Closing Bell: Australia lifts small cap rate by 2%

Via Getty

- Small Caps, ASX 200 accelerate after RBA rate call

- Cash rate to 1.35%, Capital Economics says 3.5% the target

- EasyDNA rocks GTG world

Forget the RBA, it’s small cap day at Stockhead as the Little Legends index ignores war, floods, flu, uncertainty, COVID, inflation, gas, houses, veges and Nick Kyrgios to climb stoutly on a tough Tuesday.

I psychically linked with Capital Economics’ senior Australia and Kiwi economist Marcel Thieliant, via email after the rates decision took the cash rate to 1.35%.

Marcel reckons these RBA sorts at Martin Place will keep hiking rates now until they or inflation tops out.

“We suspect that further upside surprises to inflation will encourage (the RBA) to eventually lift the cash rate to around 3.5%.”

The post-match statement certainly sounded a lot less optimistic than last month – no mention of household consumption being nice and strong. No nod to the robust nature of household and business balance sheets. Nor our high terms of trade.

Marcel says today’s statement did at least highlight the strong jobs market, which should become wages growth.

Capital Economics has already pencilled in another 50bp rate hike for August on the expectation of more strong Q2 inflation data.

Then again, there’s these NSW floods which apparently could squelch circa $1bn of fruit, vege and livestock. Less lettuce, less pomegranite? And probably less cows. I saw a lot of cows on telly who looked wet, cold and like they couldn’t swim great.

How’s your principal and interest (P&I) ?

“But back to me,” Marcel telepathically reminds me.

“We doubt that monetary policy will remain this tight for long.”

“After all, we now expect house prices to plunge by 15% from their peak in April which would mark the deepest downturn in Australia’s modern history.”

“The upshot is that we expect the RBA to reverse course and start to cut interest rates towards the end of next year.”

If the banks pass today’s rate hike on in full, (which according to a show of hands in the Stockhead east coast newsroom is about 1,0000% likely) a borrower with a $1mn housing debt, repaying principal and interest (P&I) on a variable rate mortgage, average extra monthly costs are circa $730 per month since rates started rising.

What else? Earlier in the session, the ANZ reported consumer confidence fell 1.2% on the previous week. That’s both a lot, unsurprising and also probably doubled since the RBA decision, so really ANZ, what’s the point?

Biden v China v iron ore

Out of town, there’s rumbling on Capitol Hill that US President Biden is mulling taking the scalpel to some of his predecessor’s China import tariffs which have led to the ongoing tit-for-tat trade war between the world’s two largest economies. Jo Capurso at CBA says he’s been reading estimates that reckon culling those tariffs on Chinese imports can trim a full percentage point fall in US inflation.

That’d be good on many levels.

Ah. Then there’s the iron ore biggies. Rio, BHP, Headwinds. China. They’ve not crashed today, but my spidey-sense and refusal to not editorialise says they might soon.

Vivek Dhar, CBA’s incredible whisperer on rocks’n metals’n stuff, says iron ore prices fell below $US110/t (62% Fe, CFR China) overnight on growing demand concerns in China.

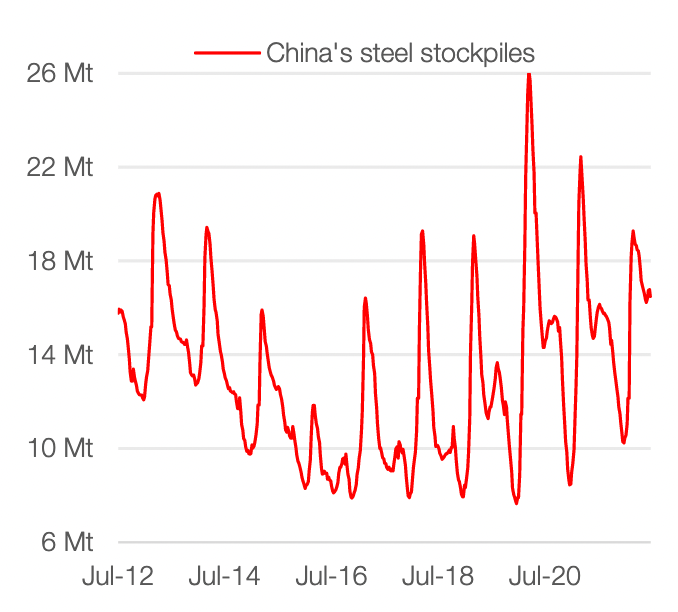

Here’s the weekly volume of steel China’s mills have been accumulating:

The fall in iron ore prices is consistent with the state of China’s steel sector. Which are overdue a cyclical blurgh, as the chart above suggests.

