CLOSING BELL: ASX showing signs of a hangover on bumpy New Financial Year day

Pic via Getty Images

- Choppy day leaves the ASX 200 benchmark below zero, down -0.2pc

- Energy surges on news of a coal fire in Queensland, because that’s good for business everywhere else

- Small Caps winners’ list dominated by a $12 million boat sale by Wellard, which is well ‘ard indeed

Local markets have kicked off the new financial year with a shudder and a moan, starting the day with a 0.6% drop that was always going to be hard work coming back from.

By the close of play, the markets had rallied somewhat during the day, leaving the benchmark at -0.22%.

It’s been a tricky day in a lot of senses, with a few news spikes adding a bit of zest to an otherwise fairly standard not-so-excellent day overall.

Several coal miners were reaping the benefits of a rival’s disaster today, after a fire that broke out in Grosvenor coal mine at Moranbah in Central Queensland that is now predicted is going to burn “for several weeks”, which is – obviously – no beuno.

“Our priority is to safely extinguish the underground fire, which emergency response teams are managing from the surface,” mine operator Anglo American said in a statement.

But what’s bad news for Anglo is a boost for its competitors in the market, with the likes of Yancoal Australia (ASX:YAL) up +4.4%, Whitehaven Coal (ASX:WHC) is up +6.86%, New Hope Corp (ASX:NHC) is up 4.0%… you get the picture.

Fingers crossed for Anglo that it manages to get the fire under control, and we don’t end up with a citation like the one in Pennsylvania, where the township of Centralia has been sitting abandoned since a fire broke out in the mine underneath the town in 1962 – with close to zero chance of it being extinguished before it runs out of fuel, sometime in the next 250 years or so.

Also on the Energy tip, Origin Energy (ASX:ORG) is in court at the moment after admitting to the Australian Energy Regulator that it failed in its obligations to meet the needs of more than 5,000 customers relying on uninterrupted service for critical life support.

The whole mess is in front of the Federal Court today, with Origin confessing to a further 1,973 breaches of the requirement to provide information packs to life support customers, and there’s no way this ends cheaply, or well, for the company.

There’s no mention of the ructions in Origin’s announcements today, and the company’s currently up 0.3% at about 2:30pm. That might change, so watch this space.

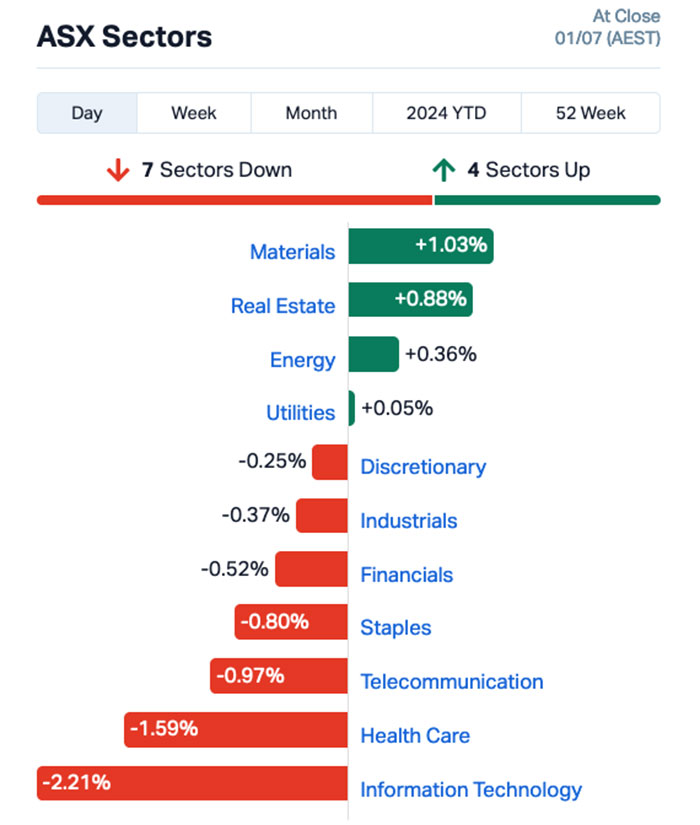

A quick look at the sectors for today shows that Real Estate is performing well, Materials is up after some wins up the top end of town – BHP (ASX:BHP) is up +1.3%, Rio Tinto’s (ASX:RIO) s up +1.6% – and Energy’s up because of the mine fire.

The rest of the market’s looking a little dire, though.

