Closing Bell: Big caps get whacked on ASX Day of the Earnings Miss

Via Getty

- ASX200 ends lower on bad corporate reveals

- The falling Healthcare Sector remains CSL’s slave

- Small cap winners led by Ansarda

A big day for blue chip earnings reports has led the Australian sharemarket all over the shop and eventually lower, on Tuesday.

At 4.15pm on February 13, the S&P/ASX200 was down 11 points or 0.15% to 7,603.6:

In good, bad and confusing news, National Australia Bank (ASX:NAB) chief economist Alan Oster reckons we should brace for an “ongoing easing in price pressures across the economy in early 2024”.

Which is surely now.

But don’t worry about assuming the brace position – because he also warns that interest rates will – “remain high for much of the year”.

And that “price pressures are still a concern against a raft of global uncertainty”.

Business confidence remained “very weak” amid “ongoing pressures across the economy”, and cost growth that was “still high notwithstanding some easing” in the later half of last year.

So…

“Both profitability and trading conditions are now below average with conditions supported somewhat by still above-average employment conditions,” Mnsr Oster says.

Now. If none of this makes any congruent sense it’s because I’m basically trying to explain what it means when NAB’s Aussie business conditions fall by 2 points to 6 index points – just below the long-term average (of 7), as per the bank’s Monthly Business Survey.

But that makes little sense either, regardless of how much I wish to support the monthly effort which seems laudable if misdirected.

Meanwhile, at least Westpac (ASX:WBC) has the smarts to share the burden of the monthly Westpac-Melbourne Institute Consumer Sentiment index, which you’ll be pleased to know has risen in February by 6.2% to 86.

That’s a 20-month high for sentiment which the bank puts down to “major purchases” and “year-ahead expectations”. Both aided by the sweet anticipation of easing inflation and the accompanying interest rate cuts.

What about sentiment and Stage 3 tax cuts? Well, they were also a positive… but a “more uneven one,” according to Westpac senior economist, Matthew Hassan, who adds that all up, the average mood of the Aussie consumer “remains pessimistic”.

Meanwhile, back on the Death Star…

Han and Chewie spent the afternoon weighing a raft of uninspiring results from across the galaxy of ASX200 stars.

Seek (ASX:SEK) , Macquarie Group, Breville (ASX:BRG) and James Hardie (ASX:JHX) and ongoing headaches from market giant CSL (ASX:CSL) weighed on the bourse.

On Monday, for those willing to relive the moment, the benchmark was dragged down by as much as 0.55% after the blood plasma giant revealed its CSL112 drug for heart attack patients failed a phase-three drug trial.

Today the big fella kept bleeding, giving up almost 4%.

Shares in investment bank Macquarie Group (ASX:MQG) also dropped about 2% after delivering a substantially lower Q3 net profit.

In typically unapologetic Macquarie-style language “exceptionally strong results” over the prior corresponding period (pcp) from the Commodities business and lower fee and commission income for Macquarie Capital were behind MQG’s decline in third quarter net profit contribution, the bank said on Tuesday.

Macquarie also lost its highest-paid banker, Nicholas O’Kane, who will exit the investment bank at the end of the month.

JB HiFi (ASX:JBH) has led retailers out the gate, up over 6% after robust earnings.

Other big names with big gains – building materials giants Boral (ASX:BLD) up 2% and IDP Education (ASX:IEL), up 3%.

In the doghouse is James Hardie, after warning of more uncertain housing conditions ahead.

Other hella disappointing corporate updates include the near 10% drop for SEK, bettered only be Breville’s 11% crash.

In random Tuesday happy news, the global private equity group CapVest Partners has come swooping down upon the local Virtual Data Room problem solver Ansarada (ASX:AND) , which says it’s all in for a proposed $236.3mn takeover.

Stock in the sassy Aussie SaaS has gone nuts after announcing to the bourse its intention to walk right into a scheme of implementation deed with a CapVest Partners set up called Datasite… “to acquire 100% of the fully diluted share capital in Ansarada at $2.50 cash per share, which implies an equity value of A$236.3 million and represents a premium of 19.0% to the last closing price of A$2.10 per share”.

