Closing Bell: ASX takes a 1pc hit as inflation spooks; IMF bullish on China

Aussie stocks fell 1pc on rising inflation. Pic via Getty Images

- Aussie stocks fell 1pc on rising inflation

- ASX sectors mostly down; IAG hit by class action lawsuit

- Asian markets dropped; IMF ups China’s growth forecast to 5pc

Aussie stocks fell by 1% on Wednesday, hitting their lowest point in three weeks after inflation rose unexpectedly in April.

According to ABS data today, Australian CPI climbed to its highest point in five months, making it unlikely that interest rates will be cut soon and instead, has raised the possibility of an RBA rate hike.

The CPI for the year ending in April was 3.6%, higher than the expected 3.4%. In comparison, monthly inflation for the year ending in March was 3.5%.

“Today’s data will be ringing alarm bells down at the RBA,” said Stephen Walters at Business Council of Australia.

“This is a terrible start to inflation for the June quarter. Inflation is accelerating on all main measures, not receding as had been hoped, thanks mainly to sticky services prices,” he told the ABC.

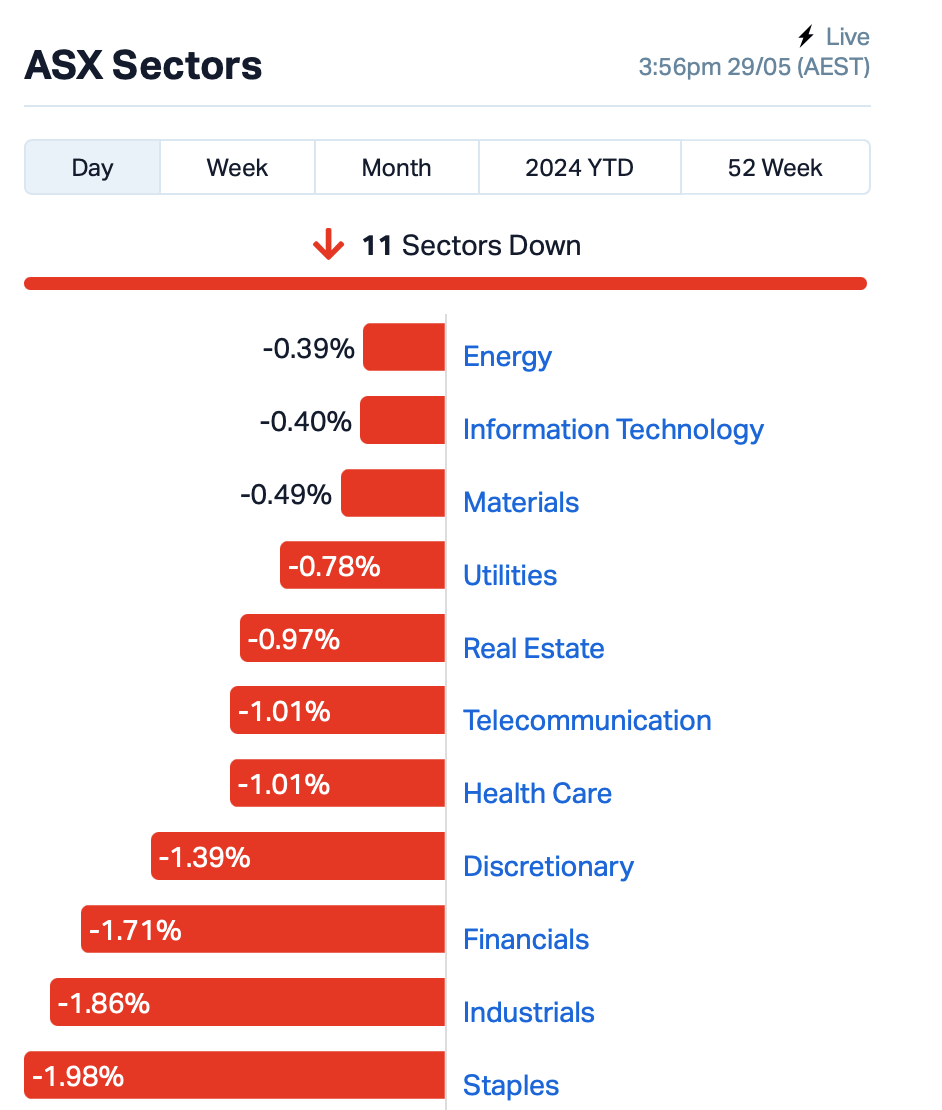

To the ASX, all 11 sectors closed in the red today:

Gold stocks once again lifted as the bullion price keeps climbing.

