Closing Bell: ASX slips as China-exposed miners retreat; Bitcoin rockets above US$81k

Bitcoin surges past US$81k as Trump’s win fuels optimism. Picture via Getty Images

- ASX starts week lower with mining stocks under pressure

- Resolute mining plunges after CEO detained in Mali

- Bitcoin surges past US$81k as Trump’s win fuels optimism

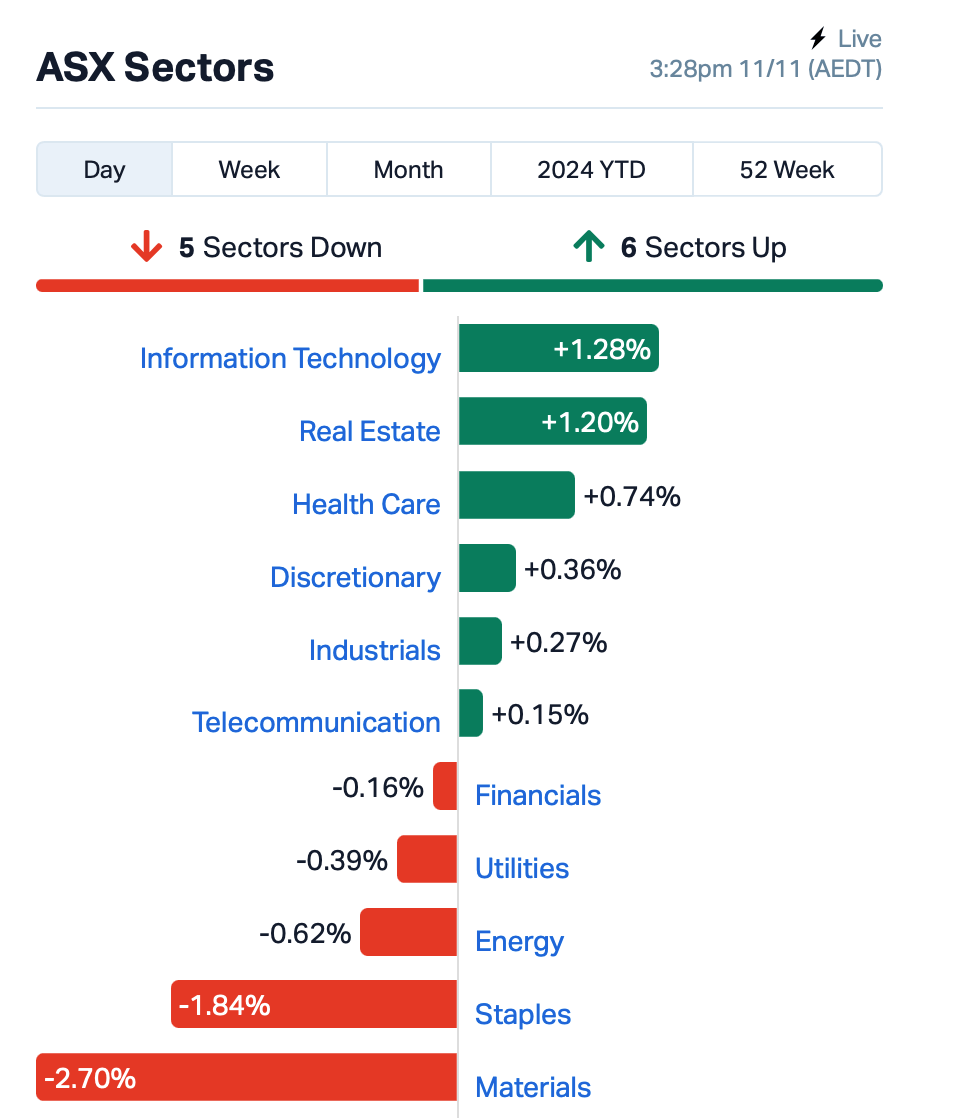

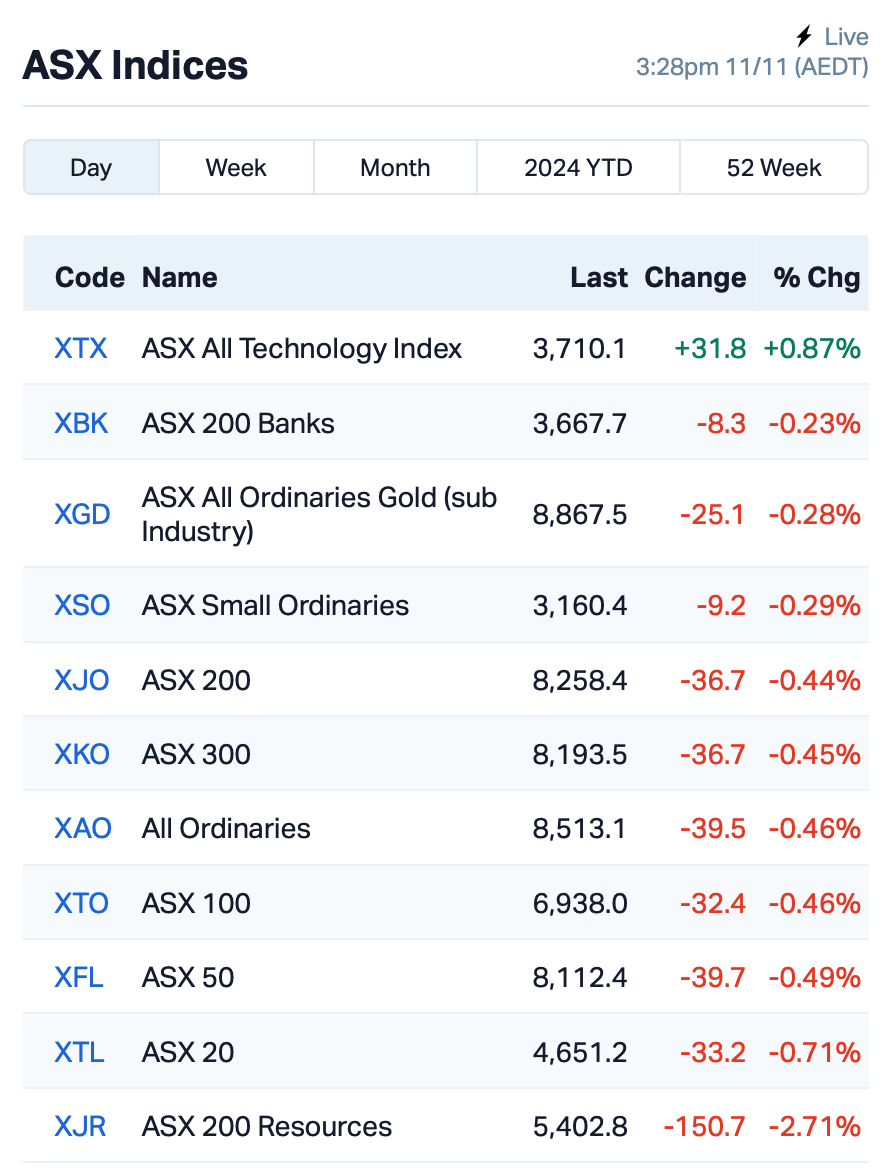

The ASX had a rough start to the week, with mining stocks dragging the market down on Monday. At the close, the S&P/ASX 200 Index was off by 0.35%.

Miners with big exposures to China took a hit after China’s stimulus package announced on Friday underwhelmed.

Despite the massive 10 trillion yuan ($2.1 trillion) headline, many traders were disappointed, feeling the plan didn’t go far enough to support China’s slowing economy and weak consumer spending.

Adding to that disappointment was data released on Saturday, which revealed that China’s consumer prices (CPI) grew at the slowest rate in four months in October, while producer price deflation worsened.

