Closing Bell: Banks coax ASX back to neutral to dodge fifth day of losses

Strong daily gains from WBC and CBA were enough to tempt the ASX back into positive territory by the last hour of trade. Pic: Getty Images

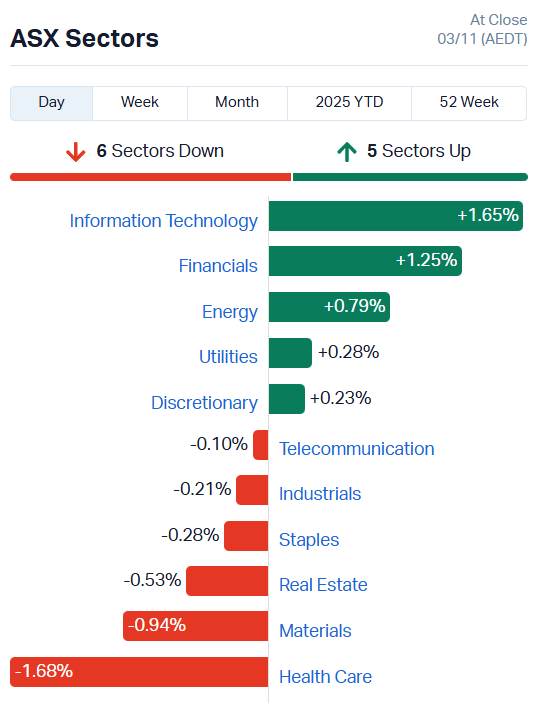

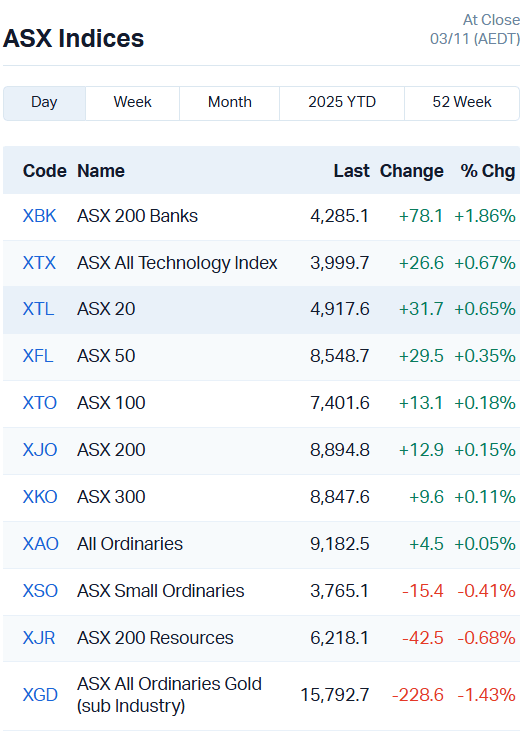

- ASX bounces off lows of -0.59pc to gain 0.15pc

- Info tech, banking stocks lead gains

- US-China trade truce undercuts critical mineral stocks

Westpac fuels banking wins

The ASX 200 was set to notch a fifth day of losses before staging a last-minute recovery, mostly on the back of the finance sector.

The market ended trade up 12.9 points or 0.15%, having bounced from lows of -0.59%. Just five of 11 sectors gained, though – led by info tech.

Solid numbers from Westpac’s (ASX:WBC) quarterly report fuelled a slow rally in the broader banking index that built through the day, finally breaking the ASX out of the negatives in the last hour of trade.

WBC’s net profit after tax fell about 1% to $6.9 billion, beating Citi Bank’s expectation of $6.807 billion.

The bank also beat net interest margin expectations by 0.5%, total dividend predictions by 0.7% and its CET1 ratio came in higher than predicted by 20 basis points (12.5% vs 12.3%).

Westpac added 2.92% in trade today, with the other major banks adding between 0.15% and 0.89%. Commonwealth (ASX:CBA) stood out, jumping 2.27%.

China and US call truce on rare earths rumble

The rare earths and critical mineral rally may be on pause for now, after the US and China revealed the official details of their most recent trade truce.

Beijing has agreed to suspend its current rare earth controls on gallium, germanium, antimony and graphite (imposed in 2022 and 2025) and pause its more restrictive controls announced in October for a full year.

In return, the US will pause its tariffs for another year, take a further 100% tariff threat fully off the table, and halve fentanyl-related tariffs to 10%.

It’s a bit of a Band-Aid solution, largely delaying export controls rather than removing them, but it’s bought the global economy some time.

