CLOSING BELL: Big Coal fires up the Energy sector, but not enough to stop the rot

News

News

Aussie markets have run out the clock on Tuesday’s session, limping back to the change sheds for an unwelcome ice bath and a proper, old school shellacking from the coach.

You know – one of those top-of-the-lungs, lips flecked with spittle, “I don’t care if the other team can hear me, because that effort was pathetic out there today” rants.

Totally deserved, by the way – the ASX 200 really looked like it never had its head in the game at all today, and if it weren’t for the efforts of a few major coalies and a bevy of spirited Energy sector Small Caps, today would have been imminently forgettable.

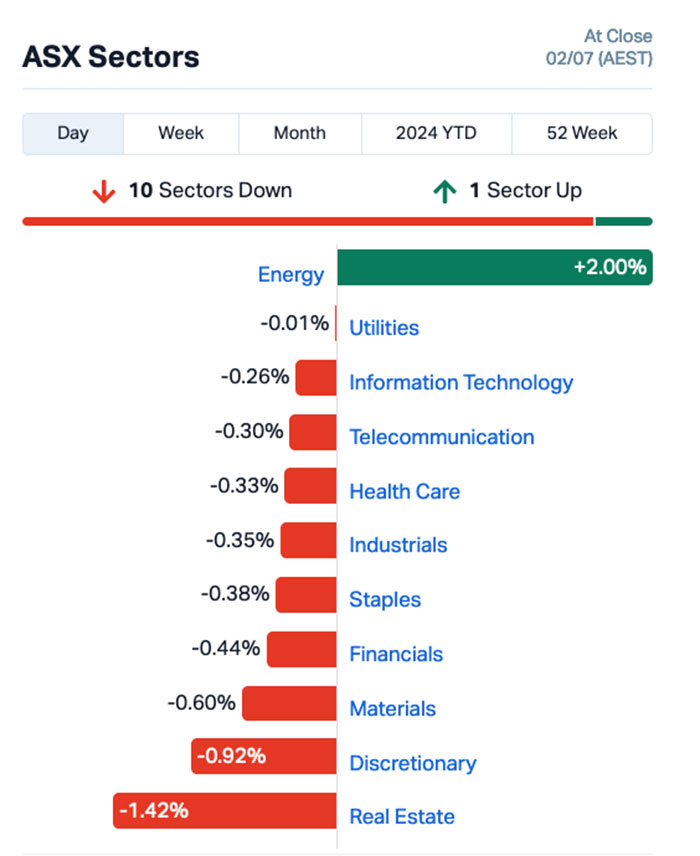

At the close of play, the sectors looked like this:

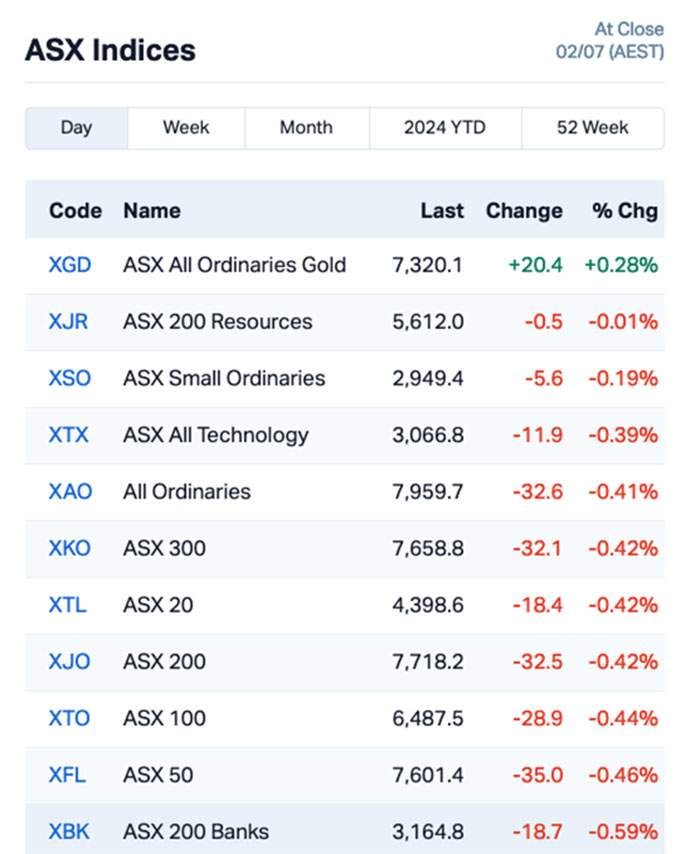

And the indices looked like this:

So, get comfy, settle in and I’ll tell you everything I know about why the ASX was in poor form today.

