Closing Bell: ASX up but MinRes slumps on lithium downgrade; China stocks also sink

Not drowning, wavering? China’s CSI 300 index sinks 5pc amid doubts over stimulus plans. Pic via Getty Images

- ASX closes higher with consumer and utilities leading the charge

- Wall Street rally boosts sentiment as Nvidia jumps 4pc

- China’s CSI 300 index falls 5pc amid doubts over stimulus plans

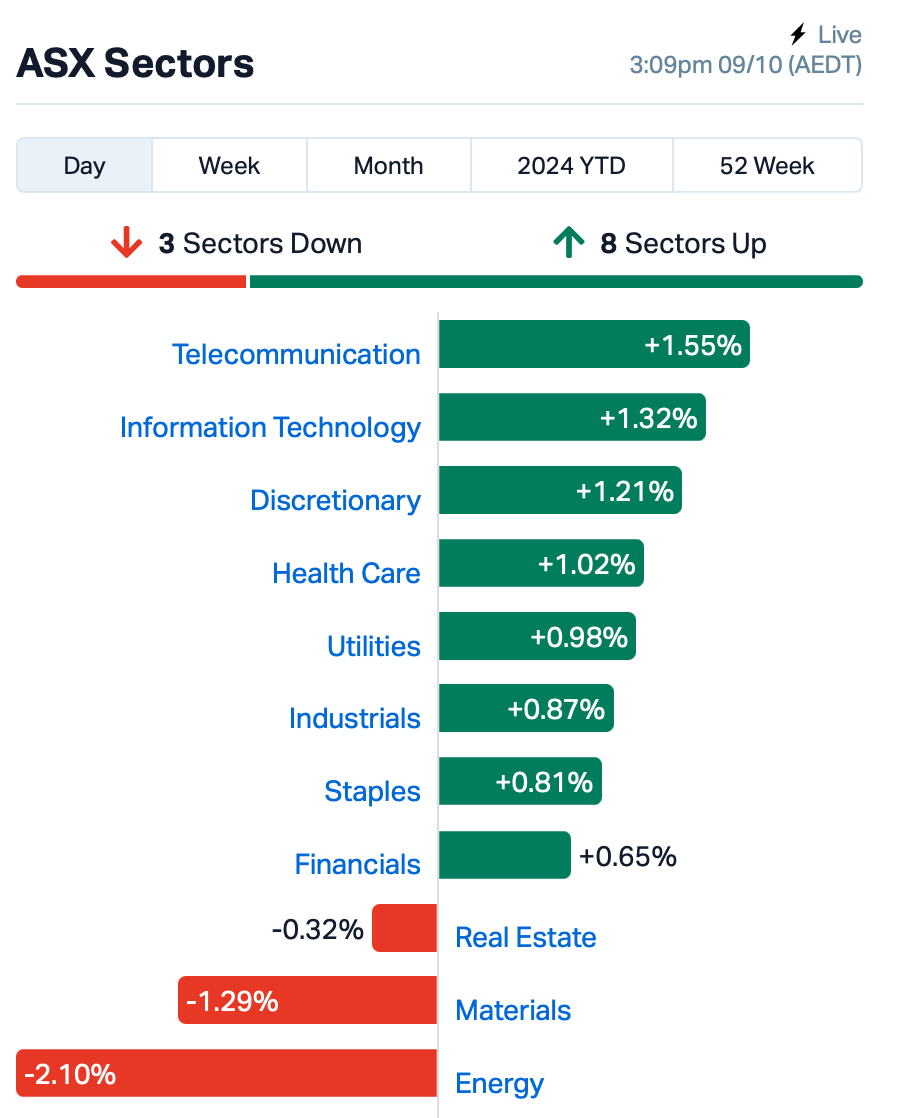

The ASX closed 0.13% higher on Wednesday, thanks to a solid rally in Comms Services, Tech and Discretionary stocks.

This came on the back of a rally on Wall Street, where the S&P 500 closed near record highs and US mega tech stocks shone with Nvidia (+4%) leading the way.

The local Comms Services sector was led by a 2% rally in REA Group (ASX:REA). REA held its AGM today, in which the company re-iterated it remains optimistic, highlighting recent investments in technology and acquisitions, and an expansion strategy in Australia and India.

Meanwhile the APA Group (ASX:APA) led the utilities sector, surging 2.5% after the Australian Energy Regulator decided not to impose full price regulation on its South West Queensland Pipeline, maintaining the current light regulatory approach. Origin Energy (ASX:ORG) also gained over 0.3% following this news.

