Closing Bell: ASX wins again, gets the girl and is generally cool and triumphant

Like this star. Via Getty

- The ASX benchmark ends the day circa +0.9pc higher

- Sectors led by Materials and Energy as gold re-tops US$2,000/oz

- Small caps led by CF1, backed up by a slew of micro Materials players

Local markets have extended the week’s treasure hunt as resources stocks lifted on Friday, after gains overnight on Wall Street still giddy at the promise of interest rate cuts.

At 4.15pm on Friday December 13, the S&P/ASX 200 (XJO) index was up 65 points, or +0.88%.

The benchmark Aussie market has closed the week +3.75% higher.

From the morning bell on Friday, traders in Sydney got right behind the majors leading both mining and energy sectors.

Both were up close to 2%.

The ASX iron ore heavyweights BHP (ASX:BHP), Fortescue (ASX:FMG), and Rio Tinto (ASX:RIO) all climbed in and around +2%

Woodside Energy Group (ASX:WDS) and Santos (ASX:STO) both enjoyed strong support as well.

IGO (ASX:IGO) and Allkem (ASX:AKE) added close to 5% in the lithium sector.

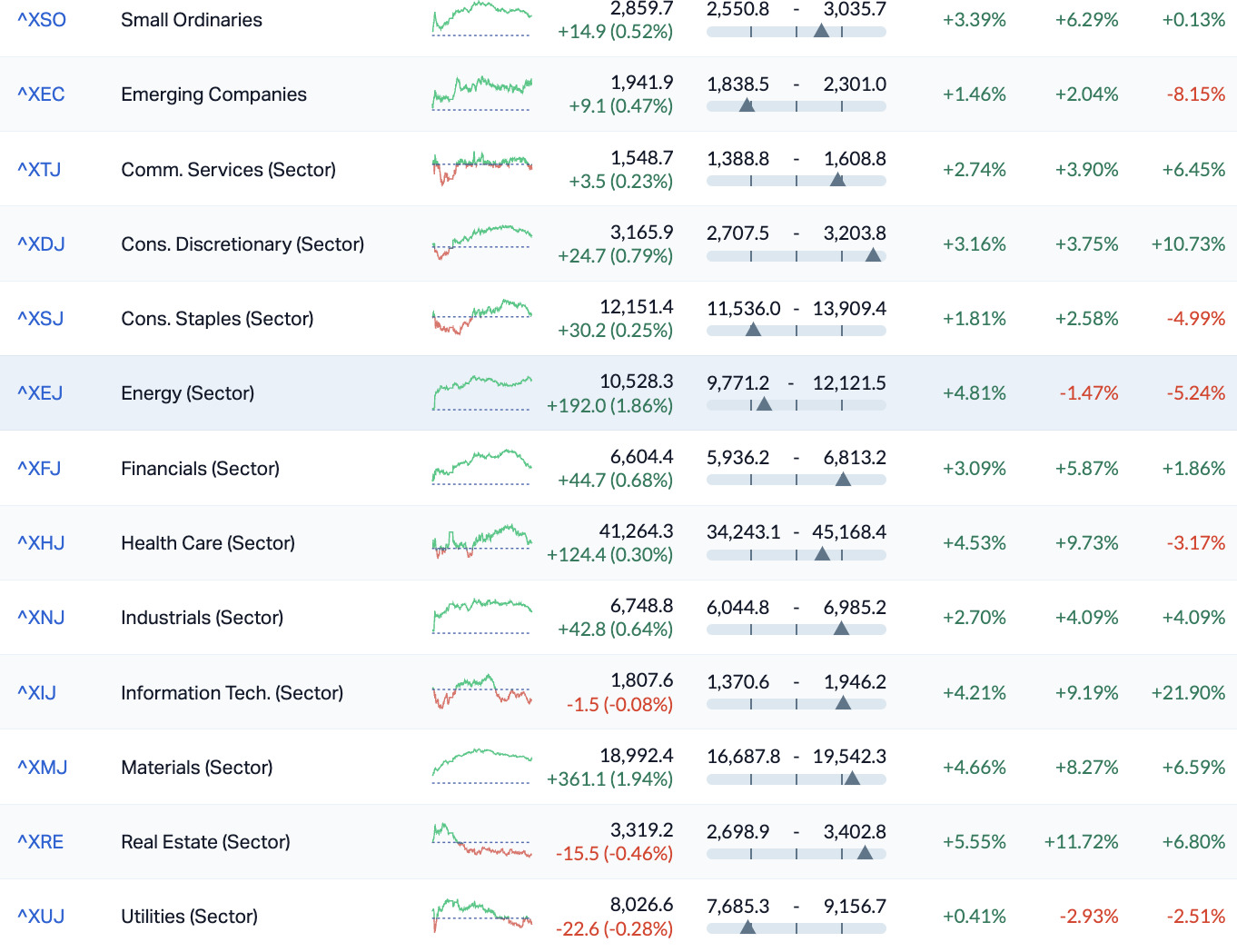

ASX Sectors on Friday

Arounnd the ‘hood…

Asian-Pacific equity markets enjoyed Friday, tracking US gains.

