Closing Bell: ASX slumps as Woolies fires warning; graphite stock GCM’s shares triple on new deal

ASX slumps after Woolies’ warning. Picture via Getty Images

- ASX slumps heavily after inflation data

- Australian inflation drops to 2.8pc, lower than expected

- Mining stocks rise while supermarket stocks struggle

The ASX trimmed its earlier gains following better-than-expected inflation figures. At the close of Wednesday, the ASX/S&P 200 index was down about 0.85%.

Year-on-year inflation in Australia came in at 2.8%, which is lower than the predicted 2.9%.

This data is crucial as it will influence the RBA’s decisions on monetary policy when they meet next week, especially with speculation about possible interest rate cuts.

“Trimmed-mean inflation eased half a percentage point to 3.5% y/y, in line with high frequency indicators and should ideally help the RBA make a dovish pivot,” said Krishna Bhimavarapu, at State Street Global Advisors.

“Delaying such a pivot might get the economy socked with prolonged below par growth rate.”

His colleague, Dwyfor Evans, added: “A lower oil price and government electricity subsidies continue to bias Australian inflation to the downside, but core prices remain elevated relative to target.”

“A cautious RBA may again indicate early 2025 for rate easing when it meets and releases its monetary policy statement on 5 November.”

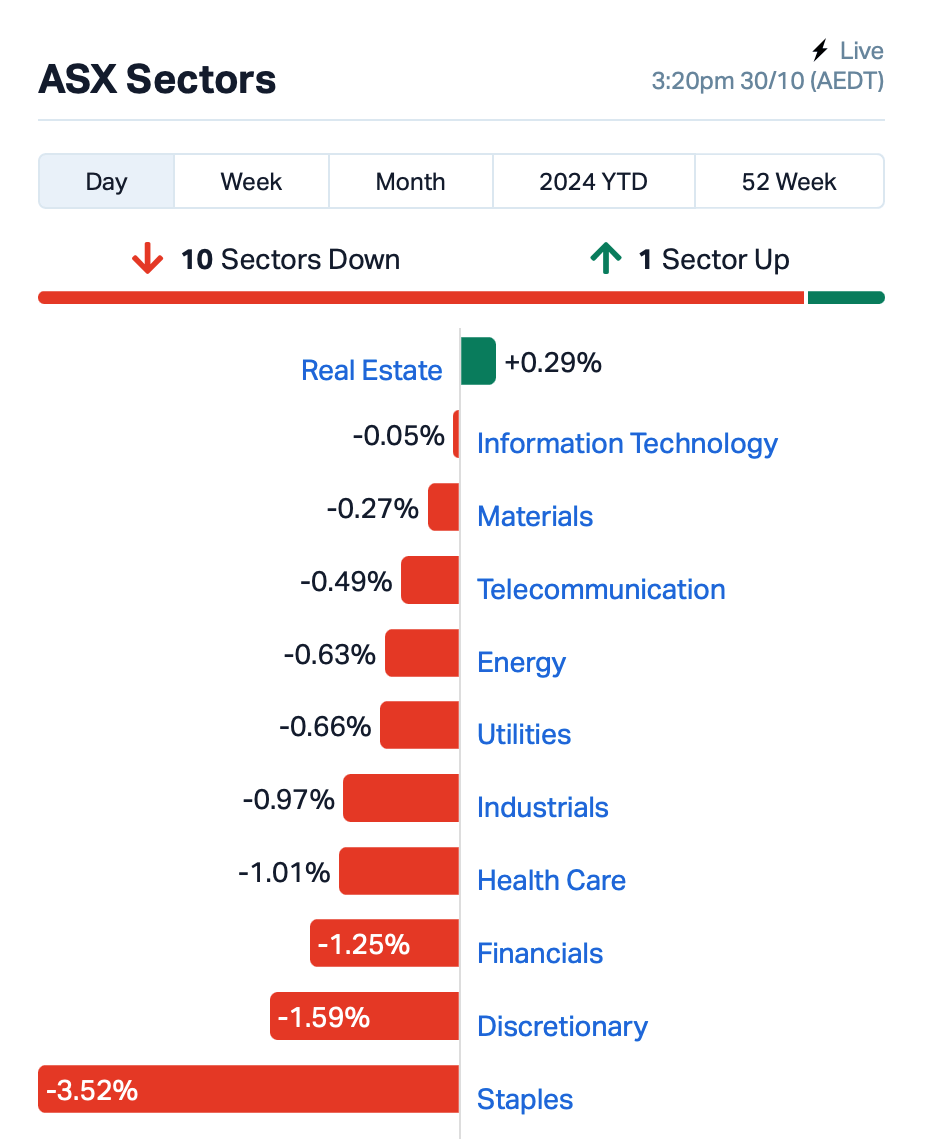

On the ASX, only the Real Estate sector showed any signs of resistance today as Consumer Staples tumbled.