“China’s steel mill margins have remained negative since 13 June 2022, suggesting that oversupply conditions are pervasive in China’s steel sector,” Vivek says.

For context, margins typically only remain negative for a short period of time as steel mills tend to respond to negative margins pretty quickly by cutting production and not buying anymore stuff – annoying because doing that makes it much cheaper.

TODAY’S BIGGEST SMALL CAP WINNERS

(Stocks highlighted in yellow rose after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| Code | Company | Price | % | Market Cap |

|---|---|---|---|---|

| CFO | Cfoam Limited | 0.009 | 200% | $2,201,521.90 |

| AL3 | Aml3D | 0.099 | 52% | $9,779,795.09 |

| FG1 | Flynngold | 0.15 | 50% | $6,406,105.00 |

| CBE | Cobre | 0.039 | 50% | $4,300,582.26 |

| AMS | Atomos | 0.335 | 49% | $50,029,106.63 |

| OSX | Osteopore Limited | 0.195 | 39% | $16,417,553.32 |

| FFG | Fatfish Group | 0.031 | 35% | $23,830,987.17 |

| ODE | Odessa Minerals Ltd | 0.017 | 31% | $6,982,964.40 |

| BPP | Babylon Pump & Power | 0.0065 | 30% | $8,065,207.74 |

| SMX | Security Matters | 0.14 | 27% | $18,250,268.74 |

| KGD | Kula Gold Limited | 0.029 | 26% | $4,949,039.54 |

| GGX | Gas2Grid Limited | 0.0025 | 25% | $8,116,204.16 |

| PRM | Prominence Energy | 0.0025 | 25% | $4,849,217.64 |

| SIH | Sihayo Gold Limited | 0.0025 | 25% | $12,204,256.18 |

| SPX | Spenda Limited | 0.01 | 25% | $25,453,293.91 |

| SCT | Scout Security Ltd | 0.046 | 24% | $5,675,602.05 |

| EXL | Elixinol Wellness | 0.0285 | 24% | $7,274,108.13 |

| IBX | Imagion Biosys Ltd | 0.043 | 23% | $39,242,648.69 |

| PUA | Peak Minerals Ltd | 0.011 | 22% | $9,372,336.76 |

| ADO | Anteotech Ltd | 0.08 | 21% | $131,199,736.93 |

| BBX | BBX Minerals Ltd | 0.115 | 21% | $43,702,040.13 |

| BCC | Beam Communications | 0.24 | 20% | $17,284,384.20 |

| 1ST | 1St Group Ltd | 0.006 | 20% | $6,440,869.08 |

| AUK | Aumake Limited | 0.006 | 20% | $3,857,234.62 |

| XST | Xstate Resources | 0.003 | 20% | $8,037,954.13 |

Eddy Sunarto who makes arto out of deciphering the insane world of bio and medtech stocks, has his beady heterochromic eye on the genomics specialist, Genetic Technologies (ASX:GTG).

Eddy says GTG’s latest toy EasyDNA, has gone off on some kind of expansion jaunt into India and Europe. Gone rogue they have, with subsidiary EasyDNA India already friends with a number of stud farms which provide “independent and comprehensive chain of custody for equine paternity testing.”

The company has its hands on initial juicy samples and says it’s testing merrily away and will add the results into the Indian Stud Book.

GTG reckons stud farming – think horses and such – is an absolute goer in India, where EasyDNA can leverage the company’s existing paternity infrastructure.

Has anyone read this from Roald Dahl? I don’t want to give it away, but it’s a lot like the EasyDNA business model.

Other winners, IOUPay (ASX:IOU), which went berserk in early trade – to the tune of 55% – before an ASX speeding ticket snapped its ASX domination. Following the case like an insane bloodhound sniffing an errant ETF, Gregor got on the blower and says IOU has replied to the exchange after being pulled over by the ASX and asked to blow in a bag.

ASX:Do you know how fast you were going, sir?

IOU: Of course. Wasn’t it awesome?”

Gregor says IOU doesn’t know, intend or need to explain anything as to why its share price shot up “like a defibrillated media mogul after a morning at the ponies.”

Meanwhile, video tech dudes Atomos (ASX:AMS) have delivered a record sales result – unaudited revenue in excess of $82m for FY22 — and investors showed their appreciation by sending its price up close to 45%.

Osteopore (ASX:OSX) has been doing super well, the bone specialist up by more than 40% as it continues to grow its presence in vital overseas markets.