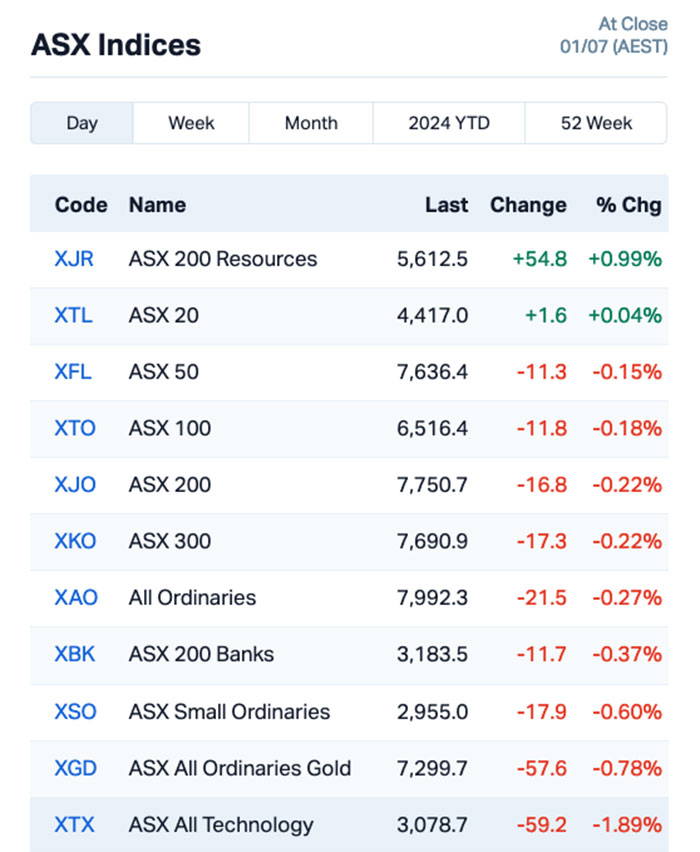

The ASX indices look like this:

OTHER LOCAL NEWS

It’s day one of the new financial year, but the markets seem dominated by the fallout from the inflation figures from May which landed with a huge thud last week, prompting fears that the RBA board is likely to start thinking about raising rates between now and Christmas.

Markets are starting to price in the distinct possibility that we’re going to have a rate rise with many experts talking a one in three chance that another pull on the interest rate lever is likely to be needed to get inflation under control.

Data released today was something of a double whammy for the local economy with the drop in both job numbers and manufacturing data pointing to a softening economy, right when we didn’t need it.

On the manufacturing front, data from judo bank showed that the latest purchasing and manufacturing index figures indicate yet another slowdown from that sector.

The June PMI fell from 49.7 to 47.2 points, which is alarming because any number under 50 represents a contraction – and the lower that number is, the worse the contraction has been.

The June figures show a fifth straight slowdown and are the worst in three months as the sector lowered employment levels and spending on purchasing declined throughout the period, against the backdrop of falling inventory and a lowering demand for locally made goods.

That hiring drop is broadly represented in the results of the ANZ-Indeed Job Ads survey, with the headline numbers from that showing a 2.2% drop over the month which intern has led to a 17.6% drop so far this year.

Between rising inflation and this latest starter it paints fairly grim picture of precisely how weak the Australian economy is at present and how much work lies ahead for the economy to get back on track before the end of the calendar year.

But today does bring some good news for the bulk of Australia’s wage earning population with the stage three tax cuts that come into force today.

According to the bins at JPMorgan the cuts that are arriving today will drive wage growth of around 6% over the next 12 months, assuming 3.7% pre-tax wage growth which – frankly – is being pretty generous, given that historically it normally tops out at around 2.5%.

WHAT’S HAPPENING OVERSEAS

US markets likely to be in for a bumpy launch this morning, lately due to geopolitical happenings of the past few days.

Locally for US investors, the upcoming November election is proving to be something of an albatross around the neck of the markets, with some genuinely massive question marks hanging over the political career of incumbent president Joe Biden.

Biden’s performance in the presidential debate last week was an embarrassment to his campaign, with a large number of heavyweight Democrat operatives and donors, both privately and publicly suggesting that the old man is simply too old to continue.

At this stage, Biden’s campaign is unlikely to pull the pin, leaving the door wide open for the unlikeliest of Republican wins, especially considering the presumptive candidate is already a convicted felon, and is due to be sentenced on 34 counts in the coming weeks.

On top of that, rising political turmoil in Europe is shaking up markets there, after France’s far right National Rally emerged the dominant political force from the first round of parliamentary elections.

That first round has been severe blow to the Macron camp, which is trailing in third place behind Marine Le Pen’s anti-immigration National Rally on 33.2% of the vote, a broad coalition from the left on 28.1% of the vote and Macron’s ruling coalition languishing on 21%.

It’s the first time that the far right has triumphed in the first round of a French parliamentary election, with National Rally chasing an absolute minority of 289 seats in the 577-seat National Assembly.

Early projections suggest that they might fall short in Sunday’s second round run-off but only time will tell. In the meantime, the effect on the markets in the lead-up to the election was noticeable, with European markets off by -0.3% and the UK off by -0.2%.

