Closing Bell: ASX tumbles hard as tariff fears slam miners; Life360 keeps impressing

The ASX stumbled on Friday. So what else is new? Picture via Getty Images

- ASX drops on tariff fears; BHP, Rio hit

- Star Entertainment Group sinks amid financial crisis

- Life360 shines as Endeavour tanks

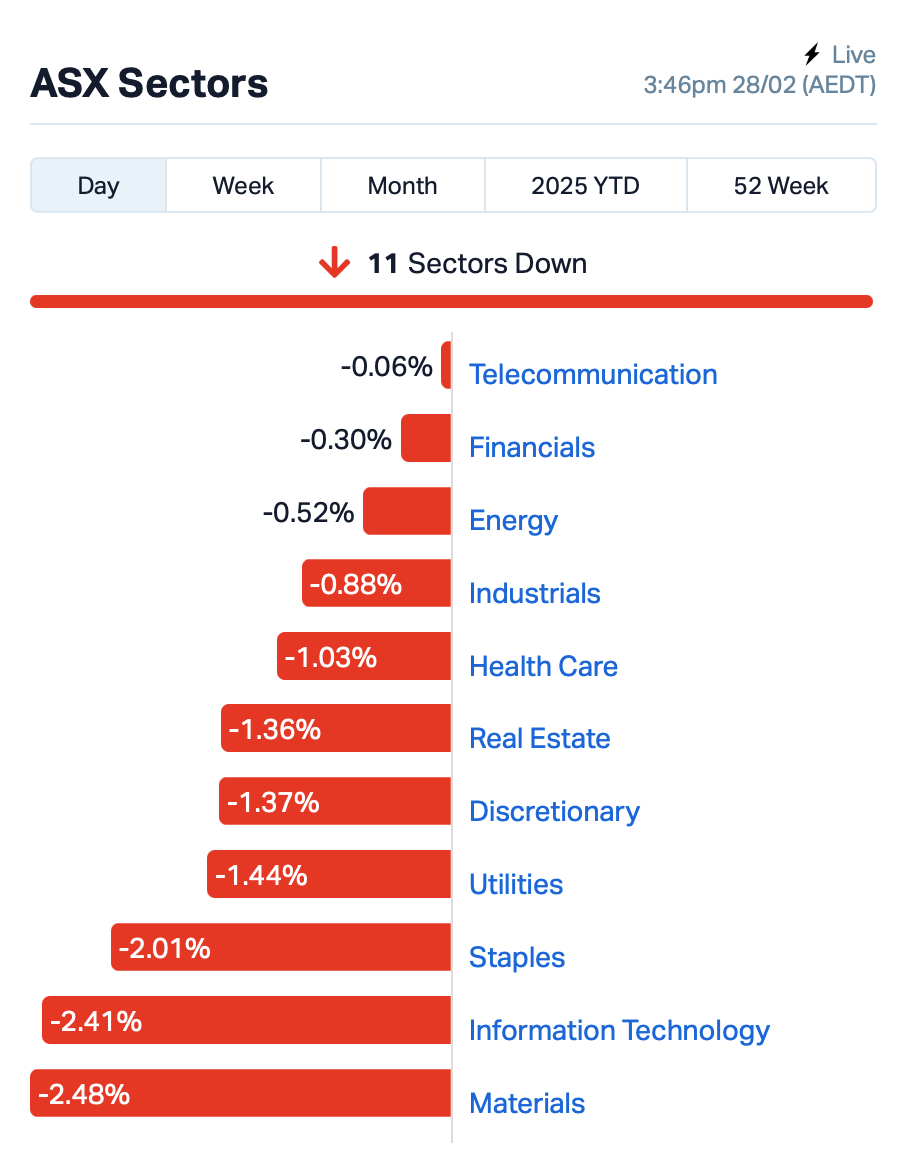

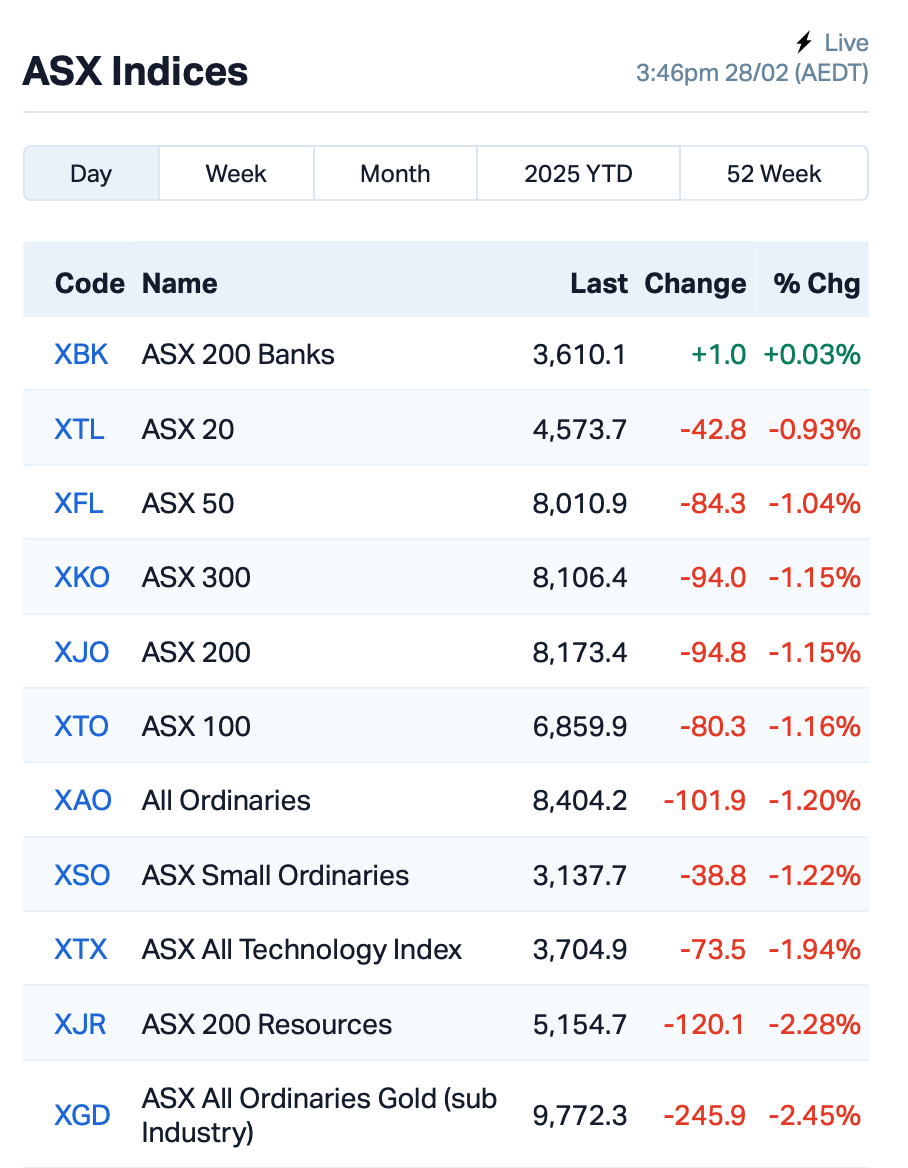

It was a rough day for the ASX, dropping 1.16% as fears over new US-China tariffs sent Aussie stocks spiralling. For the week, the benchmark ASX200 index was down 1.5%.

Trump ramped up the pressure last night, announcing an additional 10% tariff on Chinese goods, which sparked worries that demand for Aussie commodities like iron ore would take a hit.

BHP (ASX:BHP), Rio Tinto (ASX:RIO) and Fortescue (ASX:FMG) all shed 2-3% on the tariff news. Even gold miners couldn’t escape the sell-off.

Elsewhere, Endeavour Group (ASX:EDV) weighed on the discretionary sector after dropping 6%. The owner of liquor retailers Dan Murphy’s and BWS reported a profit slump of 15% in the half, and the company had to lower its dividend by 12.6%.

Star Entertainment Group (ASX:SGR) got absolutely smashed, sinking 18% as the casino operator warned it might not make it through the day without some changes to its financial situation.

The casino is waiting on some proposals that could save the day, but no word yet if that will happen.

Star also said it might not be able to finalise its financial report for the first half of 2024 unless these proposals are sorted. Trading in SGR shares were temporarily paused this morning.