BHP (ASX:BHP) and Rio Tinto (ASX:RIO) tumbled by around 4%, with Fortescue (ASX:FMG) falling even further by 6%.

The infoTech sector, meanwhile, was led by heavyweight WiseTech Global (ASX:WTC), which rose 2% on no specific news.

Resolute Mining (ASX:RSG) saw its stock drop 34% after news broke that CEO Terry Holohan and two employees were detained by Mali’s military government over the weekend.

The detentions come amid tensions around the company’s 80% stake in the Syama gold mine, partly controlled by the Malian government. The reasons for the detentions remain unclear.

Endeavour Group (ASX:EDV), the owner of Dan Murphy’s and BWS, warned that lower sales and rising costs would hit profits, sending its stock down more by nearly 5%.

On a more positive note, battery tech company Novonix (ASX:NVX) jumped by 13% after securing a supply deal with car giant Stellantis for high-performance synthetic graphite. Novonix said it planned to expand its Riverside facility and build a new site in the US to meet this demand.

Still in large caps, HMC Capital (ASX:HMC), led by deal maker David Di Pilla, is snapping up iSeek, a top-tier Australian data centre platform, for $400 million. This deal is a big part of HMC’s plan to create a global digital infrastructure platform, DigiCo, which will seed an ASX-listed REIT with over $4 billion in assets.

Elsewhere, Bitcoin surged past US$81,000 for the first time, driven by President-elect Trump’s support for digital assets and a pro-crypto Congress. Smaller coins such as Dogecoin also rose – that one partly by Elon Musk’s love for the meme.

US bulls to keep charging ahead?

Last week, Wall Street had its best week of the year, with major indices hitting new record highs. The S&P 500 briefly topped 6000, and the Dow Jones crossed 44,000 for the first time.

The rally was driven by optimism based around Donald Trump’s presidential win and a Federal Reserve rate cut.

Moomoo Australia’s Jessica Amir says this bull market will continue to charge ahead. She believes optimism around Trump’s plans to cut taxes and ease regulations has sparked fresh investor confidence.

“And it’s at a time when US consumer sentiment rose to its highest in seven months with Americans optimistic about personal incomes strengthening,” Amir said.

Amir also believes Aussie traders are wary about the strength of the US dollar, and rising US tariffs against China.

“So you could expect Aussies to rotate out of positions in Australia’s sharemarket and back momentum and top up positions in US stocks,” she said.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MHC | Manhattan Corp Ltd | 0.002 | 100% | 359,818 | $4,497,970 |

