Closing Bell: ASX surges late as weak China PMIs smell a lot like pre-stimmy

Via Getty

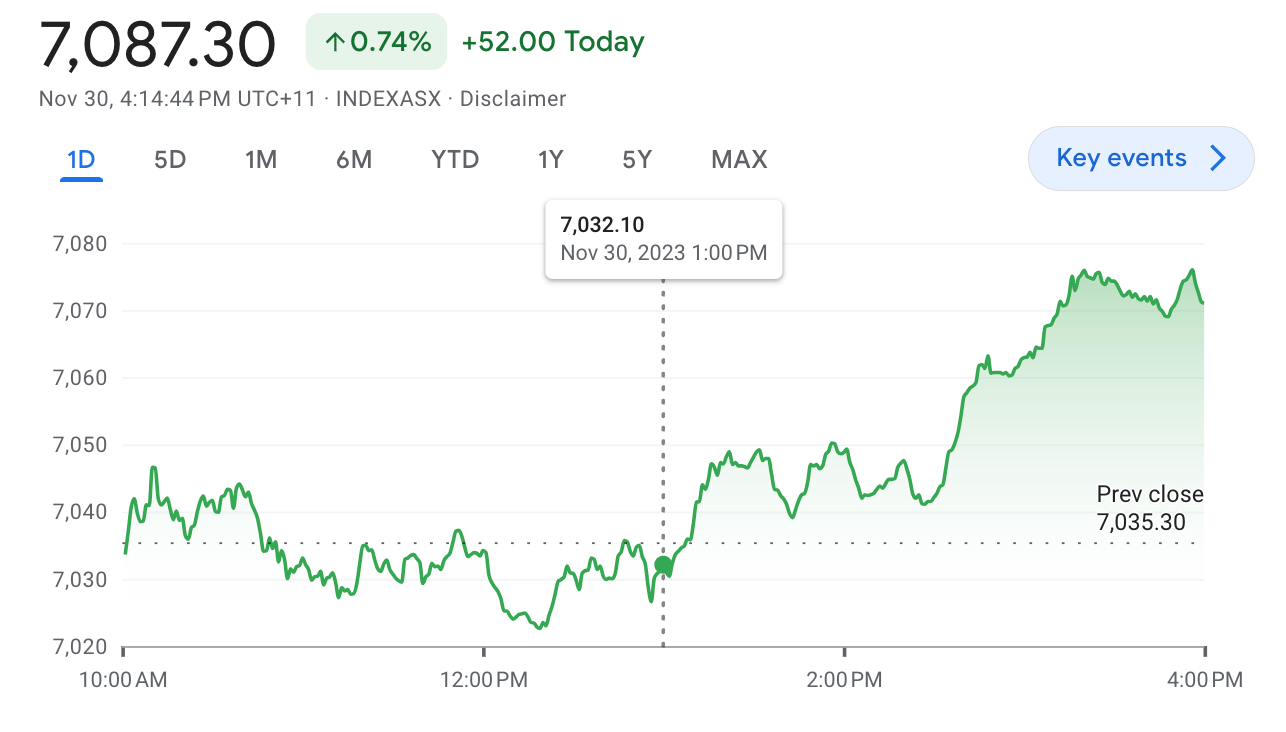

- The ASX200 has surged late, closing +0.75%; ends month +4.5% higher

- Banks, Industrial and Tech sectors all rise between +1% and +1.35%

- Small caps led by Mt Cooper’s copper hits

Bad news travels fast and when it comes to the Chinese economy, local markets are among the first to take note.

A dramatic afternoon surge – 50pts in a few hours – has left a dull start to business in the dust on Thursday. The ASX200 has ended sharply higher on what looks to me like the stars aligning around the good news of our largest trading partner’s latest bad news.