Life360 (ASX:360), the family-tracking app, continued to impress, up 8% after hitting its earnings targets in Q4.

Meanwhile over in China, things weren’t looking too hot either, as Trump’s tariff announcement sent Chinese stocks tumbling.

“Whether this is still a negotiation tactic or a definite move remains up for debate, but markets are unwilling to take chances,” said Jun Rong Yeap at IG Asia.

This is where we stood leading up to Friday’s close:

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Code Description Last % Volume MktCap PEB Pacific Edge 0.115 109% 1,015,944 $44,655,379 FAU First Au Ltd 0.003 50% 500,000 $4,143,987 RFA Rare Foods Australia 0.024 50% 14,294 $4,351,732 EAX Energy Action Ltd 0.365 35% 209,093 $10,524,989 BP8 Bph Global Ltd 0.004 33% 125,000 $1,824,924 VML Vital Metals Limited 0.002 33% 6,240,808 $8,842,600 SP3 Specturltd 0.015 25% 1,614,303 $3,697,801 1TT Thrive Tribe Tech 0.003 25% 8,405,175 $4,063,446 HPC Thehydration 0.010 25% 146,593 $2,439,305 NAE New Age Exploration 0.005 25% 14,282,242 $8,625,596 NRZ Neurizer Ltd 0.003 25% 1,138,827 $6,716,008 RVT Richmond Vanadium 0.145 21% 23,922 $26,620,000 VFX Visionflex Group Ltd 0.003 20% 2,462,633 $8,419,651 ORD Ordell Minerals Ltd 0.580 20% 2,201,450 $17,434,620 GG8 Gorilla Gold Mines 0.300 18% 6,997,950 $142,979,685 VGL Vista Group Int Ltd 3.430 17% 73,045 $694,014,510 FWD Fleetwood Ltd 2.450 17% 1,201,428 $194,812,188 BLZ Blaze Minerals Ltd 0.004 17% 2,112,254 $4,700,843 BNL Blue Star Helium Ltd 0.007 17% 1,505,960 $16,169,312 RAN Range International 0.004 17% 40,000 $2,817,871 SEG Sports Ent Grp Ltd 0.220 16% 25,000 $52,716,619 CTO Citigold Corp Ltd 0.004 14% 1,815,750 $10,500,000 IPB IPB Petroleum Ltd 0.008 14% 2,029,629 $4,944,821 MEM Memphasys Ltd 0.008 14% 1,629,170 $12,397,103 ORN Orion Minerals Ltd 0.016 14% 47,822 $95,906,269

Pacific Edge (ASX:PEB) just got a big win with its Cxbladder Triage test being added to the American Urological Association’s (AUA) updated clinical guidelines. The new guidelines for managing microhematuria (blood in the urine) now recommend Cxbladder Triage as the only urine-based biomarker with strong ‘Grade A’ evidence. This is a huge deal because intermediate-risk patients make up around 70% of those with this condition. It’s expected that more US doctors will start using the test. Shares more than doubled after the news.

Vital Metals (ASX:VML) said it’s expanding its Tardiff Scoping Study in Canada to include niobium, which is found alongside rare earths at the site. Initial tests showed niobium can be recovered at a 15% rate, and with further work, it could add big value to the project. Niobium is used in things like aeronautic engines, electronics, and lithium-ion batteries, so the market is very keen on it. Vital is now on track to wrap up the study by late April.

Surveillance tech company Spectur’s (ASX:SP3) H1 FY25 results show strong growth with operating revenue hitting $4.46m, up 7% from last year. Nearly 70% of that comes from recurring revenue, including a 26% rise in subscription revenue. The company’s net loss dropped by 77%, and it now has a positive cash flow.