“We expect gold prices to stay volatile and price setbacks to be shallow, targeting gold prices to test new record highs later this year,” said a UBS report.

Iron ore giants BHP (ASX:BHP) and Fortescue (ASX:FMG) tumbled as the price of iron ore shaved more than 1% in Singapore.

BHP meanwhile is likely request more time to finalise a deal with Anglo American. It has until 5pm in London today to make a new offer to Anglo after its previous three were rejected.

Still in the large caps space, finance stocks also got pummelled today.

Insurer IAG (ASX:IAG) tumbled -3% after being slapped with a class action lawsuit following a civil case filed by regulators last year that accused IAG of misleading customers about loyalty discounts on home insurance products.

Law firm Slater and Gordon said the class action represents millions of customers affected by these loyalty discount practices.

IMF bullish on China

Across the region, Asian stock markets also fell on Wednesday, with stocks declining in Hong Kong and Japan.

China’s yuan fell to its lowest level since November, as policymakers appear to be allowing the currency to weaken against the strong US dollar.

Some good news though, the International Monetary Fund (IMF) now expects China’s economy to grow by 5% this year, up from its earlier forecast of 4.6%.

The IMF also raised its forecast for China’s growth in 2025 to 4.5% from 4.1%.

China itself has said that it aims for around 5% growth this year, and has reported a better-than-expected 5.3% growth in the first quarter.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| GES | Genesis Resources | 0.007 | 75% | 500,000 | $3,131,365 |

| 8IH | 8I Holdings Ltd | 0.015 | 50% | 96,064 | $3,573,560 |

| APC | Aust Potash Ltd | 0.002 | 50% | 56,094 | $4,020,189 |

| CNJ | Conico Ltd | 0.002 | 50% | 26,500 | $1,805,095 |

| HYD | Hydrix Limited | 0.016 | 33% | 392,507 | $3,050,626 |

| OAR | OAR Resources Ltd | 0.002 | 33% | 12,314,194 | $4,729,966 |

| COV | Cleo Diagnostics | 0.225 | 32% | 2,078,459 | $12,597,000 |

| OLY | Olympio Metals Ltd | 0.047 | 31% | 19,483 | $3,077,153 |

| DES | Desoto Resources | 0.095 | 25% | 9,251,081 | $4,554,414 |

| BDX | Bcaldiagnostics | 0.175 | 25% | 1,313,844 | $35,321,260 |

| IVX | Invion Ltd | 0.005 | 25% | 68,648 | $25,698,129 |

| MCT | Metalicity Limited | 0.003 | 25% | 2,000,000 | $8,970,190 |

| PUR | Pursuit Minerals | 0.005 | 25% | 7,114,406 | $11,775,886 |

| SIT | Site Group Int Ltd | 0.003 | 25% | 900,000 | $5,204,980 |

| SQX | SQX Resources Ltd | 0.120 | 24% | 376,858 | $2,425,000 |

| VTI | Vision Tech Inc | 0.135 | 23% | 110,913 | $6,023,147 |

| GDM | Greatdivideminingltd | 0.280 | 22% | 160,660 | $6,267,500 |

| ASQ | Australian Silica | 0.041 | 21% | 103,661 | $9,583,253 |

| TTM | Titan Minerals | 0.030 | 20% | 12,776,622 | $45,442,008 |

| LRL | Labyrinth Resources | 0.006 | 20% | 100,000 | $5,937,719 |

| PRX | Prodigy Gold NL | 0.003 | 20% | 3,808,482 | $5,294,436 |

| CR1 | Constellation Res | 0.250 | 19% | 147,707 | $12,917,890 |

| BEZ | Besragoldinc | 0.105 | 18% | 2,435,047 | $37,210,981 |

| GCM | Green Critical Min | 0.004 | 17% | 634,782 | $3,409,755 |

Winning on Wednesday was Desoto Resources (ASX:DES), soaring early on news that the company is all set to buy a rare earths project in the Northern Territory called Spectrum, where previous drilling pulled up a highlight 6m @ 6.55% total rare earths (TREO) from 248m.