However, those gains were offset by losses in the commodities sector, with Energy stocks mostly falling as crude oil prices plummeted by 5% overnight – partly due to disappointment over China’s latest stimulus plans and news of a potential ceasefire between Hezbollah and Israel. While Hezbollah seems open to negotiation, oil traders are still feeling cautious.

Woodside Energy Group (ASX:WDS) and Santos (ASX:STO) declined around 2% each.

The mining sector was facing pressure as well today, following a sharp drop in iron ore prices in Singapore, with both BHP (ASX:BHP) and Rio Tinto (ASX:RIO) down around 1-2%.

Still in large caps, Mineral Resources (ASX:MIN) was the worst performer today, down by 6.5% on no specific announcements.

There were, however, reports that JPMorgan has reduced its lithium price forecasts (although we can’t get our hands on this report at this moment) prompting a downgrade of lithium stocks.

Lithium stocks on the ASX were surging in the last couple of sessions after Rio Tinto, the world’s second-largest miner, announced its interest in acquiring US lithium producer Arcadium Lithium (ASX:LTM) on Monday.

What else happened today?

Over the pond, the New Zealand Reserve Bank has made a bold move this morning by slashing the cash rate by 50 basis points, bringing it down to 4.75% – as per market expectations.

In a statement, the RBNZ noted that annual inflation is now within the target range and is “converging on the 2% midpoint”.

In China, the CSI 300 index, which tracks the top 300 stocks on the Shanghai and Shenzhen exchanges, took a hit at the open as doubts grew over Beijing’s stimulus plans.

The CSI 300 Index initially fell by 5% at the morning bell, and is now down 5.4% at the time of writing.

Investor excitement about another stimulus-fuelled rally in Chinese stocks is fading, especially after a key policy meeting on yesterday revealed no significant new stimulus.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AUH | Austchina Holdings | 0.002 | 100% | 3,834,534 | $2,100,384 |

| IBG | Ironbark Zinc Ltd | 0.003 | 50% | 346,989 | $3,667,296 |

| NES | Nelson Resources. | 0.003 | 50% | 100,000 | $1,277,189 |

| SMM | Somerset Minerals | 0.004 | 33% | 658,672 | $3,092,996 |

| SHP | South Harz Potash | 0.012 | 33% | 3,858,853 | $8,497,601 |

| GRX | Greenx Metals Ltd | 0.86 | 26% | 542,819 | $190,060,702 |

| AVE | Avecho Biotech Ltd | 0.0025 | 25% | 419,936 | $6,338,594 |

| NAE | New Age Exploration | 0.005 | 25% | 11,360,790 | $7,175,596 |

| TMK | TMK Energy Limited | 0.0025 | 25% | 40,274 | $13,843,224 |

| EIQ | Echoiq Ltd | 0.29 | 21% | 36,949,438 | $141,245,050 |

| AZ9 | Asianbatterymet PLC | 0.036 | 20% | 720,398 | $9,066,449 |

| BP8 | Bph Global Ltd | 0.003 | 20% | 271,340 | $991,604 |

| CYQ | Cycliq Group Ltd | 0.006 | 20% | 1,847,121 | $2,227,583 |

| H2G | Greenhy2 Limited | 0.006 | 20% | 4,821,846 | $2,990,921 |

| IPB | IPB Petroleum Ltd | 0.006 | 20% | 751,039 | $3,532,015 |

| IXR | Ionic Rare Earths | 0.012 | 20% | 7,190,631 | $48,697,626 |

| LML | Lincoln Minerals | 0.006 | 20% | 606,725 | $10,281,298 |

| PUR | Pursuit Minerals | 0.003 | 20% | 205,000 | $9,088,500 |

| WML | Woomera Mining Ltd | 0.003 | 20% | 166,666 | $5,137,686 |

| 1AI | Algorae Pharma | 0.007 | 17% | 1,618,707 | $10,124,368 |

| AL8 | Alderan Resource Ltd | 0.0035 | 17% | 3,870,234 | $4,713,747 |

| ATH | Alterity Therap Ltd | 0.0035 | 17% | 8,100 | $15,961,008 |

| G88 | Golden Mile Res Ltd | 0.014 | 17% | 293,859 | $4,934,674 |

Polymetals Resources (ASX:POL) is growing increasingly confident in its decision to restart the prolific Endeavor mine near Cobar in NSW after it cropped up some exceptional results from geotechnical drilling at the Upper North Lode area of the project.

The junior believes the intercepts of up to 13.5g/t gold, 1410g/t silver, 12.5% zinc & 34.0% lead are evidence that a significant portion of Upper North Lode can support accelerated mining rates, especially after hitting into a nice thick 67m at 517g/t silver and 2.01g/t gold mineralised zone.