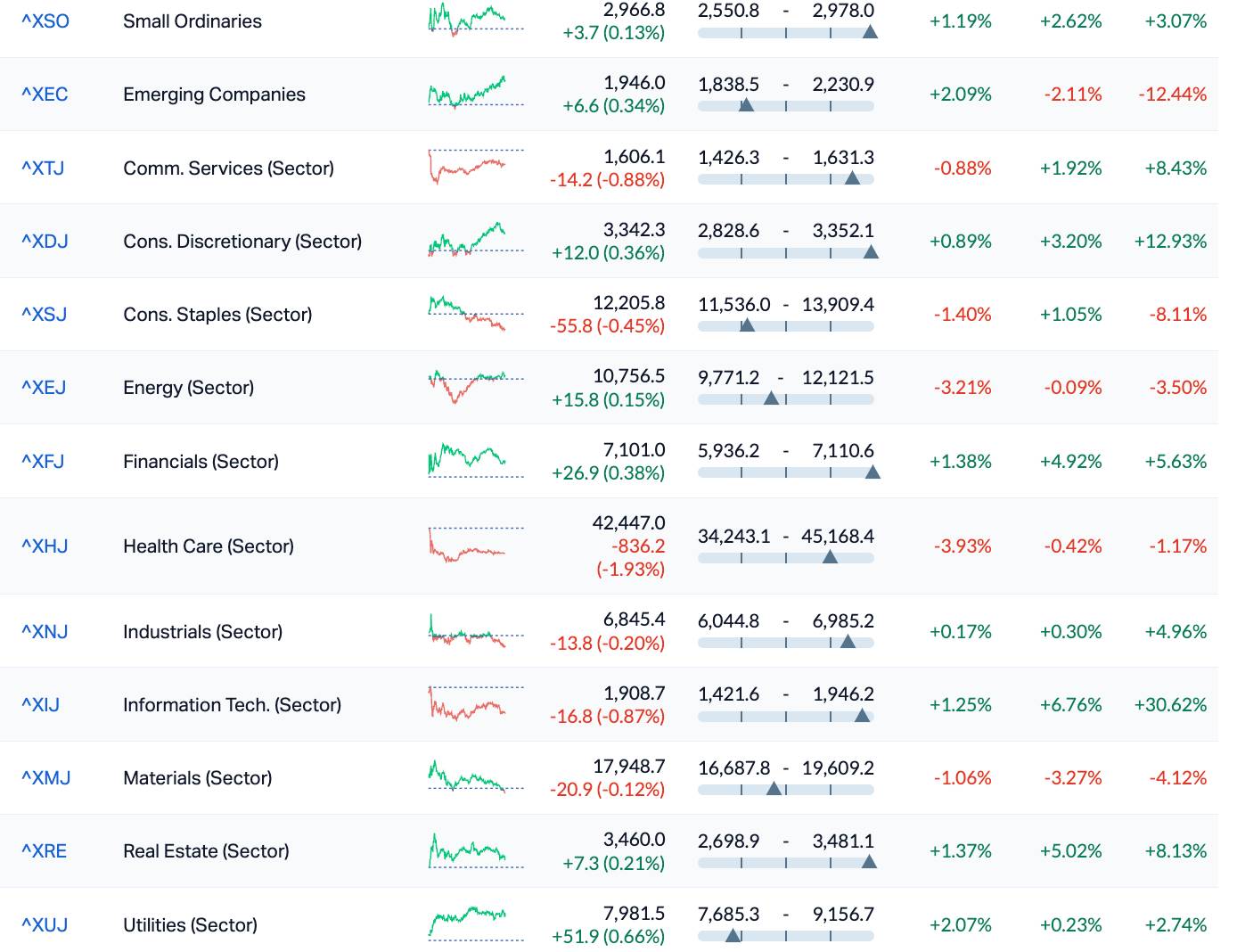

At the sector level, Utilities gained, but couldn’t nearly offset the hell that is Healthcare while CSL sinks.

Both the ASX small ordinaries (XSO) and the (XEC) emerging companies index were in the green.

ASX Sectors on Tuesday

![]()

Meanwhile, in the States…

According to Bespoke Investment Group, the S&P500 has now gone over 70 trading days without a single 2% decline. The only way, despite what Yazz told us, is not up. So try to remember that pullbacks and corrections are real.

Any old hoo, last night it was time for the Dow Jones Industrial Average to clock a new high, with the 30-stock index rising 0.33%, to close above 38,797 for the first time.

The S&P500 dropped 0.1% and the tech heavy Nasdaq Composite slid 0.3%.

Overall, US sectors were mixed on Monday. Utilities was the best performer whilst the Tech sector was the worst.

In corporate action not related too much to the Magnificent Seven, Diamondback Energy rose near 10% after announcing plans to acquire oil and gas producer Endeavor Energy Partners in a US$26bn shake up.

Diamondback, which was valued at $27bn before the deal was announced, had been vying for weeks with the much larger Conoco to buy the shale oil producer.

The cash and stock deal will instantly make the Texas-based Diamondback one of the majors to poke about in the Permian Basin across Texas and New Mexico, the biggest US oilfield.

On the flipside, Salesforce dragged with the cloud-based software stock sliding 1.5%.

Shares of Hershey slipped less than 1 per cent following a downgrade to underweight from Morgan Stanley on the back of softer caramel. Sorry, demand.

