Closing Bell: ASX ticks up on Christmas Eve, Avita soars, St Barbara slumps

News

News

It’s Christmas Eve, the market’s winding down, and so are the journos – for a couple of days at least. But before we all race off, here’s a quick rundown on market.

The ASX ended today’s shortened session with a 0.24% rise in what’s been a solid week so far, following yesterday’s 1.7% bump.

Overnight on Wall Street, the S&P 500 also crept up 0.7%, while the Nasdaq surged by 1%.

Mega-cap tech stocks like Meta, Tesla, Nvidia, and the big boys – Apple, Amazon, and Alphabet – all ended the day in the green, shrugging off a rise in US bond yields.

In the world of magic internet money, Bitcoin has taken bit of a breather lately after its meteoric rise. It dipped a further 0.5% earlier and is currently trading around $94,000. It’s now down about 12% from its record high just a week ago.

Strangely, however, several prominent ‘altcoins’ (that’s pretty much every crypto that isn’t Bitcoin) are faring much better today, with double-digit spikes for the likes of Aave, Hedera, Injective and Render.

Top 10 altcoins such as Ethereum (+4%), XRP (+4%), Solana (+5%) and Dogecoin (+4%) are in a more festive mood than a day or so ago, too.

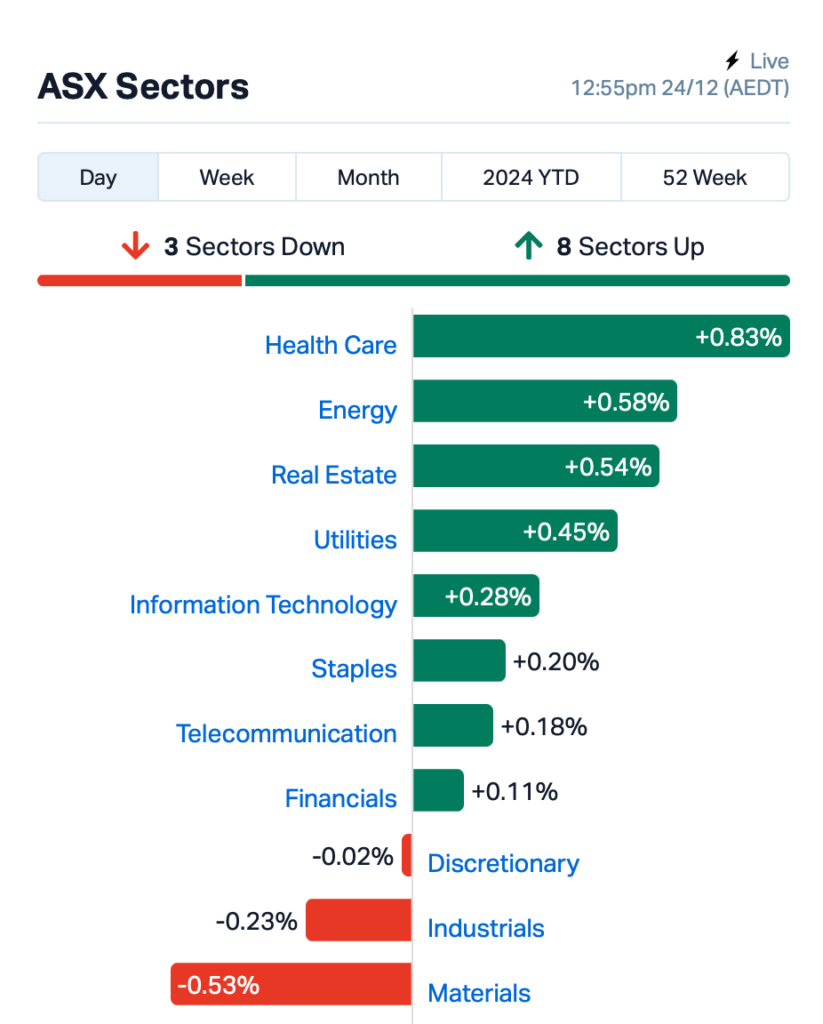

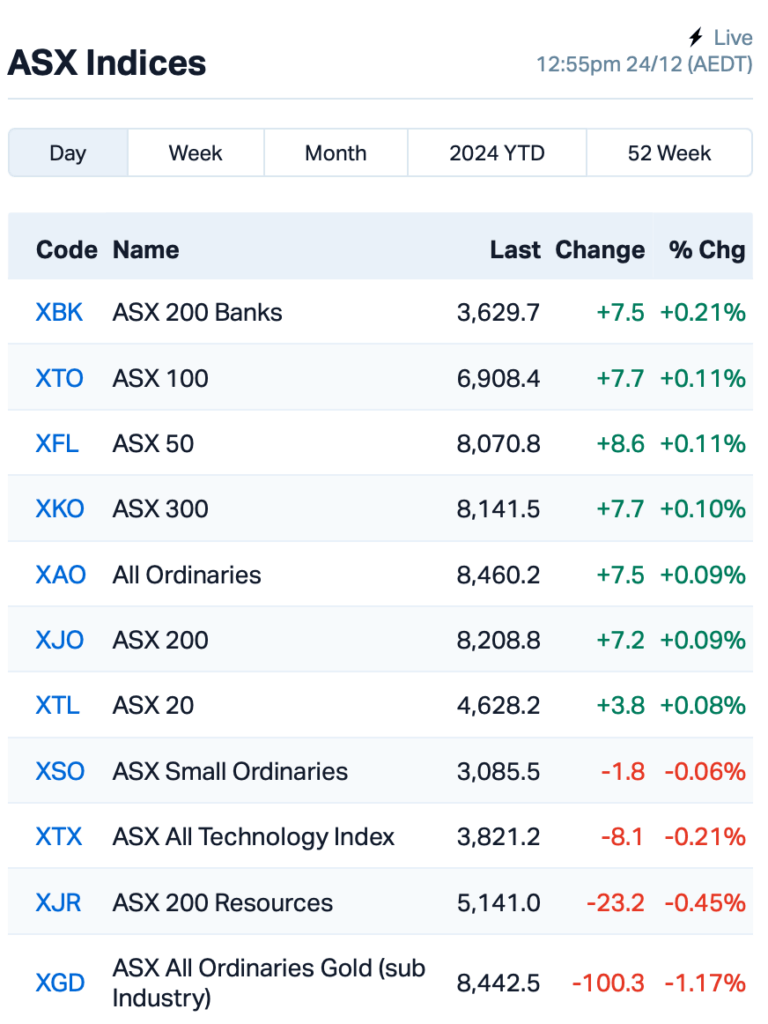

Back on the ASX, this is how things looked at a 12:55pm AEDT:

Avita Medical (ASX:AVH) was the star of the day, jumping 6% after getting the green light from the US FDA for its Recell Go mini product – a device that helps treat smaller wounds.

Paladin Energy (ASX:PDN) added 1.5% after completing its acquisition of Fission Uranium Corp, and now has its eyes set on hiring a new Canadian executive to lead its operations.

Coal miner St Barbara (ASX:SBM), however, got walloped by a 34% drop after getting a $206.6 million tax bill from the Papua New Guinea government.

Here are the best performing ASX small cap stocks for December 24 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| NRZ | Neurizer Ltd | 0.002 | 100% | 10,123,628 | $2,964,861 |

