Closing Bell: Banks tumble after RBA finally cuts rates; Bullock speech sparks late selloff

The RBA slashed rates by 25 basis points today. Picture via Getty Images

- RBA cuts rates to 4.1pc after 13 months of holding steady

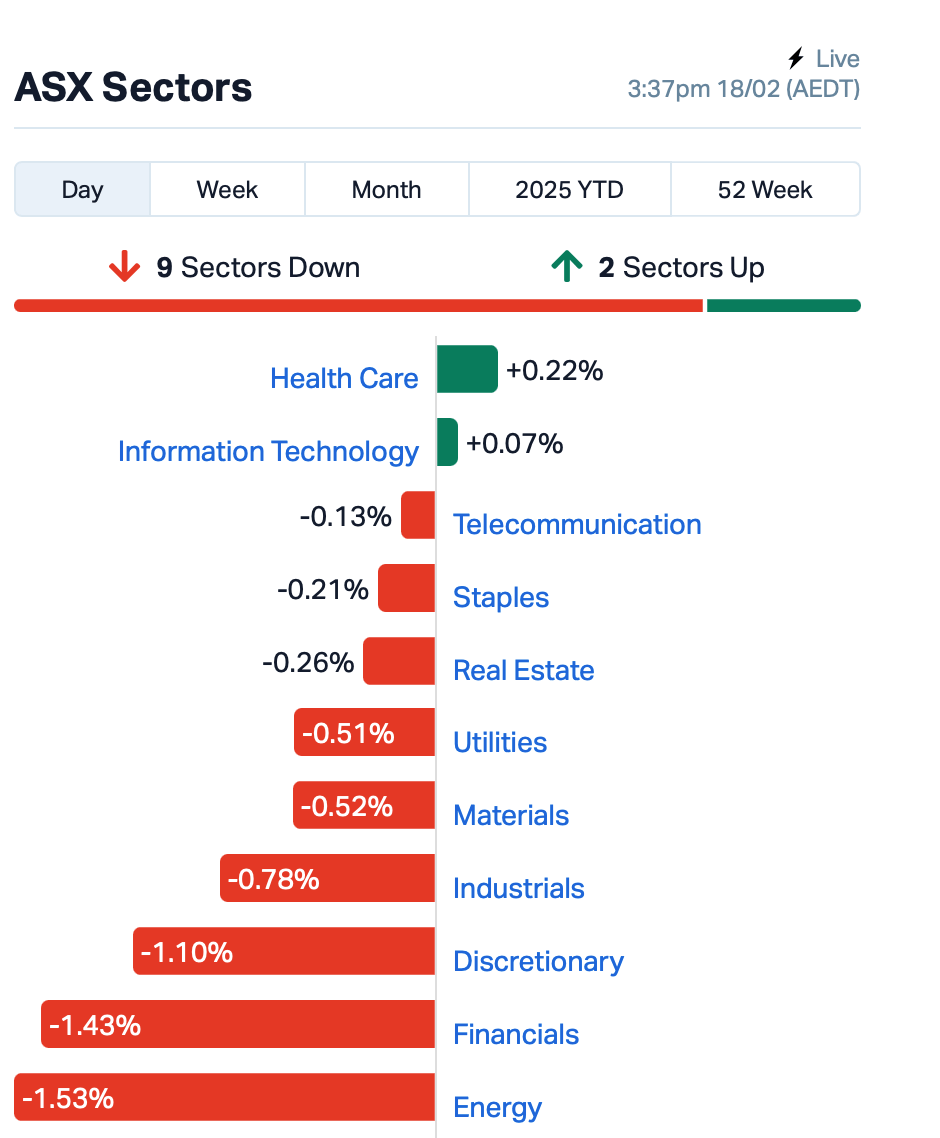

- Banks slash mortgage rates, stock prices drop

- Real estate and energy stocks also flounder

Well, it’s finally happened.

After holding the line at 4.35% for months on end – the highest the cash rate’s been in 13 years – the Reserve Bank of Australia (RBA) has decided to make a move and cut interest rates.

The decision to cut by 0.25 percentage points brought the rate to 4.1%.

This came after a long stretch where things felt like they were stuck in place, with the RBA keeping rates on hold since November 2023.

In a nutshell, the RBA said that it decided to finally cut rates because “inflationary pressures are easing a little more quickly than expected”.

Here’s the scoop straight from the RBA’s statement:

“There has also been continued subdued growth in private demand, and wage pressures have eased,” the RBA board said.

“These factors give the Board more confidence that inflation is moving sustainably towards the midpoint of the 2–3 per cent target range.”

Dr Grant Feng at Vanguard, however, said investors shouldn’t get too excited just yet.

“We believe that the RBA is likely to adopt a cautious stance towards further rate cuts, and that the pace of easing will be gradual throughout the year.”

And there’s been a late selloff on the ASX after RBA Governor Michele Bullock cooled down market hopes for multiple rate cuts this year, saying they’re “far too confident” and it all depends on the data.

She also warned about the unpredictable impact of US tariffs, which could hurt global activity and possibly raise inflation.

The benchmark ASX200 index dipped after her comments, closing the day down by 0.75%.