I do not know why the ASX was in poor form today.

But I can offer some theories, which mostly have to do with the RBA Board justifying why it didn’t move the interest rate needle only to get egregiously turkey-slapped by the May inflation figures a few days later.

The thing is, the RBA is really quite limited in what it can do about rates – because the rate lever is the single effective tool in the arsenal for controlling (or not controlling, as the case may be) the patently uncontrollable monster that is slowly but surely pricing all but the basic necessities of life into the realms of unaffordability.

To their credit, the RBA team with access to said lever did talk about changing things up last month, but decided not to, because the tea leaves weren’t particularly clear on how things are likely to look over the coming months.

The upshot of all of this is that the RBA Board is urging all Australians to hurry up and wait – because there aren’t any kind of rock-solid indicators that they’re going to be able to hang a policy opinion on at the moment.

There was a bit more macro garbage, and news from overseas, which appeared to play a part in today’s proceedings – but, really… the market’s been a bit crap because investor confidence is low, risk appetite is low, morale is low.

You get the picture.

On the stock front today, it was hard not to notice that a couple of coal miners had big gains today – largely because they kept the market from disappearing beneath the waves.

Whitehaven Coal (ASX:WHC) was the best of the bunch, after the now $7.2 billion market capper put on a wallet-fattening +5.66%, and the grand-daddy of the sector, Woodside Energy Group (ASX:WDS) , pumped up +2.69% over the course of the session.

That’s off the back of yesterday’s tidy gains among the coal producers, which happened because Anglo American’s Grosvenor coal mine is definitely on fire right now, and investors – being the canny bunch that they are – saw an opportunity to benefit from that by piling on to Anglo’s competitors.

I genuinely don’t know if today’s gains for Woodside and Whitehaven et al are a continuation of that, but it makes sense since there’s been nothing that I’ve spotted that would’ve caused those stocks to gallop today.

Interesting footnote to the Grosvenor coal mine fire comes from our buddies at The Australian, who have noted that Anglo’s plans for a restructure are now in a pretty bad state of disarray.

I don’t have the time (or the energy) to rabbit on about it, as much as I would love to, so instead I shall defer to the wonderful Nick Evans and Joseph Carbone at The Australian to fill you in on the effects of the fire.

READ MORE: Anglo American’s Grosvenor mine fire delivers blow to company restructure plan after blocking BHP takeover.

Now that you’re done with that, here’s how the Small Caps fared today.

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| JAV | Javelin Minerals Ltd | 0.002 | 33% | 467,726 | $3,751,846 |

