Closing Bell: ASX up as Block Inc soars 10pc; Rincon cranks up another 60pc gain

Block Inc soars 10pc after smashing revenue and EPS expectations. Picture Getty

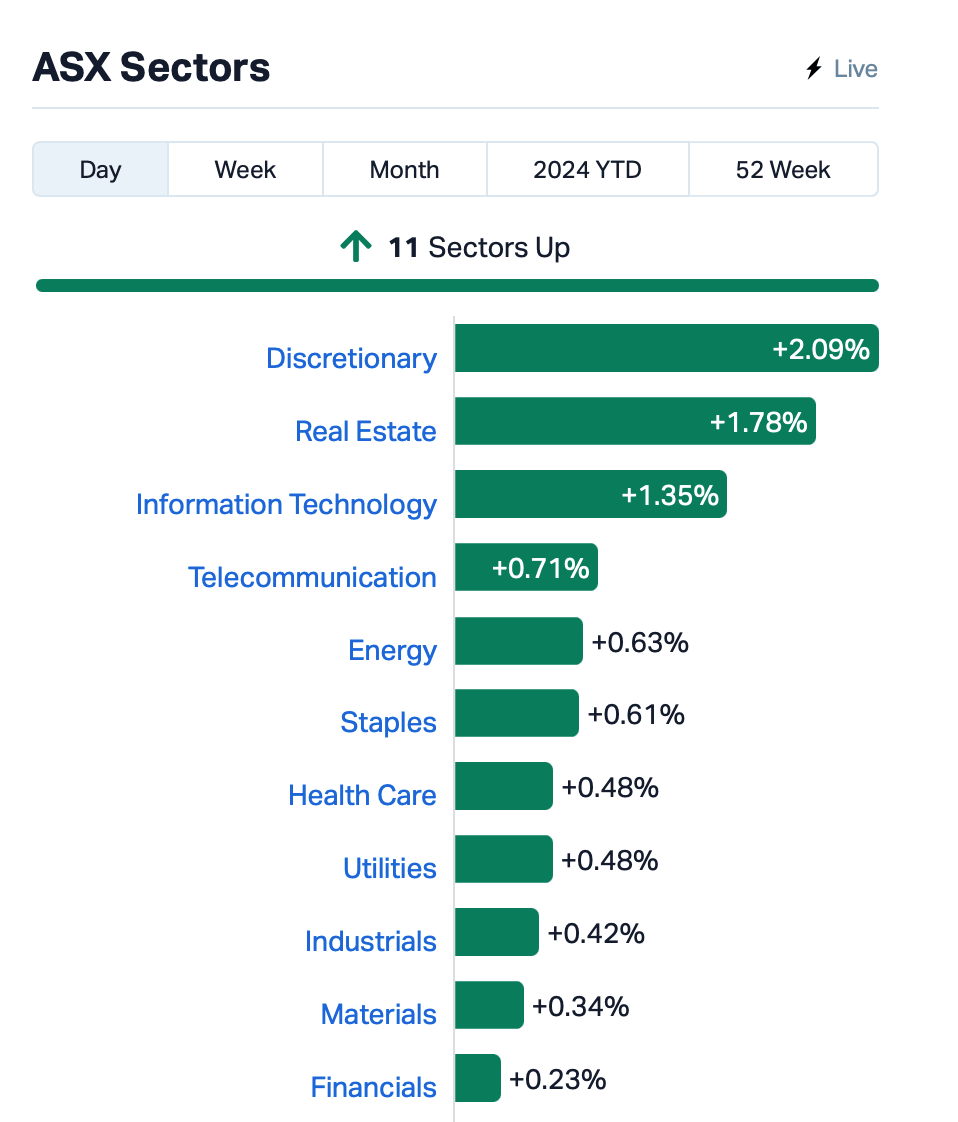

- ASX up, with Discretionary and Tech leading the charge

- Block Inc soars 10pc after smashing revenue and EPS expectations

- Macquarie takes a hit with a 32pc drop in net profit, CEO cites ongoing uncertainty

The ASX bounced back on Friday, clinching its fourth win in five days despite some jitters about US interest rates going up for longer.

At the close of day, the broad ASX200 index was up by +0.6% (and up +0.8% for the week), with the Discretionary, Real Estate, and Tech stocks leading the charge.

The broad-based rally follows action on Wall Street overnight, where the S&P 500 and tech-heavy Nasdaq both lifted strongly.

This afternoon, US stocks futures were flashing green again, adding to the positive vibes after Apple’s eye-popping US$110 billion buyback announcement last night.

