Closing Bell: Banks and gold stocks push ASX to high note for second week of September

Three of the ASX’s biggest sectors came together to give the market a win today, with iron ore, gold and banking stocks joining forces to lift the bourse into the green for the week. Pic: Getty Images

- ASX lifts 0.68pc, virtually unchanged for second week of September

- Gains in banks, iron ore and gold stocks core driver of strength

- Energy drags, down more than 2pc

Iron, banks and gold

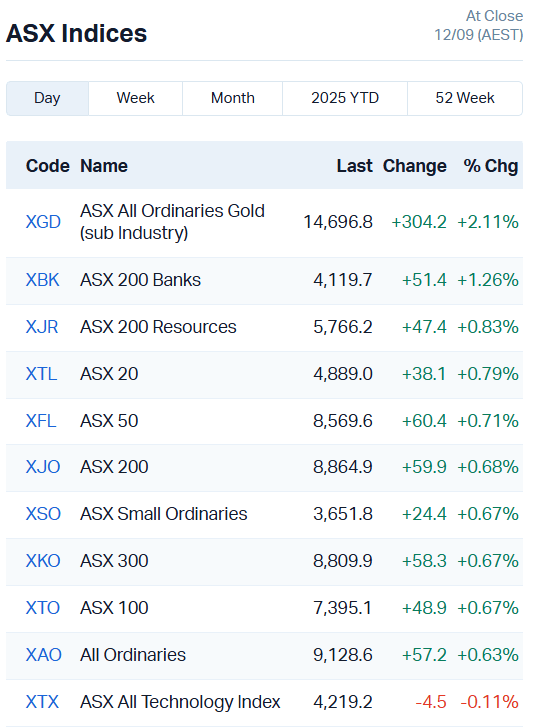

The ASX 200 lifted 0.68% or 59.9 point today, just about returning to the same levels we started the week at with 8864 points.

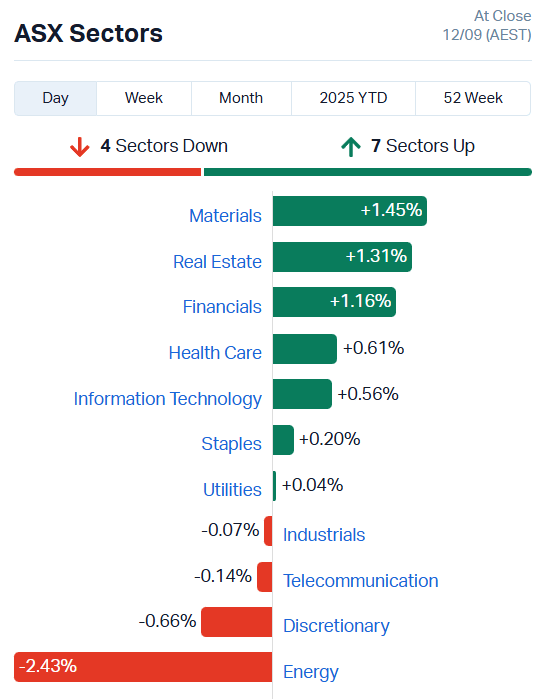

It was a team effort, but most of the gains came from our two strongest sectors.

Materials had a two-pronged boost, benefiting both from a weekly rise to iron ore prices – for a third week straight – and continued all-time high gold prices.

While they weren’t huge swings, the iron ore giants are large enough segments of our market that we certainly notice them.

BHP (ASX:BHP) added 1.3%, Rio Tinto (ASX:RIO) climbed 1%, and Fortescue (ASX:FMG) ticked up 0.86%.

The major banks were dancing to the same tune, lifting their index 1.26%.

All seven majors – bar Suncorp (ASX:SUN), which added only 0.6% – climbed at least 1% each.

As for our goldies, it was the usual suspects that made the market dial move most.

Northern Star (ASX:NST) added 1.6%, Newmont (ASX:NEM) 2.2%, Evolution Mining (ASX:EVN) 2% and Ramelius Resources (ASX:RMS) 2.8%.

Woodside Energy gets final green light for North West Shelf

The federal government has given Woodside Energy (ASX:WDS) the final approvals necessary to extend the run life of the North West Shelf project out to 2070.

Originally slated to end production in 2030, the second largest liquefied natural gas plant in Australia will now have the option to run for a further 40 years.

WDS agreed to several conditions imposed by the federal government after several rounds of legal challenges over the 7-year application process.

