrial and healthcare solutions.

“Interestingly, we are getting both volume and price growth. The price benefit is on the back of launching two new industrial products at higher prices than the products they replaced. And we are picking up good volume growth in all key markets in both respirator units and consumables.

“We will continue to optimise costs where possible, but I believe we have already made the significant cost reductions that were possible in FY23, without compromising our ability to grow revenue. Importantly, we believe that the business is now under control and we do not expect to need to raise further capital with the current structure and strategy.”

TODAY’S ASX SMALL CAP LAGGARDS

Here are the day’s worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| TWE | Treasury Wine Estate | 0.079 | -71% | 731,668 | $21,006,164 |

| PVS | Pivotal Systems | 0.001 | -67% | 11,690,764 | $2,305,138 |

| AMD | Arrow Minerals | 0.001 | -50% | 131,825,006 | $6,047,530 |

| RR1 | Reach Resources Ltd | 0.0065 | -46% | 153,307,497 | $38,523,565 |

| AL8 | Alderan Resource Ltd | 0.008 | -38% | 46,463,524 | $8,017,030 |

| EMU | EMU NL | 0.001 | -33% | 5,000,000 | $2,501,282 |

| VPR | Volt Power Group | 0.001 | -33% | 654,675 | $16,074,312 |

| KEY | KEY Petroleum | 0.0015 | -25% | 1,000,000 | $3,935,856 |

| TNY | Tinybeans Group Ltd | 0.135 | -25% | 28,361 | $15,090,947 |

| GSM | Golden State Mining | 0.019 | -24% | 7,102,543 | $4,777,207 |

| ALV | Alvomin | 0.23 | -23% | 870,463 | $27,939,094 |

| GSN | Great Southern | 0.022 | -21% | 362,033 | $21,129,785 |

| BCT | Bluechiip Limited | 0.02 | -20% | 1,269,552 | $19,677,202 |

| CRB | Carbine Resources | 0.004 | -20% | 174,200 | $2,758,689 |

| EDE | Eden Inv Ltd | 0.002 | -20% | 653,679 | $8,409,092 |

| MCT | Metalicity Limited | 0.002 | -20% | 8,467,437 | $10,627,715 |

| OSL | Oncosil Medical | 0.008 | -20% | 436,802 | $19,758,411 |

| 5EA | 5Eadvanced | 0.275 | -19% | 967,944 | $103,368,874 |

| IVZ | Invictus Energy Ltd | 0.185 | -18% | 18,266,301 | $290,435,443 |

| SKS | SKS Tech Group Ltd | 0.185 | -18% | 29,154 | $24,704,855 |

| ZEO | Zeotech Limited | 0.043 | -17% | 5,127,347 | $89,877,999 |

| NYM | Narryermetalslimited | 0.12 | -17% | 292,058 | $6,959,069 |

| KNI | Kunikolimited | 0.25 | -17% | 37,442 | $25,771,880 |

| ME1 | Melodiol Glb Health | 0.0025 | -17% | 109,868,737 | $11,502,311 |

| VFX | Visionflex Group Ltd | 0.01 | -17% | 30,000 | $17,003,894 |

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.