Closing Bell: Banks lead ASX recovery as CPI softens to 2021 levels

Finance and banking stocks propped up a falling ASX, surging on softening inflation data. Pic: Getty Images

- May CPI reading comes in soft at 2.1pc

- Low inflation prompts banking stock rally, lifting financials

- Banks and financials prop up flailing ASX, pulling market back into positive

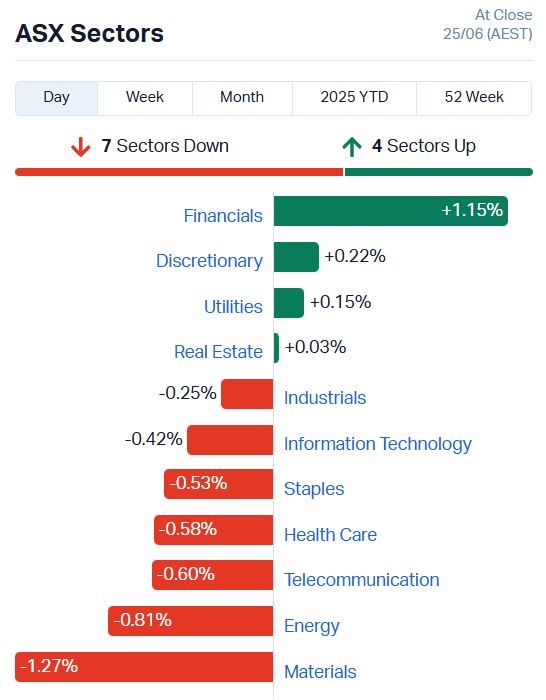

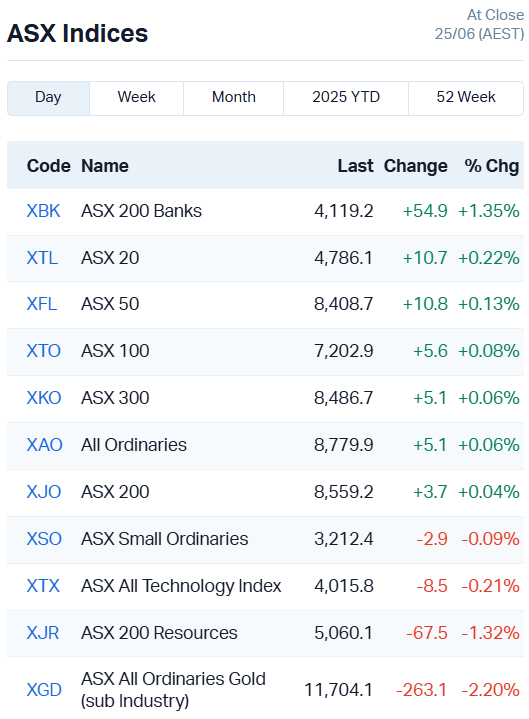

The ASX 200 recovered from a midday slump to add just 3.7 points or 0.04% today.

The recovery came after May’s inflation reading came in soft, prompting a rally in the financial sector. More on that in a moment.

The ASX 200 Resources (-1.3%) and ASX All Ord Gold (-2.2%) indices weighed heavily on the bourse, with several of the larger gold miners floundering.

Emerald Resources (ASX:EMR) fell 10.3%, Pantoro (ASX:PNR) 4%, Capricorn Metals (ASX:CMM) 4.7%, Perseus Mining (ASX:PRU) 3.4% and Northern Star Resources (ASX:NST) 2.3%.

RBA expected to cut rates in July as inflation falls

Australian consumers can breathe a sigh of relief as inflation continues to cool in the lucky country, falling to 2.1% over the year to May and 2.4% in terms of annual trimmed mean, a measure of underlying inflation.

That’s the lowest inflation rate we’ve experienced since November 2021, when half the world was in lockdown to tackle the Covid-19 pandemic.

What does it mean?

For one, the chance of the Reserve Bank cutting rates in July is getting pretty close to certain – the market is pricing an 88% probability at this stage.

“Today’s figures show the RBA is tantalisingly close to being declared the winner in its fight against inflation. Headline inflation dropped to 2.1% year on year in May,” Oxford Economics Australia economic analyst Ivy Yu said.

Yu reckons the rate cut is a strong possibility in July, but given the RBA prefers the more detailed quarterly CPI data, that cut could be pushed back to August.