| MNC | Merino and Co | 1.050 | 54% | 734,126 | $36,092,068 |

| ADD | Adavale Resource Ltd | 0.003 | 50% | 6,007,097 | $2,447,531 |

| AXP | AXP Energy Ltd | 0.002 | 50% | 300,000 | $5,824,681 |

| TKL | Traka Resources | 0.002 | 50% | 1,203,505 | $1,945,659 |

| VPR | Voltgroupltd | 0.002 | 50% | 2,921,688 | $10,716,208 |

| EEL | Enrg Elements Ltd | 0.002 | 33% | 340,921 | $1,744,524 |

| OAR | OAR Resources Ltd | 0.002 | 33% | 516,524 | $4,951,252 |

| PAB | Patrys Limited | 0.004 | 33% | 16,898,282 | $6,172,342 |

| XPN | Xpon Technologies | 0.020 | 33% | 2,301,605 | $5,436,622 |

| EQN | Equinoxresources | 0.165 | 32% | 5,052,285 | $15,481,250 |

| PVT | Pivotal Metals Ltd | 0.012 | 28% | 16,962,557 | $7,870,283 |

| ID8 | Identitii Limited | 0.015 | 25% | 1,122,558 | $7,807,290 |

| OVT | Ovanti Limited | 0.030 | 25% | 57,972,382 | $48,723,494 |

| VTI | Vision Tech Inc | 0.135 | 23% | 5,835 | $6,054,011 |

| CUS | Coppersearchlimited | 0.036 | 20% | 568,466 | $3,407,562 |

| OLL | Openlearning | 0.018 | 20% | 99,078 | $6,346,031 |

| ICG | Inca Minerals Ltd | 0.006 | 20% | 1,234,344 | $5,133,613 |

| PRM | Prominence Energy | 0.006 | 20% | 200,000 | $1,945,882 |

| BIS | Bisalloy Steel | 3.670 | 20% | 523,982 | $147,064,055 |

| EMP | Emperor Energy Ltd | 0.025 | 19% | 2,589,646 | $9,507,761 |

| PEC | Perpetual Res Ltd | 0.019 | 19% | 6,447,571 | $11,776,487 |

| PFE | Panteraminerals | 0.026 | 18% | 5,410,148 | $10,004,075 |

Pointsbet (ASX:PBH) surged by 10% following media speculation about a potential transaction, as reported in The Australian on November 8. Even though PointsBet denied the speculation in today’s market release, the rise in share price suggests that traders are speculating on potential mergers.

Liontown Resources (ASX:LTR) rose 3% after updating its mine plan and providing positive H2 FY25 guidance. The new plan aims to reach a 2.8Mtpa production rate by FY27, focusing on high-margin production while reducing costs. Operating costs for H2 FY25 are expected to be between $775 – $855 per ton. LTR is also targeting up to $100 million in cost reductions through its Business Optimisation Program.

Silk Logistics Holdings (ASX:SLK) has entered into an agreement with DP World Australia for the full acquisition of Silk by way of a scheme of arrangement. Under the scheme, Silk shareholders will receive $2.14 per share, minus any dividends paid before the deal goes through. This offer represents a significant premium, with a 45.6% increase on Silk’s last share price and a 60.6% premium on its one-month average.

Silk’s board fully supports the deal, recommending that shareholders vote in favour. Key shareholders, controlling 46% of Silk’s shares, have already pledged their support, contingent on the same conditions. The scheme is still subject to regulatory approvals and shareholder voting.

Nagambie Resources (ASX:NAG) has updated its JORC Inferred Resource estimate for its Nagambie Mine gold-antimony deposit, showing a significant increase in both size and grade. The new figures reflect higher gold and antimony prices, which have allowed for a lower cut-off grade and a larger resource. The updated resource now stands at 322,000 gold equivalent ounces (AuEq) at an average grade of 18.6 g/t AuEq, a 110% increase from the previous estimate, with gold contributing 18% and antimony 82%.

Fintech stock Douugh (ASX:DOU) announced it has received its FY24 R&D tax refund for the work carried out on its Embedded Finance platform, Stakk, in FY24. The total amount received was around $1 million.

According to DOU’s ASX announcement, Stakk is a full-service embedded finance platform, which helps brands launch their own fintech products, managed through a single admin portal.

Fonterra (ASX:FSF) meanwhile raised its farmgate milk price forecast for the 2024/25 season, giving its shares a nice 2% bump. The company also announced its intention to sell off its consumer unit.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AKG | Academies Aus Grp | 0.105 | -38% | 3,550 | $22,544,459 |