China has also agreed to drop some antitrust investigations into Nvidia and Qualcomm among others, buy 12 million tonnes of US soy beans this year, and resume specific semiconductor shipments.

While the uneasy ceasefire has eased the urgency around securing ex-Chinese sources of critical minerals, the need to build out those supply chains is still very much present.

In the short term, though, critical mineral stocks are likely to look a little deflated.

Dateline Resources (ASX:DTR) is one such victim, alongside Lynas (ASX:LYC), European Lithium (ASX:EUR) and Australian Strategic Materials (ASX:ASM).

They topped the biggest fallers lists on the ASX 200 today, shedding between 11% and 8% each.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| DTI | DTI Group Ltd | 0.016 | 220% | 9451208 | $4,485,514 |

| MRD | Mount Ridley Mines | 0.055 | 72% | 2.44E+08 | $38,197,813 |

| AUR | Auris Minerals Ltd | 0.03 | 50% | 14302164 | $10,962,397 |

| VML | Vital Metals Limited | 0.3 | 30% | 1534096 | $33,693,639 |

| IMA | Image Resources NL | 0.078 | 30% | 14800873 | $66,965,132 |

| PHO | Phosco Ltd | 0.125 | 29% | 2101198 | $42,517,181 |

| EMT | Emetals Limited | 0.007 | 27% | 8498230 | $4,675,000 |

| SFX | Sheffield Res Ltd | 0.125 | 26% | 5935491 | $39,157,203 |

| BVR | Bellavistaresources | 0.52 | 25% | 505448 | $42,250,135 |

| AYM | Australia United Min | 0.005 | 25% | 279626 | $7,370,310 |

| JAV | Javelin Minerals Ltd | 0.0025 | 25% | 46867832 | $15,584,450 |

| NTM | Nt Minerals Limited | 0.0025 | 25% | 1710428 | $2,421,806 |

| AR3 | Austrare | 0.255 | 21% | 3695661 | $46,257,813 |

| BB1 | Blinklab Limited | 0.79 | 21% | 2081909 | $57,352,556 |

| AQX | Alice Queen Ltd | 0.006 | 20% | 12606881 | $6,923,481 |

| ERA | Energy Resources | 0.003 | 20% | 3139037 | $1,013,490,602 |

| LKY | Locksleyresources | 0.4125 | 20% | 18838688 | $97,807,142 |

| AU1 | The Agency Group Aus | 0.025 | 19% | 1016945 | $9,231,108 |

| UNT | Unith Ltd | 0.013 | 18% | 5475742 | $16,710,196 |

| 8CO | 8Common Limited | 0.033 | 18% | 322803 | $6,274,657 |

| EMD | Emyria Limited | 0.067 | 18% | 5160540 | $38,070,788 |

| EME | Energy Metals Ltd | 0.115 | 17% | 63378 | $20,548,965 |

| RGT | Argent Biopharma Ltd | 0.088 | 17% | 30861 | $5,832,665 |

| LDX | Lumos Diagnostics | 0.24 | 17% | 5349316 | $161,100,770 |

| HVY | Heavymineralslimited | 0.49 | 17% | 146415 | $28,704,309 |

In the news…

Mount Ridley Mines (ASX:MRD) has welcomed former Locksley Resources (ASX:LKY) head of critical minerals Allister Caird as CEO, effective November 6.

Management says the appointment strengthens the company’s technical and strategic capabilities as it advances its rare earth and critical minerals portfolio across the Esperance region of WA.

Caird was instrumental in securing a key technology partnership with Rice University in the US, the kind of global connections MRD will be keen to establish as it builds out critical mineral offtake potential.

Image Resources (ASX:IMA) has fended off an ASX price query after being hit with a speeding ticket today. The company points to an independent article from the ABC referencing IMA in connection to defence-vital critical mineral supplies. There’ll be a related Four Corners piece aired this evening.

Bellavista Resources (ASX:BVR) has brought former De Grey Mining (ASX:DEG) managing director Glenn Jardine into the fold as its own freshly minted managing director.

Peter Canterbury, who served as CFO at De Grey Mining from February 2021 until its takeover by Northern Star, will also be joining the board as finance director.

BVR will be keen to leverage their extensive experience in developing its own Edmund Basin projects, targeting base metal deposits, IOCG-style copper-silver-gold, and sulphide nickel and platinum group metal deposits.

Locksley Resources (ASX:LKY) has fielded a letter of intent from the US Export-Import Bank offering up to US$191 million in financing support for its Mojave antimony and rare earths project in California.