The Endeavor mine is on track for an imminent restart with first cashflows in H1 2025 after an optimised mine plan demonstrated the mine could produce 260,000t zinc, 90,000t lead and 10.6Moz silver to generate a whopping $1.85 billion in revenue over an initial 10-year Stage 1 mine life.

Junior explorer Patagonia Lithium (ASX:PL3) has announced it’s been granted exploration rights for three years on 830154/2024, which is one claim in a group of seven covering 12,032 hectares.

Exec chairman Phillip Thomas noted: “We now have a major component of our exploration concessions granted and are actively assessing the potential for other minerals in addition to lithium, such as antimony, niobium and gold where the granites and ultramafic rocks are present.”

Medicinal cannabis company Cann Group (ASX:CAN) is trading up on capital raising news. The company is seeking to raise, through a non-renounceable rights issue, approximately $6.25 million (before associated costs) in order to fund increased production at its Mildura facility.

Dreadnought Resources (ASX:DRE) is lighting the candle for carbonatite-hosted niobium (Nb) finds in WA’s Gascoyne. After a nine-hole drill program testing its Stinger discovery at Mangaroon, it’s popped up with what it says are exceptional hits into the Gifford Creek REE-Nb complex.

Reason? Because niobium’s properties are used to create high-strength, low-alloy steel that’s perfect for renewables, infrastructure and automobiles, reducing weight by up to 30%. The explorer has held the tenure since September 2022 and spent much of last year fingerprinting high-grade zones of Nb and rare earths carbonatites across the 17km-long Gifford Creek carbonatite zone.

In DRE’s latest round of digging it’s cropped up three zones of thick oxide Nb mineralisation with up to 1.3% NbO5 discovered at Stinger. The holes paint a picture of a 1.2km-long strike that’s open in all directions which DRE says has significant upside potential for Nb and other critical minerals such as rare earths (REE), scandium (Sc), titanium (Ti) and phosphorous (P).

Nova Minerals (ASX:NVA) has been digging into resource expansion of the RPM North pit area within its 500km2 Estelle gold project in Alaska’s prolific Tintina gold belt and the first eight holes of a 21-hole RC program have delivered multiple >5g/t gold from surface intersections.

Interval grades showed up to 39g/t in sections and a thick 43m at 4.4g/t gold mineralisation was discovered from the ground down. The drilling is targeting the near-surface mineralisation above the current high-grade core of RPM North and things are looking upbeat to add results of the program to an upcoming resource update that will incorporate two years’ worth of exploration and resource drilling.

It’ll all be jigsawed in to an upcoming pre-feasibility study of the RPM starter mine with an aim to commence a smaller-scale, low-capex, high-margin operation as soon as possible, which will provide cashflow to fund the expansion of the larger Estelle project organically.

And, Echo IQ (ASX:EIQ) has received FDA marketing approval for its aortic stenosis diagnostic, causing its shares to jump over 20% after emerging from a trading halt. The company is now preparing to seek approval for a heart failure indication and is confident about the process, having worked closely with the FDA for 18 months.

EchoSolv AS aims to enhance standard echocardiograms by automatically identifying patients at significant risk, addressing the underdiagnosis of aortic stenosis, which affects about 1.5 million people in the US. The company estimates a potential US revenue of $6.5 million annually with a 10% market penetration. Echo IQ is also gearing up for FDA submission for heart failure and has appointed a new US CEO to lead its commercial efforts.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| LPD | Lepidico Ltd | 0.002 | -33% | 1,000,000 | $25,767,375 |

