Closing Bell: ASX struck down again as $100bn wiped out; tech stocks take biggest hit

ASX struck down on fears of global recession. Picture Getty

- The ASX 200 dropped over 3% on Monday amid recession fears and weak US data

- Over $100 billion was wiped off the Aussie market in two days

- Global markets fell sharply, while safe-haven assets like gold and the yen gained

The ASX 200 index crashed by over 3% on Monday as investors grew anxious about the potential for a US recession.

The Index is now in the midst of its largest drop in two years following the 2% drop last week. Investors have erased over $100 billion from the Aussie stock market in just the past two trading sessions.

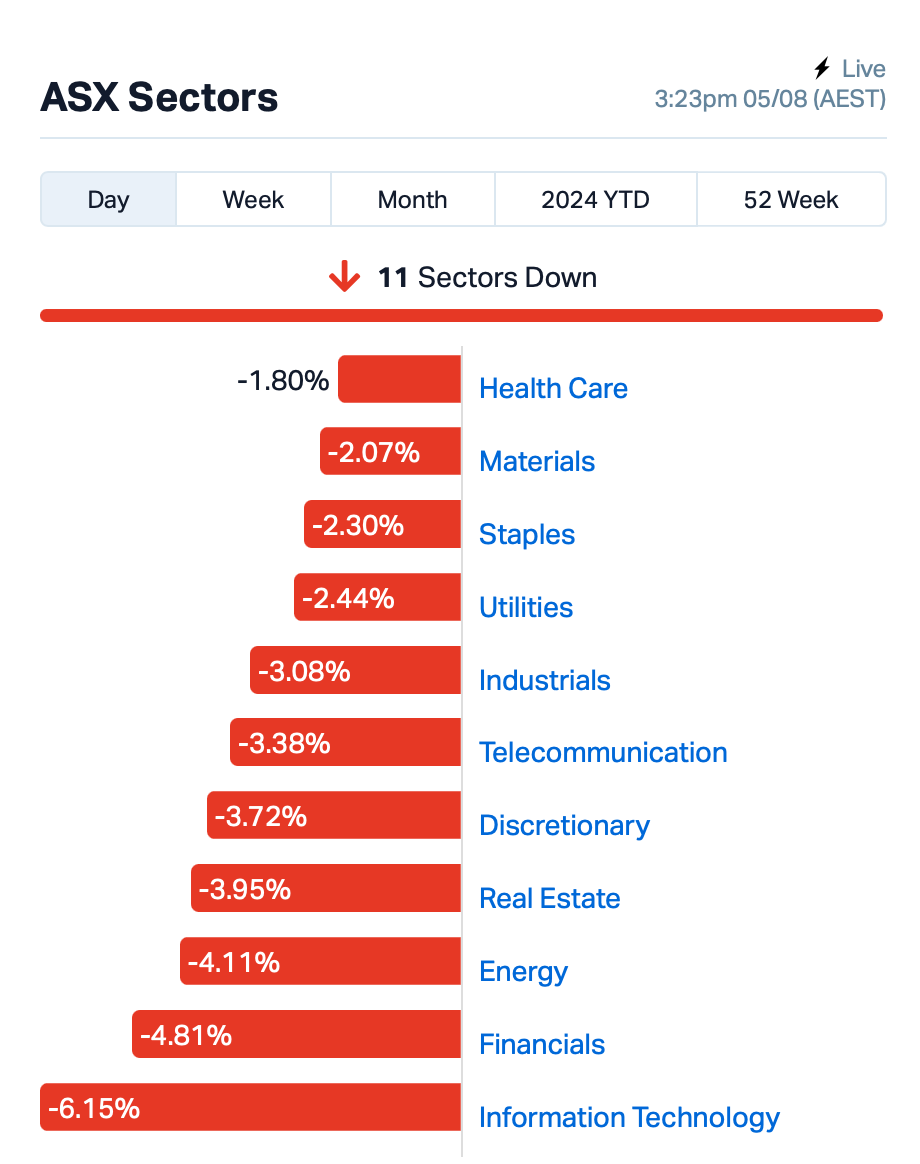

All 11 sectors retreated on Monday, with technology stocks suffering the biggest loss.

The recent selloff was triggered by last week’s US employment report, which showed a surprising rise in the unemployment rate.

This came on the heels of disappointing economic data from the previous day, including a decline in US manufacturing activity, a sector severely impacted by elevated interest rates.

“The Fed almost always waits too long to cut rates,” Matt Maley at Miller Tabak + Co told Bloomberg.

