CLOSING BELL: ASX sinks to -1.4pc, despite a late tech rally and some sunny Small Caps news

I don't think anyone saw today's Small Caps winner coming today...but it did, and now here we are. Pic via Getty Images.

- Benchmark slides throughout the day after a shocker on Wall Street last night.

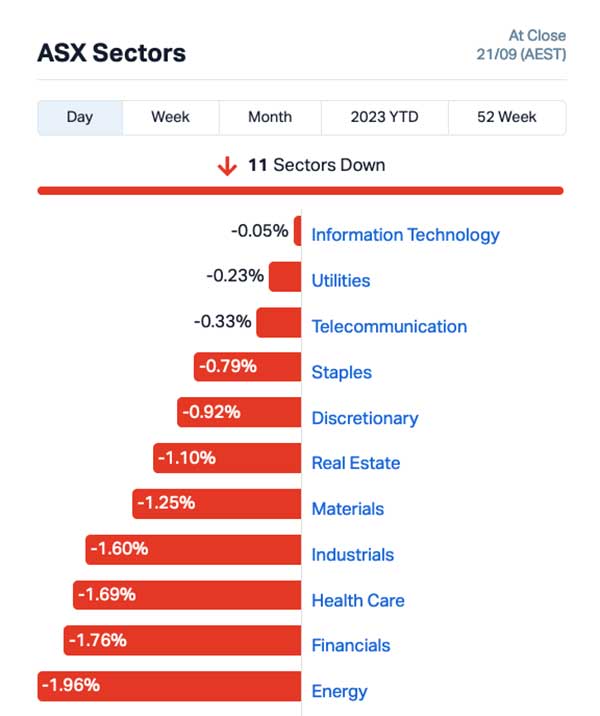

- Utilities did best but still ended up losing, down 0.3% for the day.

- Paincheck a ray of sunshine this afternoon, up 33% today despite an early speeding ticket.

Righto… this is gonna be relatively short this afternoon because your normal host for long-winded late afternoon rambles, Christian Edwards, has been incapacitated by an over-enthusiastic dentist, leaving him (blessedly, an uncharitable person some might say) mute for the day.

But the bell’s been rung, the day is done and here’s how it all panned out.

TO MARKETS

The afternoon session was more of the same as this morning, as the ASX 200 benchmark continued a graceless slide to reach -1.37% by the time we were supposed to be packing the toys away and preparing to head home.

At least five of the sectors have ended the day more than 1% lower, the worst of them being Energy which fell 1.96%, with Health Care, Financials, Industrials, Materials and Consumer Discretionary in hot pursuit with bad results of their own.

Even the goldies took a blow today, with the XGD ASX All Ords Gold index pointing 1.14% lower. Meanwhile it was a slow, late in the day rally for the XTX ASX All Tech index that saw it recover to a still-a-bit-sh-t -0.75%.

Mader Group (ASX:MAD) is showing a -7.9% fall today after going ex-div on Tuesday, and the ever-swinging Sayona Mining (ASX:SYA) dropped below $1 billion market cap with an 11% fall which sounds horrendous, but is actually pretty normal for the company.

FROM THE HEADLINES

Qantas (ASX:QAN) ) chairman Richard Goyder has made it very clear that he has no plans to step down, as the appalling stink surrounding the Aussie airline continues to linger, long after former CEO Alan Joyce knocked off early because people were being mean.

Goyder told the ABC this morning that he has been “busy meeting with major investors to win back trust and confidence, and he was dealing with the fallout on a number of fronts”, which includes the roughly 1,700 angry staff the company unlawfully binned during the pandemic, and a number of unhappy major investors who require placating as well.

Goyder – who’s set to front a Senate grilling next week – also touched on the circulating theory that the board might end up clawing back a lot of money from Joyce. The sum being bandied about is $14.4 million, as some serious questions are being asked about the company’s behaviour in some key areas.

$14.4m is a hefty pricetag, but pales into comparison to the (roughly calculated by me, a noted numberphobe) $103.6m he took home from his 11-year turn in the Captain’s Chair.

In political news, the much vaunted “comeback” of former Federal Treasurer Josh Frydenburg has a gigantic golden snag, thanks to a reported job offer to become the chair of Goldman Sachs Australia.

And the Albanese Government has tentatively laid out plans for its enquiry into how the Covid-19 pandemic was handled at a government level, with the outcome widely expected to be overwhelmingly positive due to two small things being omitted from the probe’s scope.

Little things, they are. Tiny, even. Just state and territory local lockdowns and border closures – the two things that made everybody furious.

So… gold stars to everyone involved, I guess.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MTB | Mount Burgess Mining | 0.004 | 33% | 293,945 | $3,046,940 |