Steve Sosnick over at Interactive Brokers summed it up pretty well: “An astonishing number,” he said.

“Apple may be acknowledging that they are becoming a value stock that returns money to shareholders rather than a high powered growth stock that needs its cash for R&D or expansion.”

To the ASX, Macquarie Group (ASX:MQG) was down over -2% after net profit for the whole year hit $3.5 billion, which sounds like a lot until you realise it’s down a whopping 32% from last year.

Macquarie’s return on equity also took a bit of a nosedive, going from 16.9% to 10.8%, but the silver lining is that the second half of the year wasn’t as awful as the first.

Macquarie CEO Shemara Wickramanayake however pointed to the firm’s 55th consecutive year of profitability since inceptions, “despite ongoing economic uncertainty and subdued market conditions in many parts of the world”.

Elsewhere, Afterpay’s owner, Block Inc (ASX:SQ2), surged by +10% today after the company dropped some serious cash news: that it raked in a whopping US$5.96 billion in revenue for the quarter ending March (beating forecast of US$5.75 billion) – in a trading update released in New York after the bell.

And get this – Block’s earnings per share (EPS) more than doubled from US$0.40 to US$0.85 for the same period – almost 40% above expectations!

All eyes on US jobs data

Meanwhile, Asia’s stock markets were on the rise today, especially the Tech sector, and the Yen was doing its own little victory dance – all in anticipation of some juicy US Non-Farm Payrolls numbers later tonight.

Hong Kong stocks are on a winning streak, hitting a 9-session high thanks to the recent tech rally.

As we know, HK-listed stocks like Alibaba, Tencent, and JD.com have hit new highs for 2024.

“Even after the sharp rally, valuations for the China tech stocks are still well below historical average,” Vey-Sern Ling down at Union Bancaire Privee told Bloomberg.

All eyes will now turn to that US April Non-Farm Payrolls (NFP) report.

Bloomberg has dished out the deets, predicting that the US job market might have added around 240,000 new jobs in April. That’s a bit of a dip from March’s impressive 303,000.

But remember, the NFP has been beating expectations for the past 5 months, so will it keep up the streak this time?

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| RCR | Rincon | 0.155 | 63% | 32,921,429 | $21,109,130 |

| GTI | Gratifii | 0.011 | 57% | 11,118,173 | $11,284,315 |

| ADG | Adelong Gold Limited | 0.004 | 33% | 116,333 | $2,911,467 |

| EDE | Eden Inv Ltd | 0.002 | 33% | 1,734,954 | $5,517,407 |

| RIL | Redivium Limited | 0.004 | 33% | 1,198,566 | $8,192,564 |

| PPK | PPK Group Limited | 0.555 | 29% | 1,700,722 | $38,394,396 |

| SVG | Savannah Goldfields | 0.035 | 25% | 89,511 | $7,870,378 |

| RML | Resolution Minerals | 0.003 | 25% | 250,000 | $3,220,044 |

| VML | Vital Metals Limited | 0.005 | 25% | 1,306,407 | $23,580,268 |

| BCA | Black Canyon Limited | 0.135 | 23% | 151,962 | $7,715,561 |

| ZGL | Zicom Group Limited | 0.055 | 22% | 271,798 | $9,655,200 |

| ALC | Alcidion Group Ltd | 0.068 | 21% | 7,518,266 | $75,178,500 |

| PL3 | Patagonia Lithium | 0.145 | 21% | 1,658,824 | $5,895,420 |

| CGR | Cgnresourceslimited | 0.380 | 19% | 766,323 | $29,049,021 |

| GHY | Gold Hydrogen | 1.620 | 18% | 1,214,195 | $105,028,342 |

| KP2 | Kore Potash PLC | 0.013 | 18% | 1,003,437 | $7,263,725 |

| GSR | Greenstone Resources | 0.010 | 18% | 4,553,912 | $11,672,687 |

| LYN | Lycaonresources | 0.400 | 18% | 1,706,783 | $14,979,125 |

| OSX | Osteopore Limited | 0.350 | 17% | 98,332 | $3,098,607 |

| 88E | 88 Energy Ltd | 0.004 | 17% | 9,106,226 | $86,678,016 |

| ADY | Admiralty Resources. | 0.007 | 17% | 252,322 | $9,776,844 |

| LPD | Lepidico Ltd | 0.004 | 17% | 1,867,796 | $22,914,924 |

| SGC | Sacgasco Ltd | 0.007 | 17% | 7,105,661 | $4,678,122 |

| SP8 | Streamplay Studio | 0.007 | 17% | 272,984 | $6,903,743 |

PPK Group (ASX:PPK) was one of the leaders today, following gains on Thursday’s news that investee company Craig International Ballistics has been handed a very juicy $30 million order for body armour by the Australian Defence Force. The remit for the contract will see Craig International Ballistics manufacture and deliver a new order of body armour components to help protect troops from moving threats like fragmentation, and low and high velocity rounds, from its factory in Queensland.

