Closing Bell: ASX up about 1pc despite tech slump; Bitcoin defies gravity

Bitcoin soars after US SEC chair resigned. Picture via Getty Images

- ASX rises on energy gain as oil prices soar

- A2 Milk jumps on revenue upgrade and dividends

- WiseTech and Megaport drag down tech; Bitcoin climbs (again)

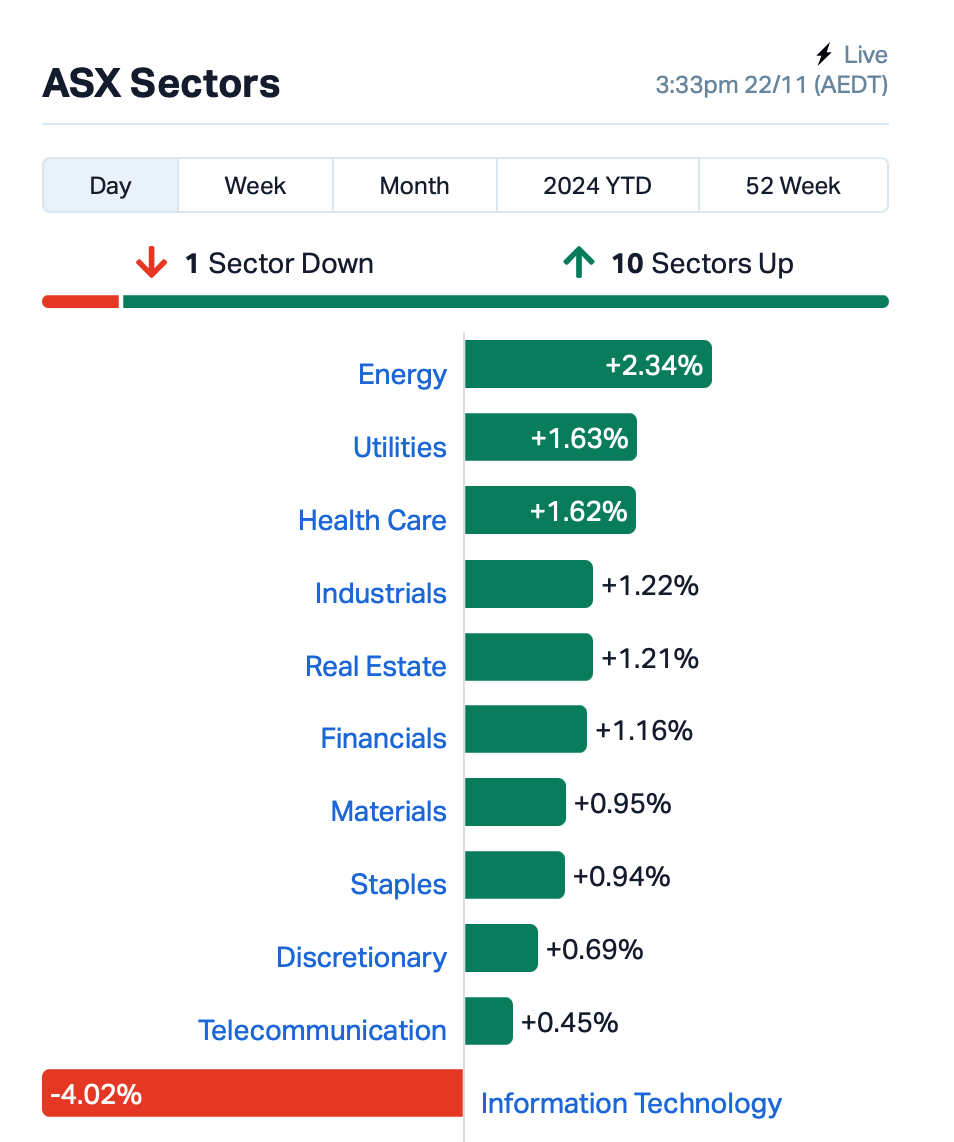

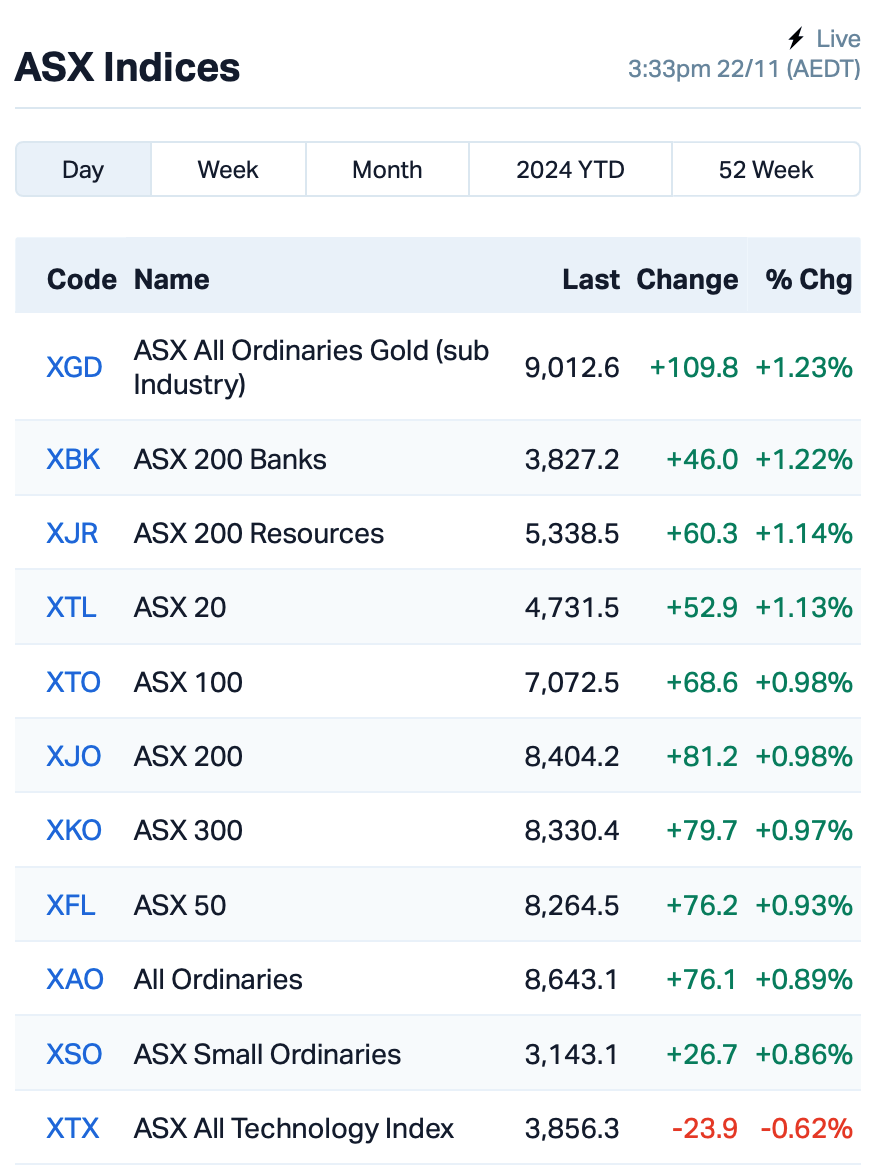

The ASX extended its gains on Friday, up by 0.8% as energy stocks surged, driven by higher oil prices amid escalating tensions in the Russia-Ukraine war.

For the week, the benchmark S&P/ASX 200 was up by around 1.55%, on track to surpass Tuesday’s all-time closing record.

Tech was the only sector in the red today.

The sector struggled after an 11% drop in heavyweight WiseTech Global (ASX:WTC) as the company downgraded its revenue and earnings forecasts for FY25.

Fellow heavyweight Megaport (ASX:MP1) also dropped 9% despite affirming its earnings guidance of $57 million to $65 million for FY25.

One of the best performers today was A2 Milk (ASX:A2M), which surged nearly 15% after raising its revenue forecast and announcing plans to start paying dividends, on the back of strong sales and higher dairy prices.

Energy stocks also saw solid gains, with Woodside Energy Group (ASX:WDS) and Santos (ASX:STO) both climbing around 2%.

Gold stocks rose once again, benefiting from the geopolitical uncertainty.

In the retail space, Kogan (ASX:KGN) faced shareholder backlash at today’s AGM, with over 60% of votes against its pay report, marking the first strike for the board. Shares were down 2%.

Meanwhile, Bitcoin took a brief pause after briefly climbing above US$99,000 following news that US SEC Chairman Gary Gensler, known for his tough stance on crypto, will step down next year.

Gensler resigned after a Texas court ruled against the SEC overnight, ordering it to cancel a rule that tried to bring crypto firms under its control. The court said the rule was too broad and didn’t fit with existing laws.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| SFG | Seafarms Group Ltd | 0.002 | 33% | 555,769 | $7,254,899 |