At match-out on Thursday November 30, the S&P/ASX 200 (XJO) index was up 52 points, or +0.74%:

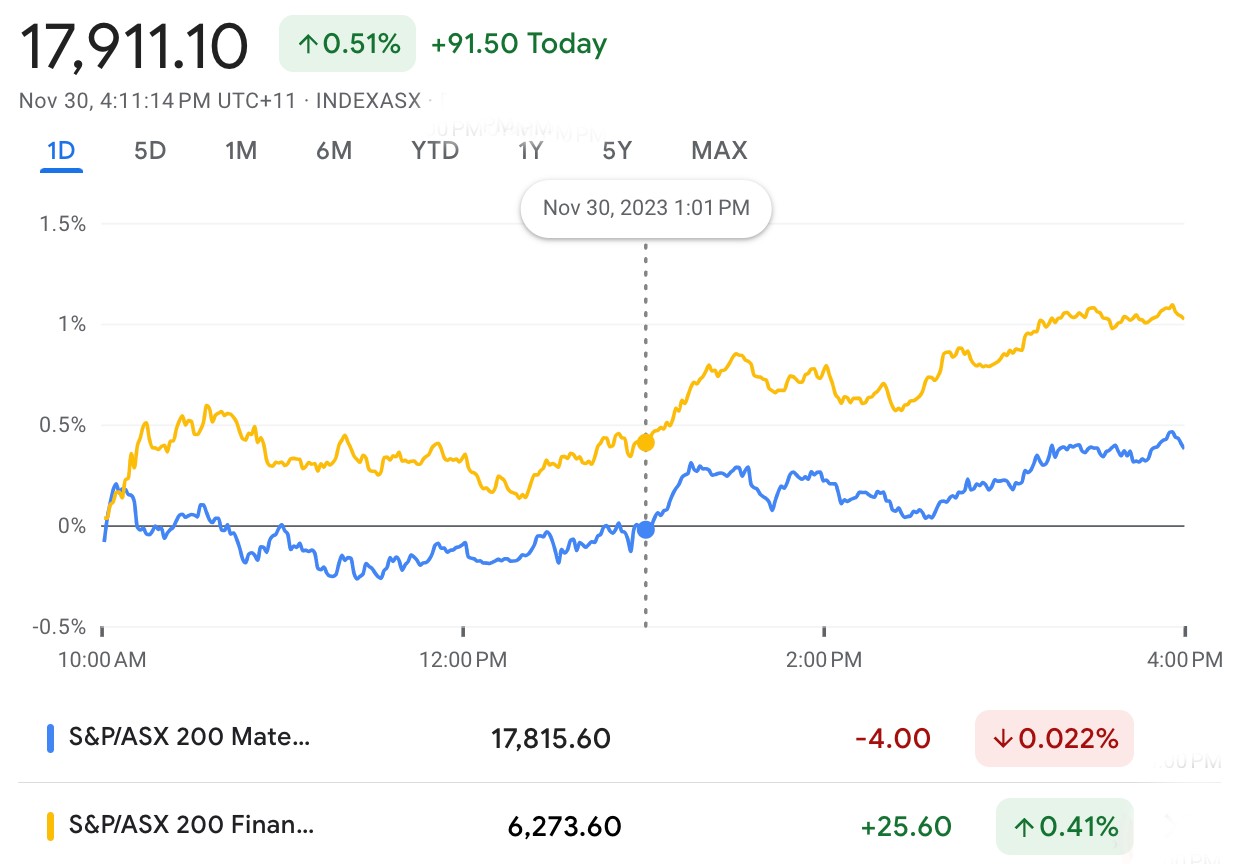

The resources-heavy ASX has a nose for weakness, while a storming performance by the local dollar – the humble AUD is today’s top currency gainer vs every one else – rising 0.45% this arvo, has added ballast to everything from big banks to industrial stocks.

Macquarie Group (ASX:MQG) has surged circa +2%, while all the Big 4 have made inroads, led by Commonwealth Bank (ASX:CBA), which has ended up +1.5%.

