Closing Bell: ASX up 1pc, Tech stocks surge as market toasts Life360’s 17pc gain

Life360 and News Corp saw big gains today. Picture Getty

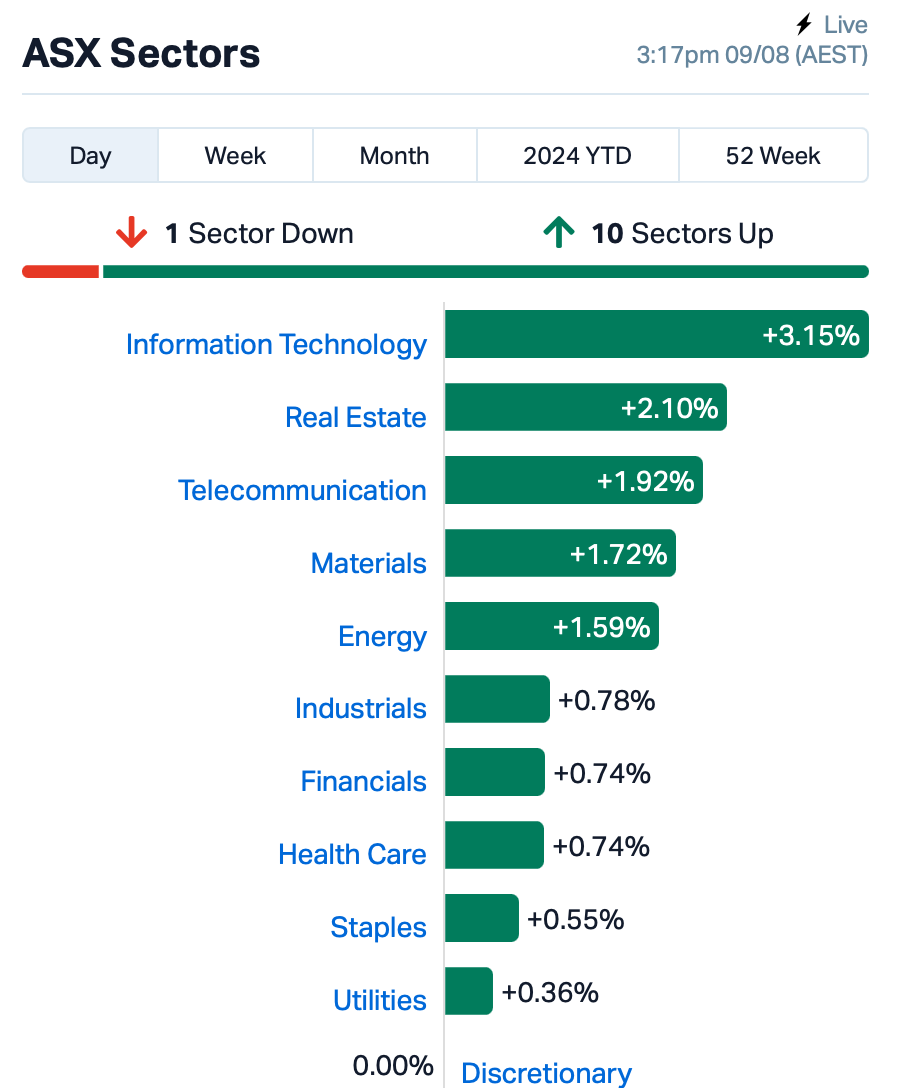

- ASX up 1pc, boosted by a 3pc surge in tech

- Wall Street rallied last night as US job data eased recession fears

- Life360 and News Corp saw gains today, China dipped due to CPI data

Aussie stocks jumped 1.3% by Friday, driven by tech after a big rally on Wall Street overnight. For the week however, the ASX is still down over 2%.

US stocks staged a strong rebound, with the tech-heavy Nasdaq rising by 3%, after the latest labour market data eased worries about a significant slowdown in the world’s largest economy.

According to the Labour Department data, new claims for US unemployment benefits fell to 233,000 last week, coming in lower than anticipated and helping to quell recession concerns.

In today’s trading, all 11 ASX sector gained, led by tech which surged 3%.

The tech sector’s performance was helped along by the ASX’s fifth-largest tech company, Life360 (ASX:360).

The roughly $4 billion market capper has jumped 17% on news that it has grown its monthly active user total to approximately 71 million, and boosted total revenue 20% year-on-year to $84.9 million.

“Q2 FY24 was excellent for Life360, as we set new records in business and financial performance, and completed our U.S. IPO,“ said Life360’s co-founder and CEO, Chris Hulls.

WiseTech Global (ASX:WTC) , Xero (ASX:XRO) also made gains for the tech sector.

In media, News Corp (ASX:NWS) jumped 7% after telling shareholders that there is “third-party interest in a possible deal involving the Foxtel Group”. News Corp owns 65% of Foxtel Group.

REA Group (ASX:REA) also rose 7% after the realestate.com.au operator reported a 23% rise in revenue to $1.45 billion and a 27% increase in EBITDA to $825 million for the full year of FY24, surpassing estimates.