Hydration Pharmaceuticals (ASX:HPC) had a strong turnaround in FY24 after selling its non-US assets for US$9.5m, helping the company swing from a loss to a net profit of US$2.8m. With debt fully paid off and a solid cash position of US$3.2m, HPC said it is now in a great spot to grow its US operations.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| VBC | Verbrec Limited | 0.087 | -30% | 759,081 | $36,344,070 |

| RLL | Rapid Lithium Ltd | 0.004 | -30% | 25,509,852 | $6,169,898 |

| AXP | AXP Energy Ltd | 0.002 | -25% | 7,817,593 | $13,149,361 |

| TTI | Traffic Technologies | 0.003 | -25% | 4,775,247 | $4,614,933 |

| MM1 | Midasmineralsltd | 0.100 | -23% | 389,232 | $16,136,858 |

| BIT | Biotron Limited | 0.007 | -22% | 15,419,580 | $8,121,445 |

| IPT | Impact Minerals | 0.007 | -22% | 12,950,795 | $27,534,903 |

| AFL | Af Legal Group Ltd | 0.115 | -21% | 1,823,810 | $13,238,385 |

| BRN | Brainchip Ltd | 0.205 | -20% | 42,680,800 | $507,910,504 |

| NGS | NGS Ltd | 0.024 | -20% | 242,500 | $4,064,485 |

| AX8 | Accelerate Resources | 0.008 | -20% | 1,856,236 | $7,467,539 |

| APX | Appen Limited | 1.335 | -19% | 36,343,838 | $429,602,701 |

| G88 | Golden Mile Res Ltd | 0.009 | -18% | 2,101,208 | $5,986,726 |

| WHK | Whitehawk Limited | 0.009 | -18% | 14,201,116 | $7,143,356 |

| C1X | Cosmosexploration | 0.100 | -17% | 2,189,678 | $12,415,992 |

| ADG | Adelong Gold Limited | 0.005 | -17% | 17,481,623 | $8,384,917 |

| AMS | Atomos | 0.005 | -17% | 197,622 | $7,290,111 |

| BUY | Bounty Oil & Gas NL | 0.003 | -17% | 1,000,000 | $4,684,416 |

| OSL | Oncosil Medical | 0.005 | -17% | 1,405,401 | $27,639,481 |

| PKO | Peako Limited | 0.003 | -17% | 71,419 | $4,463,226 |

| YAR | Yari Minerals Ltd | 0.005 | -17% | 559,425 | $2,894,147 |

| GHY | Gold Hydrogen | 0.440 | -15% | 315,698 | $83,064,800 |

| SGR | The Star Ent Grp | 0.110 | -15% | 120,304,526 | $372,928,514 |

| ADR | Adherium Ltd | 0.011 | -15% | 5,560 | $9,861,540 |

IN CASE YOU MISSED IT

Neurotech International (ASX:NTI) has received a positive opinion from the European Medicines Agency on its orphan drug application for NTI164 to treat Rett syndrome, following a similar designation from the US FDA in November last year.

ReNerve (ASX:RNV) has reported strong first-half results since its ASX listing in November, with revenue jumping 167% on the previous corresponding period to $102,000. The company is focused on expanding US sales, advancing clinical programs for its NervAlign nerve cuff, and growing internationally with new distribution deals in Hong Kong, the Middle East and Mexico.

Impact Minerals (ASX:IPT) is raising up to $5.2 million through a two-for-seven rights issue at 0.6c per share to fund the development of its Lake Hope high-purity alumina project and exploration at Arkun and Broken Hill.

Altech Batteries (ASX:ATC) is increasing its stakes in the Cerenergy and Silumina Anodes projects, now holding 75% and 100% ownership, respectively, pending shareholder approval. The move streamlines decision making, enhances project execution, and strengthens Altech’s position in the high-value battery market as it pushes toward commercialisation.

Kingsrose Mining (ASX:KRM) is growing its footprint in Finland with the acquisition of the Jakon nickel-copper-cobalt project in Central Finland from Rio Tinto Exploration Finland Oy, through its Exploration Alliance with BHP. The 205 km² project boosts the company’s presence in the region, bringing its total landholding in Central Finland to 1198 km² under the Alliance.

LTR Pharma (ASX:LTP) is set to share Spontan’s groundbreaking clinical data at the Urological Society of Australia and New Zealand’s Annual Scientific Meeting in Perth. The data highlights how Spontan absorbs 470% faster than current erectile dysfunction (ED) treatments, illustrating its potential to disrupt the global ED market.

At Stockhead, we tell it like it is. While Neurotech International, ReNerve, Impact Minerals, Altech Batteries, Kingsrose Mining and LTR Pharma are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.