Closing Bell: Benchmark ends lower, loses 2.2% for the week. China jitters, I suppose. It’s unpleasant to report and I’m not proud

How was the market today? Ruff. Pic via Getty Images

- ASX 200 closes about 0.3% lower, down well over 2.2% for the week.

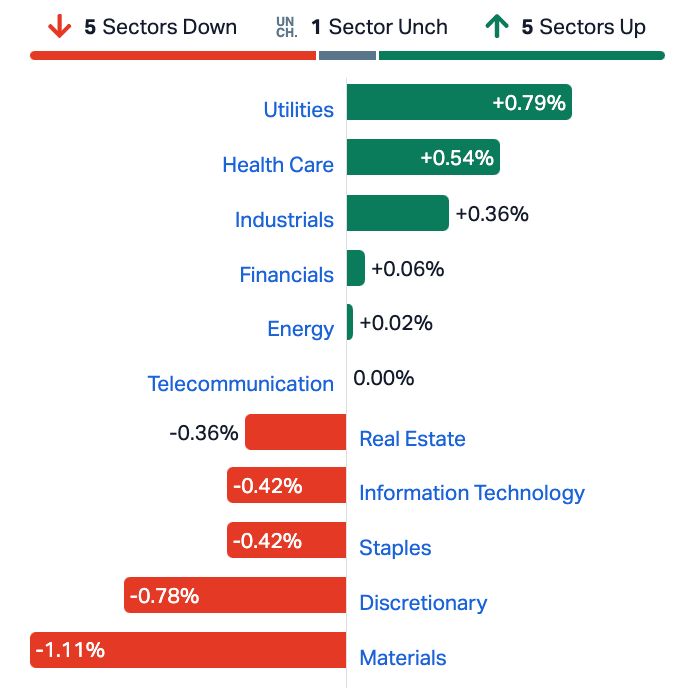

- Materials and Consumer discretionary weigh, Healthcare rises.

- Small caps led by Oliver’s Real Foods, which has leapt mightily despite having no fresh news.

The Aussie sharemarket has made it three losses straight to end a tough 5 sessions. The benchmark lost 0.3% on Friday to make it a walkback of well over 2.2% for the week.

Despite a punchy few hours of morning play which saw the Healthcare and Utilities Sectors head into the break undefeated, the broader ASX200 was down about 36 points or circa 0.5% at the luncheon interval (there is no break).

Investors remain rattled about China’s glass castle of an economy and its ticking time bomb of a property sector. With Wall Street wavering again overnight, it’d appear we’re not done starting at the shadow of the Federal Reserve either.

The iron ore majors were all down over 1%, but what caught the eye is the exit of fund manager Platinum Asset’s co-founder and CEO Andrew Clifford, reportedly following pressure from his co-cofounder Kerr Neilson who has more shares than Clifford.

Anyway, Platinum is also down about 1%, both outflows caused sans doubt by the after market release last night that Platinum has copped net outflows of circa $911mn last month.

Friday’s ASX sectors:

The ASX Emerging Co’s (XEC) index lost -0.35% on Friday and -1.9% for the week. The ASX Small Ords (XSO) shed -0.2 and -2.2%.

RIPPED FROM THE HEADLINES

What’s going on with Germany?

And well might you ask, as the EU’s formerly reliable centre of economic growth and manufacturing efficiency saw industrical production slide lower for a third straight month.

Overnight, the euro took a battering – pretty much since I left the EU this has been going on – an 8th straight week of losses against the USD, almost like the fix was in from the beginning. FX traders are apparently responding to an ever deepening disconnect between a German dragged EU economy, regularly copping a dressing down from the central bank boss Christine Lagarde and what’s going in on the states – which seems to be coping well in all weather.

The Euro meanwhile, is now 5% down since the last weeks of July and is a total bargain at US$1.07. It’s merde.

ARM wrestle

Last night was well timed for the soon to be Nasdaq-listed British boyband of tech, Arm Holdings which made the most of its investor roadshow by pumping FY revenue growth of an expected – but not in the bag – 11%… wait for it – to be followed up by a circa 25% improvement in fiscal 2025.

Reports filtering out of a very leaky investor lunch in New York overnight dropped the numbers but didn’t want to put their names to them.

Demand for anything remotely AI, wherein Arm has its hands on some reportedly quality processing and semiconductor chip tech – is the apparent driver.