The major materials stocks have been lifted by late gains as BHP (ASX:BHP), Rio Tinto (ASX:RIO) and Fortescue (ASX:FMG) all reversed fortunes, with FMG finishing +1% the better.

The benchmark was trading with sluggish abandon all morning, but… ahead of the 1pm read on China’s manufacturing PMI’s, it has since sprung to life.

A grim November Chinese factory activity read showed purchases weakening for a 2nd straight month and it did so faster than many were expecting…

Fast enough to turn attention once again on the odds of Beijing doing something expensive about it.

Something like throw lots of money at great big aimless infrastructure builds.

The icing on the Hope of Stimulus cake – China’s services sector growth has also slumped to an 11-month low.

Things really took off for the ASX at about 1pm

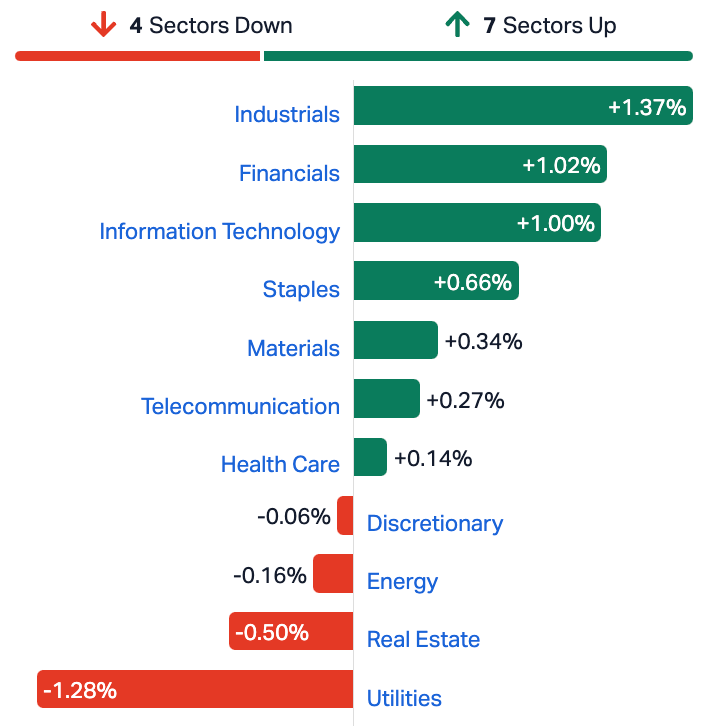

On a day where 7/11 Australia got sold, seven of the 11 ASX sectors closed higher, surging late and led by a broad mixture of business – the Industrial, IT and Financial sectors closed +1% or better, while previously languishing Healthcare, Materials and Staples lifted into positive territory.

ASX Sectors On Thursday

We’re also watching gold on Thursday…

The price of gold inched higher over the past 24 hours, as the safe haven favourite acclimates nicely to six-month highs, decently above the US$2,040 an ounce on Thursday.

Local gold stocks lifted in response.

It’s staring down the barrel of a second straight month of gains.

The ingredients for this recent golden success?

A dollop of US dollar weakness. A tablespoon of dovish Fedspeak. Consistent recent data suggesting significant progress on snuffling out toppy US inflation. Add an 80% chance (and rising) for a rate cut at the US central bank’s meeting in May next year. Throw into a large frying pan geopolitical tension, particularly in oil-producing regions… and VOILA!

Earlier this week, Fed officials flagged the possibility of a rate cut in the coming months amid cooling inflationary pressures, though others warned that such discussions were premature.

Which brings us quickly to Wall Street, where stocks traded stiffly in a tight range as Q3 GDP data added a little extra encouragement for the resilient US economy.

All three major indices trimmed gains late. The Dow slipped home (up +0.04%), while the S&P 500 and Nasdaq Composite closed lower by -0.1% and -0.16%, respectively.

On the plus side of the ledger, all of the big US indexes look set to finish November with gains.

