Closing Bell: ASX takes big tumble as banks, tech and retailers feel the pain

It was a mini crash for the ASX on Monday. Picture via Getty Images

- ASX drops as US jobs data crushes rate cut hopes

- Banks and retailers hammered, Myer tanks

- Energy stocks soar and Star Casino rebounds

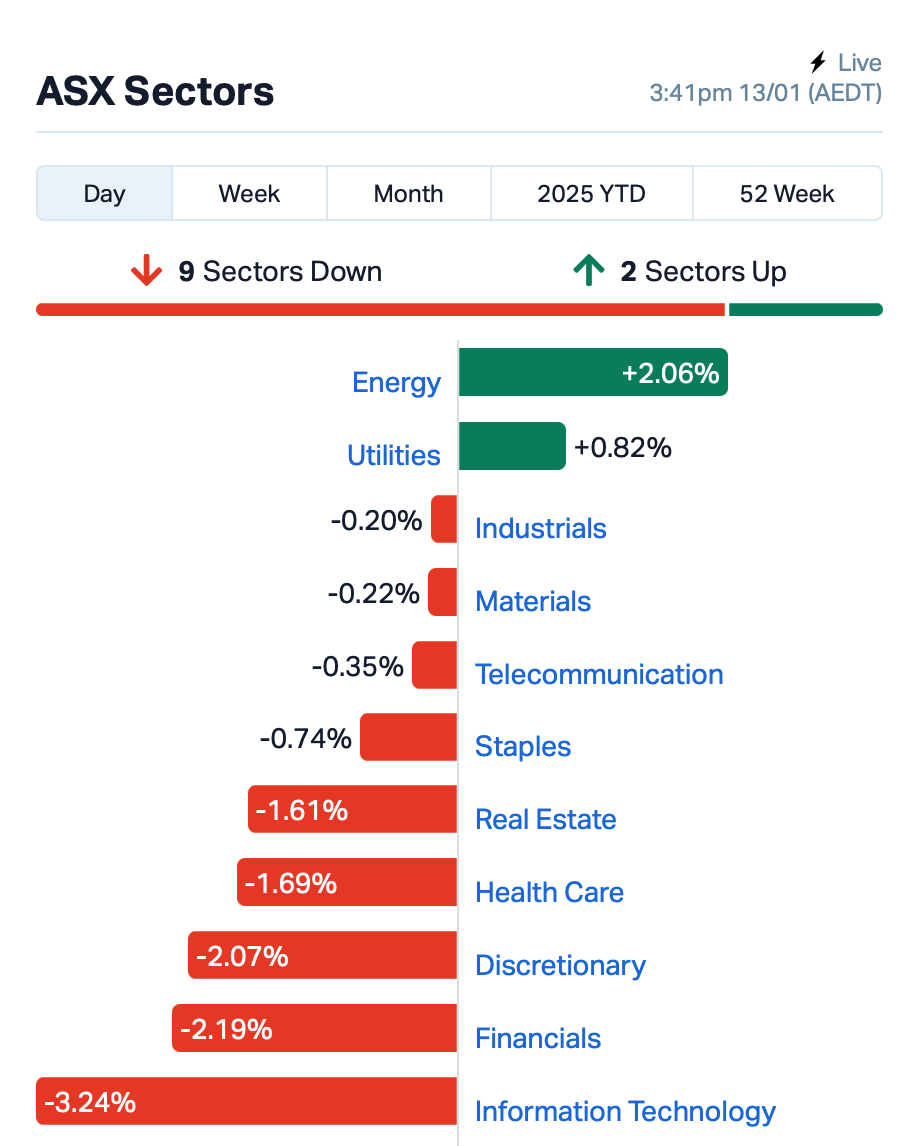

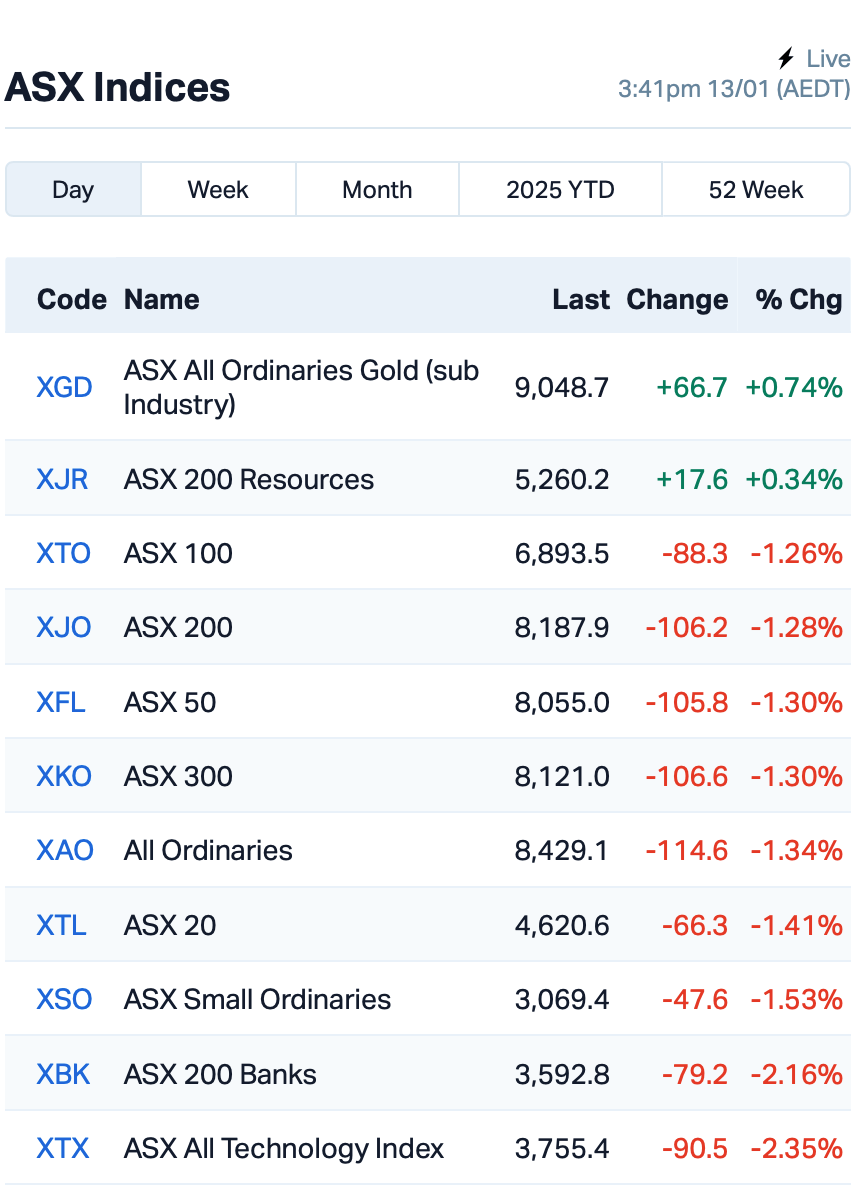

The ASX slumped further on Monday, with the S&P/ASX 200 index down 1.23% following strong US jobs data, dashing hopes of an imminent rate cut from the Federal Reserve.

US payrolls showed a surprise 256,000 jobs added last month, far above the 164,000 expected, sending Wall Street lower and dragging the ASX down with it.

Banks were hammered today, with Commonwealth Bank (ASX:CBA) shedding over 2%, while tech stocks followed suit, including a 3% drop for WiseTech Global (ASX:WTC).

Retailers also took a hit, especially Myer (ASX:MYR), which plummeted 22% after a disappointing trading update, while Premier Investments (ASX:PMV) sank 15%.

On a brighter note, energy stocks surged, with Woodside Energy Group (ASX:WDS) up 2% as Brent crude hit a four-month high of US$81 per barrel following new US sanctions on Russia.