“Then, as investors come to realise that the rate cuts are coming more due to a slowdown in growth — rather than a drop in inflation — the situation on the stock market tends to get ugly.”

The big question now is whether we’re heading straight into a recession or if the US economy is just experiencing a temporary downturn.

A quick refresher on what happened last week

Last week, global stock markets fell heavily due to a disappointing jobs report from the US, which stoked fears of a possible recession.

In the US, the major indices fell sharply, with the Nasdaq dropping over 4% and entering correction territory, which is defined as a decline of at least 10% from its most recent peak.

The Nasdaq’s 10% drop since 10th July shows growing worries about whether top tech companies are too expensive amid the cooling US economy.

Even stocks like Tesla and Alphabet have reported weaker-than-expected results.

The Dow Jones and S&P 500 also had losses as investor concerns were heightened by weaker-than-expected job growth and rising unemployment.

European stocks similarly fell, with broad declines across sectors following weak US economic data.

In Asia, markets followed the US lead with Japan’s Nikkei and Topix both seeing their worst losses in years, while South Korea’s Kospi and Hong Kong’s Hang Seng also dropped.

In Australia, the ASX 200 fell by 2% last week, which saw particular pressure on discretionary retailers and resources companies, though tech stocks showed some resilience.

This week, investors will be looking at more earnings reports and a speech from Australia’s Reserve Bank Governor, Michelle Bullock, for further market direction.

What happened on the ASX today?

Banks stocks took another beating today, with Westpac (ASX:WBC) and ANZ (ASX:ANZ) both falling by over 4%, continuing their declines from the previous session.

Among the large cap mining stocks, BHP (ASX:BHP) and Fortescue (ASX:FMG) both declined, with both falling around 1.7% each.

WiseTech (ASX:WTC) was the biggest loser among large-cap stocks, plummeting over 7%, followed by Promedicus (ASX:PME) and Xero (ASX:XRO), which fell by 6% each.

What happened elsewhere?

The global rout has worsened today as Asian stocks tumbled, and the Nasdaq 100 futures falling by 3% in Asian hours.

In Japan, the Nikkei lost more than 7%.

Eyes were on the Yen, with the currency now rebounding to 143 vs the USD, solidifying its status as a safe haven.

The Swiss franc, another classic safe-haven currency, will also be one to watch when European markets open tonight.

Gold’s rebound is also gaining strength as European traders get ready to take over in the next few hours.

Crude oil, meanwhile, plunged by 3.5% on Friday, but on the weekend, the US has announced plans to send more warships and aircraft to the Middle East, which could lead to a spike in oil prices.

This move comes amid heightened tensions after Iran’s Revolutionary Guards vowed “severe revenge” following the killing of a Hamas leader in Tehran last week.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| E33 | East 33 Limited. | 0.021 | 75% | 2,550,481 | $9,302,207 |