“This approval is subject to 48 strict conditions designed to protect 60,000-year-old rock art in the Pilbara region,” Federal Environment Minister Murray Watt said.

The rock art in question is the Murujuga rock art, a collection of more than one million petroglyphs on the Murujuga (Burrup) Peninsula and surrounding islands in Western Australia.

The area was granted UNESCO World Heritage status back in July after a two-year-long nomination process.

Just yesterday, Vanuatu’s climate minister warned the Australian government that the North West Shelf extension approval could violate a recent International Court of Justice (ICJ) ruling on climate change.

“The advisory opinion of the International Court of Justice made it clear that going down the fossil fuel production expansion [path] is an internationally wrongful act, under international law,” he said.

A Woodside spokesperson decline to respond to those comments, instead saying the approval would “secure the ongoing operation and project and the thousands of direct and indirect jobs that it supports”.

Prime Minister Albanese said simply that his government would “act in Australia’s interests”.

“We know that gas has an important role to play in the transition. We’ll continue to make decisions based upon our domestic law,” he said.

Woodside shares slipped 3.3% to $24.22 each today despite obtaining the final go-ahead.

The broader energy sector is sliding on expectations of an incoming crude oil glut. Brent futures sliding 1.7% overnight as OPEC+ increases output.

“Oil prices are falling today in response to bearish IEA headlines, which suggest massive oversupply on the oil market next year,” said Carsten Fritsch, an analyst at Commerzbank.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| T3D | 333D Limited | 0.16 | 103% | 7158639 | $14,919,451 |

| PAB | Patrys Limited | 0.002 | 100% | 788821 | $4,583,757 |

| ALM | Alma Metals Ltd | 0.006 | 50% | 2702687 | $7,428,948 |

| BMO | Bastion Minerals | 0.0015 | 50% | 678000 | $2,204,953 |

| PRX | Prodigy Gold NL | 0.003 | 50% | 1580032 | $13,483,725 |

| L1M | Lightning Minerals | 0.055 | 38% | 12085043 | $7,568,133 |

| LKY | Locksleyresources | 0.485 | 35% | 42041747 | $90,687,827 |

| TG1 | Techgen Metals Ltd | 0.036 | 33% | 4086782 | $8,139,551 |

| BMM | Bayanminingandmin | 0.2 | 25% | 7042064 | $21,324,260 |

| DTM | Dart Mining NL | 0.0025 | 25% | 5007311 | $2,749,052 |

| MEL | Metgasco Ltd | 0.0025 | 25% | 500000 | $3,674,173 |

| RLG | Roolife Group Ltd | 0.005 | 25% | 923404 | $7,513,982 |

| SER | Strategic Energy | 0.005 | 25% | 1699999 | $3,346,767 |

| TKL | Traka Resources | 0.0025 | 25% | 750000 | $4,844,278 |

| VEN | Vintage Energy | 0.005 | 25% | 996639 | $8,347,655 |

| BSA | BSA Limited | 0.13 | 24% | 8596312 | $7,906,527 |

| LTP | Ltr Pharma Limited | 0.575 | 24% | 2999518 | $52,062,778 |

| AT1 | Atomo Diagnostics | 0.022 | 22% | 13190281 | $14,583,155 |

| THB | Thunderbird Resource | 0.017 | 21% | 1916505 | $5,456,380 |

| OLL | Openlearning | 0.023 | 21% | 1890073 | $9,173,352 |

| ABE | Ausbondexchange | 0.036 | 20% | 59643 | $3,380,043 |

| ASE | Astute Metals NL | 0.018 | 20% | 1467537 | $10,663,061 |

| AOA | Ausmon Resorces | 0.003 | 20% | 7475887 | $3,278,034 |

| FIN | FIN Resources Ltd | 0.006 | 20% | 200000 | $3,474,442 |

| KGD | Kula Gold Limited | 0.012 | 20% | 11571150 | $10,366,383 |

In the news…

333D (ASX:T3D) is riding a bullish cryptocurrency wave, surfing more than 100% to $0.16 a share on no fresh news.

T3D copped a speeding ticket from the ASX today, but management essentially shrugged in response, pointing to its Bitcoin reserve strategy as a possible draw for the massive influx of investor cash.

In August, the company bought just over 2 BTC for $370,500, with plans to convert all excess cash into Bitcoin moving forward. Seems the market approves of the strategy.

Bastion Minerals (ASX:BMO) is looking to build out its copper-gold resource at the ICE project in Canada with a regional geochemical campaign.