US Futures for the Dow Jones Industrial Average, the S&P 500 and the Nasdaq Composite were higher ahead of trade on Thursday morning in New York:

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| WEC | White Energy Company | 0.002 | 100% | 5,526 | $68,406 |

| CPM | Coopermetalslimited | 0.425 | 63% | 19,951,032 | $16,183,869 |

| CRB | Carbine Resources | 0.006 | 50% | 1,103,480 | $2,206,951 |

| KEY | KEY Petroleum | 0.0015 | 50% | 310,000 | $1,967,928 |

| TZN | Terramin Australia | 0.039 | 39% | 369,671 | $59,263,756 |

| PLG | Pearlgullironlimited | 0.043 | 34% | 79,404 | $6,545,337 |

| IEC | Intra Energy Corp | 0.004 | 33% | 2,497,250 | $4,982,345 |

| PAB | Patrys Limited | 0.008 | 33% | 4,313,244 | $12,344,684 |

| WGR | Westerngoldresources | 0.037 | 32% | 739,333 | $4,303,275 |

| DMG | Dragon Mountain Gold | 0.013 | 30% | 144,508 | $3,946,717 |

| CHK | Cohiba Min Ltd | 0.0025 | 25% | 400,000 | $4,426,488 |

| TSI | Top Shelf | 0.185 | 23% | 160,660 | $31,112,379 |

| R3D | R3D Resources Ltd | 0.05 | 22% | 341,466 | $6,247,235 |

| EXT | Excite Technology | 0.009 | 20% | 2,586,798 | $9,069,313 |

| OPT | Opthea Limited | 0.5 | 19% | 901,725 | $278,379,626 |

| ODY | Odyssey Gold Ltd | 0.026 | 18% | 619,923 | $16,841,832 |

| WCN | White Cliff Min Ltd | 0.013 | 18% | 18,373,733 | $14,042,153 |

| BPH | BPH Energy Ltd | 0.04 | 18% | 19,397,269 | $34,867,424 |

| BFC | Beston Global Ltd | 0.007 | 17% | 1,384,182 | $11,982,281 |

| IBG | Ironbark Zinc Ltd | 0.007 | 17% | 2,508,522 | $8,843,236 |

| KNM | Kneomedia Limited | 0.0035 | 17% | 327,593 | $4,599,814 |

| MOM | Moab Minerals Ltd | 0.007 | 17% | 141,150 | $4,271,781 |

| PUA | Peak Minerals Ltd | 0.0035 | 17% | 282,334 | $3,124,130 |

| ATV | Activeportgroupltd | 0.115 | 15% | 20,872 | $31,714,787 |

| LDR | Lode Resources | 0.115 | 15% | 211,368 | $10,678,415 |

Cooper Metals (ASX:CPM) has found more copper at its Brumby Ridge Prospect at the Mt Isa East Cu-Au project.

The latest assays look convincing to me – and the company says they “confirm bonanza copper grades” at Brumby Ridge, so must be true.

For example, the drill hole called 23MERC028, has returned:

– 71m @ 2.8% Cu & 0.05 g/t Au from 115m to end of hole at 186m, including: 24m @ 5.4% Cu and 0.10g/t Au from 115m hole 23MERC028 ended in mineralisation – 3m @ 1.88% Cu.

The company says that of the 5 drill holes to date, three have hit significant mineralisation and finished in mineralisation.

This new result builds on the initial RC drill hole 23MERC024, which intercepted 50m at 1.32% Cu and 0.05g/t Au from 80m including 2m @ 6.1% Cu & 0.23g/t Au.

MD Ian Warland says that mineralisation is “open in all directions and appears to increase in copper and gold grade with depth.”

“Seventy-one metres at 2.8% Cu, with a higher-grade intersection of twenty-four metres at 5.4% Cu could be the start of a significant discovery at Brumby Ridge for Cooper Metals.