Westpac (ASX:WBC), National Australia Bank (ASX:NAB), Commonwealth Bank (ASX:CBA), and Australia and New Zealand Banking Group (ASX:ANZ) all fell after announcing they will drop their mortgage rates by 0.25%.

For anyone with a $500k home loan, that means an extra $90 in savings each month.

Not all financial stocks got hit, however.

HMC Capital (ASX:HMC) went on a tear, up 12%, thanks to a massive boost in assets under management.

Judo Capital Holdings (ASX:JDO) also got a bit of love, up 9%, after lifting its margin guidance.

In the energy sector, Woodside Energy Group (ASX:WDS) didn’t have a great day, falling 2%. The stock continued to drop from yesterday after hinting its final dividend might come in up to 20% below expectations.

And BHP (ASX:BHP) has slashed its half-year dividend by 31% to US50c due to global economic uncertainty and falling iron ore prices, though it still delivered nearly $4bn to shareholders. While profit soared 376% to US$4.4bn, underlying profit dropped 23% to US$5.1bn.

This is where things stood leading up to Tuesday’s close:

Meanwhile over in Asia, stocks are on the up after a meeting between President Xi and China’s biggest business names sparked a surge in tech shares.

Investors are hoping this signals an end to the harsh crackdown on private companies.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| ENL | Enlitic Inc. | 0.085 | 47% | 3,707,282 | $33,385,339 |

| DBO | Diablo Resources | 0.029 | 45% | 34,148,648 | $2,061,429 |

| IPB | IPB Petroleum Ltd | 0.007 | 40% | 3,755,720 | $3,532,015 |

| BDM | Burgundy D Mines Ltd | 0.062 | 29% | 6,200,015 | $68,223,949 |

| 1TT | Thrive Tribe Tech | 0.003 | 25% | 17,286,463 | $4,063,446 |

| EMT | Emetals Limited | 0.005 | 25% | 200,079 | $3,400,000 |

| FHS | Freehill Mining Ltd. | 0.005 | 25% | 204,272 | $12,314,111 |

| MSG | Mcs Services Limited | 0.005 | 25% | 1,156,422 | $792,399 |

| VEN | Vintage Energy | 0.005 | 25% | 5,264,943 | $6,678,125 |

| PER | Percheron | 0.009 | 21% | 11,803,928 | $7,612,063 |

| MGL | Magontec Limited | 0.255 | 21% | 2,500 | $11,961,983 |

| CDT | Castle Minerals | 0.003 | 20% | 509,722 | $4,742,035 |

| EVR | Ev Resources Ltd | 0.006 | 20% | 720,825 | $9,662,517 |

| MTB | Mount Burgess Mining | 0.006 | 20% | 1,640,594 | $1,697,687 |

| VFX | Visionflex Group Ltd | 0.003 | 20% | 170,000 | $8,419,651 |

| SNT | Syntara Limited | 0.085 | 20% | 8,172,656 | $112,130,233 |

| CGR | CGN Resources | 0.089 | 19% | 382,943 | $6,808,364 |

| C1X | Cosmosexploration | 0.085 | 18% | 497,298 | $7,449,595 |

| PNT | Panthermetalsltd | 0.010 | 18% | 23,960,140 | $2,109,451 |

| AVE | Avecho Biotech Ltd | 0.007 | 17% | 3,279,084 | $19,015,782 |

| SRN | Surefire Rescs NL | 0.004 | 17% | 1,684,250 | $7,248,923 |

| TMK | TMK Energy Limited | 0.004 | 17% | 9,112,423 | $27,976,695 |

| TZL | TZ Limited | 0.074 | 16% | 58,712 | $16,977,969 |

| GAL | Galileo Mining Ltd | 0.155 | 15% | 248,909 | $26,679,365 |

Enlitic (ASX:ENL) is teaming up with global player GE HealthCare and its subsidiary Laitek to revolutionise medical imaging migrations using AI. The collaboration will speed up the transition to GE HealthCare’s latest Enterprise Imaging and PACS solutions. With AI-powered tools, Enlitic said the migration process will optimise data quality and improve care decisions for healthcare providers worldwide.

Diablo Resources (ASX:DBO) has just locked in the Lisbon Valley Copper Project, a high-grade near-mine copper opportunity in Utah’s world-class Lisbon Valley Mining District. Initial sampling has shown rock chip assays hitting up to 45.7% copper and an average of 6.29%. With 750m of strike and copper mineralisation identified, DBO said it’s on track to explore and drill the area in 2025.

Syntara (ASX:SNT) said its topical drug, SNT-63021, has shown major progress in improving skin scars, with advanced imaging technology revealing it helps remodel scar tissue and improve blood flow, making scars look and act more like normal skin. After just three months, patients treated with SNT-63021 saw significant improvements, while placebo patients showed no change. This marks a global first for a drug in scar treatment.