And a cranking find by PolarX (ASX:PXX) of 9.1m at a tummy-tingling 124g/t gold from just 24m gave its price a lift through 18% before settling in the lower colon at around 10%.

TODAY’S BIGGEST SMALL CAP LOSERS

(Stocks highlighted in yellow rose after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| Code | Company | Price | % | Market Cap |

|---|---|---|---|---|

| WTN | Winton Land | 2.74 | -20% | $1,017,385,114.48 |

| SBR | Sabre Resources | 0.004 | -20% | $13,948,655.04 |

| XF1 | Xref Limited | 0.41 | -18% | $92,648,144.50 |

| BAT | Battery Minerals Ltd | 0.005 | -17% | $17,426,838.70 |

| MRD | Mount Ridley Mines | 0.005 | -17% | $35,142,170.63 |

| SVY | Stavely Minerals Ltd | 0.17 | -15% | $52,192,290.40 |

| E33 | East 33 Limited. | 0.046 | -15% | $14,523,921.49 |

| AQX | Alice Queen Ltd | 0.003 | -14% | $5,948,301.37 |

| ILA | Island Pharma | 0.125 | -14% | $6,270,717.56 |

| OPL | Opyl Limited | 0.04 | -13% | $2,501,727.71 |

| DAF | Discovery Alaska Ltd | 0.048 | -13% | $12,332,908.39 |

| KFE | Kogi Iron Ltd | 0.0035 | -13% | $6,470,311.02 |

| RD1 | Registry Direct | 0.014 | -13% | $6,688,710.48 |

| GFN | Gefen Int | 0.105 | -13% | $7,330,903.92 |

| LRD | Lordresourceslimited | 0.21 | -13% | $7,628,309.04 |

| BRX | Belararoxlimited | 0.33 | -12% | $10,623,757.50 |

| FRB | Firebird Metals | 0.225 | -12% | $13,384,391.04 |

| AWV | Anova Metals Ltd | 0.008 | -11% | $13,482,847.80 |

| AYT | Austin Metals Ltd | 0.008 | -11% | $9,142,871.90 |

| LCT | Living Cell Tech. | 0.008 | -11% | $11,568,273.51 |

| NZS | New Zealand Coastal | 0.004 | -11% | $4,621,522.64 |

| RIM | Rimfire Pacific | 0.008 | -11% | $16,256,202.62 |

| CD3 | Cd Private Equityiii | 1.48 | -11% | $119,567,177.20 |

| COD | Coda Minerals Ltd | 0.295 | -11% | $39,012,674.25 |

| CLA | Celsius Resource Ltd | 0.017 | -11% | $23,207,849.59 |

Finally, there were no losers in a very big afternoon for the both SH newsrooms – east and west coast – just as the cash rate dropped, up in BrisVegas Scott “Kinder than Krygios” McGrath took on a kiwi lad in a gripping Rod Laver junior thingy in front of very proud mum and Qld correspondent Nadine McGrath. Scott won the final set in a tiebreak 10-7.

ANNOUNCEMENTS YOU MAY’VE MISSED

Perpetual Resources (ASX:PEC) says it’s finalised reconnaissance and is ready to get cracking on auger drilling at the northern end of the Beharra exploration licence. The company says its received the Program of Works (PoW) from the WA Government Department of Mines, Industry, Regulation and Safety (DMIRS) – and sorted out access requirements from landholders – and expects to start poking holes in the ground in late July.

Perennial winner of the annual Best Subliminal ASX Code of the Year award, Bounty Oil & Gas NL (ASX:BUY) has announced a successful start to the 2022 oil appraisal program at the Cooroo Northwest Oilfield in SW Queensland.

Bounty says the team managed to catch a few good oil shows in both the Hutton and the Birkhead Formations, but the more we think about it, the more we suspect we’re thinking of an entirely different kind of oil show… but it’s exciting news.

ARB Corporation (ASX:ARB), purveyors of things to bolt onto your truck so you can drive up the side of a building if you want to, says it’s appointed a new Chief Executive Officer, Lachlan McCann – effective immediately. McCann has been overseeing the business as as COO, and as such the company expects he will slide into the driver’s seat with a minimum of effort.

I can hear the ScoMo dir. TV ads already:

“Trust ARB Corp to bolt stuff onto your truck?

Lachlan McCann!

TRADING HALTS

Black Dragon Gold Corp. (ASX:BDG) – The company is getting its ducks in a row prior to finalising a corporate transaction to acquire rights to mining tenements.

Bubs Australia Limited (ASX:BUB) – There’s an equity raising (comprising a fully underwritten accelerated non-renounceable pro-rata entitlement offer and a fully underwritten placement) in the works.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.