Closing Bell: ASX up as US rate cut hopes boost tech and real estate

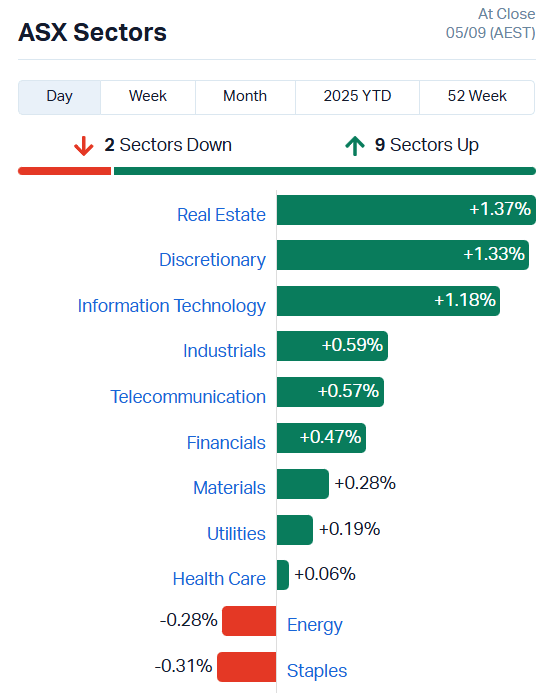

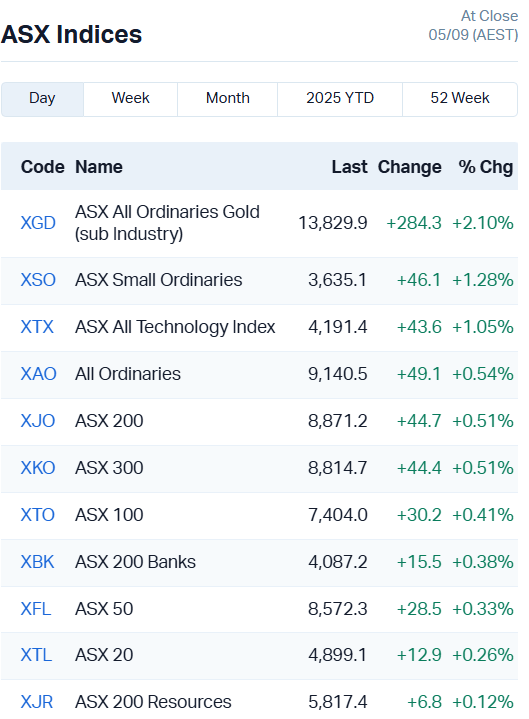

The ASX gained 0.51pc today, having fallen 1.1pc over the first trading week of September. Info tech, discretionary and real estate led gains.

- ASX climbs 0.51pc with 9 of 11 sectors higher

- Real estate, discretionary and info tech lead gains

- Rising gold prices support materials sector

ASX closes out first September week on a semi-positive note

The ASX 200 lifted 0.51% or 44.7 points today with all but two sectors in the green.

The first week of September, traditionally a bear month for markets, was a rough one for the Aussie market.

The bourse shed 1.1% over the week and now sits some 2% below its all-time high set last month. Still, it’s nice to close out the week on a positive note.

Weaker US job numbers gave Wall Street a boost overnight. With the US economy showing signs of weakness, the likelihood the US Fed will cut interest rates this month jumps.

You’d think that would be a red flag, but traders are more interested in access to cheap capital than the long-term health of the economy.

The optimism spilled over into our own rate-sensitive sectors today, boosting real estate, info tech and consumer discretionary.

Property management company Goodman Group (ASX:GMG) lifted 2%, while 5 of the top 6 tech stocks added more than 1%. WiseTech (ASX:WTC) was the exception, sliding 1.36%.

Over in discretionary, Wesfarmers (ASX:WES) lifted again, adding 1.8%, while JB Hi Fi (ASX:JBH) climbed 1.7% and Harvey Norman Holding (ASX:HVN) 1%.

The materials sector didn’t have much to say today, despite gold remaining near all-time highs.

The safe haven precious metal pushed the ASX All Ords Gold Index up more than 2% but a 0.88% fall in BHP’s (ASX:BHP) share price and a 3% drop in Lynas Rare Earth’s (ASX:LYC) dampened gains.