| TMK | TMK Energy Limited | 0.002 | 100% | 44,979,707 | $9,325,565 |

| VPR | Voltgroupltd | 0.002 | 50% | 3,241,666 | $10,716,208 |

| RML | Resolution Minerals | 0.002 | 33% | 54,039 | $2,415,033 |

| DEV | Devex Resources Ltd | 0.145 | 32% | 4,199,071 | $48,585,974 |

| EWC | Energy World Corpor. | 0.021 | 31% | 1,481,325 | $49,262,740 |

| BEL | Bentley Capital Ltd | 0.013 | 30% | 200,000 | $761,279 |

| SOC | Soco Corporation | 0.115 | 28% | 160,001 | $12,504,569 |

| SP3 | Specturltd | 0.019 | 27% | 825,566 | $4,484,350 |

| PCL | Pancontinental Energ | 0.018 | 25% | 24,026,870 | $113,842,202 |

| BUY | Bounty Oil & Gas NL | 0.005 | 25% | 2,948,889 | $5,994,004 |

| CUL | Cullen Resources | 0.005 | 25% | 500,000 | $2,773,607 |

| ERA | Energy Resources | 0.003 | 25% | 7,274,415 | $810,792,482 |

| ROG | Red Sky Energy. | 0.010 | 25% | 30,388,137 | $43,377,818 |

| VFX | Visionflex Group Ltd | 0.005 | 25% | 250,000 | $13,421,298 |

| 5EA | 5Eadvanced | 0.087 | 24% | 597,720 | $23,508,565 |

| HRE | Heavy Rare Earths | 0.036 | 24% | 138,173 | $2,443,979 |

| PAR | Paradigm Bio. | 0.325 | 20% | 3,891,205 | $94,485,614 |

| G11 | G11 Resources Ltd | 0.018 | 20% | 1,728,253 | $14,499,332 |

| IFG | Infocusgroup Hldltd | 0.048 | 20% | 25,005,016 | $4,351,041 |

| SBW | Shekel Brainweigh | 0.024 | 20% | 200,000 | $4,561,225 |

| SGA | Sarytogan | 0.099 | 19% | 805,466 | $12,427,866 |

| C29 | C29Metalslimited | 0.125 | 19% | 654,702 | $18,289,765 |

| IR1 | Irismetals | 0.315 | 19% | 417,785 | $36,864,145 |

5E Advanced Materials (ASX:5EA) said it has made significant progress, including the decision to use calcium chloride as a by-product, which will reduce capital costs by 15%. The company recently shipped its first truckload of boric acid to a US customer and has improved production efficiency, saving an estimated $2.2 million in 2025. It has also secured a letter of intent for up to $285 million in project financing. 5EA focuses on producing and supplying specialty boron and lithium products for industries.

Sarytogan Graphite (ASX:SGA) has received $2.64 million from the EBRD (European Bank for Reconstruction and Development), giving the bank a 9.99% stake. The funds will support key projects, including graphite sample testing and management recruitment. A second investment tranche, bringing total funding to $5 million, is expected by February 2025.

DevEx Resources (ASX:DEV) surged after Chairman Tim Goyder’s comments at the company’s AGM sparked investor optimism.

Goyder highlighted the resurgence of the uranium sector, driven by growing global demand for clean energy and nuclear power’s crucial role in the energy transition. He outlined DevEx’s strategic focus on uranium exploration in the Northern Territory, alongside recent progress at its Nabarlek and Murphy West projects, which have yielded promising results.

Goyder also discussed the company’s ongoing restructuring efforts and the appointment of new managing director, Todd Ross.

Energy World Corporation (ASX:EWC) surged after the company responded to an ASX query about the significant impairment of assets related to its gas projects, including the Sengkang and Gilmore LNG facilities.

Investors reacted positively as the company provided clarity on its financial position, explaining the impairments were based on revised economic assumptions and challenges in its projects.

Asian Battery Metals (ASX:AZ9) has confirmed the discovery of sulphide mineralisation at the North Oval area of its Oval Cu-Ni-PGE Project in Mongolia.

Drillhole OVD025 intercepted 3.6 metres of sulphide, located 500 metres northwest of a previous high-grade find in OVD021. The company said the new discovery suggests that additional massive sulphide zones could exist in the area, supporting the potential for high-grade ore accumulation within the project.

Further drilling and assays are ongoing, with results expected in the coming weeks.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| RBR | RBR Group Ltd | 0.001 | -50% | 5,000,000 | $3,718,809 |