| TGH | Terragen | 0.021 | 62% | 869,317 | $4,798,055 |

| SMM | Somerset Minerals | 0.003 | 50% | 950,000 | $2,061,997 |

| MHK | Metalhawk. | 0.075 | 42% | 939,612 | $5,335,510 |

| AUH | Austchina Holdings | 0.004 | 33% | 1,999,999 | $6,301,151 |

| MTL | Mantle Minerals Ltd | 0.002 | 33% | 435,631 | $9,296,169 |

| RNE | Renu Energy Ltd | 0.004 | 33% | 2,986,555 | $2,178,402 |

| HCT | Holista CollTech Ltd | 0.013 | 30% | 186,136 | $2,788,001 |

| AVE | Avecho Biotech Ltd | 0.003 | 25% | 175 | $6,338,594 |

| CAV | Carnavale Resources | 0.005 | 25% | 12,000 | $13,694,207 |

| TTI | Traffic Technologies | 0.005 | 25% | 610,491 | $3,891,541 |

| ABE | Ausbondexchange | 0.031 | 24% | 99,999 | $2,816,703 |

| KLI | Killiresources | 0.115 | 24% | 3,360,425 | $11,180,808 |

| TEM | Tempest Minerals | 0.011 | 22% | 1,791,500 | $4,890,387 |

| GES | Genesis Resources | 0.006 | 20% | 100,000 | $3,914,206 |

| OCN | Oceanalithiumlimited | 0.040 | 18% | 27,500 | $2,804,932 |

| FML | Focus Minerals Ltd | 0.140 | 17% | 314,876 | $34,387,037 |

| ADG | Adelong Gold Limited | 0.004 | 17% | 217,817 | $3,353,967 |

| FTC | Fintech Chain Ltd | 0.007 | 17% | 9,276 | $3,904,618 |

| MKL | Mighty Kingdom Ltd | 0.004 | 17% | 1,000,000 | $9,647,829 |

| APS | Allup Silica Ltd | 0.043 | 16% | 41,760 | $3,182,432 |

| NGY | Nuenergy Gas Ltd | 0.022 | 16% | 111,110 | $28,138,154 |

| BEZ | Besragoldinc | 0.100 | 15% | 2,390,077 | $36,374,779 |

East 33 (ASX:E33) was moving rapidly on Monday after news broke that the company, along with Yumbah Aquaculture, has entered a Bid Implementation Deed that would see an off-market takeover of 100% by Yumbah, for cash of $0.022 per East 33 share – a premium that is well above East 33’s previous close at $0.012 a pop.

Red Mountain Mining (ASX:RMX) was up on Monday morning on news that the company has acquired four exploration licences that are prospective for gold in the Yilgarn‘s Murchison Domain southeast of Mount Magnet. The Project covers 111km2 of the Kiabye Greenstone Belt, an underexplored gold belt adjacent to the Narndee Igneous Complex, where shallow historical exploration has found evidence of gold mineralisation before.

Carnavale Resources (ASX:CAV) was up on news that its ongoing metallurgical testwork for its headline Swiftsure Deposit within the Kookynie gold project in Western Australia has produced some great results, with high overall gold recovery rates ranging from 98.9% to 99.5%, with recovery of gravity gold averaging 87.1% and recovery from carbon in Leach (CIL) test 99.7%.

Metal Hawk (ASX:MHK) joined the growing list of goldies announcing discoveries today, revealing that it has rock chip and soil samples from the new Siberian Tiger prospect at Leinster South which have returned significant high grade gold assays over a broad area. MHK says the best of the results include 20.2 g/t Au with a total of 16 samples grading above 1.0 g/t Au.

Killi Resources (ASX:KLI) says that its hunt for gold at its 100% owned Mt Rawdon West project in Queensland, where pole-dipole Induced Polarisation (IP) geophysical survey showed a strong spatial association with gold-copper mineralisation that have helped the company identify new, discrete chargeable targets in line with earlier surface sampling that showed copper-gold mineralisation of 238g/t Au and 5.4% Cu.

Spirit Telecom (ASX:ST1) was one of a handful of tech companies doing well on Monday morning, after announcing that it is expecting to do better than expected for FY25, saying that the company is confident that its strategy of selling combined Cyber Security, Managed Services and Collaboration platforms will improve its profitability and deliver uEBITDA of between $9.5 million and $10.5 million and revenue of between $150 million and $160 million in FY25

One of the first cabs off the rank to pull ahead from its Day 1 presentation at the Diggers & Dealers conference in Kalgoorlie, Ardea Resources (ASX:ARL) has pushed the supply chain diversification narrative to sell its 50:50 4Mt KNP Goongarrie Nickel Hub JV. ARL warns of mounting concerns from OEM’s about buying product from the environmentally non-compliant and high-risk jurisdictions of China and Indonesia – two of the world’s largest nickel producers.

ARL signed on Japanese majors Sumitomo and Mitsubishi, which will fully fund a DFS for up to $98.5m and jointly farm-in to a 50% share of the project.

The two companies will have access to 75% of the offtake on commercial terms, with Sumitomo’s technical expertise in nickel-laterite mining and refining to come to the fore during development. A preliminary study outlined KNP Goongarrie as a 194.1Mt at 0.70% Ni and 0.05% Co for 1.36Mt of nickel and 99,000t of cobalt as a low-cost operation comparable with Indonesia’s globally dominant pig iron opex. Perhaps ARL sees an opportunity with BHP’s shuttering of its WA nickel operations and subsequent pivot to copper.

Another winner from Day 1 at Diggers, Grant Haywood-led Horizon Minerals (ASX:HRZ) has geared itself to start production and gold sales from its 1.8Moz Goldfields assets, with the 428,000oz Boorara to kick off in the September quarter and 54,570oz Phillips Find during the following. It has a 1.24Mt ore sale agreement with Norton Gold Fields in place and a toll agreement through FMR Investments’ 1Mtpa Greenfields mill. There’s also its cornerstone Burbanks asset which has a growing >460,000oz resource, which was last topped up from 10,000m of drilling that added 188,000oz.