Some 61 names in the S&P 500 are set to report earnings this week including gig economy stocks Lyft, Instacart and DoorDash.

Kraft Heinz, Hasbro and Coca-Cola will also be exciting – and handy tells for what the US consumer is up to.

Tonight in the US investors will be gripping their bookmakers as the US consumer price index (CPI) drops.

Other key inflationary reads stateside this week range from January retail sales, imports and exports, housing starts and the producer price index, (PPI).

Bitcoin just clocked over US$50k for the first time in about 26 months. The wonder drug hit $50,334.00, its highest level since December 2021.

Ether is also rising. As are a multitude of other magical internet monies with daft names, I’m reliably informed.

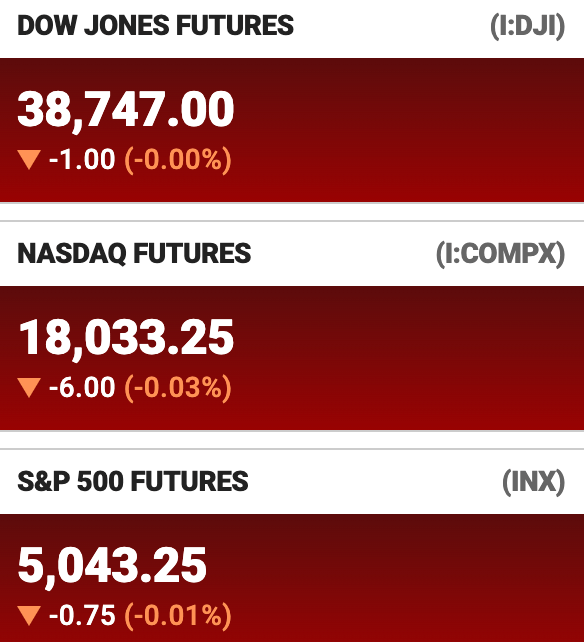

And US Futures are lower in Sydney (at 3.30pm on Tuesday).

ASX SMALL CAP LEADERS

Unfortunately the original corresponding table is no longer available, but here are the day’s standouts:

Dateline Resources (ASX:DTR) was well out in front Tuesday morning, after the company reported hitting wide, high grade gold during drilling at its Colosseum Gold Project in San Bernardino County, California, with the highlight being 70.1m @ 6.53g/t Au in drill hole CM23-14 Inc. 25.9m @ 15.31g/t Au.

IncentiaPay (ASX:INP) was also tracking well in early trade, after the company delivered its half-yearly report after hours on Monday evening, showing that while revenue has faltered -6.41% to 8,674,712 in PCP, the company has managed to turn around Loss from ordinary activities after tax attributable to members by 80.6% to $3,236,540, compared to $16,707,381 on PCP.

Hammer Metals (ASX:HMX) took off like a jackrabbit around lunchtime, rushing through +37% before going into a trading halt, ahead of announcing drilling results from one of its copper interests in the Mt Isa region of Queensland.

BrainChip Holdings (ASX:BRN) also enjoyed a sizeable jump during the day, responding to an ASX “Please Explain” with “nothing to see here”, leaving the company’s 19% leap a total mystery…

