Closing Bell: Australian resources dominate as ASX storms higher

Via Getty

- Energy stocks have lifted the ASX200 almost 0.83% higher on Tuesday

- 9 of the 11 ASX Sectors were trading in the green

- Small caps led by MTC, CPM

The commodity-heavy Australian share market has rebounded handsomely on Tuesday off the back of some enthusiasm for old school resources names.

The Energy Sector was ahead by almost +3% at about 3.30pm when some late profit taking took some cream off the top of what were some pretty epic intraday gains, while an array of mining stocks benefited from the upsurge in underlying commodity prices.

“No other major stock market index is so dominated by just two sectors,” says Morningstar’s Brian Han director of equities ANZ. “With financials accounting for 28.8% on the one end and materials making up 24.8% on the other.”

That’s why. when these two sectors are on song, everyone follows.

At match out, the benchmark ASX200 was 58 points or 0.83% higher at 7,007 points, its highest intraday gain this month.

BHP (ASX:BHP) , Rio Tinto (ASX:RIO) and Fortescue Metals Group (ASX:FMG) lifted more than 1% each as iron ore futures extended gains into a 4th consecutive day.

Gold and lithium producers also climbed.

After losing momentum with two straight sessions of losses, the ASX 200 index was supported by strong buying in energy names which until today were looking mighty oversold following eight straight losing sessions.

WTI crude futures climbed to around US$78.5 per barrel on Tuesday, rising for the fourth straight session after OPEC said market fundamentals remained strong and attributed the recent price drop to financial market speculators

The Energy XEJ index was triggered by the overnight jump in oil prices, but all the consituents seemed to benefit, including many of the uranium names.

Leading the way, Beach Energy and Paladin Energy climbing thriughout the session as worries around weak US and Chinese oil demand seemed to evaporated during the previous night of trade in New York.

Goldman Sachs has done its bit too by predicting outsized returns of 21% on commodity prices over the next 12 months, saying commodities will rise as monetary policy eases, and because traders will be buying commodities to hedge against geopolitical supply risks.

What else?

Aussie consumer sentiment is now wallowing somewhere down at “deeply pessimistic” levels, according to the constant reminder that is the Westpac-Melbourne Institute Consumer Sentiment read.

While NAB’s business confidence index for October has its lowest read in 6 months.