It also helped that China’s industrial output rose at the fastest monthly pace in about 24 months.

Equities climbed in Japan, South Korea, Hongkers and China.

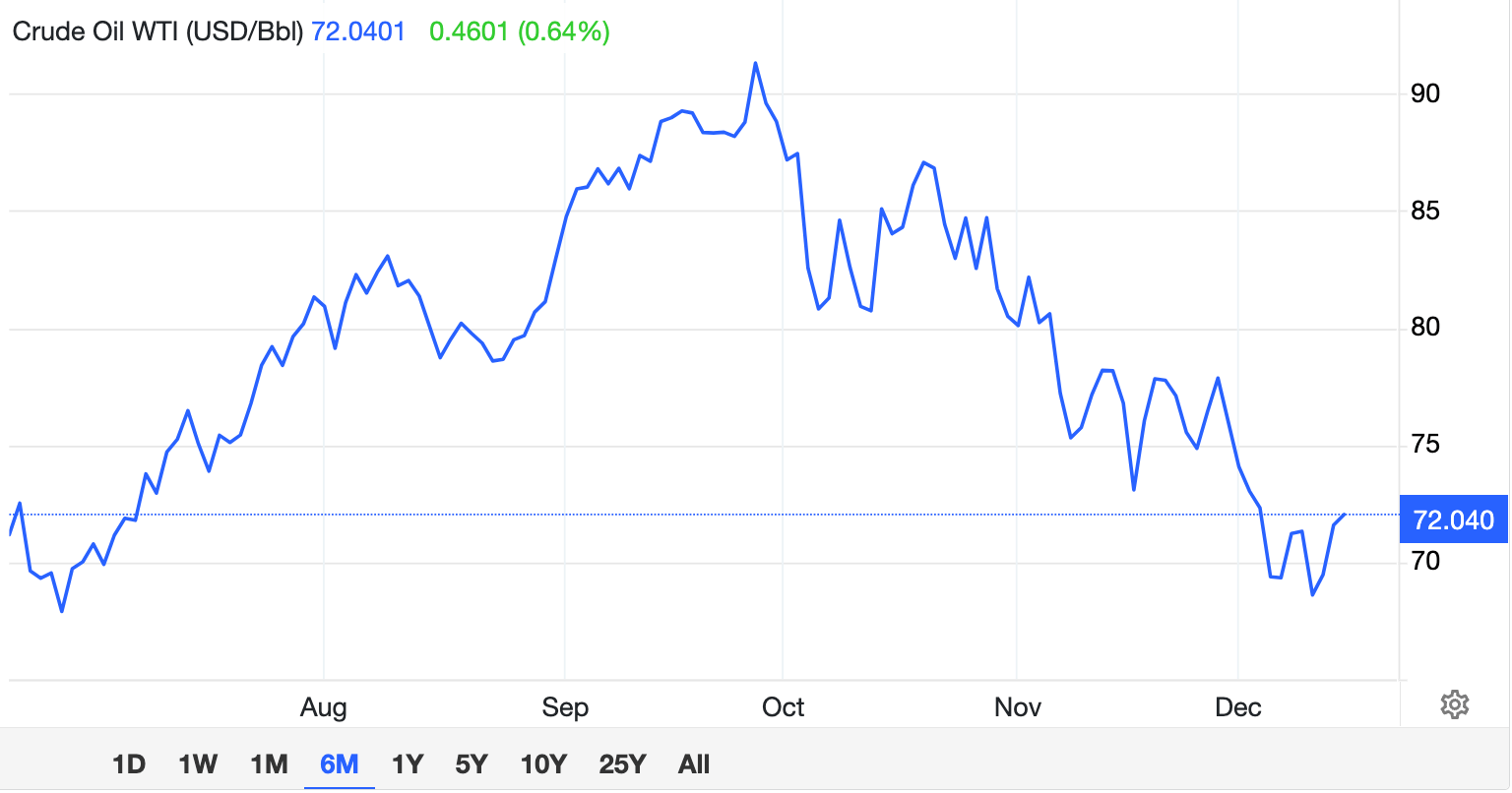

Oil…

Unless they find more US inventories this arvo, oil – WTI (West Texas Intermediate) specifically – is probably going to log its first weekly gain in two months.