Owned by Japan’s company crunching SoftBank Group, the Cambridge-based chip maker is looking to deliver what many expect will be the IPO of the year.

On Tuesday, according to an Arm filing with the US SEC (Securities and Exchange Commission) the poms struck a deal with Apple providing it access to Arm’s semiconductor component designs for use in its iPhone and Mac chips.

Arm is expected to go public on the Nasdaq in the coming weeks at a valuation as high as US$52 billion.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| TD1 | Tali Digital Limited | 0.002 | 100% | 24,000 | $3,295,156 |

| ZEU | Zeus Resources Ltd | 0.021 | 62% | 16,942,282 | $5,970,653 |

| EXT | Excite Technology | 0.0075 | 50% | 1,825,087 | $5,796,209 |

| ICN | Icon Energy Limited | 0.006 | 50% | 3,366,066 | $3,072,055 |

| MTH | Mithril Resources | 0.0015 | 50% | 40,000 | $3,368,804 |

| CRB | Carbine Resources | 0.01 | 43% | 465,103 | $3,862,164 |

| RMX | Red Mount Min Ltd | 0.005 | 43% | 1,044,809 | $8,835,229 |

| ODE | Odessa Minerals Ltd | 0.014 | 40% | 50,388,505 | $9,471,118 |

| MRI | Myrewardsinternation | 0.015 | 36% | 7,819,575 | $4,692,972 |

| OLI | Oliver'S Real Food | 0.023 | 35% | 487,781 | $7,492,443 |

| NAE | New Age Exploration | 0.008 | 33% | 61,925,815 | $8,615,393 |

| WCN | White Cliff Min Ltd | 0.009 | 29% | 5,554,096 | $8,799,130 |

| ASW | Advanced Share Ltd | 0.16 | 28% | 917,502 | $24,175,972 |

| ELS | Elsight Ltd | 0.485 | 28% | 938,526 | $57,121,441 |

| ECT | Env Clean Tech Ltd. | 0.0075 | 25% | 35,357,724 | $17,085,331 |

| ABE | Ausbondexchange | 0.125 | 25% | 91,496 | $3,875,310 |

| GTR | Gti Energy Ltd | 0.01 | 25% | 19,506,487 | $15,582,033 |

| LYN | Lycaonresources | 0.285 | 24% | 263,318 | $8,951,313 |

| SUH | Southern Hem Min | 0.026 | 24% | 2,577,802 | $11,063,933 |

| TZL | TZ Limited | 0.021 | 24% | 37,380 | $4,364,888 |

| LV1 | Live Verdure Ltd | 0.215 | 23% | 376,260 | $15,707,835 |

| AEV | Avenira Limited | 0.011 | 22% | 3,601,645 | $15,570,065 |

| BDG | Black Dragon Gold | 0.034 | 21% | 195,973 | $5,618,762 |

| MRR | Minrex Resources Ltd | 0.017 | 21% | 8,449,470 | $15,188,145 |

| R8R | Regener8Resourcesnl | 0.17 | 21% | 5,808 | $3,591,875 |

It wasn’t going to be long before we heard from Errawarra Resources (ASX:ERW) again.

The WA explorer (which has expanded its portfolio from nickel and lithium, to gold and graphite), is up once more, following the company’s impressive annual report, which dropped late Thursday.

The report provides a clear roadmap up front in Executive Chairman Thomas Reddicliffe’s letter to shareholders, which notes:

• The company’s main focus over the past year has been to secure the Andover West tenement in the Pilbara, where it is hunting “compelling nickel targets”…

• … as well as digging into some pretty compelling lithium nearology, too – what with the Azure Minerals (ASX:AZS) lithium success story being pretty much adjacent.

• Further exploration at the gold, nickel, graphite focused Errabiddy project is ongoing.

• Meanwhile, “the company has reviewed its commitment to its foundation projects at Binti Binti and Fraser Range, and is actively seeking to sell or Joint Venture these projects.”

The other day, ERW surged upwards after Errawarra closed a heavily-oversubscribed placement early, receiving commitments for $4.25 million from sophisticated investors to fund and accelerate its exploration.

Friday’s top gainers also include, Advanced Share Registry (ASX:ASW) up 32% while Gregor was watching, after revealing its entered a scheme of arrangement, which will see Automic Enterprise will buy 100% of the company, at $0.165 per share.

