Closing Bell: ASX stumbles, but Brainchip has mysteriously gained 68pc in five days

ASX stumbles today. Picture via Getty Images

- ASX 200 drops as Santa rally fades

- Energy and gold stocks rise

- Brainchip surges another 15pc

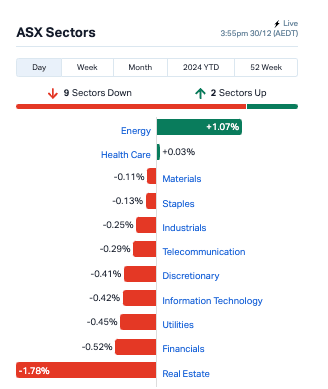

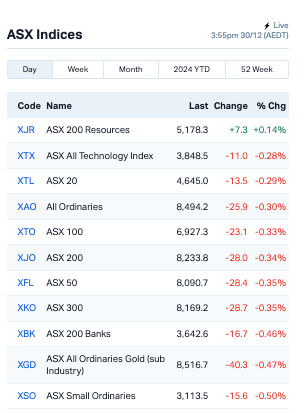

The ASX 200 had a rough start to the shortened week, sliding 0.36% (as of 4pm) and reversing the much-hyped “Santa rally” that was supposed to cap off the year in style.

But despite the setback, the ASX is still on track for a decent 2024, up 9% so far – its biggest yearly gain since 2021.

On Friday, the US S&P 500 tumbled by 1%, and the sense of caution has rippled across the globe with Asian stocks also declining today.

Bitcoin took a tumble, slipping back to around $93,560 at this time of writing.

Back home, Monday saw a number of major ASX companies go ex-dividend, which partly led to the broad pullback we’re seeing:

Gold and energy sectors, however, saw some bright spots. Karoon Energy (ASX:KAR) climbed 3%, driven by a rise in crude oil prices.

Chip stock BrainChip Holdings (ASX:BRN) has spiked another 15%, bringing its five-day gains to around 68%, despite no clear news driving the rally.

The ASX asked if BRN knew anything that could explain the recent trading spike. BRN replied with a firm “no” both times when asked if there was anything it hadn’t announced.

And finally, while all eyes are on Wall Street’s volatility, markets are also bracing for what 2025 might bring.

Torsten Slok, the top economist at Apollo Global Management, reckons the US economy will remain resilient.

“The US economy remains strong with no signs of major slowing going into 2025,” Slok noted.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| NTM | NT Minerals Limited | 0.004 | 100% | 1,937,988 | $2,421,806 |

| MTL | Mantle Minerals Ltd | 0.002 | 50% | 1,000,000 | $6,197,446 |

| MXR | Maximus Resources | 0.060 | 33% | 7,261,738 | $19,256,746 |

| BCB | Bowen Coal Limited | 0.009 | 29% | 83,597,247 | $75,425,228 |

| GCM | Green Critical Min | 0.014 | 27% | 79,457,780 | $20,983,086 |

| ADD | Adavale Resource Ltd | 0.003 | 25% | 45,041,138 | $3,081,664 |

| AOK | Australian Oil. | 0.003 | 25% | 168,629 | $2,003,566 |

| BNL | Blue Star Helium Ltd | 0.005 | 25% | 362,802 | $10,779,541 |

| CDT | Castle Minerals | 0.003 | 25% | 4,654,566 | $3,345,628 |

| MOH | Moho Resources | 0.005 | 25% | 2 | $2,865,898 |

| TEM | Tempest Minerals | 0.005 | 25% | 200,000 | $2,538,119 |

| VML | Vital Metals Limited | 0.003 | 25% | 327,999 | $11,790,134 |

| PIQ | Proteomics Int Lab | 0.740 | 22% | 926,877 | $79,256,644 |

| SCP | Scalare Partners | 0.180 | 20% | 8,662 | $5,232,420 |

| EVR | Ev Resources Ltd | 0.003 | 20% | 168,015 | $4,531,258 |

| RFT | Rectifier Technolog | 0.012 | 20% | 2,065,906 | $13,819,839 |

| AHF | Aust Dairy Limited | 0.080 | 19% | 9,551,205 | $49,802,562 |

| PUA | Peak Minerals Ltd | 0.010 | 19% | 6,633,723 | $20,416,882 |

| 5EA | 5Eadvanced | 0.089 | 19% | 1,533,926 | $25,269,083 |

| EPX | Ept Global Limited | 0.021 | 17% | 183,797 | $11,811,744 |

| BUY | Bounty Oil & Gas NL | 0.004 | 17% | 186,257 | $4,495,503 |

Proteomics International Laboratories (ASX:PIQ) said it has developed a blood test, PromarkerEndo, which can now diagnose all stages of endometriosis with high accuracy. Unlike the current method, which involves invasive surgery, this non-invasive test uses a panel of 10 protein biomarkers to identify the condition early – often before it causes severe damage. Endometriosis affects 1 in 9 women, and the PromarkerEndo is expected to launch in Q2 2025.