Earlier in the week, the US Fed turned markets upside down by flagging near-future rate cuts, including the muscular run of the US dollar and the anemic outlook for growth stocks and risk assets.

A weak greenback also makes USD-bought global commodities cheaper for everyone else – especially China.

Meanwhile, the IEA (International Energy Agency) says global oil demand will rise by 1.1mn barrels a day next year, up a pretty profound 130K bpd from earlier estimates.

OPEC+ previously projected a 2.2 million bpd global oil demand growth for next year.

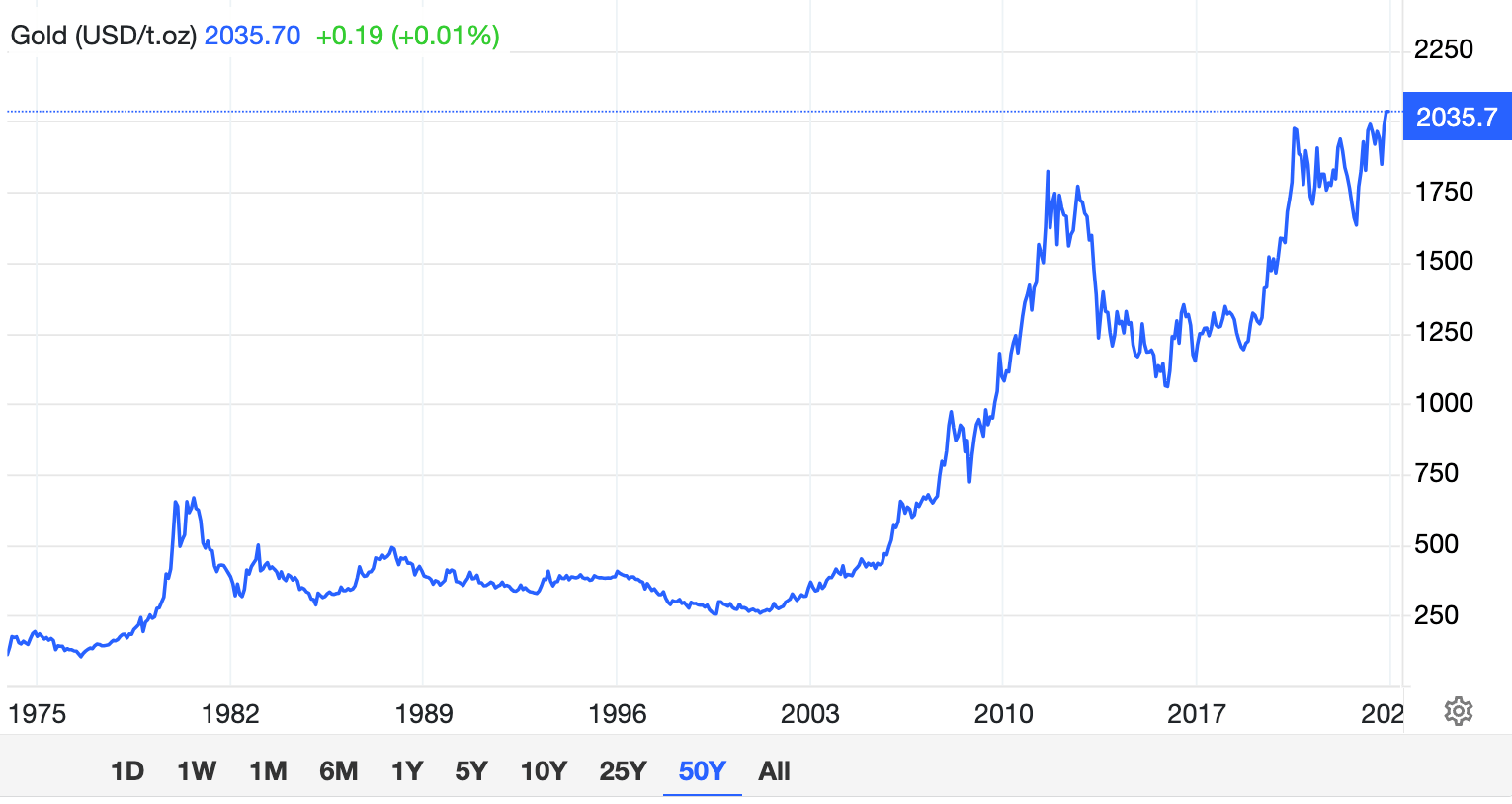

And damned if we’re not still watching gold…

The price of Gold held above US$2,030 an ounce on Friday and was set to gain about 1.5% this week, underpinned by the same factors which have seen everything else enjoy the latter half of the week and wot made the greenback and US Treasury yields dive.