| CCZ | Castillo Copper Ltd | 0.006 | -25% | 1,136,216 | $10,396,043 |

| CRB | Carbine Resources | 0.003 | -25% | 722,000 | $2,206,951 |

| SCN | Scorpion Minerals | 0.013 | -24% | 1,520,545 | $6,960,755 |

| GTR | Gti Energy Ltd | 0.004 | -20% | 300,000 | $13,358,133 |

| NTM | Nt Minerals Limited | 0.004 | -20% | 1,300,668 | $5,087,015 |

| TYX | Tyranna Res Ltd | 0.004 | -20% | 12,078,700 | $16,439,627 |

| VML | Vital Metals Limited | 0.002 | -20% | 1,032,540 | $14,737,667 |

| FFG | Fatfish Group | 0.009 | -18% | 840,009 | $15,472,303 |

| 88E | 88 Energy Ltd | 0.003 | -17% | 40,926,032 | $86,801,436 |

| SFG | Seafarms Group Ltd | 0.003 | -17% | 200,000 | $14,509,798 |

| ATC | Altech Batt Ltd | 0.044 | -15% | 8,059,578 | $97,962,311 |

| ANR | Anatara Ls Ltd | 0.046 | -15% | 271,926 | $10,416,261 |

| ROG | Red Sky Energy. | 0.006 | -14% | 499,121 | $37,955,590 |

| GLN | Galan Lithium Ltd | 0.125 | -14% | 4,664,633 | $86,429,333 |

| RR1 | Reach Resources Ltd | 0.013 | -13% | 52,000 | $13,116,470 |

| HPC | Thehydration | 0.020 | -13% | 676,058 | $7,013,001 |

| ADY | Admiralty Resources. | 0.007 | -13% | 40,000 | $13,035,792 |

| SPQ | Superior Resources | 0.007 | -13% | 6,206,225 | $17,358,910 |

| CAG | Caperangeltd | 0.175 | -13% | 90,799 | $18,981,660 |

| KAL | Kalgoorliegoldmining | 0.022 | -12% | 3,840,953 | $6,757,710 |

IN CASE YOU MISSED IT

Equinox Resources (ASX:EQN) has made a stunning rare earth and titanium dioxide discovery at the Mata da Corda project in Brazil after drilling seven RC holes with an average depth of 22m.

Elevate Uranium (ASX:EL8) has upgraded a significant portion of its resources at Koppies to the higher confidence indicated category and has also defined a maiden 10.2Mlbs U3O8 resource for the Hirabeb deposit.

Astral Resources (ASX:AAR) is on the cusp of turning into a +100,000oz per annum gold producer in the Kalgoorlie Goldfields, with infill drilling paving the way for an upgrade from inferred to indicated resources at the Theia deposit of its Mandilla project.

Recce Pharmaceuticals (ASX:RCE) has successfully dosed half of its targeted 30 patients with RECCE® 327 (R327G) topical gel in its Phase 2 trial for Acute Bacterial Skin and Skin Structure Infections (ABSSSI).

Bailador Technology Investments (ASX:BTI) has completed a $3m investment in Rosterfy, a leading software as a service platform that allows not-for-profit organisations, government bodies and mass-scale sports and events to recruit, screen, train, and schedule their volunteer communities.

This has resulted in a 14% uplift to the valuation of the company’s existing $12.4m investment in Rosterfy, which is now worth $17.1m. BTI managing partner David Kirk said the funding will allow Rosterfy to expand their global go-to-market teams, and further accelerate their product roadmap to extend their product leadership.

Far East Gold (ASX:FEG) has executed a conditional agreement to acquire the high-grade Idenburg project in Indonesia’s Papua province from PT Iriana Mutiara Idenburg. Subject to the satisfaction of conditions precedent, the conditional share purchase plan enables the company to secure an initial 51% ownership of the project.

Idenburg covers 952.8km2 and is known for high-grade lode gold occurrences characteristic of orogenic gold systems and sits within the same province that hosts world class Grasberg (>70Moz gold), Porgera (>7Moz gold), Frieda River (20Moz gold) and Ok Tedi (20Moz gold) projects. It has been previously explored by major companies such as Barrick, Newmont, Newcrest and Placer Dome.

PharmAust (ASX:PAA) has received a $887,129 R&D tax rebate from the Australian Government in relation to eligible Australian or local expenditure incurred in the 2023-24 financial year. The company has also submitted an Advance Overseas Finding Application to AusIndustry in respect of eligible overseas expenditure incurred during the same period, which is expected to result in an additional $655,274 rebate.

“We continue to appreciate the support that the Federal Government provides for our programs,” managing director Dr Michael Thurn said.

“The R&D Tax Incentive Rebate strengthens PharmAust’s cash position and will be primarily applied toward preparations for the adaptive Phase 2/3 HEALEY ALS Platform Trial, GMP grade MPL manufacturing, preclinical models for other neurodegenerative diseases, regulatory filings, and general working capital.”

TRADING HALTS

DRA Global (ASX:DRA) – Application to be removed from ASX

Novatti (ASX:NOV) – Cap raise

Neometals (ASX:NMT) – Cap raise

Excite Technology (ASX: EXT) – Cap raise

Anax Metals (ASX:ANX) – Cap raise

Metals Acquisition (ASX:MAC) – Cap raise

Antilles Gold (ASX:AAU) – An update to an announcement released on October 8

At Stockhead, we tell it like it is. While Equinox Resources, Elevate Uranium, Astral Resources, Recce Pharmaceuticals, Bailador Technology Investments, Far East Gold and PharmAust are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Today’s Closing Bell is brought to you by Webull Securities. Webull Securities (Australia) Pty. Ltd. is a CHESS-sponsored broker and a registered trading participant on the ASX.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.