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | MARKET CAP |

|---|---|---|---|---|---|

| HCL | Highcom Ltd | 0.17 | -47% | 2,677,555 | $32,858,455 |

| GRE | Greentechmetals | 0.205 | -40% | 4,301,374 | $28,587,192 |

| GCR | Golden Cross | 0.002 | -33% | 50,000 | $3,291,768 |

| ICL | Iceni Gold | 0.033 | -27% | 376,031 | $11,095,247 |

| ADS | Adslot Ltd. | 0.0015 | -25% | 400,000 | $6,448,991 |

| ABE | Ausbondexchange | 0.03 | -25% | 308,911 | $4,506,725 |

| NYM | Narryermetalslimited | 0.034 | -24% | 801,305 | $2,159,711 |

| STX | Strike Energy Ltd | 0.325 | -23% | 74,799,827 | $1,202,134,861 |

| ERW | Errawarra Resources | 0.059 | -20% | 1,150,223 | $7,098,130 |

| 88E | 88 Energy Ltd | 0.004 | -20% | 28,588,575 | $123,627,103 |

| EM2R | Eagle Mountain - Rights 23-Feb-24 | 0.004 | -20% | 100,000 | $381,209 |

| LNU | Linius Tech Limited | 0.002 | -20% | 1,636 | $12,348,102 |

| MCT | Metalicity Limited | 0.002 | -20% | 882,616 | $11,212,634 |

| SI6 | SI6 Metals Limited | 0.004 | -20% | 2,704,000 | $9,969,297 |

| EG1 | Evergreenlithium | 0.093 | -19% | 21,335 | $6,466,450 |

| ICR | Intelicare Holdings | 0.013 | -19% | 2,061 | $3,757,192 |

| KGL | KGL Resources Ltd | 0.115 | -18% | 292,947 | $79,420,861 |

| AQX | Alice Queen Ltd | 0.005 | -17% | 96,292 | $4,145,905 |

| CT1 | Constellation Tech | 0.0025 | -17% | 1,051,983 | $4,424,201 |

| FAU | First Au Ltd | 0.0025 | -17% | 65,000 | $4,985,980 |

| NRZ | Neurizer Ltd | 0.005 | -17% | 1,130,752 | $8,483,465 |

| OAR | OAR Resources Ltd | 0.0025 | -17% | 348,861 | $7,931,183 |

| TEG | Triangle Energy Ltd | 0.02 | -17% | 16,875,366 | $33,637,099 |

| TMR | Tempus Resources Ltd | 0.005 | -17% | 999,753 | $4,385,992 |

| NSX | NSX Limited | 0.021 | -16% | 88,951 | $10,035,507 |

In Case You Missed It – PM Edition

Assays from Brightstar Resources’ (ASX:BTR) first two diamond holes drilled into the Laverton prospect at Cork Tree Well – which already boasts an existing 303,000oz @ 1.4 g/t gold resource – have returned up to 172.41g/t Au with visible gold also observed in cut core on multiple occasions.

Corella Resources’ (ASX:CR9) product characterisation study has confirmed the exceptional quality of kaolin sourced from its Tampu project in WA’s Wheatbelt region after producing an extremely pure >99% kaolinite product.

A program of detailed geological mapping and rock chip sampling has turned up several multi-kilometre manganese-rich zones at Mako Gold’s (ASX:MKG) Korhogo project in Côte d’Ivoire, adding to the potentially significant discovery already made on the company’s Ouangolodougou permit at Korhogo.

Infill soil sampling has confirmed further significant lithium-caesium-tantalum (LCT) anomalies to the north of the historical quarry area at NickelSearch’s (ASX:NIS) Carlingup project in WA, which covers 108km2 of ground within the Ravensthorpe greenstone belt – a highly prospective region for nickel sulphide deposits on the southern margin of the Archean Yilgarn Craton.

Azure Minerals’ (ASX:AZS) ongoing drilling at the Andover project in WA’s Pilbara region has delivered yet more stunning lithium intersections that has allowed the company to define an exploration target of between 100Mt and 240Mt with a grade range of 1-1.5% Li2O.

Basin Energy’s (ASX:BSN) exploration and drilling teams have arrived on site at the Geikie project in Canada’s Athabasca Basin to begin Phase 2 drilling of up to 2,500m for a minimum of eight drill holes.

Future Metals (ASX:FME) has identified multiple magmatic sulphide drill targets prospective for copper-nickel-PGMs along the highly prospective Alice Downs Corridor within its Eileen Bore project in WA’s East Kimberley region.

A recently completed four-hole diamond drill program has provided GreenTech Metals (ASX:GRE) with new information on the Osborne pegmatite trend, which is evolving into a very exciting target with some 700m of strike.

Arafura Rare Earths has signed gas supply agreements with the Mereenie joint venture partners for the supply of up to a combined 27.4 petajoules (PJ) of natural gas to the site from 2026 on a three-year term.

Dateline Resources (ASX:DTR) has hit wide, high grade gold during drilling at its Colosseum Gold Project in San Bernardino County, California, with the highlight being 70.1m @ 6.53g/t Au in drill hole CM23-14 Inc. 25.9m @ 15.31g/t Au.

Miramar Resources (ASX:M2R) today reported an electromagnetic (EM) survey currently under way over its Mount Vernon project in WA’s Gascoyne region has identified multiple, strong conductors which indicate the potential for nickel-copper sulphide mineralisation.

Lithium Universe (ASX:LU7) has started metallurgical test work on various sources of spodumene in response to the lithium conversion capacity gap in the North American market, to process spodumene feedstock from any part of the world, subject to freight and transportation costs.

Greenstone Resources (ASX:GSR) and Horizon Minerals (ASX:HRZ) have agreed to a merger, which will see Horizon acquire 100% of the fully paid ordinary shares in Greenstone and 100% of the listed Greenstone options, which will see Greenstone shareholders receive 0.2868 Horizon shares – a massive 89% premium to Greenstone’s last traded price on 9 February 2024 of $0.0055.

TRADING HALTS

Suvo Strategic Minerals (ASX:SUV) – pending an announcement regarding a capital raising.

Hammer Metals (ASX:HMX) – pending the release of an announcement in relation to drilling results.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.