| MTL | Mantle Minerals Ltd | 0.001 | -33% | 5,481,337 | $9,296,169 |

| NRZ | Neurizer Ltd | 0.002 | -33% | 543,027 | $6,543,358 |

| CZN | Corazon Ltd | 0.003 | -25% | 10,698,439 | $2,671,622 |

| H2G | Greenhy2 Limited | 0.003 | -25% | 471,091 | $2,392,737 |

| KP2 | Kore Potash PLC | 0.048 | -21% | 2,123,517 | $41,604,316 |

| LCY | Legacy Iron Ore | 0.010 | -20% | 4,679,805 | $122,566,349 |

| COY | Coppermoly Limited | 0.008 | -20% | 165,770 | $7,076,574 |

| PRM | Prominence Energy | 0.004 | -20% | 75,000 | $1,945,882 |

| TSL | Titanium Sands Ltd | 0.004 | -20% | 51,279 | $11,058,736 |

| 1TT | Thrive Tribe Tech | 0.003 | -17% | 38,454,462 | $2,110,085 |

| ALM | Alma Metals Ltd | 0.005 | -17% | 176,074 | $9,399,133 |

| FIN | FIN Resources Ltd | 0.005 | -17% | 83,821 | $3,895,612 |

| LML | Lincoln Minerals | 0.005 | -17% | 7,660,370 | $12,337,557 |

| ERW | Errawarra Resources | 0.061 | -16% | 26,115 | $7,002,209 |

| LYK | Lykosmetalslimited | 0.016 | -16% | 15,000 | $3,578,756 |

| JLL | Jindalee Lithium Ltd | 0.225 | -15% | 375,599 | $18,911,911 |

| GCM | Green Critical Min | 0.006 | -14% | 11,368,117 | $13,352,873 |

| JAV | Javelin Minerals Ltd | 0.003 | -14% | 675,000 | $18,162,887 |

| PR2 | Piche Resources | 0.120 | -14% | 1,400 | $11,240,675 |

| SRN | Surefire Rescs NL | 0.003 | -14% | 1,560,000 | $6,952,077 |

| TMS | Tennant Minerals Ltd | 0.012 | -14% | 1,034,511 | $13,382,466 |

| PGM | Platina Resources | 0.019 | -14% | 836,203 | $13,709,967 |

| GRL | Godolphin Resources | 0.013 | -13% | 415,198 | $4,743,168 |

IN CASE YOU MISSED IT

Bevis Yeo reported that:

Cannindah Resources (ASX:CAE) has identified a new Induced polarisation (IP) anomaly at its Mt Cannindah copper gold project in Queensland, which could expand the current resource – last upgraded in July to 14.5Mt at 1.09% copper equivalent.

Fatfish Group (ASX:FFG) has received firm commitments for a $1.5m placement to accelerate its investments into blockchain mining, digital gaming and other strategic frontier technology assets within its portfolio.

The placement of shares priced at 1.2c each includes one free attaching option exercisable at 2c and expiring on April 11, 2027, for every two shares subscribed for.

“We are pleased to have seen robust support from the market as we look to accelerate investments we are making into frontier technologies including blockchain mining, social and digital gaming, as well as artificial intelligence,” chief executive officer Kin Wai Lau said.

“Renewed interest in the blockchain sector – within which FFG has several investments – has created strong tailwinds for our growth.”

iTech Metals (ASX:ITM) signed a binding MoU with one of the world’s largest lithium chemicals producers, Sociedad Química y Minera de Chile, to develop the Reynolds Range lithium project in the NT. SQM can earn up to 70% of the project where ~55km strike remains to be tested.

Altech Batteries (ASX:ATC) has finalised a funding invitation document for its 120-megawatt-hour Cerenergy sodium chloride (common salt) solid-state battery project in Saxony, Germany, and has distributed to various financial institutions.

It had previously engaged 10 commercial banks and two venture debt funds in a first market round and received predominantly positive initial feedback with several of the institutions expressing strong interest in participating in the financing.

The company has also engaged several equity advisers to support the equity component of the project’s funding package, which will likely see the divestment of a minor interest in the project to one or two strategic investors.

It is targeting large utility groups, data centre operators, investment funds and corporations that are heavily involved in the green energy transition as they are strongly aligned with the project’s focus on sustainable energy solutions. Financing for the project will be structured into three key areas – debt, equity and grants – that will cover not only capital expenditures but also financing costs, working capital, debt service coverage, and an additional contingency.

The Saxony plant will manufacture batteries using common table salt and ceramic solid-state technology without the use of critical minerals such as lithium, copper, graphite, nickel and cobalt.

They are fire and explosion proof, have a life span of more than 15 years and operate in all but the most extreme conditions. Testing of the prototype using continuous daily charging and discharging cycles under real world conditions has thus far affirmed its efficiency and performance whilst maintaining safe, optimal operating temperatures.

Aurum Resources (ASX:AUE) has declared that its off-market takeover offer for Mako Gold (ASX:MKG) is now unconditional after securing a relevant interest of 39.86% in the company.

It had offered MKG shareholders one AUE share for every 25.1 MKG shares held and option holders one AUE share for every 248 MKG January 2025 options held and one AUE share for every 170 MKG June 2025 options held.

This offer, which represented a 112% premium on the 30-day volume weighted average price of $0.00855, was unanimously recommended by MKG’s directors in the absence of a superior offer.

The offer will close on Wednesday, December 4, 2024.

At Stockhead, we tell it like it is. While Altech Batteries, Cannindah Resources, Fatfish Group, iTech Minerals and Mako Gold are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.