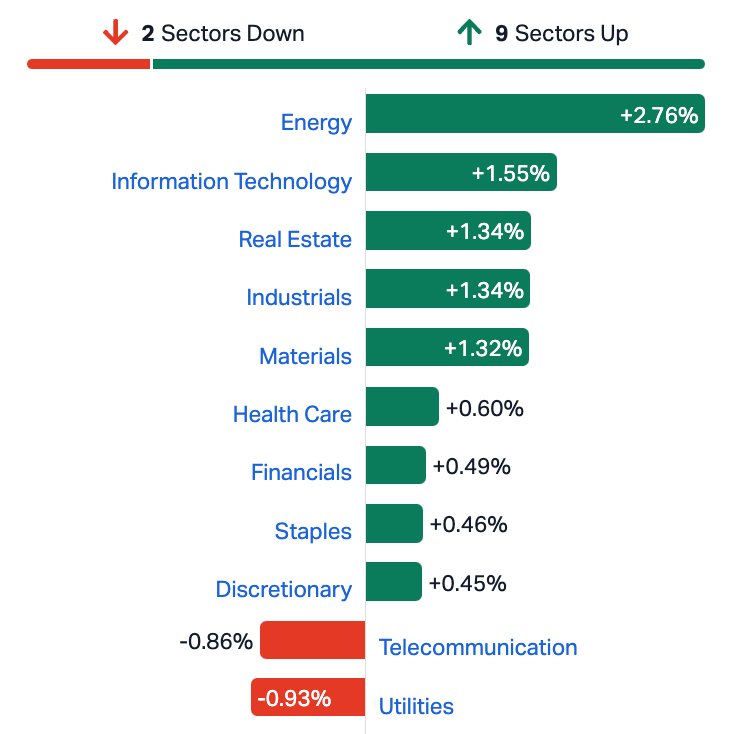

ASX SECTORS ON TUESDAY

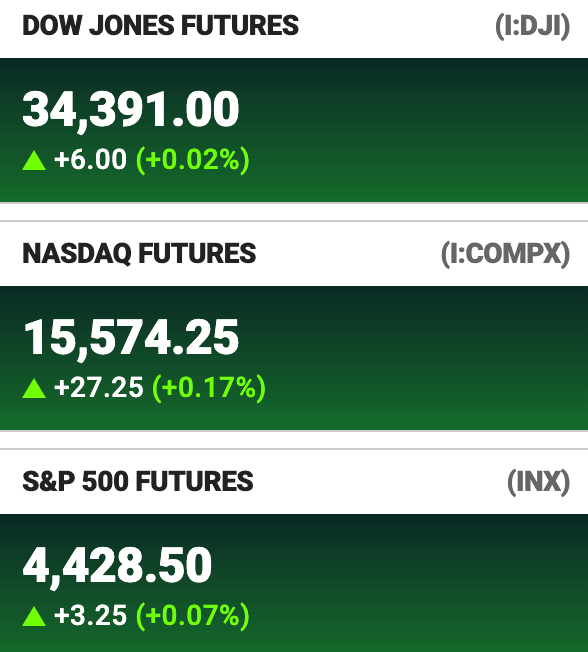

The major US averages were mixed overnight. The S&P 500 down a smidgen, by -0.09%, the Dow Jones up by +0.16% and tech heavy Nasdaq lower by -0.22%.

US inflation data due out on Wednesday has US investors in a holding pattern.

Overnight Wall Street also digested the downgrade on the US credit outlook to Negative from Stable, by Moody’s. The the ratings agency seeing increased downside risks to US fiscal strength. I’m no ratings agency, but the US economy looks pretty reilient.

Tesla led US stocks up +4.2%, while Boeing also took off adding +4% on news that China might start buying its planes again.

Futures tied to the S&P 500, the Dow Jones Industrial Average and the Nasdaq are all on the right side of green at 9.30pm in New York.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for Tuesday [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap MTC Metalstech Ltd 0.22 83% 2,436,757 $22,632,551 CPM Coopermetalslimited 0.22 57% 9,935,336 $7,450,471 RDN Raiden Resources Ltd 0.07 49% 152,109,173 $112,146,570 AVE Avecho Biotech Ltd 0.005 43% 11,638,553 $9,444,022 ERW Errawarra Resources 0.19 41% 6,075,852 $12,949,290 ADS Adslot Ltd. 0.004 33% 1,129,329 $9,673,487 SBR Sabre Resources 0.046 28% 26,458,483 $12,858,795 MAG Magmatic Resrce Ltd 0.074 28% 843,165 $17,730,182 YRL Yandal Resources 0.07 27% 1,211,449 $8,679,169 FNX Finexia Financialgrp 0.285 27% 25,043 $10,890,608 CRB Carbine Resources 0.005 25% 500,000 $2,206,951 ME1 Melodiol Glb Health 0.0025 25% 7,193,695 $7,668,207 MKL Mighty Kingdom Ltd 0.02 25% 50,000 $6,725,914 AKO Akora Resources 0.175 21% 62,611 $13,772,508 ESR Estrella Res Ltd 0.006 20% 5,602,873 $8,795,359 MEL Metgasco Ltd 0.012 20% 468,846 $10,638,867 EEG Empire Energy Ltd 0.16 19% 1,140,984 $104,371,355 CXU Cauldron Energy Ltd 0.013 18% 11,815,283 $12,453,798 FFG Fatfish Group 0.013 18% 863,416 $13,092,637 EMS Eastern Metals 0.033 18% 113,849 $2,307,935 LRD Lordresourceslimited 0.081 17% 90,551 $2,562,116 ATH Alterity Therap Ltd 0.007 17% 733,888 $14,639,386 LML Lincoln Minerals 0.007 17% 4,705,885 $10,163,072 LRL Labyrinth Resources 0.007 17% 14,020 $7,125,262 TOY Toys R Us 0.014 17% 4,180,154 $11,789,562

MetalsTech (ASX:MTC) has made short work of Tuesday, ahead by about 125% when I last looked at about 3pm.