Woolworths (ASX:WOW) and Coles (ASX:COL) dragged down the staples sector, with Woolworths falling almost 6% after a profit warning, and Coles down nearly 3%.

Woolies’ CEO Amanda Bardwell said, “We are pleased with the trading momentum in the lead up to the important Christmas trading period, however, we expect the environment for F25 to remain challenging.”

On the mining front, gold stocks rose as gold prices reached a new record of $US2,778 an ounce.

Emanuel Datt from Datt Capital noted that concerns about the upcoming US presidential election and escalating conflicts in the Middle East are driving investors toward safe-haven assets like gold.

In other large-cap news, Pilbara Minerals (ASX:PLS) rose 2% despite cutting its guidance for FY25 and pausing operations at its West Australian plant due to falling lithium prices.

Meanwhile, Star Entertainment’s (ASX:SGR) shares plummeted 11% after reporting an 18% drop in revenue and an $18 million bottom-line loss.

Elsewhere, the Aussie dollar slumped to a low of US65.40¢ today, a drop of more than 5% in October so far, which is the steepest monthly decline in two years.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| GCM | Green Critical Min | 0.008 | 200% | 111,980,776 | $3,815,107 |

| AMD | Arrow Minerals | 0.002 | 100% | 6,732,255 | $13,023,628 |

| OD6 | Od6Metalsltd | 0.048 | 66% | 8,331,376 | $3,732,015 |

| CLE | Cyclone Metals | 0.002 | 50% | 149,327,000 | $12,738,964 |

| FAU | First Au Ltd | 0.002 | 50% | 94,000 | $1,811,993 |

| PUR | Pursuit Minerals | 0.003 | 50% | 2,690,442 | $7,270,800 |

| TD1 | Tali Digital Limited | 0.002 | 50% | 250,000 | $3,295,156 |

| VPR | Voltgroupltd | 0.002 | 50% | 13,272 | $10,716,208 |

| TYP | Tryptamine Ltd | 0.033 | 43% | 49,143,426 | $25,048,118 |

| AKN | Auking Mining Ltd | 0.004 | 33% | 1,200,000 | $1,174,051 |

| ATH | Alterity Therap Ltd | 0.004 | 33% | 864,523 | $15,961,008 |

| BP8 | Bph Global Ltd | 0.004 | 33% | 1,370,221 | $1,189,924 |

| LNR | Lanthanein Resources | 0.004 | 33% | 200,250 | $7,330,908 |

| TKL | Traka Resources | 0.002 | 33% | 2,185,000 | $2,918,488 |

| RMX | Red Mount Min Ltd | 0.012 | 33% | 11,416,963 | $3,486,220 |

| KNI | Kunikolimited | 0.190 | 31% | 491,897 | $12,581,544 |

| YRL | Yandal Resources | 0.300 | 30% | 1,655,251 | $61,595,751 |

| EBG | Eumundi Group Ltd | 1.600 | 27% | 238,953 | $62,707,390 |

| PHL | Propell Holdings Ltd | 0.015 | 25% | 100,000 | $3,340,057 |

| IVX | Invion Ltd | 0.003 | 25% | 2,627,201 | $13,633,183 |

| LNU | Linius Tech Limited | 0.003 | 25% | 12,563,332 | $11,730,481 |

| VML | Vital Metals Limited | 0.003 | 25% | 6,836,714 | $11,790,134 |

| LRV | Larvottoresources | 0.710 | 21% | 6,346,547 | $186,357,434 |

Green Critical Minerals (ASX:GCM) is moving straight into the pilot stage of proving up its graphite tech after entering into a binding technology purchase agreement with Cerex, which produces saleable graphite blocks from graphite powder.

The technology mixes graphite with pre-cursors and heating, resulting in very high-density graphite blocks (‘VHD Graphite’) which can be used in a wide variety of applications. Given the unique properties of VHD Graphite, it is expected that the final product will be produced in a mould, allowing a large variety of graphite shapes and blocks to be manufactured.

Notwithstanding the proposed acquisition, GCM will continue to be a mineral exploration and development company with its flagship asset – the Mcintosh project in WA – boasting 30.2Mt in WA following a substantial 26% grade upgrade in July.