“DHEM is being trialled at the Brumby Ridge and Raven Prospects, along with plans to conduct a larger program of RC and diamond drilling at Brumby Ridge in first quarter 2024, chasing the higher-grade mineralisation at depth and along strike.

‘This whole Prospect area is well located, just down the road from Mt Isa township and will continue to be our main focus going in to 2024.”

Meanwhile, Dragon Mountain Gold (ASX:DMG) has held its AGM.

The voting’s done and there was almost wholesale backing of the various resolutions including a 99.97% vote in favour of changing the company name.

Shares are up 50% so it must be a right cracker of a name – ‘cos I thought Dragon Mountain Gold was pretty bloody good already.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the day’s worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| NPM | Newpeak Metals | 0.027 | -73% | 947,502 | $9,995,579 |

| LBT | LBT Innovations | 0.012 | -33% | 752,160 | $20,806,206 |

| ADS | Adslot Ltd. | 0.002 | -33% | 14,933,927 | $9,673,487 |

| AMD | Arrow Minerals | 0.001 | -33% | 23,800,000 | $4,535,648 |

| 4DS | 4Ds Memory Limited | 0.075 | -29% | 47,724,399 | $183,601,416 |

| BP8 | Bph Global Ltd | 0.0015 | -25% | 500,000 | $3,231,126 |

| CYQ | Cycliq Group Ltd | 0.003 | -25% | 49,001 | $1,430,067 |

| MCT | Metalicity Limited | 0.0015 | -25% | 4,233,247 | $8,502,172 |

| EWC | Energy World Corpor. | 0.016 | -20% | 1,997,185 | $61,578,425 |

| WIN | Widgienickellimited | 0.11 | -19% | 1,580,572 | $40,222,582 |

| SRH | Saferoads Holdings | 0.09 | -18% | 20,000 | $4,120,796 |

| BCA | Black Canyon Limited | 0.115 | -18% | 98,156 | $9,239,212 |

| CXU | Cauldron Energy Ltd | 0.014 | -18% | 7,369,564 | $19,246,778 |

| NFL | Norfolkmetalslimited | 0.37 | -17% | 1,389,764 | $15,719,623 |

| LVT | Livetiles Limited | 0.005 | -17% | 60,000 | $7,062,664 |

| PKO | Peako Limited | 0.005 | -17% | 18,608 | $3,162,508 |

| CCE | Carnegie Cln Energy | 0.052 | -15% | 681,070 | $19,084,062 |

| AQX | Alice Queen Ltd | 0.006 | -14% | 434,951 | $1,018,444 |

| AVE | Avecho Biotech Ltd | 0.003 | -14% | 120,000 | $11,092,540 |

| CBH | Coolabah Metals Limi | 0.06 | -14% | 40,000 | $4,046,000 |

| EEL | Enrg Elements Ltd | 0.006 | -14% | 2,502,659 | $7,069,755 |

| IVX | Invion Ltd | 0.006 | -14% | 351,637 | $44,951,425 |

| LNR | Lanthanein Resources | 0.006 | -14% | 20,710 | $7,851,029 |

| RLC | Reedy Lagoon Corp. | 0.006 | -14% | 168,000 | $4,316,785 |

| VRC | Volt Resources Ltd | 0.006 | -14% | 1,034,629 | $28,910,747 |

TRADING HALTS

Memphasys (ASX:MEM) – Pending an announcement regarding. capital raising

RocketDNA (ASX:RKT) – Pending an announcement regarding a capital raising

Estrella Resources (ASX:ESR) – Pending an announcement regarding the outcome of the awards ceremony in Dili for its Timor Leste Minerals Tender

Apollo Minerals (ASX:AON) – Pending an announcement regarding a capital raising

Surefire Resources (ASX:SRN) – Pending an announcement in relation to a Pre-feasibility Study having been completed

EV Resources (ASX:EVR) – Pending an announcement regarding a capital raising

Advanced Health Intelligence (ASX:AHI) – Pending the release of an announcement in relation to an agreement with a new partner

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.