| MTB | Mount Burgess Mining | 0.002 | 100% | 995,024 | $1,298,147 |

| MRQ | Mrg Metals Limited | 0.005 | 67% | 76,178,657 | $7,575,356 |

| EEL | Enrg Elements Ltd | 0.003 | 50% | 163,893 | $2,019,930 |

| NGS | NGS Ltd | 0.003 | 50% | 3,583,726 | $502,455 |

| SGC | Sacgasco Ltd | 0.005 | 43% | 18,092,299 | $3,138,240 |

| NNL | Nordicnickellimited | 0.078 | 37% | 155,938 | $7,403,379 |

| AD1 | AD1 Holdings Limited | 0.008 | 33% | 482,534 | $5,391,890 |

| EXL | Elixinol Wellness | 0.004 | 33% | 6,953,155 | $3,963,547 |

| SFG | Seafarms Group Ltd | 0.004 | 33% | 732,416 | $14,509,798 |

| TMK | TMK Energy Limited | 0.004 | 33% | 17,565,931 | $20,734,836 |

| MMM | Marley Spoon Se | 0.02 | 33% | 35,955 | $1,765,866 |

| NPM | Newpeak Metals | 0.024 | 33% | 50,000 | $2,225,131 |

| REC | Rechargemetals | 0.033 | 27% | 234,481 | $3,631,939 |

| 1CG | One Click Group Ltd | 0.015 | 25% | 2,054,186 | $8,438,146 |

| AEV | Avenira Limited | 0.005 | 25% | 2,636,744 | $9,396,136 |

| AMD | Arrow Minerals | 0.0025 | 25% | 8,614,980 | $21,078,730 |

| AVE | Avecho Biotech Ltd | 0.0025 | 25% | 7,000 | $6,338,594 |

| HOR | Horseshoe Metals Ltd | 0.01 | 25% | 3,000,000 | $5,196,629 |

| SPQ | Superior Resources | 0.01 | 25% | 3,440,876 | $16,009,763 |

| TG6 | Tgmetalslimited | 0.225 | 22% | 203,346 | $13,154,895 |

| CL8 | Carly Holdings Ltd | 0.017 | 21% | 323,123 | $3,757,185 |

| TSO | Tesoro Gold Ltd | 0.034 | 21% | 3,081,191 | $34,428,260 |

| BEO | Beonic Ltd | 0.029 | 21% | 209,228 | $11,716,060 |

| AHK | Ark Mines Limited | 0.18 | 20% | 649,521 | $8,316,962 |

TMK Energy (ASX:TMK) was up on Friday afternoon, on news that the company has put a broom through the boardroom and managerial roster, to “align individuals’ competencies and experience with the immediate and future direction of the company”.

The shakeup comes as TMK preps for a big push forward on the delivery of its Gurvantes XXXV Project in Mongolia and says the changes will provide additional support to management to progress the significant growth opportunity that lies ahead.

Tesoro Gold (ASX:TSO) was pleased to report significant assay results from first-pass drilling of the Ternera East target, which has intercepted a newly identified, thick (+200m), well-mineralised El Zorro Tonalite (EZT) intrusive, approximately 300m east of the 1.3Moz Ternera Gold Deposit within Tesoro’s broader El Zorro Gold Project in Chile.

Ark Mines (ASX:AHK) revealed that an extensive reconnaissance drilling programme has been conducted, allowing the company to assess an exploration target range for the Sandy Mitchell rare earths tenement.

Ark says in the release that the target is estimated at 1.3 billion tonnes to 1.5 billion tonnes @ 1250 to 1490ppm monazite equivalent – but does also note that “the potential quantity and grade of the Exploration Target is conceptual in nature; there has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration will result in estimation of a Mineral Resource.”

Earlier in the day, Critical Resources (ASX:CRR) was climbing on Tuesday morning after it announced that its summer field program has reinforced the company’s recently announced Exploration Target of 18-29Mt at 0.8-1.2% Li2O at its Mavis Lake prospect, with new assays confirming “exceptionally high grades” at surface with lithium assays of up to 5.12% Li2O along the extensions of pegmatites 7 and 24.

Redflow (ASX:RFX) was moving sharply on news that it has signed an MoU with the Queensland government-owned Energy producer Stanwell, setting out out Redflow’s and Stanwell’s intention to collaborate on the development and deployment of Redflow’s X10 battery for use in a 400 MWh large-scale project, which will serve as a potential anchor order for Redflow’s planned manufacturing facility in Queensland.

Cygnus Metals (ASX:CY5) announced some pleasant news from its lithium prospect, after a ground gravity survey suggested the Pegasus spodumene pegmatite trend extends for at least 1.7km and remains open in all directions. The survey was centred around a find the company reported in February this year, which included a fabulous intersection of 43.7m @ 1.15% Li2O below 10m of glacial cover.

And Pioneer Lithium (ASX:PLN) jumped nicely on news that its 300m exploratory auger drilling campaign at its 100% owned Verde Valor Rare Earth tenements in Bahia state in Brazil has been completed, with the samples all packed carefully and sent off to the lab to be processed.