| T3D | 333D Limited | 0.006 | -33% | 40,006 | $1,075,004 |

| RNE | Renu Energy Ltd | 0.001 | -33% | 522,879 | $2,590,993 |

| TMK | TMK Energy Limited | 0.002 | -33% | 19,131,887 | $25,177,217 |

| VML | Vital Metals Limited | 0.002 | -33% | 16,217 | $17,685,201 |

| SAN | Sagalio Energy Ltd | 0.005 | -29% | 80,000 | $1,432,621 |

| AIV | Activex Limited | 0.013 | -28% | 350,256 | $3,879,046 |

| PKO | Peako Limited | 0.003 | -25% | 947,970 | $3,513,899 |

| RGL | Riversgold | 0.003 | -25% | 45,000 | $6,509,850 |

| RML | Resolution Minerals | 0.002 | -25% | 900,000 | $3,220,044 |

| TAS | Tasman Resources Ltd | 0.003 | -25% | 1,050,000 | $3,220,998 |

| AVE | Avecho Biotech Ltd | 0.002 | -20% | 1,126 | $7,923,243 |

| AYT | Austin Metals Ltd | 0.004 | -20% | 30,000 | $6,620,957 |

| CAV | Carnavale Resources | 0.004 | -20% | 3,863,282 | $20,451,092 |

| IS3 | I Synergy Group Ltd | 0.004 | -20% | 99 | $1,781,089 |

| PLC | Premier1 Lithium Ltd | 0.009 | -18% | 5,891,878 | $1,920,315 |

| CBY | Canterbury Resources | 0.025 | -17% | 199,426 | $5,923,227 |

| ERA | Energy Resources | 0.003 | -17% | 1,441,518 | $66,444,898 |

| NOR | Norwood Systems Ltd. | 0.032 | -16% | 216,360 | $18,106,500 |

| ASR | Asra Minerals Ltd | 0.003 | -14% | 50,000 | $7,810,453 |

| PPY | Papyrus Australia | 0.012 | -14% | 14,880 | $6,897,696 |

Shares in respiratory protection maker Cleanspace (ASX:CSX) plummeted 18% after reporting revenue below expectations for the year to date.

IN CASE YOU MISSED IT

Brazilian Critical Minerals (ASX:BCM) has successfully produced a high-value, bulk mixed rare earth carbonate (MREC) using material sourced from its Ema project and environmentally friendly magnesium-based reagents instead of ammonium.

Great Southern Mining (ASX:GSN) and its JV partner, $21Bn capped global gold miner, Gold Fields, have identified a shallow, large-scale induced polarisation anomaly in the Edinburgh Park project that is interpreted to be a porphyry system hosting large-scale (over 2 km wide) intrusive related gold-copper and/or epithermal gold deposit.

Recce Pharmaceuticals (ASX:RCE) has achieved a ‘landmark milestone’ with Human Research Ethics Committee approval received for its Phase 3 clinical trial for RECCE 327 Topical Gel (R327G) in patients with diabetic foot infections (DFIs).

Preliminary metallurgical testwork at Sunshine Metals’ (ASX:SHN) Liontown project in Queensland has recovered up to 99.4% gold and 95.2% copper on mineralised core from the Gap Zone. This is expected to be positive for the upcoming resource update in December and will feed into a planned scoping study.

Earths Energy (ASX:EE1) has appointed a new non-executive director in Glenn Whiddon, who has an extensive background in equity capital markets, banking and corporate advisory with a specific focus on natural resources. He is also currently a director of a number of public listed companies in the resources sector.

“Glenn is a highly skilled director that brings extensive energy sector and listed company experience to the board,” executive chair Grant Davey said.

“This is a particularly exciting time for the company, with the technical and economic study on our Paralana Project demonstrating that Paralana has the characteristics of a world-class geothermal system.”

RiversGold (ASX:RGL) has sent samples from drilling at the Northern Zone gold project in WA off to the laboratory, with assays expected in four weeks.

“Northern Zone progress continues and I look forward to the next round of assays, as well as completion of the mineralisation report and application for a mining lease, so we can advance the project more quickly as we continue to see significant mineralised intercepts over an increasing porphyry footprint,” chairman David Lenigas said.

The drilling is following up previous assays including 5m at 12.27 g/tgold from 32m (including 1m at 58.09g/t gold from 34m).

“The more recent set of significant high-grade gold assays at Northern Zone have continued to expand the gold mineralised footprint of the porphyry over a much larger area than originally thought and it has confirmed the presence of a significant gold mineralised system, that is located just 25km east of Kalgoorlie, Western Australia, with all of the benefits of being brilliantly located to excellent roads and infrastructure,” Lenigas said.

At Stockhead, we tell it like it is. While Brazilian Critical Minerals, Earths Energy, Great Southern Mining, Recce Pharmaceuticals, RiversGold and Sunshine Metals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.