| GCM | Green Critical Min | 0.008 | 60% | 31,290,377 | $9,537,766 |

| ERA | Energy Resources | 0.003 | 50% | 93,151 | $810,792,482 |

| MRQ | Mrg Metals Limited | 0.004 | 33% | 2,794,493 | $8,179,556 |

| RGL | Riversgold | 0.004 | 33% | 26,012,022 | $4,994,888 |

| BUR | Burleyminerals | 0.080 | 33% | 137,934 | $9,022,257 |

| RML | Resolution Minerals | 0.014 | 27% | 313,283 | $2,479,280 |

| PPG | Pro-Pac Packaging | 0.025 | 25% | 100,000 | $3,633,754 |

| RON | Roninresourcesltd | 0.175 | 25% | 99,999 | $5,652,501 |

| CDT | Castle Minerals | 0.003 | 25% | 20,428 | $3,345,628 |

| LNR | Lanthanein Resources | 0.003 | 25% | 2,255,146 | $4,887,272 |

| MMR | Mec Resources | 0.005 | 25% | 1,124,899 | $7,327,228 |

| VML | Vital Metals Limited | 0.003 | 25% | 5,382 | $11,790,134 |

| TMK | TMK Energy Limited | 0.003 | 20% | 10,363,985 | $23,313,913 |

| PNT | Panthermetalsltd | 0.013 | 18% | 1,325,803 | $2,588,835 |

| BDG | Black Dragon Gold | 0.061 | 17% | 1,453,013 | $15,697,902 |

| AAU | Antilles Gold Ltd | 0.004 | 17% | 100,013 | $5,573,628 |

| AJL | AJ Lucas Group | 0.007 | 17% | 28,795 | $8,254,378 |

| ALY | Alchemy Resource Ltd | 0.007 | 17% | 220,000 | $7,068,458 |

| PXX | Polarx Limited | 0.007 | 17% | 1,700,000 | $14,253,006 |

| HLX | Helix Resources | 0.004 | 14% | 125,000 | $11,424,678 |

MRG Metals (ASX:MRQ) has made an update on its joint venture with Sinowin Lithium (SLC) for the Mozambique Corridor Sands projects. The Hong Kong-based JV, Terriland (70% SLC, 30% MRG), is now operational, with SLC committing US$6 million in working capital. To date, SLC has funded US$150k for MRG’s in-country costs, US$90k for management, and US$55k for exploration. Progress includes a revised scoping study, resubmission of mining licence applications, and the start of an environmental and social impact assessment (ESIA) study.

Alchemy Resources (ASX:ALY) said it’s making solid progress on its exploration at Roe Hills, WA. The team’s completed 1,500 lithium soil samples, with more to follow in January 2025. Geophysical surveys will also kick off in mid-January to help with drill targeting. On the gold front, RC drilling at the Monty Prospect shows low-grade mineralisation, extending along a 4km strike from the Parmelia Resource. Plans are in place to test more targets along the same structure, with drilling set for mid-2025.

Here are the worst performing ASX small cap stocks for December 24 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| NRZ | Neurizer Ltd | 0.001 | -50% | 3,851,924 | $5,929,721 |

| VML | Vital Metals Limited | 0.002 | -33% | 454,143 | $17,685,201 |

| SRI | Sipa Resources Ltd | 0.013 | -28% | 2,131,888 | $4,106,846 |

| AMD | Arrow Minerals | 0.002 | -25% | 1,762,853 | $26,447,256 |

| ERL | Empire Resources | 0.003 | -25% | 258,333 | $5,935,653 |

| FHS | Freehill Mining Ltd. | 0.003 | -25% | 4,980 | $12,314,111 |

| NAE | New Age Exploration | 0.003 | -25% | 3,000,000 | $8,575,596 |

| TX3 | Trinex Minerals Ltd | 0.002 | -25% | 78,811 | $3,657,305 |

| VFX | Visionflex Group Ltd | 0.003 | -25% | 240,000 | $13,471,442 |

| MMR | Mec Resources | 0.004 | -20% | 1,000,000 | $9,159,035 |

| TEG | Triangle Energy Ltd | 0.004 | -20% | 2,682,701 | $10,446,170 |

| LML | Lincoln Minerals | 0.005 | -17% | 426,008 | $12,337,557 |

| AXN | Alliance Nickel Ltd | 0.036 | -14% | 71,559 | $30,485,264 |

| RML | Resolution Minerals | 0.012 | -14% | 264,642 | $3,155,448 |

| SRN | Surefire Rescs NL | 0.003 | -14% | 2,300,000 | $7,232,077 |

| ZMM | Zimi Ltd | 0.012 | -14% | 200,000 | $5,417,217 |

| SMX | Strata Minerals | 0.020 | -13% | 614,150 | $4,388,749 |

| AAU | Antilles Gold Ltd | 0.004 | -13% | 3,236,210 | $7,431,504 |

| CTO | Citigold Corp Ltd | 0.004 | -13% | 332,000 | $12,000,000 |

| T92 | Terrauraniumlimited | 0.037 | -12% | 274,641 | $3,354,113 |

| JAL | Jameson Resources | 0.040 | -11% | 1,153 | $27,482,999 |

| MML | Mclaren Minerals | 0.040 | -11% | 11,112 | $4,682,926 |

Vertex Minerals (ASX:VTX) has raised $5.1 million through a convertible loan to support the completion of the Reward gravity gold processing plant, infrastructure, underground mine development, sustaining costs and working capital. The funding was strongly backed by institutional and sophisticated investors, with shares convertible at 17 cents apiece.

At Stockhead, we tell it like it is. While Vertex Minerals is a Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.