Here are the least best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| GCR | Golden Cross | 0.00001 | -1% | 10,250 | $2,194,512 |

| RNX | Renegade Exploration | 0.00009 | 0% | 49,925,144 | $19,200,801 |

| AXP | AXP Energy Ltd | 0.00001 | 0% | 88,471,751 | $8,737,021 |

| AYM | Australia United Min | 0.00002 | 0% | 244,844 | $5,527,732 |

| NES | Nelson Resources. | 0.00002 | 0% | 212,065 | $1,840,783 |

| TX3 | Trinex Minerals Ltd | 0.00002 | 0% | 41,085 | $5,485,957 |

| VML | Vital Metals Limited | 0.00002 | 0% | 8,168,996 | $17,685,201 |

| RLG | Roolife Group Ltd | 0.00003 | 0% | 2,796,700 | $3,129,527 |

| TMX | Terrain Minerals | 0.00003 | 0% | 24,338 | $5,726,683 |

| SUM | Summitminerals | 0.0027 | 0% | 8,263,804 | $21,465,189 |

| MAY | Melbana Energy Ltd | 0.00028 | 0% | 20,333,671 | $117,957,144 |

| 1MC | Morella Corporation | 0.00002 | 0% | 1,146,407 | $15,446,999 |

| ATH | Alterity Therap Ltd | 0.00004 | 0% | 614,355 | $26,225,577 |

| CCO | The Calmer Co Int | 0.00008 | 0% | 23,934,126 | $13,813,143 |

| MCT | Metalicity Limited | 0.00002 | 0% | 208,000 | $11,214,632 |

| SIH | Sihayo Gold Limited | 0.00002 | 0% | 9,645,441 | $30,510,640 |

| AX8 | Accelerate Resources | 0.00029 | 0% | 2,184,894 | $22,347,142 |

| WMG | Western Mines | 0.0028 | 0% | 305,374 | $26,253,793 |

| RCE | Recce Pharmaceutical | 0.0049 | 0% | 1,228,342 | $122,392,346 |

| PHL | Propell Holdings Ltd | 0.00009 | 0% | 13,000 | $3,061,719 |

| RC1 | Redcastle Resources | 0.00018 | 0% | 1,438,913 | $7,222,251 |

| TON | Triton Min Ltd | 0.00009 | 0% | 3,255,924 | $17,252,276 |

| ASQ | Australian Silica | 0.00023 | 0% | 166,916 | $7,892,091 |

| OAU | Ora Gold Limited | 0.00005 | 0% | 401,568 | $42,846,958 |

| RGL | Riversgold | 0.00005 | 0% | 28,408 | $7,257,461 |

Indiana Resources (ASX:IDA) – pending an announcement to the market in relation to a settlement being reached with the United Republic of Tanzania in relation to the arbitration proceedings at the International Centre for Settlement of Investment Disputes (ICSID), a division of the World Bank.

Liontown Resources (ASX:LTR) – pending an announcement by the Company in connection with funding arrangements.

West African Resources (ASX:WAF) – pending the release of an announcement by the Company regarding a potential capital raising.

eCargo (ASX:ECG) – pending an announcement by ECG concerning a proposed application to be removed from the official list of the ASX.

Compumedics (ASX:CMP) – pending an announcement in relation to a proposed capital raising.

Ark Mines (ASX:AHK) has defined an exploration target for its Sandy Mitchell rare earths project in Queensland of between 1.3-1.5 billion tonnes at 1,250 to 1,490 ppm monazite equivalent. Pre-feasibility study underway with further exploration planned.

Summit Minerals (ASX:SUM) surface rock chip sampling has uncovered new niobium, tantalum and rare earths-rich pegmatites parallel to known pegmatites at its Equador project in northeastern Brazil.

Tesoro Gold (ASX:TSO) has discovered a major new gold intercept just 300m to the east of its 1.3Moz Ternera gold deposit within the broader El Zorro gold project in Chile.

Toubani Resources (ASX:TRE) has increased the indicated ounces in the oxide zone of its mineral resource estimate at the Kobada gold project in Mali by 44% to 1.4Moz and grown overall indicated ounces by 30% to 2.0Moz.

Zeotech (ASX:ZEO) controlled infield validation trials of its zeoteCH4 technology that could control methane emissions from landfills is progressing well with three field simulation configurations commissioned.

At Stockhead, we tell it like it is. While Ark Mines, Summit Minerals, Tesoro Gold, Toubani Resources and Zeotech are Stockhead advertisers, they did not sponsor this article.