And now here’s a 50-year Gold chart

And in the US…

Well, what happened this week was simple – the Fed held interest rates steady and flagged x3 actual rate cuts for next year.

Overnight the S&P 500 found +0.3%, the Dow Jones +0.4% and the Nasdaq Composite +0.2%.

Inflation is falling is the takeaway from Fed Chair J.Powell who also says the time for cutting the cost of money is coming “into view.”

In New York, analysts are pricing in a 75% chance the Fed starts that in March.

Meanwhile, some robust US retail sales and falling jobless claims had no impact on sentiment

Even both the European Central Bank (ECB) and the BoE (Bank of England) paused this week, but also said they’re likely to hold at higher for longer as long and as high as required till inflation is dead, dead, dead.

At 4pm in Sydney, Futures tied to the 3 major US indices were ahead of the Friday open in New York:

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| T3D | 333D Limited | 0.008 | 60% | 2,310,999 | $597,225 |

| JAV | Javelin Minerals Ltd | 0.003 | 50% | 5,177,549 | $2,176,340 |

| CF1 | Complii Fintech Ltd | 0.028 | 40% | 246,514 | $11,358,410 |

| AD1 | AD1 Holdings Limited | 0.008 | 33% | 832,217 | $5,153,550 |

| DCX | Discovex Res Ltd | 0.002 | 33% | 2,545,020 | $4,953,852 |

| KPO | Kalina Power Limited | 0.004 | 33% | 1,462,553 | $6,630,384 |

| M4M | Macro Metals Limited | 0.004 | 33% | 579,784 | $7,401,233 |

| RML | Resolution Minerals | 0.004 | 33% | 5,050,000 | $3,771,875 |

| TKL | Traka Resources | 0.004 | 33% | 200,664 | $2,625,988 |

| BFC | Beston Global Ltd | 0.009 | 29% | 1,197,940 | $13,979,328 |

| MEL | Metgasco Ltd | 0.009 | 29% | 328,166 | $7,447,207 |

| FRX | Flexiroam Limited | 0.028 | 27% | 318,999 | $14,533,358 |

| NXS | Next Science Limited | 0.27 | 26% | 1,397,870 | $62,714,447 |

| EWC | Energy World Corpor. | 0.025 | 25% | 1,977,991 | $61,578,425 |

| DOU | Douugh Limited | 0.005 | 25% | 99,400 | $4,328,276 |

| GMN | Gold Mountain Ltd | 0.005 | 25% | 4,681,608 | $9,076,314 |

| VFX | Visionflex Group Ltd | 0.01 | 25% | 2,361,792 | $11,335,930 |

| CXU | Cauldron Energy Ltd | 0.026 | 24% | 8,941,792 | $23,775,848 |

| GUE | Global Uranium | 0.11 | 21% | 2,869,387 | $19,140,577 |

| ZMI | Zinc of Ireland NL | 0.018 | 20% | 10,000 | $3,197,164 |

| NWF | Newfield Resources | 0.12 | 20% | 15,000 | $90,322,242 |

| RHY | Rhythm Biosciences | 0.18 | 20% | 377,818 | $33,171,388 |

| 1MC | Morella Corporation | 0.006 | 20% | 234,936 | $30,893,997 |

| BPH | BPH Energy Ltd | 0.048 | 20% | 10,060,321 | $41,037,078 |

| ECT | Env Clean Tech Ltd. | 0.006 | 20% | 833,394 | $14,321,552 |

The Small Caps market was in a rather vague mood on Friday, with a number of the chart leaders at various stages of the day occupying senior positions without fresh news to explain why they were there.

That includes Complii Fintech Solutions (ASX:CF1) , which soared 40% post-lunch, with the only recent news to the ASX being the disbursement of performance-related shares to three directors, totalling 26 million shares (about $640,000 worth when issued) a few days prior.

Similarly, Next Science (ASX:NXS) took off after lunch, racing through a 28% gain with a near-tenfold increase in trading volume over the 4-week average, again on no fresh news.