The details are as follows: DeSoto has signed a binding term sheet to acquire 70% of Copperoz’ Spectrum REE project via a two stage minimum exploration spend of $5m over the next 39 months, with a right to acquire up to 100% of the project.

During the first 15 months, DeSoto agrees to spend a minimum of $2m, including a minimum 3500m worth of RC/DD drilling, while Stage 2 requires a minimum $3m expenditure during the following 24 months, and upon completion of a positive feasibility study, DeSoto has an option to buy out the remaining 30%.

Oar Resources (ASX:OAR)has announced the expansion of its Brazilian assets by the pegging of an additional 650km2 of prospective ground in the states of Rio Grande Do Sul and Goiás. This is an increase of 283% and brings the total Brazilian landholding to 880km2.

The acquired tenements are considered prospective for sandstone and sedimentary hosted uranium mineralisation. Both projects are located within 10km of historic uranium occurrences identified by the Industrias Nucleares do Brasil (INB), which is a Brazilian state-run company engaged in the prospection, exploration and extraction of uranium and other heavy metals.

OD6 Metals (ASX:OD6) has doubled the resource at its rare earths Splinter Rock project – to 682Mt at 1,338ppm TREO.

“This mineral resource estimate sets OD6 apart from any other clay-hosted rare earth project in Australia, and highlights Splinter Rock to be one of the largest and highest-grade projects globally,” MD Brett Hazelden says.

Splinter Rock is located in the Esperance-Goldfields region of Western Australia – about 30 to 150km northeast of the major port and town of Esperance.

Cleo Diagnostic’s (ASX:COV) made gains after revealing that its ovarian cancer blood test outperforms the current clinical benchmark, correctly detecting 90% of early-stage cancers compared to only 50% using standard workflows.

Pursuit Minerals (ASX:PUR) was celebrating some early success, with results from Drill Hole 1 at its Maria Magdelena tenement in the Rio Grande Sur project delivering “significant high grade intercepts of lithium brine at shallow depths of ~131m”.

Milk company Fonterra (ASX:FSF) provided its Q3 business update, announcing profit after tax from continuing operations of $1,013 million, up $20 million on pcp or equivalent to 61c per share. CEO Miles Hurrell says the Foodservice and Consumer channels in particular had a strong third quarter with a lift in earnings compared to the same time last year.

DY6 Metals (ASX:DY6) is still trading nicely off Monday’s news that saw it burst up more than 300% at one stage earlier this week. There’s nothing fresh to report, but in case you missed it: “Exceptional” high grade historical drill hits confirm the Tundulu rare earths project in Malawi as a significant asset, says the company.

And, Critical Resources (ASX:CRR said 31 new LCT pegmatites were discovered to the east of the Mavis Lake Main Zone, including multiple spodumene-bearing pegmatites. The discoveries were confirmed by the discovery of several new exposed rock formations, extending the known area of spodumene-containing rocks up to 250m in length.

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| TKL | Traka Resources | 0.001 | -33% | 322,518 | $2,625,988 |