Australian Oil Company (ASX:AOK) has received $300k from Blue Sky Resources as part of the Tranche 3 payment under the revised settlement deal. The next payment of $1.2 million is due by 27 January, and will attract 9% interest on the deferred portion of the Tranche 3 payment. AOK also said it’s on track to connect its pipeline from Pacific Gas and Electric to its Rec Board wells in January, with plans to boost production. AOK is also exploring new gas assets in Australia and South-East Asia.

Austral Gold (ASX:AGD)’s subsidiary, Casposo, has signed a Toll Processing Agreement with Challenger Gold (ASX:CEL), following a deal announced earlier in December. Under the agreement, Casposo will process Challenger’s gold at its plant in Argentina, starting in the second half of 2025. The deal includes a US$3 million upfront payment, plus a monthly fee of US$110k and extra bonuses tied to gold recovery. To get the plant ready, Casposo has secured a US$7 million loan for refurbishments.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MKL | Mighty Kingdom Ltd | 0.011 | -42% | 3,378,644 | $4,105,205 |

| X2M | X2M Connect Limited | 0.020 | -38% | 416,518 | $12,062,102 |

| MOM | Moab Minerals Ltd | 0.002 | -33% | 3,999 | $4,700,998 |

| M4M | Macro Metals Limited | 0.011 | -27% | 56,783,673 | $56,009,157 |

| ERL | Empire Resources | 0.003 | -25% | 552,454 | $5,935,653 |

| M2R | Miramar | 0.003 | -25% | 250,034 | $1,587,293 |

| BLZ | Blaze Minerals Ltd | 0.004 | -20% | 4,345 | $7,834,739 |

| FIN | FIN Resources Ltd | 0.004 | -20% | 2,040 | $3,246,344 |

| TAS | Tasman Resources Ltd | 0.004 | -20% | 10,000 | $4,026,248 |

| AUK | Aumake Limited | 0.005 | -17% | 2,063 | $18,064,153 |

| C7A | Clara Resources | 0.005 | -17% | 11,512 | $1,688,987 |

| ERA | Energy Resources | 0.003 | -17% | 5,634,908 | $1,216,188,722 |

| RMI | Resource Mining Corp | 0.005 | -17% | 1,410,791 | $3,914,087 |

| EMN | Euromanganese | 0.026 | -16% | 809,021 | $6,535,823 |

| CCO | The Calmer Co Int | 0.006 | -14% | 5,201,308 | $17,785,969 |

| ODE | Odessa Minerals Ltd | 0.006 | -14% | 4,777 | $11,196,728 |

| SLZ | Sultan Resources Ltd | 0.006 | -14% | 508,775 | $1,620,289 |

| CAQ | CAQ Holdings Ltd | 0.007 | -13% | 30,000 | $5,742,290 |

| DOU | Douugh Limited | 0.007 | -13% | 917,220 | $9,458,047 |

| FFF | Forbidden Foods | 0.007 | -13% | 234,652 | $4,577,788 |

| MQR | Marquee Resource Ltd | 0.014 | -13% | 730,536 | $6,662,150 |

| MRR | Minrex Resources Ltd | 0.007 | -13% | 2,000 | $8,678,940 |

IN CASE YOU MISSED IT

Clinical-stage biotech company Dimerix (ASX:DXB) has completed recruitment for part 2 of its ACTION3 global phase III trial. The trial is investigating the company’s lead drug, DMX-200, as a potential treatment for focal segmental glomerulosclerosis (FSGS).

Astral Resources (ASX:AAR) has acquired a 19.99% stake and proposed a non-binding 7c per share all-scrip takeover of its Kambalda gold field neighbour, Maximus Resources (ASX:MXR). If successful, the merger would create a company with a ~1.8Moz resource in WA’s Eastern Goldfields.

Challenger Gold (ASX:CEL) has finalised a previously announced binding MoU with Casposo, a subsidiary of Austral Gold, for a toll treatment agreement to process mineralised material from CEL’s Hualilan project at the Casposo Plant in San Juan, Argentina. Operations are expected to begin in the second half of 2025, with Challenger also completing a strategic placement of $6.6m to contribute to plant refurbishment and preparation for tolling operations.

Imricor Medical Systems (ASX:IMR) has expanded into the Middle East, receiving its first purchase order for capital equipment and consumables from Qatar. The company is partnering with East Agency WWL, the exclusive distributor of Imricor products in Qatar under a five-year agreement.

At Stockhead, we tell it like it is. While Dimerix, Astral Resources, Challenger Gold and Imricor Medical Systems are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.