Ever since it tripped over 8oz of gold on some exposed land at its Mt Rawdon West gold-copper project in QLD near Evolution Mining (ASX:EVN) 70,000ozpa Mt Rawdon mining operation, trade on Killi Resources (ASX:KLI) has been quite significant. The explorer is holding court on the ASX once again today, after confirming gold and copper drill targets from ground IP surveying across the Kaa prospect at Mt Rawdon West which intercepted some bonkers gold grades up to 238g/t gold and 5.2% copper.

Those grades were found via IP line 3600N, a trend that’s sub-parallel to the recently mapped 1.8km-long high-grade copper-gold trend at surface.

Metal Hawk (ASX:MHK) says high-grade gold has been discovered from rock chip and soil samples across the Siberian Tiger prospect, part of MHK’s Leinster South gold project, also in the Goldfields. The prospect area is just 15km from the 4.5Moz Lawlers mining centre and assayed results showed up to 20.2g/t gold from 16 >1g/t samples.

PYC Therapeutics (ASX:PYC) has provided an update on its ongoing clinical trials for VP-001, an investigational drug candidate designed to treat Retinitis Pigmentosa type 11 (RP11). RP11 is a rare and severe eye disease that leads to blindness. The company has previously highlighted encouraging developments in its trials, showcasing the drug’s potential to significantly improve visual function in affected patients. In its latest update, PYC revealed that VP-001 has continued to show positive effects in patients from the Single Ascending Dose (SAD) study. The drug was initially administered to a patient, and two months later, this individual showed notable improvements in visual function. This improvement has been sustained, with further positive results observed four months after treatment. A second patient in the same cohort has also demonstrated similar progress, with their visual function improving to levels deemed clinically significant by the US FDA.

Metal Bank (ASX:MBK) has gained exploration rights for Area 47 in Jordan, a promising site for copper and molybdenum. The company is also applying for rights to Area 65, where nearby drilling has shown high copper levels. MBK plans to evaluate these areas along with its Malaqa Project, aiming for efficient drilling by combining efforts. This move supports their broader strategy in the MENA region and complements its ongoing projects in Saudi Arabia. Metal Bank’s Chair, Inés Scotland, said the new projects align with the company’s goal of exploring copper and critical minerals in the prolific Nubian Shield.

Magnetic Resources (ASX:MAU) has released a positive economic update for its Lady Julie Gold Project in WA. The project is expected to produce 817,470 ounces of gold over 8 years, averaging 104,000 ounces per year, with low costs and high profit margins. The project’s payback period is 12 months, and it boasts a 135% internal rate of return (IRR) and a total EBITDA of $1.49 billion. Operating costs are projected at $1,377 per ounce, with all-in sustaining costs at $1,386 per ounce. The project’s net present value (NPV) is $925 million. The open pit contains 883,000 ounces of gold, with 84% of the resource classified as Indicated. Development costs are estimated at $111.3 million, including a contingency for plant costs. A Mining Proposal is underway to secure further approvals and advance the project.

And…. eNova Mining (ASX:ENV) has made notable progress with exploration drilling at its CODA project. The company has completed 6 diamond drill holes and 5 reverse circulation holes, with over 500 samples sent for analysis. The drilling has revealed significant mineralised zones in the Patos formation, which belongs to the Cretaceous Mata Do Corda Group, indicating the potential for valuable rare earth element resources. The drilling program is on track and within budget, and a third diamond drill rig is expected to boost progress starting in mid-August. The drilling campaign is anticipated to wrap up by the end of the third quarter of 2024, with the first assay results expected between late August and early October.

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| APC | Aust Potash Ltd | 0.001 | -50% | 110,025,008 | $8,140,379 |