Star Entertainment Group (ASX:SGR) bounced back 9% after last week’s massive sell-off, showing signs of recovery despite liquidity concerns.

Meanwhile, Bain Capital has sweetened the deal for Insignia Financial (ASX:IFL), offering $4.30 per share, a 7.5% premium on its earlier bid. IFL’s shares rose almost 3%.

Across the region, Asia’s markets slid for the fourth consecutive session. In China, the yuan dropped to near-record lows, sparking a response from the People’s Bank of China.

As traders await key US inflation data and other economic updates this week, the mood remains cautious across global markets.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Security Description Last % Volume MktCap EQN Equinoxresources 0.145 45% 3,089,636 $12,385,000 WC1 Westcobarmetals 0.024 41% 885,481 $2,990,511 AAU Antilles Gold Ltd 0.004 33% 23,170,824 $5,573,628 NAE New Age Exploration 0.004 33% 1,886,771 $6,431,697 H2G Greenhy2 Limited 0.005 25% 214,807 $2,392,737 MMR Mec Resources 0.005 25% 859,359 $7,327,228 PUA Peak Minerals Ltd 0.010 25% 1,889,999 $20,416,882 RAN Range International 0.005 25% 3,516,520 $3,757,161 TMK TMK Energy Limited 0.003 25% 25,086,432 $18,651,130 CLA Celsius Resource Ltd 0.011 22% 2,921,444 $24,023,146 HCF Hghighconviction 0.930 22% 252,034 $18,651,644 QML Qmines Limited 0.058 21% 619,243 $16,497,847 LMS Litchfield Minerals 0.120 20% 341,534 $2,821,135 RNX Renegade Exploration 0.006 20% 1,390,773 $6,420,017 BMG BMG Resources Ltd 0.013 18% 9,775,693 $9,222,369 ETM Energy Transition 0.084 17% 14,571,787 $101,427,025 SPQ Superior Resources 0.007 17% 1,464,285 $13,019,183 TZL TZ Limited 0.058 16% 9,606 $13,264,038 TM1 Terra Metals Limited 0.037 16% 1,343,298 $12,711,069 MFD Mayfield Childcr Ltd 0.505 15% 107,874 $33,186,828

Gas is now flowing from all six pilot wells at TMK Energy (ASX:TMK)‘s Gurvantes XXXV Coal Seam Gas project, with the new wells (LF-04, LF-05, LF-06) in full production alongside the original trio. Total field gas production has more than doubled, though current gas flows are still “pre-desorption” and not yet commercial. Water levels in the new wells are slowly being reduced as expected, with the critical desorption point likely to hit by late Q1 or early Q2 2025.

QMines (ASX:QML) has wrapped up its first 5,000m drilling campaign at Develin Creek, hitting high-grade copper, gold, silver, and zinc at the Scorpion deposit, with standout intersections like 20m at 2.94% Cu and 6m at 4.16% Cu. The results back Scorpion as a strong, shallow deposit with potential to extend the Mt Chalmers mine life.

Equinox Resources (ASX:EQN)’s Mata da Corda’s latest drilling results have hit high-grade titanium, with standout intercepts like 61.2m at 11.89% TiO2 from surface. Over 1,900 samples reveal an average of 10.23% TiO2, with multiple intercepts above 10%. The project also has niobium and rare earth elements as valuable co-products.

Antilles Gold (ASX:AAU)’s pre-feasibility study for the Nueva Sabana mine in Cuba shows a 4-year life at 500,000tpa, starting with a 100m pit. The company said plans to drill deeper in 2026-27 could extend it. Off-take talks are in progress, and early gold sales should cover debt. First shipments might start in Q1 2026, with more exploration to boost resources.

Energy Transition Minerals (ASX:ETM) has brought in Julie Bishop & Partners for strategic advice, stakeholder engagement, and government relations. Julie Bishop, former Australian Foreign Minister, will use her deep knowledge of geopolitics to support the company’s Kvanefjeld Rare Earth Project in Greenland.