Rare earths explorer OD6 Metals (ASX:OD6) is the latest company on the bourse to shift its focus towards the red metal – an essential building block to modern life and the transition towards a net zero economy – following the acquisition of one of Australia’s highest grade historical copper mines.

After reviewing over 40 potential new projects, OD6 MD Brett Hazelden said the company has entered into a binding documentation to acquire the licence over the historical Gulf Creek project in NSW.

A high-grade volcanogenic massive sulphide (VMS) deposit, the asset was mined at the turn of the last century, between 1896 and 1912, with very high grades averaging between 2 to 6.5% copper within the three main lodes.

Arrow Minerals (ASX:AMD) has released its quarterly update.

Arrow’s CEO, David Flanagan said: “We made strong progress in our strategy to create shareholder value by leveraging the Simandou multi-user railway.

“Both the Simandou North Iron Project and the Niagara Bauxite Project are within trucking distance of the railway, making them highly prospective for logistics, mining, haulage and shipping operations.

“The MoU agreed with Baowu Group and potential mine gate sales will provide Arrow direct access to iron ore markets through our nearest neighbour, the world’s largest steel producing company. The Niagara drilling has now started, and we look forward to delivering results in the December quarter.”

Red Mountain Mining (ASX:RMX) has completed a detailed review of historical exploration at its Flicka Lake Project in Canada, identifying three parallel quartz veins containing gold. Previous work has found gold-bearing channel samples with values of 9.96 g/t and 12.96 g/t, along with grab samples showing 17.88 g/t, 7.38 g/t, and a peak of 20.07 g/t gold. These veins are hosted by gabbroic rocks and have varying widths, with the veins showing a tendency to pinch and swell. Results from the Flicka Lake Gold Sampling Program are expected soon.

Pursuit Minerals (ASX:PUR) has completed Drill Hole 2 (DDH-2) at the Rio Grande Sur Project, uncovering significant high-grade lithium brine at depths as low as 484 metres. Key findings include lithium concentrations exceeding 500 mg/L at various depths, which could expand the existing mineral resource estimate. Following this successful drilling, the team has temporarily paused drilling to assess the results, which will help reduce costs. The company is now focusing on lithium carbonate production from its pilot plant in Salta.

Tryptamine Therapeutics (ASX:TYP), a clinical stage biotech, was surging earlier after having secured firm commitments from new and existing professional, sophisticated, and institutional investors to raise $6 million to accelerate development of its novel IV-infused psilocin formulation TRP-8803.

Gold Hydrogen (ASX:GHY) shares were on the up with exciting developments at the company’s Ramsay project in South Australia including the confirmation of Helium-3 within the asset area. Helium-3 is an incredibly rare and valuable gas in high demand from the world’s largest countries for its use in nuclear fusion.

It is a non-radioactive isotope of helium, prized for its neutron absorption capabilities and its unique role in neutron detection, low-temperature physics experiments plus nuclear detection and quantum computing. GHY said confirming Helium-3 within a land-based system could be revolutionary.

And in its quarterly report today, Vital Metals (ASX:VML) said it has made progress on a Scoping Study for the Tardiff deposit at its Nechalacho Rare Earths Project in Canada. ERM Consultants will assess potential production scenarios, while Corem has been appointed to create a preliminary processing flowsheet. The Tardiff deposit has a mineral resource estimate of 213 million tonnes at 1.17% total rare earth oxides, including over 623,000 tonnes of neodymium and praseodymium. An updated resource estimate is expected later this year.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| SI6 | SI6 Metals Limited | 0.001 | -33% | 1,001,927 | $4,150,938 |