BMO says the results will inform the next stage of exploration at ICE, which already holds a 2012 JORC resource of 6.43Mt at 1.07% copper.

Astute Metals (ASX:ASE) is drill testing six targets at the Needles gold project in Nevada, US, chasing high-grade results up to 33/g/t gold and 622 g/t silver.

ASE is putting drills to ground at the Eastern Shaft historical mine, Tomahawk trend, Arrowhead Mine, Arrowhead East target and Whopper Junior pathfinder anomaly.

When the program is finished – in about two weeks – the drill rigs will head straight over to the Red Mountain lithium project, where they’ll work toward a maiden resource estimate for the end of the calendar year.

Continuing the exploration theme, Ausmon Resources (ASX:AOA) is putting its own drilling rigs to work at its tenements along the Limestone Coast of South Australia, on the hunt for rare earth elements.

AOA intends to drill a total of 18 holes, looking to get a better feel for the geological conditions and a better understanding of a rare earth trend the company has identified over a 122 km2 area.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| NES | Nelson Resources. | 0.003 | -25% | 2011033 | $8,687,711 |

| HFR | Highfield Res Ltd | 0.068 | -24% | 3162656 | $42,192,857 |

| AN1 | Anagenics Limited | 0.004 | -20% | 2000 | $2,481,602 |

| CTN | Catalina Resources | 0.004 | -20% | 9872534 | $12,130,095 |

| MQR | Marquee Resource Ltd | 0.0105 | -19% | 32840492 | $9,534,187 |

| ADR | Adherium Ltd | 0.005 | -17% | 92215 | $11,179,048 |

| M2R | Miramar | 0.0025 | -17% | 480001 | $3,584,770 |

| TEG | Triangle Energy Ltd | 0.0025 | -17% | 3000016 | $6,567,702 |

| KLR | Kaili Resources Ltd | 0.28 | -16% | 816983 | $49,379,122 |

| H2G | Greenhy2 Limited | 0.011 | -15% | 738946 | $8,942,854 |

| GRV | Greenvale Energy Ltd | 0.051 | -15% | 298047 | $32,707,401 |

| AX8 | Accelerate Resources | 0.006 | -14% | 223618 | $5,720,321 |

| DTI | DTI Group Ltd | 0.006 | -14% | 325090 | $6,279,720 |

| MMR | Mec Resources | 0.006 | -14% | 1689347 | $13,103,929 |

| BDG | Black Dragon Gold | 0.068 | -13% | 780815 | $24,924,853 |

| AM5 | Antares Metals | 0.007 | -13% | 1671943 | $4,118,823 |

| E25 | Element 25 Ltd | 0.295 | -12% | 1047289 | $76,585,154 |

| SUM | Summitminerals | 0.037 | -12% | 954951 | $3,720,195 |

| AAJ | Aruma Resources Ltd | 0.008 | -11% | 295393 | $2,951,465 |

| CAV | Carnavale Resources | 0.004 | -11% | 1151518 | $18,405,983 |

| JAY | Jayride Group | 0.004 | -11% | 12044067 | $6,425,501 |

| OEL | Otto Energy Limited | 0.004 | -11% | 418017 | $21,577,544 |

| JLL | Jindalee Lithium Ltd | 0.53 | -11% | 239234 | $47,523,153 |

| ILA | Island Pharma | 0.295 | -11% | 641097 | $83,746,331 |

| MKR | Manuka Resources. | 0.034 | -11% | 2929934 | $40,484,624 |

In Case You Missed It

Ora Banda Mining’s (ASX:OBM) Davyhurst resources rose 160,000oz to 2.11Moz despite producing 108,000oz of gold from June 1, 2024.

Altech Batteries (ASX:ATC) has passed key milestones in the development of its CERENERGY cell and battery pack prototypes.

Verity Resources’ (ASX:VRL) review of historical drilling data has highlighted broad, high-grade gold intercepts at the Monument project.

Trading halts

DY6 Metals (ASX:DY6) – material acquisition

Lakes Blue Energy (ASX:LKO) – cap raise

OzAurum Resources (ASX:OZM) – feasibility / project update

PolyNovo Limited (ASX:PNV) – trial results announcement

Rapid Critical Metals (ASX:RCM) – cap raise

Revolver Resources Holdings (ASX:RRR) – cap raise

Tivan Limited (ASX:TVN) – project acquisition & cap raise

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.