Mining stocks meanwhile gained as global markets turned optimistic and iron ore prices bounced back in Singapore today. Rio Tinto (ASX:RIO) was the pick of the large cap, up 3%.

What else happened today?

Across Asia, stock markets had a good day, mostly.

Japan, South Korea, and Hong Kong shares held their gains, but mainland Chinese stocks fell after China’s CPI increased more than expected in July, mainly due to seasonal factors like weather.

Prices rose 0.5% from last year, higher than the 0.3% forecast.

China has been battling deflation, with one indicator showing the longest period of declining consumer prices since 1999.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| IEC | Intra Energy Corp | 0.002 | 100% | 430,000.00 | $1,690,782 |

| RIL | Redivium Limited | 0.005 | 67% | 22,760,373.00 | $8,192,564 |

| HLX | Helix Resources | 0.003 | 50% | 10,699,378.00 | $6,528,387 |

| AUK | Aumake Limited | 0.011 | 38% | 21,165,293.00 | $15,425,928 |

| BCT | Bluechiip Limited | 0.004 | 33% | 250,000.00 | $3,546,119 |

| JAV | Javelin Minerals Ltd | 0.002 | 33% | 773,602.00 | $6,415,269 |

| RGT | Argent Biopharma Ltd | 0.220 | 33% | 302,238.00 | $7,986,924 |

| JAY | Jayride Group | 0.012 | 33% | 101,800.00 | $2,126,782 |

| NMT | Neometals Ltd | 0.079 | 25% | 3,491,041.00 | $39,263,580 |

| ARV | Artemis Resources | 0.015 | 25% | 25,701,508.00 | $23,002,589 |

| 1CG | One Click Group Ltd | 0.010 | 25% | 179,513.00 | $5,625,431 |

| 1TT | Thrive Tribe Tech | 0.003 | 25% | 356,636.00 | $1,223,243 |

| EEL | Enrg Elements Ltd | 0.003 | 25% | 1,503,898.00 | $2,019,930 |

| EMT | Emetals Limited | 0.005 | 25% | 106,000.00 | $3,400,000 |

| VML | Vital Metals Limited | 0.003 | 25% | 145,229.00 | $11,790,134 |

| LRV | Larvottoresources | 0.155 | 24% | 9,939,096.00 | $38,494,308 |

| IMI | Infinitymining | 0.016 | 23% | 100,000.00 | $1,543,794 |

| SM1 | Synlait Milk Ltd | 0.338 | 23% | 715,947.00 | $60,109,957 |

| NAG | Nagambie Resources | 0.011 | 22% | 12,301,450.00 | $7,169,721 |

| KOB | Kobaresourceslimited | 0.140 | 22% | 166,692.00 | $18,234,586 |

| APX | Appen Limited | 1.095 | 21% | 16,549,425.00 | $201,816,487 |

| DTR | Dateline Resources | 0.006 | 20% | 3,257,020.00 | $11,087,566 |

| KPO | Kalina Power Limited | 0.006 | 20% | 5,571,358.00 | $12,431,970 |

Triangle Energy (ASX:TEG) was climbing on Friday, after the company released an investor presentation that outlined, among other things, the company’s progress in the Perth Basin, where a two-well farm-in is underway and proceeding nicely. The company has also revealed that the sale of Cliff Head oil field and facilities to Pilot for conversion to CCS is in its final stages, with Triangle expecting it to be finalised in October, pocketing $16 million.

Pointerra (ASX:3DP) was also gaining on Friday, after revealing that it has signed new contract awards with existing US energy utility customer Florida Power & Light. Pointerra will be paid $1.23 million to analyse lidar and imagery for FPL business cases, and expects to complete all contract deliverables during FY25.

EVZ (ASX:EVZ) was climbing early on news that it has been awarded a major contract in the mining and industrial sector through its wholly owned subsidiary, Brockman Engineering. The total value of this contract – to provide a bulk process water tanks package by Rio Tinto as part of the seawater desalination project at Parker Point, Dampier – is roughly $23 million.

Investors seem to be going through the side door in trade today as BM8 tops ressie performers on the back of assay results out of Equinox Resources’ (ASX:EQN) Mata Da Corda REE project in Brazil – the world’s hottest emerging rare earths district.

READ MORE: Why ASX investors are backing juniors in Brazil’s rare earths scene

While we can’t confirm why its share price soared here at Stockhead, BM8 does have a 36% stake in EQN – one of the best performers in the small cap market in FY24 and may have risen on the back of today’s announced results from its partner.

EQN is accelerating exploration at Mata de Corda, as well as the huge 1801km2 Campo Grande project – which straddles Gina Hancock’s Brazilian Rare Earths’ (ASX:BRE) own REE portfolio – in Brazil’s emerging world-class Rocha da Rocha REE district. Additional surface sample results have reaffirmed Mata da Corda’s exceptional district-scale targets, showing >2000ppm TREO across the 972 km2 project, and the junior is now primed for drilling, according to EQN MD Zac Komur.