“But the evidence is clear now; inflation is in a better position than expected, so there’s no need to wait – especially when household spending is sluggish and global events rattle confidence.”

Our seven major banking stocks moved higher on the news, adding between 0.64% and 1.75% while the ASX 200 Banks index climbed 1.35%.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| OVT | Ovanti Limited | 0.008 | 167% | 3.19E+08 | $9,016,545 |

| RLC | Reedy Lagoon Corp. | 0.002 | 100% | 5227468 | $776,707 |

| FTC | Fintech Chain Ltd | 0.003 | 50% | 420464 | $1,301,539 |

| TEG | Triangle Energy Ltd | 0.003 | 50% | 3781571 | $4,178,468 |

| ATR | Astron Corp Ltd | 0.65 | 49% | 175974 | $90,991,450 |

| SRJ | SRJ Technologies | 0.007 | 40% | 3865016 | $3,027,890 |

| OLY | Olympio Metals Ltd | 0.11 | 38% | 2611992 | $7,045,384 |

| HCD | Hydrocarbon Dynamics | 0.002 | 33% | 2466797 | $1,617,164 |

| MGU | Magnum Mining & Exp | 0.004 | 33% | 172779 | $3,364,953 |

| IFG | Infocusgroup Hldltd | 0.014 | 27% | 4400737 | $3,035,580 |

| EVG | Evion Group NL | 0.019 | 27% | 2289821 | $6,523,800 |

| NHE | Nobleheliumlimited | 0.03 | 25% | 2352993 | $14,388,600 |

| ADG | Adelong Gold Limited | 0.005 | 25% | 1863202 | $8,274,707 |

| AN1 | Anagenics Limited | 0.005 | 25% | 105000 | $1,985,281 |

| OMG | OMG Group Limited | 0.005 | 25% | 1721869 | $2,913,180 |

| PKO | Peako Limited | 0.0025 | 25% | 746857 | $2,975,484 |

| LIS | Lisenergylimited | 0.115 | 24% | 6354283 | $59,538,621 |

| TGH | Terragen | 0.021 | 24% | 560 | $8,585,292 |

| AHN | Athena Resources | 0.008 | 23% | 2559163 | $14,728,721 |

| ZMM | Zimi Ltd | 0.011 | 22% | 84220 | $3,847,894 |

| BPH | BPH Energy Ltd | 0.009 | 20% | 3048217 | $9,136,746 |

| RBX | Resource B | 0.03 | 20% | 429237 | $2,879,612 |

| DTI | DTI Group Ltd | 0.006 | 20% | 182964 | $4,147,098 |

| FRX | Flexiroam Limited | 0.006 | 20% | 200019 | $7,586,993 |

| OLI | Oliver'S Real Food | 0.006 | 20% | 2846964 | $2,703,660 |

Making news…

Ovanti (ASX:OVT) has brought ZIP Co (ASX:ZIP) executive Peter Maher onto the board as CEO of the company’s buy now, pay later division in the US.

Maher is current USA head of enterprise merchant partnerships at ZIP, with extensive experience in commercial expansion, enterprise growth and platform integrations in North America.

He’ll be leading the company’s US market entry strategy, managing commercial partnerships, platform activation and consumer product launch.

Reedy Lagoon (ASX:RLC) has drummed up a set of drilling targets at the Burracoppin gold project with a combination of magnetic and soil sampling data.

The company will be drill testing four prospects – Lady Janet, Windmills, Shear Luck and Zebra – in its quest for gold, with the target zones stretching up to 800m in strike length.

Astron Corporation (ASX:ATR) has gotten a tick of approval for a work plan from the Victorian government for the Donald rare earths and mineral sands project, taking it a step closer to a final investment decision.

ATR wants to fill the gap in rare earths supply for the US, responding to export restrictions from China. If the project goes ahead as planned, feedstock from Donald will be shipped to a mill in Utah to be processed into separate oxides for domestic North American customers and beyond.

Evion Group (ASX:EVG) has locked in a $400,000 order to supply a leading US-based graphite supply chain company with 80 metric tonnes of expandable graphite from its Panthera JV project in India.

EVG is in talks with several other potential offtake partners in the US, Europe and Asia, as an ex-Chinese source of expandable graphite. The company reckons this order is just the first of many, as demand from US industries grows.