Litchfield Minerals (ASX:LMS) is gearing up to explore the Oonagalabi project in early 2025, with an exploration plan in place. New data has pinpointed a 3km mineralised strike and revealed a large pipe-like structure that’s now top priority. Soil and rock samples confirm the extension of the mineralisation.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Code Name Price % Change Volume Market Cap PEB Pacific Edge 0.057 -59% 608,591 $113,668,236 CT1 Constellation Tech 0.001 -50% 7,692 $2,949,467 RDN Raiden Resources Ltd 0.008 -47% 92,182,059 $51,763,372 GMN Gold Mountain Ltd 0.002 -33% 32,033,793 $13,737,670 PKO Peako Limited 0.002 -33% 1,000,000 $3,285,425 T3D 333D Limited 0.010 -29% 850,663 $2,466,569 ERW Errawarra Resources 0.044 -27% 651,518 $5,755,240 AOA Ausmon Resorces 0.002 -25% 45,470 $2,179,455 CTN Catalina Resources 0.003 -25% 1,042,724 $4,975,048 ERL Empire Resources 0.003 -25% 171,761 $5,935,653 YRL Yandal Resources 0.140 -22% 1,242,943 $55,662,297 MYR Myer Holdings Ltd 0.900 -21% 10,715,764 $959,002,791 X2M X2M Connect Limited 0.027 -21% 150,564 $12,815,984 BLZ Blaze Minerals Ltd 0.004 -20% 1,517,500 $7,834,739 CAV Carnavale Resources 0.004 -20% 1,666,667 $20,451,092 EVR Ev Resources Ltd 0.002 -20% 8,000,000 $4,531,258 LNR Lanthanein Resources 0.002 -20% 948,511 $6,109,090 PNT Panthermetalsltd 0.008 -20% 5,118,015 $2,481,708 VEN Vintage Energy 0.004 -20% 2,166,573 $8,347,656 ROC Rocketboots 0.060 -18% 350,000 $8,301,773 JCS Jcurve Solutions 0.025 -17% 91,748 $9,910,303 ADD Adavale Resource Ltd 0.003 -17% 1,020,606 $4,622,496

Novonix (ASX:NVX) fell after hitting a bump with its US Department of Energy loan plans. The company was hoping for tax credits under the 48C Program to help fund its new Tennessee facility, but it hasn’t been selected for that just yet. Still, the DOE’s conditional commitment for a US$754.8 million loan stands, and Novonix is working through what this means for its project. More updates will come as talks continue.

IN CASE YOU MISSED IT

Drilling at Equinox Resources’ (ASX:EQN) Mata da Corda project in Brazil returned impressive titanium dioxide results from surface as well as paving the way for potential niobium and rare earths co-products. Drilling also returned successful TREO intersections.

Greenvale Energy (ASX:GRV) is serving up yellowcake today after the company acquired a new uranium asset in north Queensland with supposed similarities to the world class Rossing uranium mine in Africa’s Namibia. The acquisition comes after the company turned its focus to Uranium with two other project acquisitions last year.

Explorer QMines (ASX:QML) has kicked off the year with a bang after sharing with the market today a new batch of high-grade copper intercepts including a headline 20m at 2.94% Cu, 0.42g/t Au, 20g/t Ag and 1.4% Zn strike from the Scorpion deposit.

Sustainable packaging and materials developer MyEco Group (ASX:MCO) released a Q2 FY25 sales update to the market today, earmarking total sales of $4.1 million for the quarter – representing a major 32% increase on the prior corresponding period.

Lumos Diagnostics (ASX:LDX), a provider in rapid, point-of-care diagnostic technologies has partnered with MedPro Associates. The latter will provide national contract sales coverage across the healthcare system as well as government and physician office markets in the US.

At Stockhead, we tell it like it is. While Equinox Resources, Greenvale Energy, QMines, MyEco Group and Lumos Diagnostics are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.