| PKD | Parkd Ltd | 0.028 | 33% | 188,108 | $2,138,185 |

| PLG | Pearlgullironlimited | 0.034 | 31% | 1,983,714 | $4,066,822 |

| PCK | Painchek Ltd | 0.043 | 30% | 5,864,813 | $46,297,163 |

| SPX | Spenda Limited | 0.009 | 29% | 2,396,745 | $25,699,955 |

| DCX | Discovex Res Ltd | 0.0025 | 25% | 8,666 | $6,605,136 |

| MRQ | Mrg Metals Limited | 0.0025 | 25% | 1,000,003 | $4,371,837 |

| MXC | Mgc Pharmaceuticals | 0.0025 | 25% | 327,172 | $8,855,936 |

| TAR | Taruga Minerals | 0.011 | 22% | 1,306,666 | $6,354,241 |

| OZM | Ozaurum Resources | 0.14 | 22% | 9,244,853 | $14,605,000 |

| AGC | AGC Ltd | 0.069 | 21% | 27,334,976 | $5,700,000 |

| TMR | Tempus Resources Ltd | 0.029 | 21% | 11,021,038 | $7,484,118 |

| AGD | Austral Gold | 0.03 | 20% | 96,532 | $15,307,784 |

| JNO | Juno | 0.11 | 20% | 188,994 | $12,480,536 |

| BCK | Brockman Mining Ltd | 0.031 | 19% | 2,552,345 | $241,286,035 |

| BGE | Bridgesaaslimited | 0.025 | 19% | 212,955 | $609,756 |

| MCM | Mc Mining Ltd | 0.16 | 19% | 31,876 | $53,954,802 |

| AAR | Astral Resources NL | 0.083 | 17% | 3,189,578 | $56,083,661 |

| NZK | NZK Salmon Ltd | 0.21 | 17% | 52,369 | $97,461,848 |

| EXT | Excite Technology | 0.007 | 17% | 250,000 | $7,255,450 |

| LRL | Labyrinth Resources | 0.007 | 17% | 178,564 | $7,125,262 |

| YPB | YPB Group Ltd | 0.0035 | 17% | 245,000 | $2,230,384 |

| OZZ | OZZ Resources | 0.075 | 15% | 252,999 | $6,014,458 |

| KGD | Kula Gold Limited | 0.015 | 15% | 303,286 | $4,851,755 |

| PXS | Pharmaxis Ltd | 0.038 | 15% | 168,531 | $23,828,348 |

There’s been some movement at the top of the Small Caps list this afternoon, leaving the slightly mysterious Pearl Gull Iron (ASX:PLG) on top of the ladder on +30.7%.

I don’t think anyone was expecting that today.

The company rose (apparently) on the back of its annual report, which landed after hours yesterday, showing that not much has changed in the past 12 months: PGL still has an Inferred Mineral Resource estimate of 24.5Mt at 34.3% Fe, but it still has to find an economic way of getting it off the ultra-remote Cockatoo Island.

The company says it’s been looking into a low-cost barge, but as yet nothing is set in stone.

PainChek (ASX:PCK) came out of nowhere this afternoon to post a 30% gain on no news, and that’s despite being handed a speeding ticket by the ASX for a similarly curious price yesterday.

Painchek has told the ASX that it has no explanation for the sudden interest in the company from investors, but says that maybe “it is possible that the market may be reacting to the recent issue of shares as part of the placement that was announced on 14 September 2023”.

Rounding out the Top 3 this afternoon is current favourite child OzAurum Resources (ASX:OZM), up 26% today to take its run for the past week to +353.12%, with the company’s annual report landing at 4:17pm today (after the markets closed), so I’ll endeavour to bring the contents of that to your attention tomorrow.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CYM | Cyprium Metals Ltd | 0.032 | -68% | 62,282,676 | $152,120,549 |

| HAL | Halo Technologies | 0.056 | -28% | 71,820 | $10,100,627 |

| PHL | Propell Holdings Ltd | 0.016 | -27% | 27,500 | $2,647,821 |

| TMG | Trigg Minerals Ltd | 0.011 | -27% | 3,621,298 | $3,020,769 |

| INP | Incentiapay Ltd | 0.006 | -25% | 13,000 | $10,120,509 |

| KNO | Knosys Limited | 0.032 | -24% | 62,500 | $9,077,825 |

| KED | Keypath Education | 0.32 | -22% | 15,584 | $88,024,821 |

| ODE | Odessa Minerals Ltd | 0.011 | -21% | 23,021,703 | $13,259,566 |

| PPY | Papyrus Australia | 0.024 | -20% | 297,564 | $14,777,028 |

| BP8 | Bph Global Ltd | 0.002 | -20% | 84,217 | $3,336,824 |

| MTC | Metalstech Ltd | 0.15 | -17% | 217,194 | $33,948,826 |

| DOU | Douugh Limited | 0.005 | -17% | 132,678 | $6,341,852 |

| ME1 | Melodiol Glb Health | 0.005 | -17% | 568,145 | $17,683,922 |

| MRI | Myrewardsinternation | 0.01 | -17% | 739,907 | $5,119,606 |

| IVZ | Invictus Energy Ltd | 0.1675 | -16% | 17,982,051 | $237,999,508 |

| CZN | Corazon Ltd | 0.011 | -15% | 14,590 | $8,002,773 |

| DTR | Dateline Resources | 0.012 | -14% | 2,443,462 | $12,396,200 |

| ELE | Elmore Ltd | 0.006 | -14% | 2,970,974 | $9,795,687 |

| EXL | Elixinol Wellness | 0.006 | -14% | 125,114 | $4,385,379 |

| LBT | LBT Innovations | 0.012 | -14% | 406,166 | $4,982,605 |

| TAS | Tasman Resources Ltd | 0.006 | -14% | 27,969 | $4,988,685 |

| CMP | Compumedics Limited | 0.185 | -14% | 38,446 | $38,090,034 |

| DAF | Discovery Alaska Ltd | 0.019 | -14% | 750 | $5,153,163 |

| BRN | Brainchip Ltd | 0.195 | -13% | 18,656,816 | $399,388,083 |

| CMX | Chemxmaterials | 0.1 | -13% | 43,058 | $6,103,842 |

TRADING HALTS

Armada Metals (ASX:AMM) – Capital raising.

Agrimin (ASX:AMN) – Capital raising.

Advanced Health Intelligence (ASX:AHI) – Announcement in relation to a letter of intent.

Bentley Capital (ASX:BEL) – Market announcement in relation to the company’s activities.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.