ASW closed at $0.125 yesterday, and is sitting right on top of Automic’s target price at lunchtime today. Autmoic Group, BTW, provide accounting services and finance functions to support compliance and ‘deliver efficiency to your business.’

Copper hunter Southern Hemisphere Mining (ASX:SUH) stock surged on Friday. It just so happens, Stockhead has a special report on SUH out just this week, like the legends we are.

Meanhwile, Robert Badman explains what happened here today:

SUH surged first, on the back of, first of all some funding news, and secondly, a substantial resource increase in the company’s flagship Llahuin copper project in Chile.

Regarding the first point, that’s actually news from midweek, but the gist is this…

In relation to a shortfall from the company’s pro-rata non-renounceable entitlement offer in July this year, Southern Hemisphere Mining has received binding commitments for the shortfallen securities, raising additional funds of more than $1.27m.

In total, the company advises it’s now successfully raised the full amount of $2.36m offered under the entitlement offer. And this will help enable the following…

Drilling at the Llahuin project is set to substantially increase the existing resource towards a 25 year-mine life, and this is piquing the interest of copper-hungry majors.

Chile, our special report on SUH this week notes, is the world’s largest copper producer and Southern Hemisphere’s Llahuin currently boasts a very large, open-pittable resource of 169Mt at 0.4% copper equivalent.

Oliver’s Real Food (ASX:OLI), which has wandered somewhat zombie-like to a 35.3% rise on zero news.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AMA | AMA Group Limited | 0.0605 | -43% | 88,090,387 | $113,444,983 |

| AFA | ASF Group Limited | 0.051 | -37% | 2,621 | $64,184,200 |

| M3M | M3Mininglimited | 0.082 | -37% | 2,803,948 | $6,046,729 |

| MXC | Mgc Pharmaceuticals | 0.002 | -33% | 749,107 | $13,283,905 |

| AD1 | AD1 Holdings Limited | 0.006 | -25% | 501,226 | $6,580,551 |

| CCE | Carnegie Cln Energy | 0.0015 | -25% | 11,485,469 | $31,285,147 |

| EDE | Eden Inv Ltd | 0.003 | -25% | 63,917,834 | $11,987,881 |

| PVS | Pivotal Systems | 0.003 | -25% | 4,721,723 | $3,073,517 |

| XTC | Xantippe Res Ltd | 0.0015 | -25% | 5,888,733 | $35,056,011 |

| COY | Coppermoly Limited | 0.011 | -21% | 303,298 | $7,421,777 |

| 88E | 88 Energy Ltd | 0.0065 | -19% | 72,406,940 | $165,287,509 |

| SIX | Sprintex Ltd | 0.022 | -19% | 45,000 | $8,336,106 |

| BSE | Base Res Limited | 0.185 | -18% | 1,418,065 | $265,052,666 |

| SRR | Saramaresourcesltd | 0.029 | -17% | 391,381 | $1,968,862 |

| ASP | Aspermont Limited | 0.01 | -17% | 1,739,263 | $29,265,164 |

| LML | Lincoln Minerals | 0.005 | -17% | 405,272 | $8,524,271 |

| TKL | Traka Resources | 0.005 | -17% | 7,706,900 | $5,227,976 |

| ODA | Orcoda Limited | 0.26 | -15% | 283,068 | $51,592,906 |

| YRL | Yandal Resources | 0.047 | -15% | 55,443 | $8,679,169 |

| DOU | Douugh Limited | 0.006 | -14% | 20,244 | $7,398,827 |

| VN8 | Vonex Limited. | 0.019 | -14% | 624,794 | $7,960,230 |

| EMP | Emperor Energy Ltd | 0.013 | -13% | 145,842 | $4,032,937 |

| GHY | Gold Hydrogen | 0.24 | -13% | 331,697 | $15,653,831 |

| AUE | Aurumresources | 0.105 | -13% | 35,359 | $3,000,000 |

| MGA | Metalsgrovemining | 0.105 | -13% | 23,000 | $4,464,060 |

TRADING HALTS

Galilee Energy (ASX:GLL) – Pending an announcement regarding changes to management team.

Recce Pharmaceuticals (ASX:RCE) – Pending news of a proposed capital raising.

Siren Gold (ASX:SNG) – Pending news of a proposed capital raising.

Bastion Minerals (ASX:BMO) – Pending news of a proposed material capital raising.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.