On the other side of the balance sheet, gold miner Genesis Minerals (ASX:GMD) jumped 5.5% and fellow producer Perseus Mining (ASX:PRU) 3.66%.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ANR | Anatara Ls Ltd | 0.012 | 50% | 33,385,582 | $1,708,723 |

| CHM | Chimeric Therapeutic | 0.003 | 50% | 32,686,754 | $6,509,117 |

| KRR | King River Resources | 0.011 | 47% | 15,029,352 | $10,976,903 |

| LAT | Latitude 66 Limited | 0.065 | 38% | 684,929 | $6,739,833 |

| MTL | Mantle Minerals Ltd | 0.002 | 33% | 3,892,471 | $9,671,169 |

| SAN | Sagalio Energy Ltd | 0.008 | 33% | 35,000 | $1,227,961 |

| SP3 | Specturltd | 0.032 | 33% | 5,031,237 | $7,605,603 |

| CXU | Cauldron Energy Ltd | 0.009 | 29% | 1,314,000 | $12,524,127 |

| BYH | Bryah Resources Ltd | 0.005 | 25% | 8,176,876 | $4,114,130 |

| TKL | Traka Resources | 0.0025 | 25% | 2,100,000 | $4,844,278 |

| PEK | Peak Rare Earths Ltd | 0.4175 | 25% | 11,482,010 | $144,229,892 |

| XGL | Xamble Group Limited | 0.028 | 22% | 145,273 | $7,797,328 |

| BSN | Basinenergylimited | 0.047 | 21% | 209,966 | $4,790,343 |

| ZMM | Zimi Ltd | 0.018 | 20% | 3,713,034 | $7,350,657 |

| ERL | Empire Resources | 0.006 | 20% | 100,614 | $7,419,566 |

| JAY | Jayride Group | 0.006 | 20% | 412,215 | $7,139,445 |

| NPM | Newpeak Metals | 0.019 | 19% | 136,797 | $5,266,293 |

| SUH | Southern Hem Min | 0.038 | 19% | 1,366,034 | $23,559,681 |

| MDI | Middle Island Res | 0.047 | 18% | 4,257,258 | $11,729,359 |

| GML | Gateway Mining | 0.061 | 17% | 5,942,700 | $99,258,655 |

| BTN | Butn Limited | 0.105 | 17% | 886,646 | $34,192,761 |

| UWC | Underwood Capital | 0.07 | 17% | 944,376 | $12,319,612 |

| CTO | Citigold Corp Ltd | 0.007 | 17% | 9,532,801 | $18,000,000 |

| 4DX | 4Dmedical Limited | 1.52 | 16% | 28,295,811 | $609,931,528 |

| CAE | Cannindah Resources | 0.037 | 16% | 1,500,227 | $23,298,558 |

In the news…

King River Resources (ASX:KKR) is welcoming geologist Graham Gadsby as its new managing director from October 14.

Gadsby held top roles including general manager operations and chief geologist at formerly listed Spartan Resources, where he helped drive exploration and develop gold projects in WA — including the significant Never Never and Pepper gold deposits.

Spartan was acquired by Ramelius Resources (ASX:RMS) in July.

Peak Rare Earths’ (ASX:PEK) Chinese suitor Shenghe Resources sweetened its takeover offer today.

Under the revised scheme, Shenghe now values Peak at about $195 million, offering shareholders no less than $0.443 a share in cash, which is about a 32% premium to where Peak was trading on September 4.

The improved offer follows the original takeover deal announced back in May. Shenghe originally offered $150.5m, plus the proceeds of a $7.5m cap raise, to buy out the rest of Peak it doesn’t already own, which valued Peak at roughly 36 cents a share.

Underwood Capital (ASX:UWC) rose 17% today after releasing its investment portfolio report for August. UWC said it was a strong month driven by positive fundamental news flow in its listed portfolio and improved sentiment in the legacy portfolio.

UWC’s net asset value (before tax) rose 26% in August, driven mostly by a $6m boost from its investment in Canadian cannabis company Weed Me and a $1.3m revaluation gain from its portfolio of Australian small-cap shares.