Cauldron Energy (ASX:CXU) enjoyed a solid 24% boost in trading price on friday afternoon, with its most recent announcement already two days old – a scoping study from Cauldron’s Bennet Well uranium deposit, part of the company’s Yanrey Uranium Project which encompasses a total area of 1,270km2 about 100km south of the town of Onslow in Western Australia.

Cauldron says that Bennett Well is home to a JORC compliant 30.9 million pounds (about 14,000t) of contained uranium oxide, Indicated plus Inferred Mineral Resource of 38.9 million tonnes grading 360ppm eU3O8.

Microcapper Javelin Minerals (ASX:JAV), which is showing a 50% bump according to the steady stream of data pouring out of the ASX computers.

The last piece of information coming directly from Javelin was an entitlement offer prospectus which arrived with very little fanfare from the company on Tuesday, casually announcing that the company is offering a cheeky 1,000,000,000 new shares (and an equally enormous number of attaching options) to existing shareholders at $0.001 a pop.

Both Icon Energy (ASX:ICN) and Resolution Minerals (ASX:RML) have posted sizeable percentage gains this morning, in the absence of any market-shifting news.

Global Uranium (ASX:GUE) is up more than 26%, proving that the company name is something of a misnomer as the win has come via news that the company’s exploration licence for the Enmore gold project in New South Wales has been extended for six years.

If the name is unfamiliar to you, you’re not alone – it was recently rebadged from Okapi Resources (ASX:OKR) .

And Gold Mountain (ASX:GMN) is climbing today, most likely on the back of two announcements to the market yesterday.

The first was a company update, outlining where things are at with Gold Mountain’s activities in Brazil, where it has secured 57 tenements at the application stage in the Jequié Block of the Sao Francisco craton, cheek-by-jowl with Brazilian Rare Earths.

The company also announced yesterday that it has discovered anomalous lithium concentrations within stream sediment samples at its Juremal project, which is also in Brazil.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MRQ | Mrg Metals Limited | 0.002 | -33% | 12,326,996 | $6,617,756 |

| SIT | Site Group Int Ltd | 0.002 | -33% | 655,555 | $7,807,471 |

| HMD | Heramed Limited | 0.022 | -27% | 475,197 | $8,385,426 |

| FHS | Freehill Mining Ltd. | 0.003 | -25% | 2,141,986 | $11,399,338 |

| PNX | PNX Metals Limited | 0.003 | -25% | 90,491 | $21,522,499 |

| T88 | Taitonresources | 0.1 | -23% | 363,487 | $6,990,691 |

| IVZ | Invictus Energy Ltd | 0.16 | -22% | 36,929,273 | $264,647,124 |

| RNO | Rhinomed Ltd | 0.02 | -20% | 1,504,109 | $7,142,992 |

| 88E | 88 Energy Ltd | 0.004 | -20% | 14,714,755 | $123,204,013 |

| AXN | Alliance Nickel Ltd | 0.039 | -17% | 2,277,045 | $34,114,462 |

| AAJ | Aruma Resources Ltd | 0.025 | -17% | 1,227,053 | $5,906,745 |

| AMD | Arrow Minerals | 0.0025 | -17% | 15,456,376 | $9,071,295 |

| ROG | Red Sky Energy. | 0.005 | -17% | 7,290,728 | $31,813,363 |

| PGM | Platina Resources | 0.021 | -16% | 841,600 | $15,579,508 |

| ZNC | Zenith Minerals Ltd | 0.14 | -15% | 14,200 | $58,142,846 |

| GLA | Gladiator Resources | 0.017 | -15% | 65,000 | $11,815,937 |

| TSI | Top Shelf | 0.17 | -15% | 55,028 | $41,495,172 |

| SHP | South Harz Potash | 0.024 | -14% | 1,920,839 | $20,296,567 |

| 5EA | 5Eadvanced | 0.215 | -14% | 466,682 | $76,915,043 |

| CZN | Corazon Ltd | 0.014 | -13% | 339,366 | $9,849,566 |

| GES | Genesis Resources | 0.007 | -13% | 22,530 | $6,262,730 |

| H2G | Greenhy2 Limited | 0.007 | -13% | 266,075 | $3,350,047 |

| NES | Nelson Resources. | 0.0035 | -13% | 124,169 | $2,454,377 |

| WBE | Whitebark Energy | 0.021 | -13% | 61,202 | $3,929,811 |

| LLO | Lion One Metals Ltd | 0.96 | -12% | 45,040 | $16,473,973 |

TRADING HALTS

Atlantic Lithium (ASX:A11) – pending an announcement to the market regarding a proposed capital raising.

GBM Resources (ASX:GBZ) – pending the release of an announcement regarding a proposed capital raising.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.