MTC has shared some fine, fine results of a Scoping Study the team have done at its 100%-owned Sturec Gold Mine in central Slovakia.

“The Study confirms Sturec Gold Mine can support a Base Case scenario with an underground-only mining operation delivering gold and silver concentrate production of ~1.134Moz AuEq production over an initial mine life of 9 years at 2.3Mtpa plant production capacity.”

The digger says, based on a forecast gold price of US$1,850/oz (Consensus LT Forecast), the Sturec Gold Mine ‘exhibits an operating margin of >200%.’

Ideally placed just 17km west of central Slovakia’s largest city, Banská Bystrica, (and 150km northeast of the capital, Bratislava), MTC says the study was ‘very high quality’ – with 78% of the mining inventory based on Measured and Indicated Resources, with only 22% in the Inferred category.

MTC has been doing the numbers and this study seems to have helped them add up:

▪ Total LoM capital investment for underground mining operation, process plant and infrastructure estimated at US$95.41M (including contingency, owners’ cost and sustaining capital)

▪ Pre-production capital of US$75.8M based on a significant portion of process plant infrastructure being built ex-China (Yantai Jinpeng Mining Machinery)

▪ Total undiscounted free cashflows of US$706.21M (A$1,103.45M), pre-tax

▪ Total U/G LoM production of 17.6Mt @ 2.0 g/t AuEq equating to total production of 1,134,000 oz AuEq over a 9- year mine life

▪ Pre-tax NPV8% of US$506M (A$791M) and Internal Rate of Return (IRR) of 116.0%

▪ If a conservative gold price of US$1,550 per ounce is assumed instead of Consensus LT Forecast,After-Tax NPV(8%) is robust at US$239M (A$376M)

The company says the project economics and technical viability ‘are highly encouraging, highlighting its potential to become a low cost gold-silver concentrate producer.’

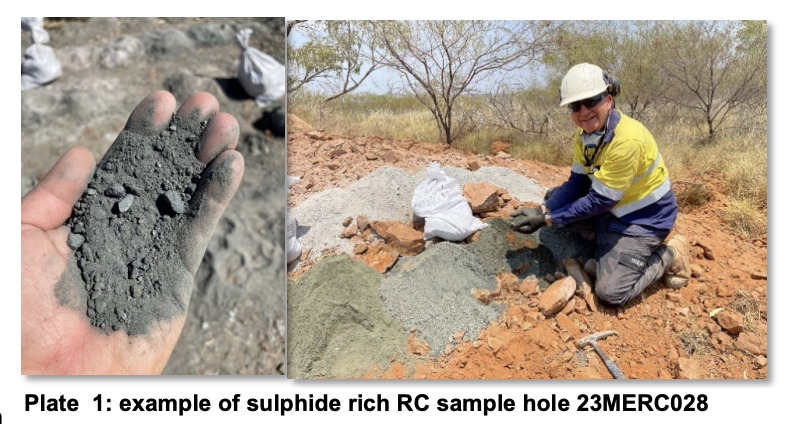

In another cracking update, Cooper Metals (ASX:CPM) says it’s got some significant assay results in hand from its Brumby Ridge and Raven Cu-Au Prospects at the Mt Isa East Cu-Au Project.

Initial RC drill hole 23MERC024 intercepted 50m at 1.32% Cu from 80m including 2m @ 6.1% Cu & 0.23g/t Au at the Brumby Ridge Cu-Au Prospect, which is the best assayed drill intercept at the Mt Isa East Cu-Au Project to date.

Follow up drilling at Brumby Ridge, which commenced last week, intercepted an amazing 72m @ 1.5% Cu from 113m to end of hole, estimated from portable XRF (pXRF) hosted in strongly altered iron oxide copper-gold brecciated mafic volcanics.

Mineralisation at Brumby Ridge prospect is open in all directions the company says and appears to be improving with depth with this phase of drilling almost complete and assays due in December.

More significant mineralisation has been intersected at Raven including: 15m @ 1.0% Cu & 0.1 g/t Au from 35m within a wider intercept of 28m @ 0.63% Cu & 0.061 g/t Au from 34m (23MERC019).