The gain from Weed Me came mainly from a 47% rise in the valuation multiple UWC uses, driven by higher market values of comparable Canadian cannabis companies in August.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| 4DS | 4Ds Memory Limited | 0.01 | -64% | 131,031,758 | $57,705,164 |

| CZN | Corazon Ltd | 0.002 | -33% | 6,601,423 | $3,703,717 |

| SKN | Skin Elements Ltd | 0.002 | -33% | 1,250,000 | $3,225,642 |

| M4M | Macro Metals Limited | 0.007 | -22% | 966,146 | $37,977,303 |

| T88 | Taitonresources | 0.07 | -20% | 16,000 | $6,552,249 |

| ERA | Energy Resources | 0.002 | -20% | 250 | $1,013,490,602 |

| MEL | Metgasco Ltd | 0.002 | -20% | 20,655 | $4,592,717 |

| SIS | Simble Solutions | 0.004 | -20% | 4,700,239 | $5,411,652 |

| THR | Thor Energy PLC | 0.01 | -17% | 16,003,366 | $8,791,633 |

| TMK | TMK Energy Limited | 0.0025 | -17% | 2,393,365 | $30,667,149 |

| MGT | Magnetite Mines | 0.067 | -16% | 3,397,814 | $10,104,619 |

| EMU | EMU NL | 0.023 | -15% | 436,141 | $5,703,709 |

| C7A | Clara Resources | 0.003 | -14% | 767,015 | $2,601,533 |

| PKO | Peako Limited | 0.003 | -14% | 1,155 | $5,207,097 |

| RAN | Range International | 0.003 | -14% | 368,914 | $3,287,516 |

| TEM | Tempest Minerals | 0.006 | -14% | 35,016 | $7,712,565 |

| SNS | Sensen Networks Ltd | 0.071 | -13% | 3,826,812 | $65,029,073 |

| TMB | Tambourahmetals | 0.04 | -13% | 1,541,531 | $7,670,666 |

| ESR | Estrella Res Ltd | 0.028 | -13% | 6,962,370 | $70,311,698 |

| PET | Phoslock Env Tec Ltd | 0.007 | -13% | 843,678 | $4,995,124 |

| WSR | Westar Resources | 0.007 | -13% | 3,641,670 | $3,189,799 |

| KCCDA | Kincora Copper | 0.875 | -13% | 60,904 | $23,547,909 |

| INF | Infinity Metals Ltd | 0.015 | -12% | 1,296,163 | $8,150,887 |

| REC | Rechargemetals | 0.015 | -12% | 150,000 | $4,368,829 |

| RGT | Argent Biopharma Ltd | 0.115 | -12% | 192,978 | $9,383,810 |

In Case You Missed It

Energy Transition Minerals’ (ASX:ETM) fieldwork is building on previous work to define new targets in under-explored areas of the Kvanefjeld REE project.

Bayan Mining and Minerals’ (ASX:BMM) rare earths targets at its Desert Star projects are supported by coincident geophysical and geochemical anomalies.

Caprice Resources (ASX:CRS) is targeting strike and depth extensions at the Island gold project with 20,000 metres of drilling.

Argent Minerals (ASX:ARD) is set to raise nearly $5 million with the support of sophisticated and professional investors.

Nordic Resources (ASX:NNL) continues to drill at the Kospa gold project in Finland with eight holes now completed across 1,700m of diamond core.

Mt Malcolm Mines’ (ASX:M2M) drilling has confirmed that shallow gold mineralisation is present at Sunday Underground beneath historical workings.

Trading halts

Adelong Gold (ASX:ADG) – cap raise

Artrya (ASX:AYA) – cap raise

Great Northern Minerals (ASX:GNM) – tenure applications Catalyst Ridge Project

Latitude 66 (ASX:LAT) – Carnaby deal update, exploration results

Marimaca Copper (ASX:MC2) – cap raise

Metal Powder Works (ASX:MPW) – cap raise

Red Mountain Mining (ASX:RMX) – pending assay results Fry Lake Gold Project

Rumble Resources (ASX:RTR) – cap raise

Solvar (ASX:SVR) – ASIC proceedings judgment

Tasmea (ASX:TEA) – cap raise

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.