Rincon Resources (ASX:RCR) is once again making some serious noise. The stock’s on a wild ride, up a whopping 100% for the week, 400% for the past month, and 328% year-to-date. Recently, Rincon hit the jackpot with a ‘bullseye’ discovery called Avalon. The market went nuts over it, especially since it was similar to other big hitters like Luni and Prominent Hill. And it’s not slowing down. The company has kicked off an RC drilling campaign, aiming to dig up to 2,000m at the Pokali prospect.

Emu (ASX:EMU) was well ahead after announcing the completion of it’s 1:30 consolidation.

Patagonia Lithium (ASX:PL3) hiked up the bourse after announcing “outstanding” assay results from its first drill well at the Formentera brines project in Argentina’s part of the ‘Lithium Triangle’.

It’s also on the hunt for rare earths and niobium there, but as its name suggests, lithium’s the main game, with two major brine projects on the go – Formentera/Cilon in Salar de Jama, Jujuy province and Tomas III at Incahuasi Salar in Salta Province. Re the Formentera drill well news, the highlight intercept was 200m at 235ppm from 170m depth, including a 21m chunk grading 591ppm. Also noted: very low levels of deleterious ions (Mg:Li 1.49 at 591ppm Li, boron 522ppm, calcium 358ppm).

Manganese explorer and developer, Black Canyon (ASX:BCA), traded higher based on some ‘dense media separation’. If only that meant a shake-up and parting of ways in the braindead mainstream Aussie breakfast telly news and current affairs schtick. Dense medium/media separation in the world of mining, meanwhile, is where particles are sorted on the basis of their densities. In Black Canyon’s case, it’s talking the delivery of almost 32% manganese concentrate in this instance. Specifically, grades of 31.8% Mn and 31.3% Mn from its KR1 and KR2 test samples conducted recently.

The small gold digger, Savannah Goldfields (ASX:SVG), spread its wings today after saying goodbye to coking coal and hello to more glittering prospects. With a tidy sum of $3.95m on the table, it has cashed in on the Ashford coking coal project. Plus, it’s holding onto a sweet deal – a $0.75 royalty on every tonne of coal sold.The company inked the deal to sell its stake in Renison Coal to Clara Resources Australia (ASX:C7A), freeing them up to focus on its golden dreams. Savannah’s aiming to be a ‘pure play’ goldie, but it’s still keeping one eye on the Ashford coking coal project, just in case it strikes gold in the future.

And hey, Cash Converters (ASX:CCV’s quarterly revenue was up 19% pcp to $93.0m, driven by Australian store network momentum and contribution of strong trading results from the UK franchise network acquisition (Capital Cash) completed in July 2023. Gross loan book was up 9% pcp to $291.7m, on the back off strong customer demand for credit.

Infini Resources (ASX:I88) says geophysical surveys including high resolution UAV drone magnetics have been approved at Portland Creek Uranium Project by the Newfoundland Government in Canada. Initial reconnaissance field work was successfully completed despite adverse weather, with field crews to recommence activities including soil sampling and geological mapping/sampling within a week.

And accounting company, Count (ASX:CUP), has today updated the market on the cost synergy benefits expected to be achieved following the integration of Diverger Limited. Annualised expected cost savings have been upgraded to approximately $4m, to be achieved in FY25. This represents a considerable increase from the initial $3m expectation announced at the time of the transaction.

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AXP | AXP Energy Ltd | 0.001 | -50% | 32,263 | $11,649,361 |