Sarytogan Graphite (ASX:SGA)has received a cornerstone investment of $5m from the European Bank for Reconstruction and Development (EBRD), one of Europe’s sovereign wealth funds that has invested >€200 billion euros across 7100 projects to date. EBRD will purchase the shares at a premium of 16c and end up with a 17.36% stake in the company, yet will also need (and likely get) approval from the Australian Foreign Investment Board.

SGA is developing its namesake Sarytogen graphite project in Central Kazakhstan, endowed with an enormous 229Mt at 28.9% total graphite content (TGC) – which is pretty bonkers.

It recently upgraded the mineralisation to 99.9992% carbon which is “five nine purity” thermal purification – without any chemical pre-treatment. The junior’s aim is to supply high-quality anode pre-cursor material for the rapidly growing EV battery market.

Green Critical Minerals (ASX:GCM) has consigned critical minerals specialist Wave International to complete the pre-feasibility study (PFS) of its McIntosh graphite project in northeast WA.

Wave has worked with long list of resources companies such as Black Rock Mining (ASX:BKT), Graphinex, Lithium Energy (ASX:LEL), Renascor Resources (ASX:RNU), Syrah Resources (ASX:SYR) and Triton Minerals (ASX:TON).

At the start of July, GCM upgraded McIntosh 26% to a resource estimate of 30.2Mt at 4.40% TGC, identifying and including fine flake graphite material. It’s also looking to expand its graphite product suite to include spherical purified graphite (SPG). The junior says it’s kicking on with further metallurgical test work program for the SPG that will also potentially form part of the PFS that’s being conducted by Wave.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| CT1 | Constellation Tech | 0.001 | -50% | 2,999,999 | $2,949,467 |

| PHX | Pharmx Technologies | 0.030 | -33% | 7,022,514 | $26,932,806 |

| CNJ | Conico Ltd | 0.001 | -33% | 435,000 | $3,302,291 |

| PUR | Pursuit Minerals | 0.002 | -33% | 242,212 | $10,906,200 |

| ATV | Activeportgroupltd | 0.047 | -33% | 1,806,970 | $22,255,907 |

| EDE | Eden Inv Ltd | 0.002 | -25% | 243,698 | $7,427,417 |

| EXL | Elixinol Wellness | 0.003 | -25% | 80,094 | $5,284,729 |

| RNE | Renu Energy Ltd | 0.003 | -25% | 314 | $2,904,536 |

| GRL | Godolphin Resources | 0.011 | -21% | 64,184 | $2,994,477 |

| ALR | Altairminerals | 0.004 | -20% | 4,283,833 | $21,482,888 |

| CTO | Citigold Corp Ltd | 0.004 | -20% | 5,000,000 | $15,000,000 |

| EEL | Enrg Elements Ltd | 0.002 | -20% | 1,892,761 | $2,524,913 |

| OVT | Ovanti Limited | 0.004 | -20% | 291,830 | $7,613,027 |

| RGL | Riversgold | 0.004 | -20% | 10,403,835 | $6,637,313 |

| RIL | Redivium Limited | 0.002 | -20% | 40,000 | $6,827,137 |

| ROG | Red Sky Energy. | 0.004 | -20% | 2,654,432 | $27,111,136 |

| TX3 | Trinex Minerals Ltd | 0.002 | -20% | 20,999,999 | $4,571,631 |

| OEQ | Orion Equities | 0.130 | -19% | 34,047 | $2,503,876 |

| DTM | Dart Mining NL | 0.014 | -18% | 477,747 | $4,393,359 |

| BEO | Beonic Ltd | 0.025 | -17% | 222,354 | $14,646,683 |

| FCT | Firstwave Cloud Tech | 0.015 | -17% | 169,457 | $30,780,349 |

| ADD | Adavale Resource Ltd | 0.003 | -17% | 3,125,000 | $3,195,796 |

| ECT | Env Clean Tech Ltd. | 0.003 | -17% | 823,706 | $9,515,431 |

| VML | Vital Metals Limited | 0.003 | -17% | 1,020,000 | $17,685,201 |

IN CASE YOU MISSED IT

Equinox Resources (ASX:EQN) has kicked off Phase 1 RC drilling across the Mata da Corda ionic-clay hosted rare earths project in Brazil and is investigating the potential for a secondary product of titanium dioxide.

TG Metals (ASX:TG6) has hooked more high-grade lithium at the Jaegermeister prospect with multiple lithium pegmatites confirmed at shallow depths, including a stand-out grade of 2.68%.

TRADING HALTS

Evolution Energy Minerals (ASX:EV1) – pending an announcement regarding the Tranche 2 Placement and associated matters.

Minbos Resources (ASX:MNB) – pending the release of an announcement regarding a strategic investment in Minbos.

Cokal (ASX:CKA) – pending an announcement in relation to a new underground mining agreement at the Bumi Barito mineral project.

White Cliff Minerals (ASX:WCN) – pending the release of an announcement relating to material assay results for the Great Bear IOCG-U project.

At Stockhead we tell it like it is. While Equinox Resources and TG Metals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.