| SFG | Seafarms Group Ltd | 0.003 | -25% | 20,000 | $19,346,397 |

| AIV | Activex Limited | 0.004 | -20% | 9,822 | $1,077,513 |

| VRC | Volt Resources Ltd | 0.004 | -20% | 803,868 | $20,793,391 |

| MGA | Metalsgrovemining | 0.044 | -20% | 125,285 | $4,945,078 |

| EMU | EMU NL | 0.029 | -19% | 315,964 | $2,429,747 |

| GML | Gateway Mining | 0.018 | -18% | 962,399 | $7,600,107 |

| SER | Strategic Energy | 0.019 | -17% | 23,141,630 | $11,173,748 |

| 1MC | Morella Corporation | 0.003 | -17% | 3,555,837 | $18,536,398 |

| 88E | 88 Energy Ltd | 0.003 | -17% | 3,052,771 | $86,678,016 |

| AEV | Avenira Limited | 0.005 | -17% | 120,000 | $14,094,204 |

| BPP | Babylon Pump | 0.005 | -17% | 4,341,947 | $14,997,294 |

| BXN | Bioxyne Ltd | 0.005 | -17% | 658,481 | $12,279,872 |

| MTL | Mantle Minerals Ltd | 0.003 | -17% | 1,350,000 | $18,592,338 |

| LMS | Litchfield Minerals | 0.190 | -16% | 1,901,399 | $6,201,562 |

| DTI | DTI Group Ltd | 0.011 | -15% | 10,000 | $5,831,168 |

| PNT | Panthermetalsltd | 0.050 | -15% | 340,313 | $5,142,804 |

| HIQ | Hitiq Limited | 0.017 | -15% | 330,162 | $7,036,899 |

| AAU | Antilles Gold Ltd | 0.006 | -14% | 8,695,333 | $6,975,745 |

| AQX | Alice Queen Ltd | 0.006 | -14% | 20,000 | $4,836,930 |

| CMB | Cambium Bio Limited | 0.006 | -14% | 102,321 | $5,362,646 |

| FAU | First Au Ltd | 0.003 | -14% | 100,000 | $5,816,976 |

| MCL | Mighty Craft Ltd | 0.006 | -14% | 391,050 | $2,582,365 |

| TON | Triton Min Ltd | 0.012 | -14% | 35,035 | $21,859,497 |

IN CASE YOU MISSED IT

Ark Mines (ASX:AHK) has defined a maiden resource at its flagship Sandy Mitchell rare earths-mineral sands project of 21.7Mt at 1,419ppm monazite equivalent.

Greenvale Energy’s (ASX:GRV) 2D Seismic Environmental Management Plan for EP 145 in the Amadeus Basin of central Australia has been accepted, allowing Greenvale to start planning its exploration programs for helium, hydrogen and hydrocarbons.

Lord Resources’ (ASX:LRD) infill soil sampling work has confirmed multiple, large high-priority lithium-caesium-tantalum geochemical anomalies at its Jingjing lithium project in WA’s Eastern Goldfields.

Pursuit Minerals’ (ASX:PUR) first diamond hole at its Rio Grande Sur project in Argentina has intersected high grades of lithium brines – up to 620mg/L lithium. The hole is one of six holes under the Stage 1 drill program that will go towards a resource upgrade.

Straker (ASX:STG) has delivered a strong set of results for the year ending March 31, 2024. This includes record profitability and positive free cash flow, affirming its strategic focus on leveraging AI technologies.

Mt Malcolm Mines (ASX:M2M) will soon carry out a bulk sampling program of up to 8000t of gold ore at its Golden Crown prospect to further explore and evaluate its gold mining potential.

Belararox’s (ASX:BRX) 3D interpretation of assay results from samples collected at the Malambo prospect within its Toro-Malambo-Tambo project, have confirmed porphyry-style targets similar to deposits at globally recognised copper mining operations.

CuFe (ASX:CUF) has completed the first heritage survey and secured approval of additional Programme of Works for an extended Stage 1 drill program at its North Dam lithium project near Coolgardie, WA.

Existing shareholders in De Grey Mining (ASX:DEG) have subscribed for ~39.1 million shares under its fully underwritten retail entitlement offer priced at $1.10 per share to raise about $43m. The shortfall of about 38.7 million shares will now be placed with the underwriters to raise a further $42.6m. Along with the completed placement and institutional component of the entitlement offer, which included major shareholder Gold Road taking up its entire entitlement, DEG will have raised a total of $600m to fund the equity component of its Hemi gold project development. It also satisfies a key pre-condition of access to debt financing with the company expecting to receive credit approved term sheets from debt financiers in mid-2024.

Elevate Uranium (ASX:EL8) continues to progress its Koppies uranium project in Namibia with the collection of bulk samples for key metallurgical test work.

Future Battery Minerals (ASX:FBM) has started Phase 4B drilling at its Kangaroo Hills lithium project in WA’s Goldfields region.

The 3000m reverse circulation program will test the interpreted north-easterly extension of the high-grade Big Red lithium mineralisation. It follows on successful Phase 4A drilling that had demonstrated a further 65m of northern continuity via a project-best intercept of 31m grading 1.13% Li2O from a down-hole depth of 86m.

Zinc of Ireland (ASX:ZMI) is nearing completion of its maiden geochemical auger drilling program targeting large rare earths targets at its Cascade project about 70km northwest of Esperance.

TRADING HALTS

Frugl Group (ASX:FGL) – pending an announcement in relation to the completion of a capital raising.

BCAL Diagnostics (ASX:BDX) – pending the company’s response to an ASX Price Query letter, and in relation to a capital raising.

At Stockhead, we tell it like it is. While DeSoto Resources, Belararox, CuFe, De Grey Mining, Elevate Uranium, Future Battery Minerals and Zinc of Ireland are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.