| ERL | Empire Resources | 0.002 | -33% | 20,059 | $3,338,805 |

| FZR | Fitzroy River Corp | 0.115 | -28% | 10,000 | $17,272,680 |

| CHK | Cohiba Min Ltd | 0.003 | -25% | 121,592 | $14,352,977 |

| ENT | Enterprise Metals | 0.003 | -25% | 2,387,851 | $3,207,884 |

| ME1 | Melodiol Glb Health | 0.003 | -25% | 54,969,315 | $2,693,949 |

| MTL | Mantle Minerals Ltd | 0.002 | -25% | 185,000 | $12,394,892 |

| TKL | Traka Resources | 0.002 | -25% | 124,065 | $3,501,317 |

| TZL | TZ Limited | 0.019 | -24% | 139 | $6,414,578 |

| PRX | Prodigy Gold NL | 0.002 | -20% | 200,000 | $5,034,435 |

| ROG | Red Sky Energy. | 0.004 | -20% | 3,096 | $27,111,136 |

| VRC | Volt Resources Ltd | 0.004 | -20% | 3,911,074 | $20,793,391 |

| NME | Nex Metals Explorat | 0.022 | -19% | 265,934 | $9,518,378 |

| MMM | Marley Spoon Se | 0.032 | -18% | 1,025 | $4,591,252 |

| STM | Sunstone Metals Ltd | 0.012 | -18% | 5,313,039 | $49,009,122 |

| FIN | FIN Resources Ltd | 0.014 | -18% | 913,011 | $11,037,568 |

| PSL | Paterson Resources | 0.015 | -17% | 1,257,455 | $8,208,682 |

| EXL | Elixinol Wellness | 0.005 | -17% | 1,795,701 | $7,806,444 |

| AUA | Audeara | 0.041 | -16% | 21,269 | $7,085,779 |

| G88 | Golden Mile Res Ltd | 0.011 | -15% | 2,577,211 | $5,345,897 |

| NMR | Native Mineral Res | 0.017 | -15% | 560,754 | $4,197,010 |

| A1G | African Gold Ltd. | 0.024 | -15% | 255,101 | $4,915,180 |

| SOP | Synertec Corporation | 0.083 | -14% | 17,999,205 | $41,887,091 |

| AAU | Antilles Gold Ltd | 0.012 | -14% | 6,291,702 | $13,181,490 |

| AIV | Activex Limited | 0.006 | -14% | 884,134 | $1,508,518 |

IN CASE YOU MISSED IT

Brazilian Critical Minerals’ (ASX:BCM) follow-up auger drilling at its Apui ENE project in Brazil has yielded high grades of up to 3357ppm total rare earth oxides along with values of up to 663ppm for the valuable neodymium and praseodymium used in the manufacture of rare earth magnets.

Fin Resources (ASX:FIN) is progressing drilling at its Cancet West lithium project in Quebec with six diamond holes targeting the White Bear spodumene-bearing pegmatite completed to date.

Haranga Resources’ (ASX:HAR) regional termite mound sampling at its Saraya project in Senegal has now identified eight uranium anomalies returning concentrations some 20 times higher than background levels.

Drilling at Miramar Resources’ (ASX:M2R) Gidji joint venture project in WA’s Eastern Goldfields region has intersected host rocks similar to those that host the +2Moz Paddington deposit at the Blackfriars prospect.

Tesoro Gold (ASX:TSO) has signed a memorandum of understanding to advance the option to secure water supply from Aguas CAP’s desalination plant ~25km from the 1.3Moz Ternera deposit within its El Zorro project in Chile.

BPH Energy (ASX:BPH) investee company Advent Energy has been offered and accepted a five-year renewal of Retention Licence 1 (RL1) in the onshore Bonaparte Basin, Northern Territory. While most of the prolific Bonaparte Basin is offshore, Advent holds 166km2 of ground in the onshore portion, which covers the Weaber gas field that was discovered in 1985. Weaber was previously assessed to host best estimate (2C) contingent resources of 11.5 billion cubic feet of gas.

Kula Gold (ASX:KGD) has started reverse circulation drilling for gold and rare earths at the Boomerang prospect within its Marvel Loch project near Southern Cross, Western Australia. The drilling tests a newly defined gold anomaly that sits in a magnetic low and in the vicinity of geochemistry results that include a previous hole drilled by the company that returned a 1m intersection grading 2.6g/t gold from 54m. Assays will also be carried out for REEs following positive indications from historical drilling in the tenement.

Lanthanein Resources (ASX:LNR) has raised $2.2m through a placement of 488 million shares priced at 0.45c each to fund exploration at its Lady Grey project near Southern Cross, WA. It expects the placement to accelerate work programs and approvals processes to allow drilling of the anomalies by mid-year. The company recently identified multiple new gold, copper and nickel anomalies through soil sampling, adding another dimension to its prospectivity following the discovery of the large Godzilla and Avenger lithium anomalies.

TRADING HALTS

Neurotech (ASX:NTI) – pending the release of the full results of the Phase I/II Rett Syndrome clinical trial.

At Stockhead, we tell it like it is. While BPH Energy, Kula Gold Lanthanein Resources, Brazilian Critical Minerals, Fin Resources, Haranga Resources, Miramar Resources and Tesoro Gold are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.