| PNT | Panthermetalsltd | 0.028 | -24% | 17,763,619 | $8,707,900 |

| VAR | Variscan Mines Ltd | 0.010 | -23% | 3,914,990 | $5,759,005 |

| PPG | Pro-Pac Packaging | 0.024 | -23% | 1,478,859 | $5,632,319 |

| BNZ | Benzmining | 0.223 | -21% | 321,232 | $29,924,839 |

| CTO | Citigold Corp Ltd | 0.004 | -20% | 1,470,764 | $15,000,000 |

| LIS | Lisenergylimited | 0.205 | -20% | 3,318,326 | $163,251,059 |

| WIN | WIN Metals | 0.027 | -18% | 9,976,076 | $10,941,318 |

| CUF | Cufe Ltd | 0.007 | -18% | 12,020,641 | $11,361,736 |

| REM | Remsensetechnologies | 0.024 | -17% | 566,209 | $4,809,931 |

| CXL | Calix Limited | 0.825 | -17% | 1,503,878 | $181,293,554 |

| TOU | Tlou Energy Ltd | 0.015 | -17% | 5,199,126 | $23,374,518 |

| AD1 | AD1 Holdings Limited | 0.005 | -17% | 84,166 | $6,584,090 |

| AVE | Avecho Biotech Ltd | 0.003 | -17% | 333,333 | $9,507,891 |

| BLZ | Blaze Minerals Ltd | 0.005 | -17% | 2,404,838 | $3,771,349 |

| QXR | Qx Resources Limited | 0.005 | -17% | 119,607 | $6,660,467 |

| PPK | PPK Group Limited | 0.525 | -16% | 184,568 | $56,757,811 |

| CTT | Cettire | 1.488 | -16% | 5,454,106 | $674,791,649 |

| C1X | Cosmosexploration | 0.041 | -15% | 141,853 | $3,983,809 |

| ALM | Alma Metals Ltd | 0.006 | -14% | 2,399,832 | $10,798,617 |

| INF | Infinity Lithium | 0.030 | -14% | 766,055 | $16,190,723 |

IN CASE YOU MISSED IT

Challenger Gold’s (ASX:CEL) Hualilán gold project is now the first gold project in Argentina’s San Juan Province to receive Environmental Impact Assessment approval in 17 years. The company recently signed a toll treatment agreement that could enable early production.

Green Critical Minerals (ASX:GCM) has acquired a revolutionary technology to produce saleable, very high-density graphite blocks with the highest thermal conductivity and lowest electrical resistivity recorded for any bulk graphite material. This could be commercialised within 12 months.

Perpetual Resources (ASX:PEC) has signed a non-binding memorandum of understanding with the Government of Minas Gerais and Invest Minas to advance its lithium, rare earths, and tin projects in the state.

Lithium Universe (ASX:LU7) has received binding commitments from sophisticated and professional investors to raise $2.14m at $0.0125 per share to fund completion of the Definitive Feasibility Study (DFS) for its Bécancour lithium refinery in Quebec. The DFS is on track for release in the March 2025 quarter, with the refinery expected to help close a lithium conversion gap in North America, which has millions of tonnes of lithium carbonate equivalent resources but a yawning chasm when it comes to chemical conversion capacity. The company also intends to undertake a non-renounceable entitlement offer of 1 share for every 10 Shares held by eligible shareholders at the same issue price to raise up to ~$1.024m

Regener8 Resources (ASX:R8R) has been awarded a co-funded drilling grant for up to $180,000 under the WA Governments’ Exploration Incentive Scheme (EIS) for the Hatlifter prospect at its East Ponton project. The company is currently undertaking its maiden drilling campaign, testing the Hatlifter paleochannel-hosted nickel-cobalt target, where historical drilling returned a high-grade, end-of-hole intersection of 3m at 1.26% nickel and 0.6% cobalt from 57m. This grant will be used towards follow-up drilling campaigns.

“The EIS grant enables Regener8 to amplify exploration at the Hatlifter prospect over the next 12 months,” managing director Stephen Foley said.

Renascor Resources (ASX:RNU) says its Battery Anode Material (BAM) project in South Australia is progressing through advanced planning stage with early contractor involvement and long-lead upstream work streams. The company is advancing work to mature the engineering design and minimise the construction period of its proposed graphite mine and processing operation, the upstream portion of the project.

Ongoing work includes site geotechnical testing, incorporation of vendor design, equipment pricing and preparation of final designs and estimates, along with upgrades to the electrical infrastructure to allow site connection with SA Power Network’s existing electricity grid network. In parallel, Renascor continues to progress its planned Purified Spherical Graphite (PSG) manufacturing facility, the downstream portion of the BAM project.

TRADING HALTS

Amplia Therapeutics (ASX: ATX) – cap raise

Lode Resources (ASX: LDR) – cap raise

Rumble Resources (ASX: RTR) – cap raise

Kingsland Minerals (ASX: KNG) – an announcement in relation to a strategic investment in Kingsland

Capricorn Metals (ASX: CMM) – material cap raise

Ironbark Zinc (ASX: IBG) – cap raise

Cobre Limited (ASX: CBE) – material cap raise

SRJ Technologies (ASX:SRJ) – pending a further announcement

At Stockhead, we tell it like it is. While Challenger Gold, Green Critical Minerals, Lithium Universe, Perpetual Resources, Regener8 Resources and Renascor Resources are Stockhead advertisers, they did not sponsor this article.

Today’s Closing Bell is brought to you by Webull Securities. Webull Securities (Australia) Pty. Ltd. is a CHESS-sponsored broker and a registered trading participant on the ASX.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.