Adelong Gold (ASX:ADG) has tapped experienced geologist Luke Olson as exploration manager, beginning July 1. Olson most recently worked on the Lauriston and Apollo gold projects, both of which are now owned by ADG.

The company is looking to ramp-up exploration across its Victorian gold portfolio and will be keen to leverage his local expertise.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AUK | Aumake Limited | 0.002 | -33% | 16655 | $9,070,076 |

| AXP | AXP Energy Ltd | 0.001 | -33% | 660000 | $10,027,021 |

| JAY | Jayride Group | 0.001 | -33% | 64010 | $2,141,834 |

| QXR | Qx Resources Limited | 0.002 | -33% | 621887 | $3,930,987 |

| RAN | Range International | 0.001 | -33% | 2836500 | $1,408,935 |

| PV1 | Provaris Energy Ltd | 0.012 | -29% | 4115559 | $11,866,022 |

| SHE | Stonehorse Energy Lt | 0.005 | -29% | 1381 | $4,791,046 |

| X2M | X2M Connect Limited | 0.019 | -27% | 3058223 | $10,092,728 |

| BP8 | Bph Global Ltd | 0.0015 | -25% | 29225 | $2,101,969 |

| HLX | Helix Resources | 0.0015 | -25% | 2542854 | $6,728,387 |

| VFX | Visionflex Group Ltd | 0.0015 | -25% | 7034438 | $6,735,721 |

| BVR | Bellavistaresources | 0.255 | -24% | 17071 | $33,795,656 |

| VAR | Variscan Mines Ltd | 0.007 | -22% | 1974500 | $7,045,719 |

| MIO | Macarthur Minerals | 0.015 | -21% | 105992 | $3,793,645 |

| OLH | Oldfields Holdings | 0.02 | -20% | 40500 | $5,326,478 |

| ANX | Anax Metals Ltd | 0.004 | -20% | 6554760 | $4,414,038 |

| CYQ | Cycliq Group Ltd | 0.002 | -20% | 1922500 | $1,151,292 |

| EAT | Entertainment | 0.004 | -20% | 75231 | $6,543,930 |

| FIN | FIN Resources Ltd | 0.004 | -20% | 899998 | $3,474,442 |

| KPO | Kalina Power Limited | 0.004 | -20% | 7946031 | $14,664,978 |

| LMG | Latrobe Magnesium | 0.008 | -20% | 5633324 | $26,265,900 |

| MEL | Metgasco Ltd | 0.002 | -20% | 179775 | $4,581,467 |

| OEL | Otto Energy Limited | 0.004 | -20% | 10745371 | $23,975,049 |

| SHP | South Harz Potash | 0.002 | -20% | 2476679 | $2,756,822 |

| AR9 | Archtis Limited | 0.165 | -20% | 2029116 | $59,033,266 |

IN CASE YOU MISSED IT

Trek Metals (ASX:TKM) has secured a diamond rig to carry out deeper drilling in parallel with RC drilling at its Christmas Creek gold project.

Break it Down: Astral Resources (ASX:AAR) has completed a PFS for its Mandilla gold project, highlighting strong economics amid a record gold price.

Greenvale Energy (ASX:GRV) is setting the stage for maiden drilling at its Oasis uranium project in Queensland where historical exploration had demonstrated continuous, high-grade mineralisation.

A thorough surface geochemistry review at Future Battery Minerals’ (ASX:FBM) Miriam project has identified 15 distinct gold anomalies and revealed an emerging 1.75km gold trend.

Stocktake: Indiana Resources (ASX:IDA) will pay out its shareholders 5 cents a share, after an ATO ruling that will make the cash return tax free.

RareX (ASX:REE) has entered a five-year deal with Curtin University to support Kenyan students in critical minerals education and training.

Taruga Minerals (ASX:TAR) is expanding its exploration plans at its new Thowagee project in the Gascoyne region of WA on the trail of gold, lead and silver trends.

TRADING HALTS

Astron Corporation (ASX:ATR) – work plan application update

Percheron Therapeutics (ASX:PER) – pending licensing deal

PointsBet Holdings (ASX:PBH) – outcome of scheme meeting

hummgroup (ASX:HUM) – potential acquisition offer

Xero Limited (ASX:XRO) – corporate transaction and equity raise

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.