Closing Bell: ASX staggers into weekend as Mayne gets mauled and gold comes back to life

Traders fought to stay animated as the ASX shuffled through a lifeless Friday session. Pic Getty Images

- ASX closes 3.60 points lower after falling in afternoon session

- Mayne Pharma falls ~32% after Australian government opposes proposed takeover

- ASX gold stocks lead materials sector higher after bullion prices rebound 2% overnight

The ASX has closed 3.60 points lower after fluctuating in afternoon trade and losing ground towards quitting time. The ASX 200 fell from a position of relative strength at +0.45% at lunchtime.

Gold is glittering once more after bullion prices rebounded 2% overnight. Goldies broadly rose with Evolution Mining (ASX:EVN) 3.67% higher, Newmont Corporation (ASX:NEM) up 3.21% and Bellevue Gold (ASX:BGL) adding 2.18%.

It was not a good day for Mayne Pharma (ASX:MYX), and that’s an understatement. The stock fell ~32% today after the Australian government opposed its proposed takeover by US-based Cosette Pharmaceuticals, signalling it may move to block the deal.

Federal Treasurer Jim Chalmers told the company that his “preliminary view is that the Proposed Acquisition would be contrary to the national interest, on the grounds that it would negatively impact the Australian economy and community”.

Meanwhile, Asian markets were mixed with the Nikkei up 1.21%, Hang Seng falling 0.81% and the SSE Composite Index falling 0.63%.

Energy stocks were on the rise across the ASX, with momentum fuelled by AGL Energy’s (ASX:AGL) $185 million commitment to new gas turbines in WA, a move that’s lifted sentiment across the broader energy sector.

But it was a different case for Origin Energy (ASX:ORG) which fell 2.58% and at one stage more than 5% after its September quarterly report showed flat gas production, causing APLNG revenue to fall 12% from the previous quarter.

While electricity sales in the energy markets business rose, overall revenue fell due to ending gas contracts. Origin’s fall weighed on the utilities sector.

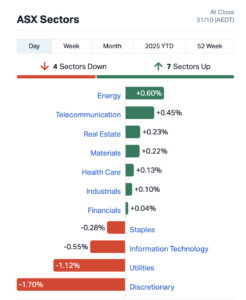

Here’s how the sectors looked at close.

Markets fall on Wall Street but Apple and Amazon surge

Overnight on Wall Street, the three major indices fell as investors weighed a high-stakes meeting between the US and Chinese presidents, mixed corporate earnings and uncertainty over future US interest rate moves.

The Nasdaq tumbled 1.6%, the S&P 500 fell 1%, while the Dow Jones Industrial Average slipped 0.2%.

However, it wasn’t all bad news with Apple reporting a record September quarter, sending its shares up 4% after hours. Amazon also surged 10% following a 20% growth in its AWS division during the quarter.

US futures are pointing to a stronger session on Wall Street to end the week.

As for Bitcoin, it’s changing hands for about $US109k at the time of writing – hanging in there – while the Aussie dollar is trading higher ~US65 cents.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| TMK | TMK Energy Limited | 0.002 | 100% | 20,579,927 | $11,897,383 |