An understated CPM boss Ian Warland says RC drilling should be done this week with results in December.

“To say we are pleased with the results of the initial scout drilling on five Cu-Au prospects is an understatement.

“The Brumby Ridge drill intercept is the single strongest mineralised intercept drilled by Cooper Metals in the last two years. Raven continues to expand with another great intercept into a home-grown conceptual target.

“These two prospects are now the Company’s main focus and are being followed up as we speak, as Cooper continues to test its pipeline of quality Cu-Au prospects in the region. This cluster of prospects, including Mafic Sweats South, are only around 30km to the SE of Mt Isa, close to infrastructure and worthy of further priority investigation and exploration by Cooper.”

Also making progress on Tuesday, Kingfisher Mining (ASX:KFM) after lobbing an update from its ongoing exploration at Mick Well within the highly prospective Gascoyne Province.

KFM Exec Dir. and CEO James Farrell says they’re seeing some significant additional carbonatites and REE mineralisation

Farrell says theres significant new strike lengths of REE mineralisation discovered from reconnaissance mapping close to the recently identified gravity targets as well as a substantial REE system confirmed, with more than 13.5km of mineralisation mapped so far within a very large 7km by 4km carbonatite complex.

“The latest discoveries confirm Mick Well is a very large and exciting REE system that extends over an area of more than 7km by 4km.

Our ongoing fieldwork has also identified outcropping ferrocarbonatites together with monazite veining proximal to the recently identified carbonatite plug targets. These are the main ingredients for the World’s largest REE resources”

Meanwhile, this mornings leaders Keypath Education (ASX:KED) – holding its AGM today – and Metal Bank (ASX:MBK) are both among the riches.

MBK says rock chips returned from reconnaissance work at its Malaqa project in Jordan include up to 8.70% copper from the Malaqa NW area ~3km from the historical Um el Amad and up to 2.51% copper in the vicinity of the Um el Amad mine.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks on Tuesday:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap AQX Alice Queen Ltd 0.008 -43% 2,924,943 $1,771,208 TWE Treasury Wine Estate 0.053 -34% 581,072 $6,110,884 AMD Arrow Minerals 0.0015 -25% 5,000,000 $6,047,530 CCE Carnegie Cln Energy 0.0015 -25% 4,090,239 $31,285,147 CT1 Constellation Tech 0.003 -25% 156,666 $5,884,801 XF1 Xref Limited 0.135 -25% 498,228 $33,511,732 EYE Nova EYE Medical Ltd 0.145 -22% 2,298,638 $35,266,345 FAU First Au Ltd 0.002 -20% 2,485,133 $3,629,983 LBT LBT Innovations 0.004 -20% 653,249 $1,779,502 RMX Red Mount Min Ltd 0.004 -20% 12,469,106 $13,367,880 BRU Buru Energy 0.11 -19% 625,204 $80,465,816 PH2 Pure Hydrogen Corp 0.12 -17% 2,469,076 $51,498,510 NGL Nightingale Intel 0.044 -17% 23,518 $5,693,993 NYM Narryermetalslimited 0.1 -17% 120,000 $5,759,229 AUH Austchina Holdings 0.0025 -17% 816,356 $6,233,651 ICN Icon Energy Limited 0.005 -17% 175 $4,608,082 LVT Livetiles Limited 0.005 -17% 29,437 $7,062,664 RML Resolution Minerals 0.005 -17% 3,553,515 $7,543,751 NAG Nagambie Resources 0.031 -16% 1 $21,523,874 MCL Mighty Craft Ltd 0.0105 -16% 3,993,290 $4,555,531 3PL 3P Learning Ltd 0.96 -16% 139,470 $313,216,457 KPO Kalina Power Limited 0.004 -16% 222,778 $7,197,180 AMM Armada Metals 0.028 -15% 71,500 $5,694,746 ALM Alma Metals Ltd 0.006 -14% 4,827,629 $7,798,006 BFC Beston Global Ltd 0.006 -14% 1,612,000 $13,979,328

TRADING HALTS

MaxiTrans (ASX:MXI) pending an announcement of a significant acquisition transaction by the Company and an associated capital raising

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.