| CNJ | Conico Ltd | 0.001 | -50% | 1,254,985 | $4,403,055 |

| ME1 | Melodiol Glb Health | 0.001 | -50% | 8,179,740 | $1,578,840 |

| RPG | Raptis Group Limited | 0.008 | -38% | 390,551 | $825,323 |

| 1TT | Thrive Tribe Tech | 0.002 | -33% | 1,848,963 | $1,411,865 |

| EEL | Enrg Elements Ltd | 0.002 | -33% | 1,234,712 | $3,029,895 |

| PRX | Prodigy Gold NL | 0.002 | -33% | 6,667 | $6,353,323 |

| RIL | Redivium Limited | 0.002 | -33% | 46,684 | $8,192,564 |

| VPR | Voltgroupltd | 0.001 | -33% | 2,058,555 | $16,074,312 |

| NRZ | Neurizer Ltd | 0.004 | -30% | 38,460,000 | $9,512,153 |

| T3D | 333D Limited | 0.007 | -30% | 147,238 | $1,194,449 |

| AAU | Antilles Gold Ltd | 0.003 | -25% | 1 | $5,845,711 |

| AL8 | Alderan Resource Ltd | 0.003 | -25% | 6,999,999 | $4,427,445 |

| FIN | FIN Resources Ltd | 0.006 | -25% | 2,682,542 | $5,194,150 |

| JAV | Javelin Minerals Ltd | 0.002 | -25% | 20,000,000 | $8,553,692 |

| MOM | Moab Minerals Ltd | 0.003 | -25% | 751,616 | $3,175,257 |

| SLZ | Sultan Resources Ltd | 0.006 | -25% | 15,781 | $1,580,692 |

| 8IH | 8I Holdings Ltd | 0.009 | -25% | 53,022 | $4,177,930 |

| PLC | Premier1 Lithium Ltd | 0.009 | -25% | 534,876 | $2,094,889 |

| DXN | DXN Limited | 0.060 | -24% | 1,370,692 | $14,764,259 |

| CVB | Curvebeam Ai Limited | 0.180 | -21% | 527,215 | $49,669,619 |

| 1MC | Morella Corporation | 0.035 | -20% | 1,619,387 | $10,874,737 |

| ASQ | Australian Silica | 0.024 | -20% | 10,721 | $8,455,811 |

| SPA | Spacetalk Ltd | 0.024 | -20% | 2,130,639 | $14,130,642 |

IN CASE YOU MISSED IT

iTech Minerals (ASX:ITM) has identified two high-priority copper-gold drill targets – the highest conductors identified by third-party exploration – at the Scimitar prospect within its Reynolds Range project in the Northern Territory.

Killi Resources’ (ASX:KLI) induced polarisation survey at its Mt Rawdon West project in Queensland has found that IP anomalies at the Kaa prospect are coincident with known surface copper-gold mineralisation of up to 238g/t gold, 5.4% copper and 907g/t silver.

Meteoric Resources (ASX:MEI) has upgraded resources at its Caldeira project by >21% to 740Mt at 2572ppm TREO. This includes the Figueira deposit now having a high-grade domain of 47Mt at 4,763ppm TREO including 1,093ppm MREO, which raises the likelihood of early production at the project.

New World Resources’ (ASX:NWC) latest round of drilling has intersected up to 5.1% copper at its Antler and Javelin projects in Arizona. The company is now eyeing resource growth at Antler with satellite deposit potential.

Future Battery Minerals (ASX:FBM) has expanded its landholding in highly prospective zones of the Goldfields region in WA, extending its existing Kangaroo Hills and Miriam lithium projects.

The company has submitted applications for the newly named Kangaroo Hills West and Kangaroo Hills North projects as well as the Kalgoorlie North project.

It also applied for P15/6813 and P15/6681, which are contiguous to its Kangaroo Hills lithium project, increasing both further prospectivity for LCT pegmatites and a larger land holding for optimal future development of the project.

“We are pleased to have identified and pegged this attractive ground holding so close to our existing footprint in the region. Its prospectivity lies squarely within our core skillset and focus areas of lithium whist also having gold exploration potential,” managing director Nick Rathjen said.

Lumos Diagnostics (ASX:LDX) has received a cash refund of $140,777 in relation to its research and development activities for the 2023 financial year.

The Research and Development Tax Incentive relates to the continued R&D it conducted on its benchtop and disposable proprietary reader technology platform, which enables testing of a greater range of clinical biomarkers, facilitating the reading and interpretation of results from point-of-care diagnostic tests and enabling them to seamlessly interface with electronic medical record systems.

This reader platform has been a highly valued element of the company’s service offering to clients and has been instrumental in recent contract wins with Hologic and the Burnet Diagnostics Initiative of the MacFarlane Burnet Institute for Medical Research and Public Health.

QMines (ASX:QML) has raised $5m through a two-tranche private placement priced at 4.7c per share to accelerate exploration and development of the Mt Chalmers and Develin Creek projects.

TRADING HALTS

Patriot Battery Metals (ASX:PMT) – pending an announcement regarding an upgraded mineral resource estimate and exploration target.

Rubicon Water (ASX:RWL) – pending an announcement in relation to a proposed equity capital raising.

At Stockhead, we tell it like it is. While Future Battery Minerals, Lumos Diagnostics, QMines, iTech Minerals, Killi Resources, Meteoric Resources and New World Resources are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.