| HCD | Hydrocarbon Dynamics | 0.003 | 50% | 136,282 | $2,874,959 |

| PVW | PVW Resources | 0.03 | 43% | 2,178,977 | $5,225,450 |

| AUH | Austchina Holdings | 0.002 | 33% | 10,696,504 | $4,538,075 |

| FBR | FBR Ltd | 0.004 | 33% | 15,005,814 | $19,655,919 |

| IPB | IPB Petroleum Ltd | 0.008 | 33% | 5,937,385 | $4,238,418 |

| EUR | European Lithium Ltd | 0.27 | 32% | 30,819,820 | $317,602,187 |

| SCP | Scalare Partners | 0.105 | 30% | 120,945 | $6,747,816 |

| MRD | Mount Ridley Mines | 0.032 | 28% | 111,739,343 | $29,842,042 |

| BOC | Bougainville Copper | 1.43 | 27% | 222,120 | $451,195,313 |

| NSB | Neuroscientific | 0.125 | 25% | 292,075 | $33,257,571 |

| AQX | Alice Queen Ltd | 0.005 | 25% | 298,009 | $5,538,785 |

| RNX | Renegade Exploration | 0.005 | 25% | 8,955,118 | $8,279,187 |

| SFG | Seafarms Group Ltd | 0.0025 | 25% | 5,859,614 | $9,673,198 |

| TSL | Titanium Sands Ltd | 0.01 | 25% | 534,475 | $18,757,978 |

| PGD | Peregrine Gold | 0.27 | 23% | 492,216 | $21,666,503 |

| UNT | Unith Ltd | 0.011 | 22% | 1,430,993 | $13,671,978 |

| NVA | Nova Minerals Ltd | 0.98 | 20% | 3,260,422 | $334,568,239 |

| VML | Vital Metals Limited | 0.24 | 20% | 328,465 | $29,298,817 |

| ENT | Enterprise Metals | 0.006 | 20% | 99,415 | $7,470,753 |

| OVT | Ovanti Limited | 0.006 | 20% | 12,315,597 | $27,578,948 |

| WMG | Western Mines | 0.26 | 18% | 421,497 | $25,024,636 |

| SBR | Sabre Resources | 0.013 | 18% | 319,839 | $4,339,081 |

| FME | Future Metals NL | 0.027 | 17% | 2,620,945 | $22,043,219 |

| RML | Resolution Minerals | 0.097 | 17% | 90,540,393 | $149,249,096 |

In the news…

PVW Resources (ASX:PVW) rose 43% after releasing its latest quarterly result showing continued progress on its Brazilian rare earth element (REE) portfolio with advanced drilling, sampling and metallurgical programs at the Southeast Hub.

The company also expanded its footprint into top-tier mining jurisdictions, signing a binding agreement to acquire gold and silver projects in Nevada and Idaho in the US.

AustChina Holdings (ASX:AUH) was up 33% after releasing its latest quarterly result with the junior kicking off fieldwork at its Sulphide Creek gold-antimony project in Tasmania, mapping a 500m alteration zone and discovering a new adit suggesting a potential new mineralisation model.

Preparations are also underway at the Mersey VMS project, also in Tasmania, with mapping, sampling and EM surveys planned.

Post quarter, AUH signed a heads of agreement for a high-grade minerals portfolio and a $1.5 million LOI with Bluestone Energy.

ASX Laggards

Today’s worst performing stocks (including small caps):

In Case You Missed it

Resolution Minerals (ASX:RML) has struck a deal to acquire Remington Capital, giving it the option to secure the Johnson Creek tungsten and antimony mill in Idaho.

Once operational, the site could make Resolution one of the few US companies able to process antimony, tungsten and gold in-house.

Stockhead’s Tylah Tully looks at Blue Star Helium (ASX:BNL), which has started construction at its Galactica helium project in Colorado – marking a major step towards first helium production, still on track for later this year.

Osmond Resources (ASX:OSM) has extended the strike of rutile, zircon and monazite mineralisation at its Orión critical minerals project in southern Spain. Zone 1 has grown by ~1.7km, Zone 3 could stretch a further 9.5km, with a third rig set to join drilling soon.

Aroa Biosurgery (ASX:ARX) has appointed seasoned healthcare executive Paul Shearer as a non-executive director, following the retirement of long-serving US-based director John Pinion. Shearer spent more than 30 years at Fisher & Paykel Healthcare, where he played a key role in the company’s US expansion.

Elevate Uranium (ASX:EL8) has raised $25 million through a strongly supported placement at 35c per share. The funds will boost operations at its U-pgrade pilot plant in Namibia and expand resource drilling across its uranium projects.

In the latest episode of The Unicorns Podcast, host Justin Kelly chats with Tea Industries founder Alexa Stathakis and How Ridiculous co-founder Brett Stanford.

The duo reveal how they built a sugar-free beverage brand shaking up the drinks market in Australia and the US – powered by one of the world’s most devoted YouTube communities.

Trading Halts

Battery Age Minerals (ASX:BM8) – cap raise

McLaren Minerals (ASX:MML) – cap raise

Volt Resources (ASX:VRC) – pending announcement

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.