CGN Resources (ASX:CGR) just wrapped up a successful UltraFine+ surface geochemistry program in December 2024, with results showing gold and IOCG pathfinder element enrichment over key targets. The company’s project-wide targeting study highlighted multiple new areas for IOCG, gold, and base metal exploration, with key spots like Horton, Snorky, and Shep reaffirmed as strong targets. The high-priority areas are ready for post-wet season drilling in April.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| BSA | BSA Limited | 0.170 | -83% | 24,706,602 | $74,229,819 |

| MOM | Moab Minerals Ltd | 0.001 | -50% | 196 | $3,133,999 |

| WEL | Winchester Energy | 0.001 | -50% | 625,000 | $2,726,038 |

| PHL | Propell Holdings Ltd | 0.012 | -37% | 1,318,533 | $5,288,424 |

| GGE | Grand Gulf Energy | 0.002 | -33% | 1,750,000 | $7,351,161 |

| ERL | Empire Resources | 0.003 | -25% | 303,720 | $5,935,653 |

| NSC | Naos Smlcap Com Ltd | 0.315 | -25% | 1,311,094 | $56,644,840 |

| ADD | Adavale Resource Ltd | 0.002 | -20% | 823,139 | $5,683,198 |

| BP8 | Bph Global Ltd | 0.004 | -20% | 373,640 | $2,416,541 |

| CTO | Citigold Corp Ltd | 0.004 | -20% | 744,444 | $15,000,000 |

| EXL | Elixinol Wellness | 0.029 | -19% | 44,807 | $7,949,525 |

| AJL | AJ Lucas Group | 0.009 | -18% | 290,907 | $15,133,026 |

| KLI | Killiresources | 0.050 | -17% | 273,949 | $8,413,425 |

| RWD | Reward Minerals Ltd | 0.050 | -17% | 361,269 | $15,973,174 |

| 1AI | Algorae Pharma | 0.005 | -17% | 4,451,312 | $10,124,368 |

| AR3 | Austrare | 0.083 | -16% | 483,608 | $15,739,983 |

| AZL | Arizona Lithium Ltd | 0.009 | -15% | 27,635,033 | $45,618,145 |

| CYB | Aucyber Limited | 0.115 | -15% | 97,021 | $22,081,054 |

| FBR | FBR Ltd | 0.018 | -14% | 48,947,037 | $106,257,034 |

| NES | Nelson Resources. | 0.003 | -14% | 16,356 | $7,601,747 |

| ODE | Odessa Minerals Ltd | 0.006 | -14% | 2,301,221 | $11,196,728 |

| SPQ | Superior Resources | 0.006 | -14% | 161,290 | $15,189,047 |

| STM | Sunstone Metals Ltd | 0.006 | -14% | 172 | $36,050,025 |

| VRC | Volt Resources Ltd | 0.003 | -14% | 390,882 | $15,852,877 |

BSA (ASX:BSA)’s shares plummeted more than 80% today after it got word from NBN Co that it hasn’t been chosen as a preferred bidder for the new NBN Field Services contract.

This contract represents about 80% of BSA’s revenue, and without it, the company’s future looks uncertain. BSA’s now scrambling to figure out next steps, including exploring other strategic options and planning for the worst-case scenario.

While the current NBN contract still runs until 2025, with no volume guarantees, this tender loss has investors worried.

IN CASE YOU MISSED IT

Frontier Energy (ASX:FHE) has strengthened its board with the appointment of former Western Power CEO Guy Chalkley as non-executive chairman. His expertise and leadership will be key in helping secure financing for the company’s Waroona renewable energy project.

Omega Oil and Gas (ASX:OMA) has also strengthened its board with the appointment of former BG Group COO Martin Houston as chairman. His expertise in gas development will help steer the company as it prepares to fracture stimulate and test the Canyon-1H horizontal well.

Maronan Metals (ASX:MMA) has reported encouraging flotation test results, delivering high-grade silver-lead concentrates with strong recoveries from its Queensland project. With an updated resource and scoping study on the horizon, the company is targeting production by 2030.

Miramar Resources (ASX: M2R) has secured a $291,413 R&D tax incentive for FY24, related to activities at its Whaleshark project in WA’s Ashburton region. The company views this tax credit, alongside recent funding from WA’s EIS, as a testament to the innovative exploration techniques being employed at Whaleshark.

Budding gold explorer Artemis Resources (ASX:ARV) has completed its $4 million raise, with the funds to support drilling at its Karratha project in WA. The company previously identified a number of priority targets, including the Marillion target, where drilling is resuming after being paused due to Cyclone Zelia.

Riversgold (ASX:RGL) has exercised its right to acquire 80% of the Kalgoorlie Gold – Northern Zone project, after exceeding the minimum dollar commitment announced in May 2023. The company is now focused on further drilling, with a rig booked to begin the 2025 drill program, aiming for a start in the coming weeks.

St George Mining (ASX:SGQ) is welcoming former industrial project specialist at CBMM, Carlos Alberto de Araújo, to its in-country management team to support the fast-tracked development of its high-grade niobium-REE Araxá project in Brazil. Araújo has extensive experience in niobium processing and phosphate operations, and will play a role in advising on plant design.

At Stockhead, we tell it like it is. While Frontier Energy, Omega Oil and Gas, Maronan Metals, Miramar Resources, Artemis Resources, Riversgold and St George Mining are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.