It’s a huge win for the company’s US-based strategy, which involves building out an integrated 100% American-made antimony and REE supply chain.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AFA | ASF Group Limited | 0.086 | -75% | 1008731 | $277,339,137 |

| ROG | Red Sky Energy. | 0.003 | -40% | 35111060 | $27,111,136 |

| KEY | KEY Petroleum | 0.063 | -36% | 112277 | $3,350,444 |

| BMO | Bastion Minerals | 0.001 | -33% | 6682500 | $3,354,675 |

| GLA | Gladiator Resources | 0.0175 | -27% | 14709035 | $19,532,457 |

| OLI | Oliver'S Real Food | 0.009 | -25% | 914 | $6,488,783 |

| TRE | Toubani Res Ltd | 0.295 | -23% | 8215093 | $200,837,062 |

| BDG | Black Dragon Gold | 0.05 | -23% | 3282674 | $20,770,711 |

| DY6 | Dy6Metalsltd | 0.125 | -22% | 1009981 | $15,641,165 |

| PVT | Pivotal Metals Ltd | 0.018 | -22% | 1.58E+08 | $24,525,286 |

| CR9 | Corellares | 0.004 | -20% | 20000 | $5,037,849 |

| RKB | Rokeby Resources Ltd | 0.004 | -20% | 676396 | $9,132,806 |

| SRN | Surefire Rescs NL | 0.002 | -20% | 1131885 | $10,064,023 |

| GGR | Goldengloberesources | 0.155 | -18% | 529974 | $21,239,231 |

| CRI | Critica Ltd | 0.028 | -18% | 11207558 | $92,055,174 |

| PIM | Pinnacleminerals | 0.14 | -18% | 426182 | $17,078,780 |

| EQS | Equitystorygroupltd | 0.01 | -17% | 845012 | $2,122,174 |

| OVT | Ovanti Limited | 0.005 | -17% | 14018776 | $33,094,738 |

| TFL | Tasfoods Ltd | 0.005 | -17% | 791357 | $2,622,573 |

| TM1 | Terra Metals Limited | 0.155 | -16% | 7016981 | $124,397,844 |

| 8IH | 8I Holdings Ltd | 0.026 | -16% | 140550 | $10,792,987 |

| SCN | Scorpion Minerals | 0.026 | -16% | 2230764 | $16,253,492 |

| FLC | Fluence Corporation | 0.105 | -16% | 600981 | $135,982,699 |

| RKT | Rocketdna Ltd. | 0.016 | -16% | 6173656 | $17,394,942 |

| BLG | Bluglass Limited | 0.011 | -15% | 413526 | $33,990,004 |

In Case You Missed It

The first surgical case using Orthocell’s (ASX:OCC) flagship nerve repair product Remplir has been successfully undertaken in Hong Kong.

Resolution Minerals’ (ASX:RML) drilling at the Golden Gate prospect of the Horse Heaven project in Idaho has returned up to 253m at 1.5g/t and delivered three holes ending in gold.

Western Gold Resources’ (ASX:WGR) grade control drilling has delivered high-grade, continuous intersections that confirm the Gold Duke geological model.

White Cliff Minerals (ASX:WCN) has acquired the Bornite Lake project, a move cementing control over one of Canada’s most prospective fault zones.

Flynn Gold’s (ASX:FG1) drilling at the greenfields Grenadier discovery has confirmed the presence of high-grade gold beneath surface veins on Tasmania’s northeast coast.

Future Battery Minerals (ASX:FBM) has uncovered multiple untested kilometre-scale targets at the Randalls project in WA’s Goldfields, using decades-old data.

Loyal Metals (ASX:LLM) is preparing for more works at Highway Reward after securing a $3.5 million placement.

Last Orders

Petratherm (ASX:PTR) has initiated resource definition drilling at the Rosewood titanium project, covering a 40-square-kilometre zone. PTR intends to drum up a maiden resource for the project with the fresh drilling data, with plans for more than 400 holes over 8000 metres.

Trading Halts

Greenvale Energy (ASX:GRV) – cap raise

Infinity Mining (ASX:IMI) – cap raise

Melbana Energy (ASX:MAY) – results of testing at Amistad-2 well, Cuba

Olympio Metals (ASX:OLY) – cap raise

Tryptamine Therapeutics (ASX:TYP) – cap raise

Bentley Capital (ASX:BEL) – ASX price query

Piche Resources (ASX:PR2) – cap raise

LCL Resources (ASX:LCL) – periodic reporting compliance failure

At Stockhead, we tell it like it is. While Petratherm, Mount Ridley Mines and Locksley Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.