Britain is also in the midst of election fever, with the Tories staring down an historic battering at the polls.

Such a severe split in sentiment between a Britain that is drifting to the left, and a Europe seemingly determined to veer hard right will cause all sorts of grief in the region over the coming months.

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| I88 | Infini Resources Ltd | 0.35 | 126% | 5,996,381 | $5,887,415 |

| WLD | Wellard Limited | 0.037 | 118% | 2,426,620 | $9,031,255 |

| IEC | Intra Energy Corp | 0.002 | 33% | 750,000 | $2,536,172 |

| OAR | OAR Resources Ltd | 0.002 | 33% | 3,000,000 | $4,833,150 |

| TMG | Trigg Minerals Ltd | 0.011 | 57% | 7,802,435 | $3,014,765 |

| AXP | AXP Energy Ltd | 0.0015 | 50% | 3,317,008 | $5,824,681 |

| CLZ | Classic Minerals | 0.0015 | 50% | 10,706,473 | $755,548 |

| EDE | Eden Innovations | 0.0015 | 0% | 3,904 | $5,517,407 |

| LNU | Linius Tech Limited | 0.0015 | 0% | 780,307 | $8,320,111 |

| PUR | Pursuit Minerals | 0.003 | 50% | 13,606,626 | $7,270,800 |

| TKL | Traka Resources | 0.0015 | 0% | 728,849 | $2,625,988 |

| TX3 | Trinex Minerals Ltd | 0.003 | 50% | 5,246,739 | $3,657,305 |

| SVG | Savannah Goldfields | 0.019 | 46% | 117,358 | $3,654,104 |

| LIN | Lindian Resources | 0.1525 | 45% | 9,148,836 | $121,056,835 |

| IMI | Infinity Mining | 0.021 | 40% | 144,851 | $1,781,301 |

| AAU | Antilles Gold Ltd | 0.004 | 33% | 2,001,959 | $2,989,605 |

| ALR | Altairminerals | 0.004 | 33% | 8,046,585 | $12,889,733 |

| ME1 | Melodiol Global Health | 0.004 | 33% | 9,539,010 | $582,276 |

| RLC | Reedy Lagoon Corp | 0.004 | 33% | 250,000 | $1,858,622 |

| SHO | Sportshero Ltd | 0.004 | 33% | 977,775 | $1,853,499 |

| SRI | Sipa Resources Ltd | 0.017 | 31% | 1,315,063 | $2,966,056 |

| MVL | Marvel Gold Limited | 0.009 | 29% | 434,182 | $6,046,535 |

| CGR | CGN Resources | 0.18 | 29% | 374,922 | $12,708,947 |

| 88E | 88 Energy Ltd | 0.0025 | 25% | 31,767,650 | $57,785,344 |

Infini Resources (ASX:I88) announced its maiden field sampling assay results at its 100% owned Portland Creek Uranium Project in Newfoundland, Canada, where the company says the results have exceeded laboratory testing limitations in 17 samples – meaning they are above 1.18% (11,792ppm) U3O8 – and have been sent for additional testing, with other high range samples close to the upper limit for testing of this type.

The company says that 52% of the samples tested have come back with readings above 1,000ppm U3O8, which sets the project up to be a potential record breaker.

Wellard (ASX:WLD) was surging early on news that the company has signed paperwork to offload one of its oldest livestock ships, the M/V Ocean Ute, for $12 million, the majority of which is set to be returned directly to shareholders in a manner that is yet to be determined by the company.

Lindian Resources (ASX:LIN) released news that its feasibility study for the company’s Kangankunde rare earths project has confirmed it as a “technically low risk and economically robust project”, boasting a Stage 1 post-tax Net Present Value of US$555M (A$831M), an IRR of 80% and an average annual EBITDA of US$84M1 (A$124.5M).

Antilles Gold (ASX:AAU) has advised that on 28 June, 2024, shareholders of the Cuban joint venture mining company, Minera La Victoria SA, formally adopted previously agreed modifications to the existing Joint Venture Agreement, paving the way for the companies to pursue a strategy to progressively evolve as a substantial mining company, with “minimal future contributions required from Antilles Gold”.

ASX SMALL CAP LAGGARDS

Here are the least best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AMD | Arrow Minerals | 0.002 | -33% | 3,062,729 | $31,618,095 |

| AVE | Avecho Biotech Ltd | 0.002 | -33% | 751,902 | $9,507,891 |

| MTB | Mount Burgess Mining | 0.001 | -33% | 28,572 | $1,947,220 |

| CUS | Copper Search | 0.063 | -31% | 2,808,749 | $10,217,972 |

| MSI | Multistack International | 0.005 | -29% | 67,116 | $954,127 |

| MRQ | MRG Metals Limited | 0.003 | -25% | 9,597,712 | $10,100,475 |

| TMK | TMK Energy Limited | 0.003 | -25% | 3,649,979 | $27,646,448 |

| HTG | Harvest Tech Group | 0.015 | -21% | 2,030,755 | $15,425,299 |

| CMB | Cambium Bio Limited | 0.004 | -20% | 20,531 | $3,830,461 |

| PNX | PNX Metals Limited | 0.004 | -20% | 110,393 | $29,851,074 |

| ROG | Red Sky Energy | 0.004 | -20% | 775,655 | $27,111,136 |

| VRC | Volt Resources Ltd | 0.004 | -20% | 128,520 | $20,793,391 |

| TZN | Terramin Australia | 0.026 | -19% | 8,030 | $67,730,007 |

| AGD | Austral Gold | 0.018 | -18% | 94,546 | $13,470,850 |

| 1MC | Morella Corporation | 0.0025 | -17% | 209,076 | $18,536,398 |

| EVR | EV Resources Ltd | 0.005 | -17% | 1,253,339 | $7,927,629 |

| LPD | Lepidico Ltd | 0.0025 | -17% | 789,667 | $25,767,358 |

| TSL | Titanium Sands Ltd | 0.005 | -17% | 1,791,806 | $13,270,483 |

| STX | Strike Energy Ltd | 0.235 | -16% | 28,690,351 | $801,016,520 |

| NMR | Native Mineral Resources | 0.021 | -16% | 154,668 | $5,246,263 |

| PSL | Paterson Resources | 0.013 | -13% | 602,700 | $6,840,568 |

| LM8 | Lunnon Metals | 0.2 | -13% | 31,416 | $50,103,975 |

| STN | Saturn Metals | 0.17 | -13% | 816,633 | $43,680,483 |

| ALM | Alma Metals Ltd | 0.007 | -13% | 1,000,000 | $11,543,031 |

| GTI | Gratifii | 0.007 | -13% | 261,005 | $14,048,381 |

TRADING HALTS

BPM Minerals (ASX:BPM) – pending an announcement regarding a project acquisition.

Rimfire Pacific Mining (ASX:RIM) – pending an announcement by the Company to the market regarding a capital raising.

Cannindah Resources (ASX:CAE) – pending the release of an announcement to the market in relation to an upgrade of the Company’s Mt Cannindah Mineral Resource.

Recce Pharmaceuticals (ASX:RCE) – pending the release of an announcement relating to a proposed equity capital raising.

Island Pharmaceuticals (ASX:ILA) – in relation to a proposed material non-binding term sheet.

Beston Global Foods Company (ASX:BFC) – pending the release of a funding and milk supply update announcement.

Jindalee Lithium (ASX:JLL) – pending an announcement with regard to a proposed capital raising.

Tivan (ASX:TVN) – pending the release of an announcement by the Company of a proposed capital raising.

ICYMI – PM EDITION

Argent Minerals (ASX:ARD) has delineated extensive silver, lead and zinc mineralisation over the Sugarloaf Hill zone, east of its Kempfield deposit at the Kempfield project in NSW.

Assay results at Belararox’s (ASX:BRX) Toro-Malambo-Tambo project in Argentina have confirmed the presence of a second porphyry system close to surface in the explorer’s hunt for a new copper orebody of global scale.

Blue Star Helium’s (ASX:BNL) State 16 SWSE 3054 helium development well has been found by independent engineering consultants to be capable of stabilised production flow rates of 250,000 to 350,000 cubic feet of gas, which is in line with modelling.

iTech Minerals (ASX:ITM) has expanded the global resource estimate for its Eyre Peninsula graphite project in South Australia by a whopping 300% for a total measured, indicated and inferred mineral resource of 35.2 Mt at 6.0% total graphitic carbon (TGC).

Lycaon Resources (ASX:LYN) has won the ballot for an exploration licence in WA’s Pilbara region, adjacent to projects held by Kali Metals and mega lithium producer SQM.

Magnetic Resources (ASX:MAU) Lady Julie North is looking to be significantly bigger than previously thought after high-grade drill hits – including 23m at 6.3g/t gold -provided more evidence that a 400m northern zone is larger than estimated.

New Age Exploration (ASX:NAE) is poised to embark on an active six-month exploration campaign at its Wagyu gold project in WA’s Pilbara region with a maiden aircore drill program intrusives and structural targets leading the way.

Sprintex (ASX:SIX) has secured a $1m initial evaluation order from MV Techniek BV for the supply of custom compressors that could lead to a five-year supply contract.

Uvre (ASX:UVA) has completed the acquisition of the Frome Downs and Yankaninna landholdings in its hunt for yellowcake in the uranium-rich Frome Basin in South Australia.

At Stockhead, we tell it like it is. While Argent Minerals, Belararox, Blue Star Helium, iTech Minerals, Lycaon, Magnetic Resources, New Age Exploration, Sprintex and Uvre are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.